Despite Antero Resources’ record-breaking production in the first half of 2023, a dramatic reduction in rig activity looks to balance out the natural gas market. (Source: Shutterstock)

Despite Antero Resources’ record-breaking production in the first half of 2023, a dramatic reduction in rig activity looks to balance out the natural gas market, executives said.

“After a record-breaking first half of 2023 operationally, we continued to build on this momentum during the third quarter. As an example, our completion pumping hours per day increased to over 17 hours per day, up nearly 50% from a year ago,” Antero CEO Paul Rady said during the Oct. 26 earnings call.

Those record-breaking numbers led to significantly shorter cycle times per pad, with pad times averaging 160 days this year—down 63% from Antero’s 2019 performance. The shorter cycle times have resulted in higher capital efficiencies and allowed Antero to complete 80% of their expected completion stages during the first nine months of 2023.

“This gain in capital efficiencies is highlighted by our 9% total production growth in the third quarter compared to the year-ago period. Our production growth was driven by an 18% liquids growth, while natural gas volumes increased 4% year-over-year,” Rady said. “Looking at this on an annual basis, we now expect production this year to increase [production] by 225 million cubic feet equivalent per day.”

Antero’s net production averaged 3.5 Bcfe/d, including 202,000 bbl/d of liquids and 2.3 Bcf/d of natural gas.

In an Oct. 25 report, Goldman Sachs analysts said they reviewed Antero’s “strong operational momentum as a positive heading into next year. Given AR is unhedged on gas and NGLs, we believe the focus in the near-term will be on both natural gas and NGLs (particularly LPG) outlook.”

Goldman Sachs noted that Antero “raised its FY23 production guidance midpoint to 3.4 Bcfe/d (high-end of the prior range of 3.35-3.40 Bcfe/d) driven by strong well performance and continued efficiency gains, and maintained its capex guidance.”

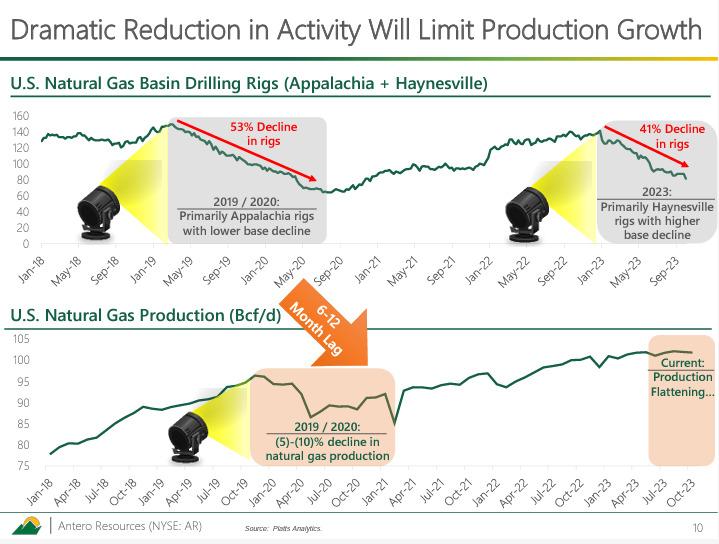

While the capital efficiency gains reduce Antero’s maintenance capital budget and lower drilling and completions capital for 2024, a dramatic reduction in activity looks to limit their 2024 production growth.

