(Source: Hart Energy)

Antero Resources Corp. sold a carveout of overriding royalty interest (ORRI) in its Appalachia position as part of the company’s strategy this year to pay down debt through asset sales.

Global investment firm Sixth Street Partners LLC agreed to buy the ORRI that Antero said June 15 will result in proceeds to the company of up to $402 million. The Denver-based company plans to use proceeds to repay revolver borrowings, which stood at $745 million as of March 31.

“The ORRI transaction addresses over half of our $650 [million] to $900 million asset sale goal for 2020 and allows us to pay down debt, while importantly retaining the long-term upside of our core acreage position,” Paul Rady, chairman and CEO of Antero, said in a statement.

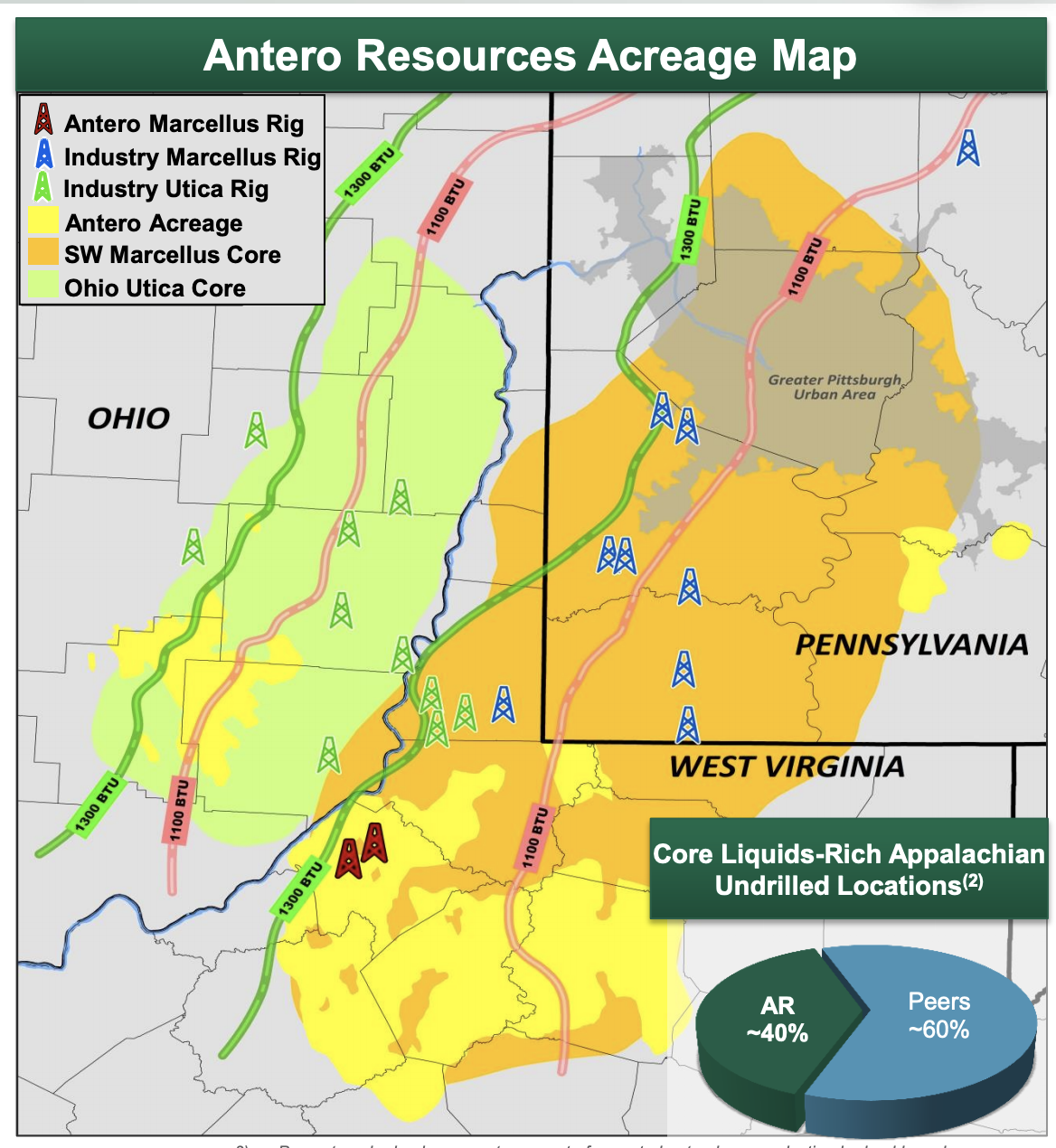

Antero is an independent E&P company with a position of about 536,000 net acres across West Virginia and Ohio in the core of the Appalachian Basin’s Marcellus and Utica shale plays. Prior to the ORRI sale, the company’s position included 84% net revenue interest.

The transaction with Sixth Street comprised of a 1.25% ORRI in all existing producing wells and a 3.75% ORRI in existing acreage in wells completed over the next three years. On a weighted average basis, the applicable overrides equate to an approximately 1% to 1.5% ORRI across Antero’s entire asset base on a perpetual basis.

During the first quarter, Antero reported a 9% increase in net production over the prior year while still managing to reduce its 2020 drilling and completion capex by 35% to $750 million. The company’s net production for the quarter averaged 3.4 Bcfe/d of net production (68% natural gas by volume).

Further, following a 13% IRR and 1.5x cash-on-cash return to Sixth Street, Antero will have an 85% reversionary interest in the ORRI and Sixth Street will have a 15% remainder interest.

Commenting on the transaction, Matt Dillard, partner at Sixth Street, said in a statement: “Antero has built an extensive core acreage position in one of the lowest cost shale basins in the U.S. Our investment further strengthens Antero’s balance sheet and provides a clear path for the company to develop its attractive acreage position for many years to come.”

Proceeds of $300 million were received at closing and up to an additional $102 million will be received over the next 12 months, according to the company release.

“The ORRI transaction increases our liquidity, reduces debt, and positions us to address our upcoming bond maturities,” Antero President and CFO Glen Warren added in a statement.

