Two independent U.S. oil and gas producers, Amplify Energy Corp. and Midstates Petroleum Co. Inc., agreed to merge in an all-stock combination expected to “achieve benefits of scale.”

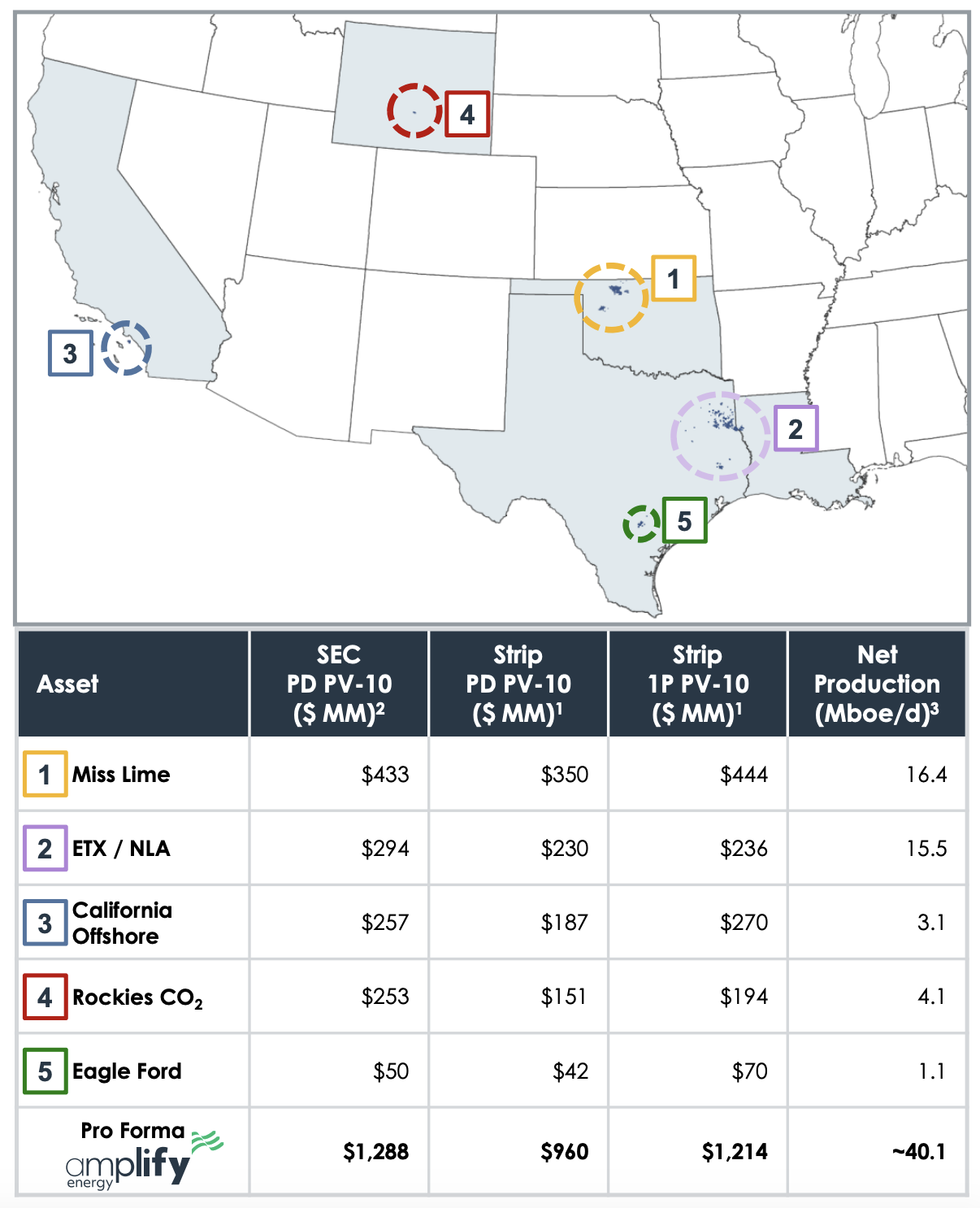

Amplify’s operations are focused in the Rockies, offshore California, East Texas / North Louisiana and South Texas. Meanwhile, Midstates has a position in the Mississippian Lime play in Oklahoma. Combined, the companies produced about 40,000 barrels of oil equivalent per day during fourth-quarter 2018.

Pro forma, the total enterprise value of the combined company will be greater than $720 million with a market cap of more than $430 million. The companies expect annual G&A synergies of at least $20 million from the combination.

The combined company will be headquartered in Houston and trade on the New York Stock Exchange under the ticker AMPY.

Amplify’s President and CEO Ken Mariani will lead the combined company. The new board of directors will include members who currently serve on the Amplify and Midstates boards.

(Source: Investor Presentation May 2019)

Under the terms of the merger agreement, Amplify stockholders will receive 0.933 shares of newly issued Midstates common stock for each Amplify share of common stock.

At closing, expected third-quarter 2019, Amplify and Midstates stockholders will each own 50% of the outstanding shares of the combined company.

Amplify’s financial adviser for the transaction is UBS Investment Bank and its legal adviser is Kirkland & Ellis LLP. Houlihan Lokey Capital Inc. is Midstates’ financial adviser and its legal adviser is Latham & Watkins LLP.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Atlas Energy Solutions to Buy Hi-Crush, Consolidating Permian Services

2024-02-27 - The $450 million deal effectively connects Atlas Energy Solutions’ Delaware Basin logistics and proppant offerings with Hi-Crush’s operations in the Midland Basin.

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.

Apollo to Buy, Take Private U.S. Silica in $1.85B Deal

2024-04-26 - Apollo will purchase U.S. Silica Holdings at a time when service companies are responding to rampant E&P consolidation by conducting their own M&A.

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.