The amount of gas flared has steadily increased, for the most part, in the Permian Basin as oil production has risen in recent years. (Source: Shutterstock.com)

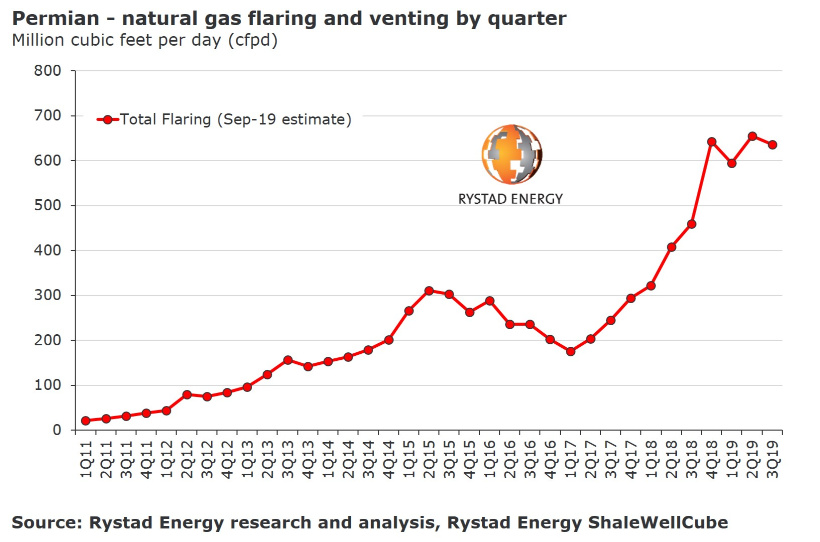

A rise in recent years of vented and flared gas from the prolific Permian Basin is still hovering near record highs, and fears are that the level could be prolonged as new wells come online in second-half 2019.

That’s according to analysts at Rystad Energy, the energy consultancy that reported this week Permian Basin flaring and venting levels have stabilized between 600 million and 650 million cubic feet per day.

New pipelines en route are expected to provide some relief.

“However, it should be noted that the significant number of new well connections in the second half of 2019 might result in a sustained high flaring level, because from an operational perspective, associated gas flaring is normal in the first two weeks following an oil well completion,” Artem Abramov, head of shale research at Rystad Energy, said in a statement.

The amount of gas flared has steadily increased, for the most part, in the Permian Basin as oil production has risen in recent years.

In Texas, flaring of associated gas from initial completion beyond 10 producing days is prohibited. But that state routinely grants exemptions to the rule.

RELATED: Texas RRC Sides With Shale Driller In Flaring Vote

Flaring is needed for safety reasons in some instances, and temporary flares may be used during well testing. But a lack of sufficient gas infrastructure needed to move gas, which flows along with oil from wells, to the market has prompted some oil companies to flare more often than not instead of shutting in wells and missing out of oil revenue.

Yet others consider the value of gas molecules—just like oil—when forming field development plans looking at the entire value chain.

RELATED: Pioneer, Chevron Call On Industry, Others To Tackle Permian Basin Flaring

Chevron, for example, has a no flaring policy.

“When we consider a development area, we consider not just how many rigs it’ll take, how many wells we can drill, what the production volume is, but how do we access markets whether it’s gas or oil,” Stephen Green, president of Chevron North America E&P, said in September during an event hosted by the Center for Strategic & International Studies. “That is why we’ve had a purposeful strategy of focusing on ultimate recovery resource but also an integrated strategy of the entire value chain.”

The company, like some others, sees gas as potential feedstock for petrochemicals, LNG, heating, power generation, powering drilling rigs or pumping fleets.

Rystad, however, noted there has been some improvement on the venting side, notably in New Mexico where the analyst said vented and flared gas amounts are reported separately instead of together like they are in Texas. Analysts reported that on average between 5% and 15% of the total flared and vented production stream is vented, or released without combustion.

“In particular, reported data from recent quarters shows a significant decrease in the frequency of venting relative to flaring, with only 8% of waste gas being vented,” Rystad said in a news release.

New pipelines coming online are expected to ease takeaway capacity woes. These include Kinder Morgan Inc.’s Gulf Coast Express pipeline, which provides about 2 billion cubic feet per day of natural gas capacity to Texas Gulf Coast markets.

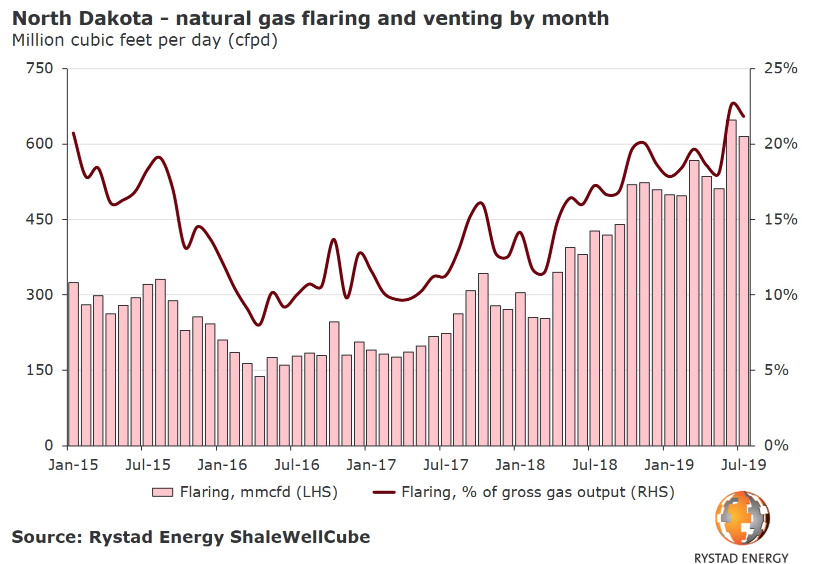

Elsewhere, venting and flaring levels are “generally low,” Rystad said, adding the exception is North Dakota’s Bakken.

“As of Summer 2019, data from North Dakota shows that 22% to 23% of produced gas was flared—twice as much as the state would like to achieve under the current regulations,” Rystad said.

Those are flaring levels never seen before, according to Abramov.

Recommended Reading

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

The One Where EOG’s Stock Tanked

2024-02-23 - A rare earnings miss pushed the wildcatter’s stock down as much as 6%, while larger and smaller peers’ share prices were mostly unchanged. One analyst asked if EOG is like Narcissus.