Arc Logistics Partners LP (ARCX) is making its debut in the Denver-Julesburg (D-J) Basin in a deal worth $87.6 million.

The New York-based company said July 14 it acquired all of the limited liability company interests of UET Midstream LLC from United Energy Trading LLC and Hawkeye Midstream LLC for about $76.6 million in cash and units.

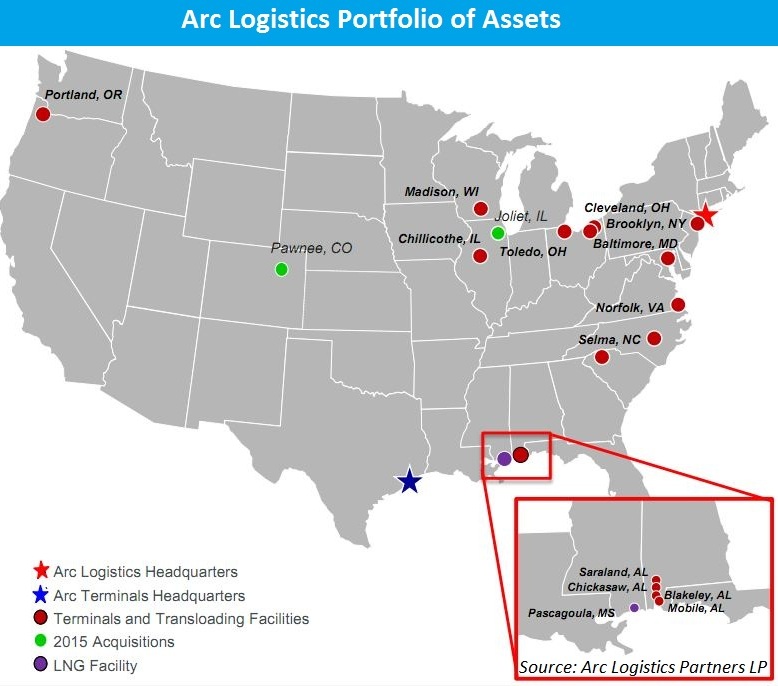

Arc Logistics plans to spend another $11 million to complete the construction of UET Midstream's Pawnee Terminal in northeastern Weld County, Colo. The deal also gives the company 9.4 acres of nearby land that is currently being permitted for possible development.

"We are very excited to announce another acquisition and the expansion of our independent terminalling business into this growing Colorado market,” said Vince Cubbage, chairman and CEO of Arc Logistics, in the release.

The Pawnee Terminal is the only non-producer owned connection to Pony Express Pipeline LLC's Northeast Colorado Lateral, which ultimately ends up in Cushing, Okla. It's also the only non-proprietary access point to an interstate pipeline within 75 miles, the company said.

“Weld County has two distinct production zones—the greater Wattenberg core and northeast Weld County and both areas include a who’s who of independent producers,” Cubbage said on a conference call. “Industry experts project that northeast Weld County production will grow at approximately 9% per year through 2025, which represents an attractive long term growth profile for the partnership.”

The terminal commenced operations on May 1 and has about 200,000 barrels (bbl) of commingled storage capacity with room for expansion. It’s supported by five-year commercial agreements. The customer base includes a mix of independent marketers, independent refiners and diversified E&Ps.

“[The Pawnee Terminal] was developed to handle the growing crude oil production transportation needs in the region, and its contract portfolio reflects that anticipated growth with built-in increases in customer take-or-pay volume commitments and associated revenues for our partnership,” Cubbage said.

The company will assume full responsibility and control of all remaining construction of the terminal post-closing. The company did this for a number of reasons, Cubbage said.

“In general, it will insure that the remaining work from the original construction is completed with the benefit of the partnership and accordance with our standards,” he said. “Managing the remaining construction will also enable our engineers to efficiently plant and integrate several intermediate upgrades to the facility.”

Remaining construction work principally includes punch list related activities. Other projected terminal upgrades include installation of a third tank and a fire protection system and building additional storage for customers.

“This additional work was not required for the terminal to begin its operation, but it’s work that we believe is important to operate the terminal at our level of safety standards and to increase the commercial opportunities available to our long-term customers,” he said.

The company said it expects the Pawnee Terminal to contribute initial minimum contracted annual EBITDA of $9- to $9.5 million.

The nearby development property that Arc Logistics also acquired in the deal is being permitted to build a potential new crude injection terminal with capacity of 100,000 bbl. If constructed, the potential terminal would have the ability to provide new and existing customers additional unloading capacity and tankage and allow for incremental volumes to be delivered to the Northeast Colorado Lateral.

“Immediately following the closing of the transaction, the partnership will work with the newly acquired customer base and local producers to not only expand the operating and storage capacity of the Pawnee Terminal, but also work to secure the customer contract commitments that we would need in order to build a new terminal at our development site,” Cubbage said.

At closing, Arc Logistics paid UET and Hawkeye about $44.6 million in cash and roughly $32.2 million in common units. In total, 1.75 million units were issued on a fixed price of $18.50 per unit. The company financed the cash portion of the consideration with borrowings under its senior bank revolving credit facility.

The company expects the UET acquisition to be immediately accretive to the its distributable cash flow per unit.

Contact the author, Emily Moser, at emoser@hartenergy.com.

Recommended Reading

Seatrium Awarded Contract for FPSO Bound for Guyana’s Stabroek

2024-05-17 - The topsides fabrication and integration contract will be for the FPSO Jaguar, bound for the Whiptail Field in the Stabroek block offshore Guyana for Exxon Mobil.

Seadrill Sells Three Jackups for $338MM to Gulf Drilling International

2024-05-17 - Seadrill Ltd. is also selling its 50% equity interest in the joint venture that operates the rigs offshore Qatar.

Third Suriname Find for Petronas, Exxon Could Support 100,000 bbl/d FPSO

2024-05-17 - A recent find offshore Suriname in Block 52 by Petronas and Exxon Mobil could support a 100,000 bbl/d FPSO development, according to Wood Mackenzie.

US NatGas Flows to Freeport LNG in Texas Seen at Five-month High, LSEG Data Shows

2024-05-17 - The startup and shutdown of Freeport and other U.S. LNG export plants often has a major impact on global gas prices.

US Drillers Add Oil, Gas Rigs for First Time in Four Weeks: Baker Hughes

2024-05-17 - The oil and gas rig count rose by one to 604 in the week to May 17.