According to the company release, Antero repurchased an additional $196 million notional amount of unsecured senior notes during the second quarter to date at a weighted average 17% discount. The company has $540 million notional amount of 2021 senior notes that remain outstanding.

Pro forma for the initial proceeds from the ORRI transaction and the repurchase of senior notes during the quarter, the company has about $745 million drawn on its revolving credit facility and $1.2 billion in liquidity under its credit facility as of March 31.

Warren also noted that Antero’s borrowing base under its credit facility “importantly” remained unchanged at $2.85 billion following the ORRI sale, further supporting the company’s liquidity profile.

The effective date of the ORRI transaction is April 1. The additional $102 million of expected proceeds consists of two contingent payments of up to $51 million each based on volume thresholds that relate to cumulative production net to the ORRI through Sept. 30, 2020 and March 31, 2021.

Credit Suisse Securities (USA) LLC was sole financial adviser to Antero on the ORRI transaction and Vinson & Elkins LLP provided legal counsel. White & Case LLP was the legal adviser to Sixth Street.

Sixth Street is a global investment firm with over $34 billion in assets under management and committed capital. Through a dedicated energy team based in Houston, the firm invests in and partners with energy companies to finance, acquire, develop and operate energy-related assets.

Recommended Reading

Exxon’s Payara Hits 220,000 bbl/d Ceiling in Just Three Months

2024-02-05 - ExxonMobil Corp.’s third development offshore Guyana in the Stabroek Block — the Payara project— reached its nameplate production capacity of 220,000 bbl/d in January 2024, less than three months after commencing production and ahead of schedule.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.

Tinker Associates CEO on Why US Won’t Lead on Oil, Gas

2024-02-13 - The U.S. will not lead crude oil and natural gas production as the shale curve flattens, Tinker Energy Associates CEO Scott Tinker told Hart Energy on the sidelines of NAPE in Houston.

What's Affecting Oil Prices This Week? (March 18, 2024)

2024-03-18 - On average, Stratas Advisors predicts that supply will be at a deficit of 840,000 bbl/d during 2024.

What's Affecting Oil Prices This Week? (March 11, 2024)

2024-03-11 - Stratas Advisors expects oil prices to move higher in the middle of the year, but for the upcoming week, there is no impetus for prices to raise.