Pipeline capacity from Appalachia to the Gulf has been at about 96% utilization, which doesn’t give producers much leeway to expand the capacity of volumes already being sent. (Source: Shutterstock)

PITTSBURGH — Moving Appalachia gas to markets is one of the major challenges for the region’s future production growth, said Amol Wayangankar, principal of Enkon Energy Advisors.

However, a closer look at the Appalachian midstream capacity picture shows some opportunities that producers can exploit now and in the future, Wayangankar said at the Hart Energy DUG Appalachia Conference on Nov. 30.

Wayangankar said the development of gas production for the Appalachia region started in 2012 at less than 10 Bcf/d. With further exploitation of the Marcellus and Utica shales, by 2021 production averaged about 35 Bcf/d, even as domestic and international demand for LNG has continued to rise.

“A primary reason for that is not just producer discipline to maintain production, but it also has to do with lack of takeaway capacity,” he said. “As Appalachia struggles to put more gas out, other basins are capturing the market.”

Over the past 24 months, Appalachia gas production grew 0.3 Bcf/d, while production in the Haynesville Shale grew 2.5 Bcf/d and 5 Bcf/d in the Permian Basin.

“So there's a significant risk for the Appalachian Basin in terms of losing the market share as they compete with the Haynesville and the Permian basins,” Wayangankar said. “It increases the importance of adding more pipelines.”

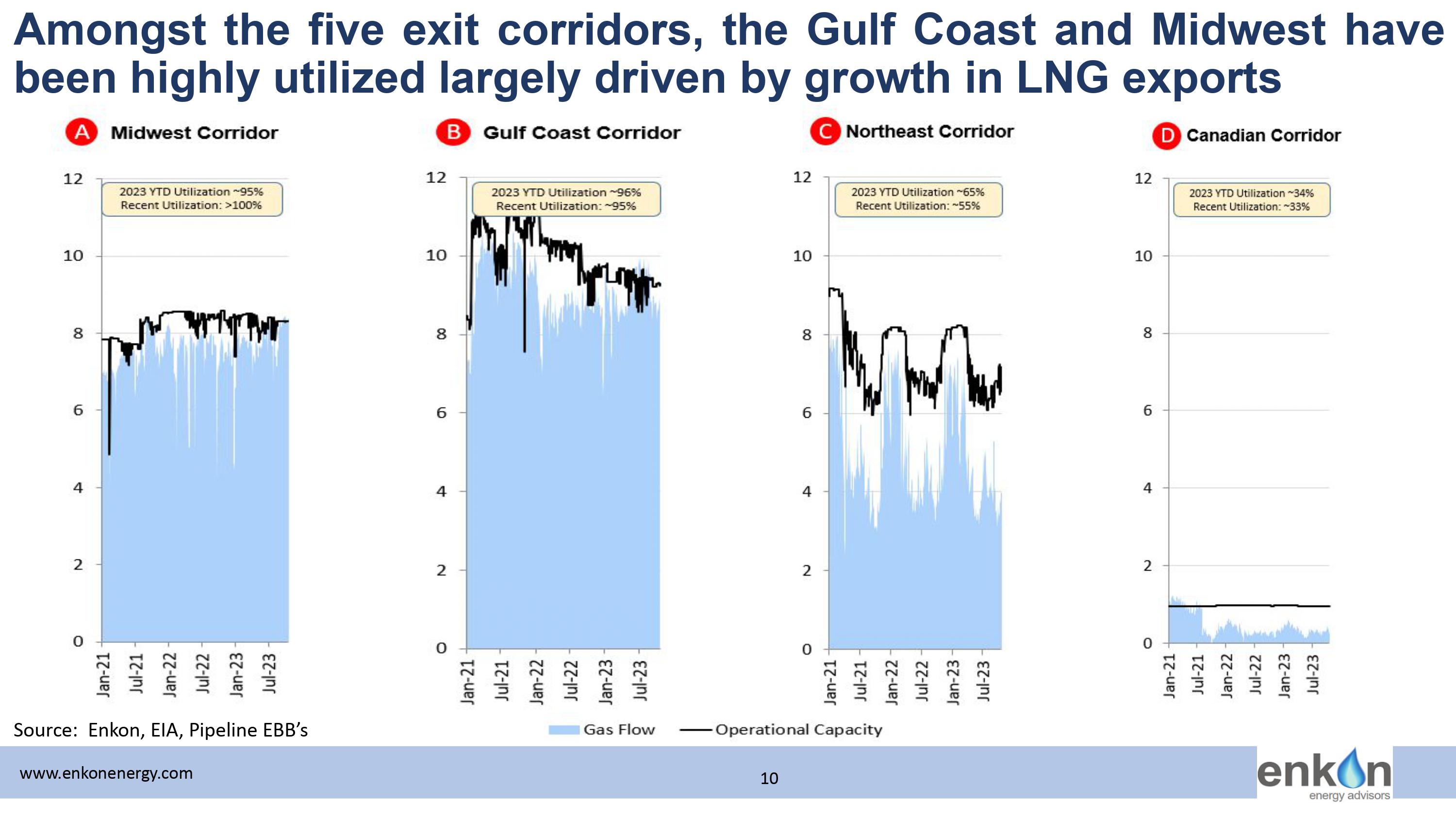

Wayangankar further broke down where gas produced in Appalachia goes to market. There are four pipeline corridors moving product out of the Marcellus and Utica basins: the Northeast U.S., the Midwest U.S., the Gulf Coast and Canada, which takes a small percentage. The Midwest and the Northeast both pull about 7.7 Bcf/d and the Gulf Coast takes about 10.8 Bcf/d.

“So you can see from the plan here, the market really is the U.S. Gulf coast,” he said.

Pipeline capacity from Appalachia to the Gulf has been at about 96% utilization, which doesn’t give producers much leeway to expand the capacity of volumes already being sent.

Some relief is coming for Appalachia with the expected opening of the Mountain Valley Pipeline adding 2 Bcf/d capacity in the first quarter of next year. Other projects currently under construction or Federal Energy Regulatory Commission review could bring an additional 1.4 Bcf/d capacity next year, with an additional 2.1 Bcf/d capacity in projects expected to come online starting in 2025.

“Luckily, there are some projects underway here that will eventually take the gas coming from the Mountain Valley Pipeline towards the Gulf Coast, and eventually ending up on ships going globally as LNG,” said Wayangankar, who forecasted that Appalachia raw gas production could hit 41 Bcf/d by 2030.

Appalachia producers have an advantage over other shale basins in the U.S., in that some acreage holdings produce wet and dry gas, he said.

Wet gases are separated from methane at a processing plant for a fee. Appalachia producers can therefore decide whether to produce dry gas or wet gas, depending on the market price for the NGL and the processing fee to produce them.

Wayangankar noted that since third-quarter 2020, the value of NGLs have been accretive, and the wet gas economics remained above dry gas economics for all second-quarter 2023.

“We do expect, as the basin adds more pipeline capacity, you'll see a significant increase in NGLs along with natural gas,” he said.