Seaport Global analyst believes the merger checks all the boxes for Eclipse, which had launched a strategic and financial review process to maximize shareholder value earlier this year. (Source: Hart Energy)

Eclipse Resources Corp. (NYSE: ECR) and Blue Ridge Mountain Resources Inc. have agreed to merge in an all-stock transaction set to create one of the largest Utica-focused operators, the companies said Aug. 27 in a joint press release.

As part of the merger agreement, Blue Ridge stockholders will receive 4.4259 shares of Eclipse common stock for each share of Blue Ridge stock. This represents consideration to each Blue Ridge stockholder of $7.44 per share based on the closing price of Eclipse stock on Aug. 24.

Mike Kelly, senior analyst with Seaport Global Securities LLC, pinned the price tag for the combination at $345 million given Irving, Texas-based Blue Ridge Mountain’s $40 million net cash position. He added that the deal price equates to roughly $1,100 per acre assuming $2,000 per flowing thousand cubic feet equivalent (Mcfe) on the PDP assets.

For Eclipse, the merger agreement ends a strategic and financial review process the State College, Pa.-based company launched earlier this year in hopes of increasing shareholder value. Further, Kelly said he was “decisively positive” on the deal as it checks all the boxes for Eclipse.

“The combo solves a lot of issues for Eclipse—meaningfully improves leverage, accelerates organic growth, cuts unit costs and adds higher quality acreage that steps up inventory years,” Kelly said in an Aug. 27 research note.

The companies expect synergies from the merger to provide competitive per unit operating costs and roughly $15 million in annual savings from general and administrative expenses (G&A).

The new company will be led by John Reinhart, who is currently president and CEO of Blue Ridge Mountain which was formerly known as Magnum Hunter Resources Corp. but changed its name in January 2017 as part of a rebranding strategy.

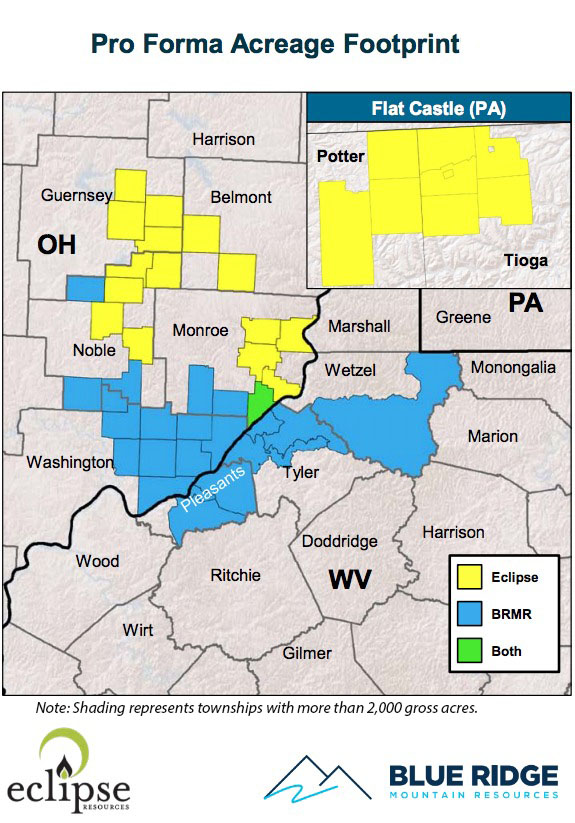

The combined company will have a position covering about 227,000 net effective undeveloped core acres across the Utica and Marcellus shale plays in Appalachia. Pro forma fourth-quarter production is expected to range between 500 MMcfe/d and 560 MMcfe/d.

Benjamin W. Hulburt, chairman, president and CEO of Eclipse, said in a statement, “This transaction provides a compelling opportunity for both Eclipse Resources and Blue Ridge shareholders to benefit from the strength of the combined company. This combination allows both of us to consolidate premier assets that significantly increase the company’s production and cash flow, seamlessly fit into a consolidated drilling program and provide for considerable G&A synergies, all while allowing for accelerated growth without adding to the company’s debt obligations.”

RELATED:

Eclipse Resources: Storming Utica's Castle

Eclipse Leans Toward Liquids In Its Appalachian Plays

The combined company is set to have 735 net locations, a 94% increase for Eclipse and a 106% increase for Blue Ridge Mountain. The new company expects to run a self-funded two- to three-rig business plan targeting 20% annual production growth positive 2020 cash flow.

Overall, the transaction implies an enterprise value for the combined company of about $1.4 billion and an equity value of roughly $908 million, according to the companies press release.

“We believe the combined company will possess a substantial scale advantage and an excellent foundation for significant organic growth with attractive cash flows while maintaining the optionality for bolt-on value-accretive acquisitions within the basin,” Reinhart said in a statement.

The exchange ratio of stock for the merger will be adjusted to reflect a 15-to-1 reverse stock split of the Eclipse stock to be effected concurrently with the closing of the transaction.

Upon closing of the transaction, existing Eclipse shareholders will own about 57.5% of the outstanding shares of the combined company and Blue Ridge shareholders will own roughly 42.5%. The company’s board of directors will consist of 10 directors, five designated by Eclipse and five designated by Blue Ridge, one of whom will be new President and CEO Reinhart.

The companies said they expect to close the transaction in the fourth quarter of 2018, subject to customary regulatory approvals, approval by the holders of a majority of Blue Ridge common stock and certain other customary closing conditions.

Jefferies LLC was financial adviser to Eclipse, and Norton Rose Fulbright US LLP was its legal adviser. Vinson & Elkins LLP was legal adviser to EnCap Investments, the majority stockholder of Eclipse. Blue Ridge’s financial adviser was Barclays and Bracewell LLP was its legal adviser.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.