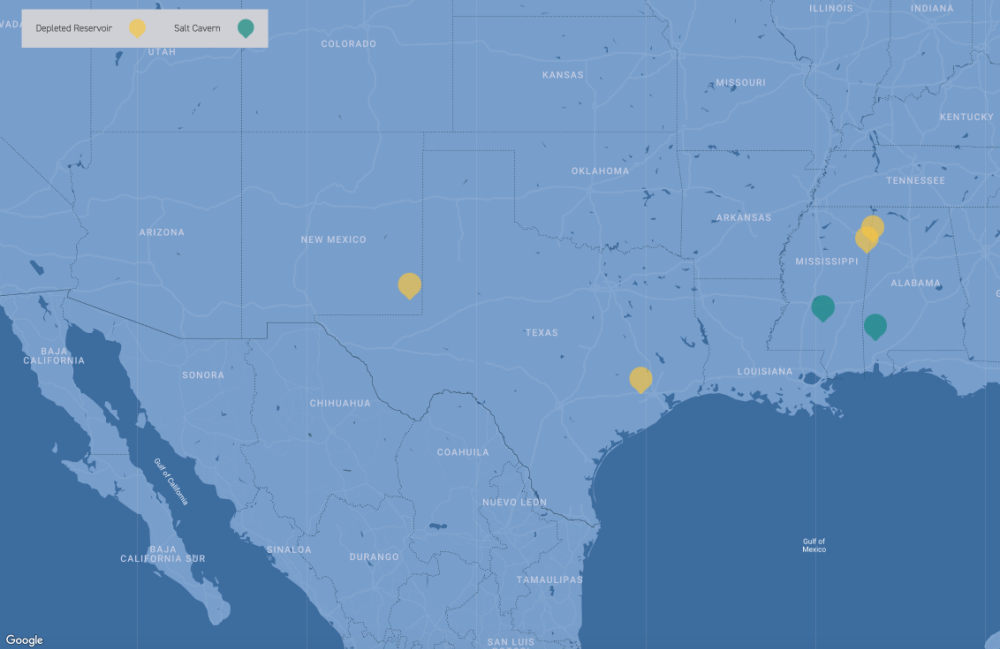

Enstor will continue to manage and operate its natural gas storage facilities in Alabama, Mississippi, Texas and New Mexico. Pictured is Enstor’s Grama Ridge Storage and Transportation facility located in New Mexico’s Lea County within the Permian Basin. (Source: Enstor Gas LLC)

ArcLight Capital Partners LLC on May 11 sold its affiliate Enstor Gas, the largest privately owned gas storage company in the U.S., for an undisclosed amount to Infrastructure Investments Fund (IIF), an investment vehicle advised by J.P. Morgan Investment Management Inc.

“Together with management, ArcLight built Enstor into a leading natural gas storage franchise through a series of asset acquisitions and commercial and engineering optimization activities beginning in 2018. With today’s sale, the next chapter of opportunity begins for Enstor, and we wish the team and IIF great success,” Dan Revers, ArcLight’s managing partner, commented in a joint release announcing the transaction.

Headquartered in Houston, Enstor owns and operates six active underground natural gas storage facilities in four states with more than 110 Bcf in working gas capacity. The company has approximately 179 miles of transmission pipelines and 39 interconnects to major transmission pipelines.

“Today’s transaction is a tribute to the strength of our assets in the U.S. gas storage market, our employees’ strong track record of safe, efficient operations and their dedication to the communities in which we operate,” Enstor CEO Paul Bieniawski said in the May 11 release. “It is because of their hard work that Enstor is the leading U.S. natural gas storage company.”

Enstor will continue to manage and operate its natural gas storage facilities in Alabama, Mississippi, Texas and New Mexico. The Enstor headquarters will remain in Houston and the Enstor executive team will continue to manage the company.

IIF is an approximately $24 billion private investment vehicle focused on investing in critical infrastructure assets. Headquartered in New York with additional offices in London, and advised by a dedicated infrastructure investment group within J.P. Morgan Investment Management Inc., IIF is responsible for investing and growing the retirement funds of more than 60 million families.

Commenting on the acquisition of Enstor Gas, Matthew LeBlanc, chief investment officer for IIF, said: “We are excited to work with Enstor, an industry-leading strategic platform uniquely positioned to provide safe, reliable natural gas storage services in strategic areas across the U.S.”

IIF is a long-term owner of companies that provide essential services, such as renewable energy, water, natural gas and electric utilities, and transportation infrastructure. The firm’s 20 portfolio companies are located primarily in the U.S, Europe, Canada and Australia and serves over 10 million customers and employs over 10,000 people from local communities.

“We look forward to partnering with the Enstor leadership team and employees to build upon the company’s track record of success for the benefit of its customers and communities,” LeBlanc added.

RBC Capital Markets served as financial adviser and Milbank LLP served as legal adviser to IIF for the transaction. Jefferies LLC served as financial adviser and Orrick Herrington & Sutcliffe LLP served as legal adviser to ArcLight.

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.