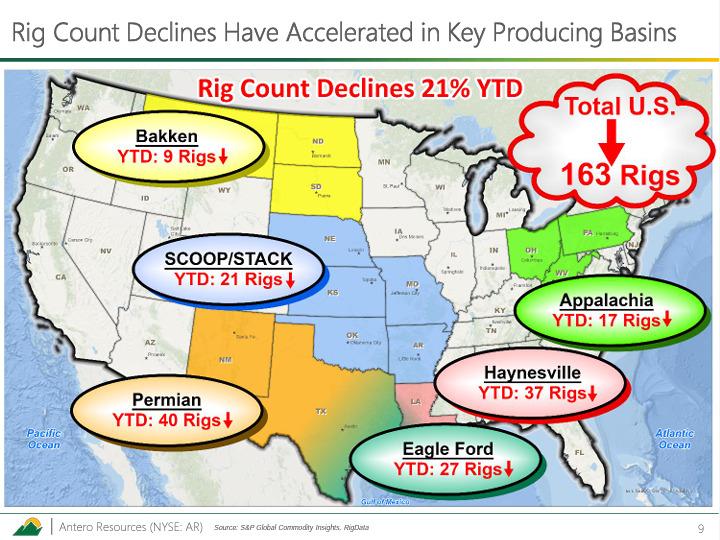

“We believe the sharp decline in rigs and completion crews will curb production growth in 2024, helping to balance the U.S. natural gas market,” Justin Fowler, Antero’s senior vice president of natural gas marketing, said during the earnings call.

In the U.S., the rig count has fallen 21% since last year. In the Permian, rig counts are down 40%, leaving about 300 rigs in the basin. The Appalachian and Haynesville rig count has decreased by approximately 50 drilling rigs since the beginning of the year, according to Antero. Even NGL-producing basins such as the Eagle Ford Shale and the Midcontinent’s SCOOP/STACK have seen their rig counts decline by 35% and 45% respectively, in the past year.

International markets to the rescue

The rig decline is reminiscent the one the industry faced in 2019 before bouncing back two years later. However, Antero executives say they can weather the storm due to their international business segments, said Dave Cannelongo, Antero’s senior vice president of liquids marketing and transportation.

“We believe that with supportive fundamentals domestically and positive demand signals from China, there are signs of improvement for NGLs heading into 2024 and in particular, for producers like Antero with direct access to international markets,” he said.

Antero’s propane exports to China have been a major driver for the company. From January through August, U.S. propane delivered to China increased 44% year-over-year. China has added 120,000 bbl/d of propane dehydrogenation capacity, with another 340,000 bbl/d expected to be added by the end of 2024. The U.S. also recently set a record high for propane exports, with two consecutive weeks at an average 2 MMbbl/d.

“While absolute propane inventories are high and prices as a percent of WTI [are] lower than usual, fundamentals are painting a better picture in recent weeks… Overall, propane export demand has been consistently strong and has averaged 1.6 MMbbl/d year-to-date,” Cannelongo said, adding that is 19% higher than the 2022 full-year average.

An Oct. 26 Tudor, Pickering, Holt & Co. commentary said that looking ahead to 2024, Antero management “still sees a material decrease in capital required to maintain increased 2023 production levels and will look to use FCF to pay down debt and deliver returns to shareholders.”

As TPH had expected, Antero did not repurchase stock in the quarter, with analysts’ model “seeing buybacks kick back in for Q4 at ~$50MM heading back to shareholders.”

Low-cost inventory

Antero maintains that its inventory is the lowest cost in the Appalachian Basin.

The company’s comparison of its inventory positions with its peer group shows Antero has the most sub-$2.75/Mcfe drilling inventory with a 22-year runway, according to Enverus date.

“It's important to note that this inventory comparison is after our peers spent a combined $17 billion on acquisitions over the last two years,” Rady said. “In contrast, we remain focused on our organic leasing efforts, where we've invested some $340 million over that same time to acquire targeted drilling locations within our development footprint.”

On average, Antero has added locations for approximately $1 million each through its leasing efforts, which is “less than half of the over $2 million average cost per location for the peer acquisitions,” Rady said.

|

Q3 2023 |

Q3 2022 |

|

|

EBITDA ($MM) [Non-GAAP] |

271 |

878 |

|

Production |

3.5 Bcfe/d |

3.2 Bcfe/d |

|

Adjusted net income($MM) |

25 |

531 |

Recommended Reading

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.