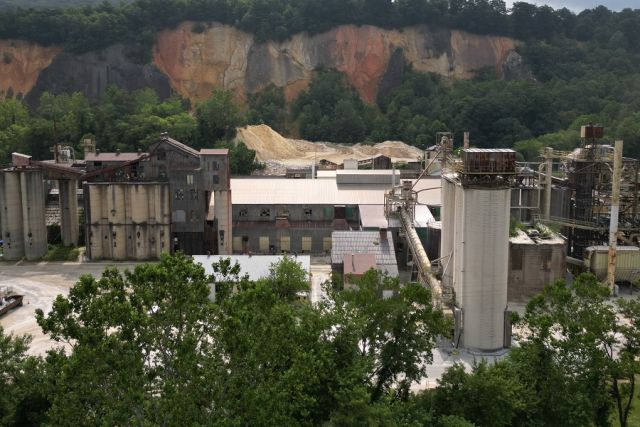

A U.S. Silica sand plant. Apollo will purchase U.S. Silica Holdings at a time when service companies are responding to rampant E&P consolidation by conducting their own M&A. (Source: Shutterstock.com)

Investment firm Apollo has agreed to buy and take private U.S. Silica Holdings, a proppant services company, in an all-cash transaction valued at $1.85 billion, the companies said on April 26. As part of a definitive agreement, Apollo will give U.S. Silica a 45-day window to seek a more attractive offer.

The deal comes amid consolidation among service companies in the wake of upstream deals that have in the past year created behemoth E&Ps, particularly in the Permian Basin.

Under the terms of the agreement, U.S. Silica stockholders will receive $15.50 per share in cash for each share of common stock owned as of the closing of the transaction.

The per-share purchase price of $15.50 represents an 18.7% premium to U.S. Silica's closing share price of $13.06 on April 25, the last full trading day before to the transaction announcement — and a 33.0% premium to the company's 90-day volume-weighted average share price for the period ended April 25, U.S. Silica said.

Upon completion of the transaction, U.S. Silica’s common stock will no longer be listed on the New York Stock Exchange, and the company will become a private company. U.S. Silica will retain its name and continue to be led by CEO Bryan Shinn and its current executive team.

Charles Shaver, chairman of the U.S. Silica board, said the deal with Apollo will provide the company’s stockholders with compelling, certain, cash value for their shares.

“Apollo Funds have a strong investment record in the minerals and mining sector and are committed to helping us achieve our long-term objectives while maintaining our core values and customer-centric approach," Shaver said.

Shinn said U.S. Silica has been a leader in the industrial silica and minerals industry for 124 years, and the agreement is a great outcome for shareholders that paves the way for the company's continued success.

"By partnering with Apollo Funds, we gain significant resources, deep industry expertise and enhanced flexibility as a private company to pursue the many market opportunities in front of us and invest in innovative capabilities that enable value-added offerings for customers,” Shinn said. “U.S. Silica has long benefitted from our large-scale production, high-quality reserve base, geographically advantaged footprint, low-cost platform, and strong customer relationships. Our ability to take this step from a position of strength is a testament to this excellent foundation and the dedication of our employees. I'm incredibly excited about the path ahead."

Gareth Turner, partner at Apollo, said, the firm is thrilled to unlock the company’s next phase of growth.

“U.S. Silica's industrial minerals and sand mining and logistics businesses each are proven leaders in their respective markets,” Turner said. “We believe there are many opportunities to grow and expand these businesses and we look forward to using our significant industry experience to build on and extend the Company's legacy of excellence to new frontiers."

The transaction, which has been unanimously approved by U.S. Silica's board, is expected to close in the third quarter, subject to customary closing conditions. The deal will require approval by U.S. Silica stockholders

The definitive agreement includes a 45-day "go-shop" period that will expire just after midnight on June 10. The period permits U.S. Silica and its financial adviser to actively initiate, solicit and consider alternative acquisition proposals from third parties.

U.S. Silica's directors will have the right to terminate the agreement to enter into a superior proposal, subject to the terms and conditions of the agreement.

Piper Sandler & Co. is acting as a financial adviser to U.S. Silica and Morrison & Foerster LLP is serving as legal counsel.

Wachtell, Lipton, Rosen & Katz is serving as legal counsel and BNP Paribas Securities Corp and Barclays are serving as financial advisers to Apollo Funds.

Recommended Reading

Battalion in Compliance with NYSE American after 2023 Meeting

2024-02-13 - Previously, Battalion Oil was not in compliance with the NYSE after failing to hold an annual meeting of stockholders during the fiscal year ending Dec. 31.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

New Fortress Energy Sells Two Power Plants to Puerto Rico

2024-03-18 - New Fortress Energy sold two power plants to the Puerto Rico Electric Power Authority to provide cleaner and lower cost energy to the island.

Tellurian Executive Chairman ‘Encouraged’ by Progress

2024-03-18 - Tellurian announced new personnel assignments as the company continues to recover from a turbulent 2023.

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.