AltaGas said it will acquire Tidewater’s Pipestone Natural Gas Processing Plant Phase 1 and II expansion projects; an adjacent natural gas storage facility; a truck-in/truck-out terminal; and associated gathering pipeline systems. (Source: Shutterstock)

AltaGas Ltd. entered into a definitive agreement with Tidewater Midstream and Infrastructure Ltd. to acquire multiple midstream, storage and terminals for CA$650 million (US$480 million), the company said on Aug. 31.

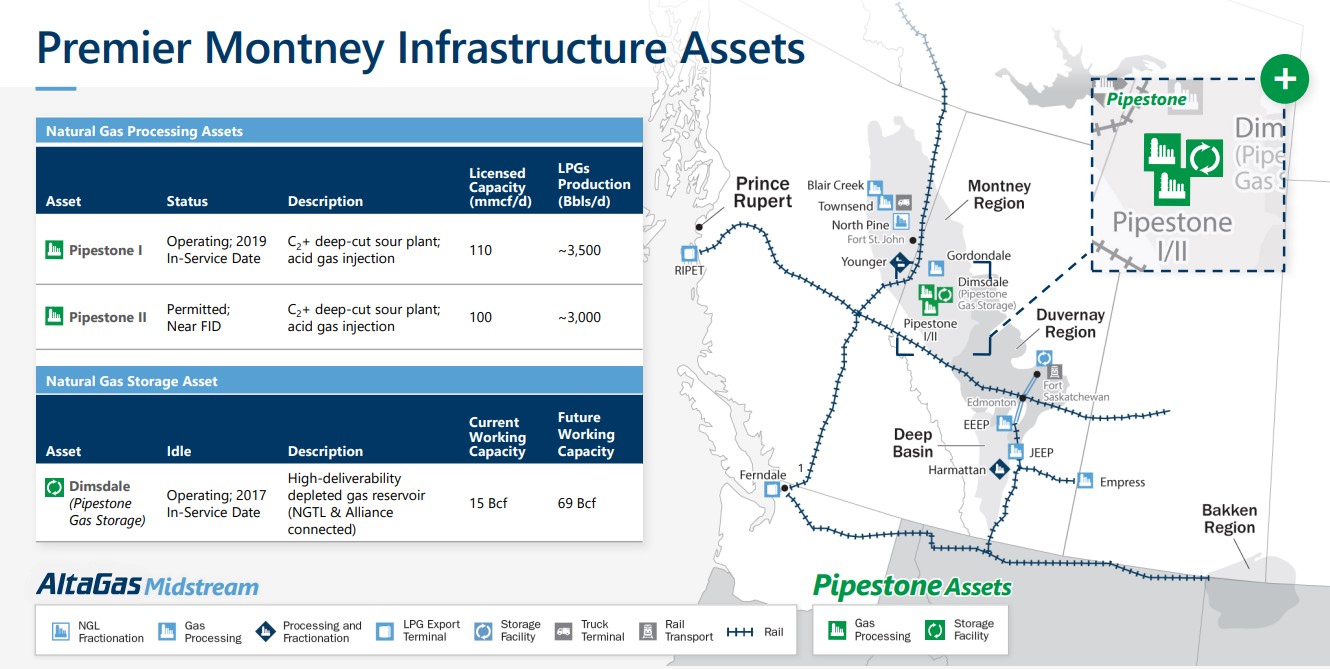

AltaGas said it will acquire Tidewater’s Pipestone Natural Gas Processing Plant Phase 1 and II expansion projects; the adjacent Dimsdale Natural Gas Storage Facility; Pipestone’s condensate truck-in/truck-out terminal; and associated gathering pipeline systems.

AtlaGas said the transaction strengthens the company’s midstream value chain through an expanded footprint in the Alberta Montney Shale and provides meaningful long-term LPG supply for its global exports platform.

The Pipestone assets consist of:

- Pipestone Phase I: a modern sour deep-cut natural gas plant with 110 MMcf/d of processing capacity and 20,000 bbl/d of liquids handling capacity located in the heart of the Alberta Montney.

- Pipestone Condensate Terminal: A truck-in/truck-out terminal used to maximize value of Pipestone liquids.

- Pipestone Phase II: A fully permitted, shovel-ready expansion project that will provide an additional 100 MMcf/d of sour deep-cut natural gas processing capacity and an additional 20,000 bbl/d of liquids handling capabilities.

- Dimsdale Gas Storage: Premier operational natural gas storage facility located east of the Pipestone I and II facilities with current working gas capacity of 15 Bcf, which can be increased more than four-fold to 69 Bcf.

Total consideration is $650 million, comprised of $325 million in cash and the issuance of approximately 12.5 million AltaGas common shares to Tidewater.

The acquisition is contingent on Tidewater and AltaGas making a positive final investment decision (FID) for the Pipestone Phase II project. To facilitate reaching FID, AltaGas and Tidewater have entered into an agreement to create a new joint venture (JV) to advance the final steps required to develop and construct the project. The terms of the JV will permit the parties to continue to collaborate on the Pipestone Phase II project even if the acquisition does not proceed.

AtlaGas said the transaction represented an approximately 7.2x estimated run-rate normalized EBITDA, inclusive of synergies and the incremental capital that AltaGas will deploy to complete the Pipestone Phase II project. The transaction is expected to be five percent EPS accretive in 2025 forward while being 0.1x net debt to normalized EBITDA credit accretive in 2025 forward.

Vern Yu, AltaGas' President and CEO said the acquisition is consistent with the company’s long-term strategy and provides an opportunity to support industry-leading producers' growth plans in one of Canada's most prolific resource plays.

“The assets will deliver highly contracted take-or-pay and fee-for-service revenue that will also bring meaningful long-term LPG supply for AltaGas' global exports platform,” Yu said. “The acquisition should also deliver stable and growing earnings and cash flows, which will deliver strong long-term value creation for our stakeholders while reducing risk and providing long-term credit accretion. We look forward to working with all key stakeholders to advance the final steps required to develop and construct the Pipestone II expansion project and support continued resource development in Western Canada.”

RBC Capital Markets are acting as financial advisors and Burnet Duckworth & Palmer LLP are acting as legal advisors to AltaGas on the transaction.

Recommended Reading

Targa Expects Another Major Permian Pipeline Project This Year

2024-05-03 - Targa Resources says different projects are falling in place for gas capacity expansion

US Appeals Court Upholds FERC Approvals for Gas Pipeline Expansion

2024-05-02 - A unanimous three-judge panel of the U.S. Circuit Court of Appeals for the D.C. Circuit held that the Federal Energy Regulatory Commission was right to determine the Evangeline Pass Expansion project is functionally separate from four related gas infrastructure developments.

Enterprise Targets FID for SPOT Project by End of 2024

2024-05-01 - Enterprise Products Partners’ co-CEO disputed capex figures reported in the media regarding its Sea Port Oil Export Terminal.

US Reforms Green Law to Speed Clean Energy, Infrastructure Permits

2024-04-30 - The reforms are the second and final phase of adjustments to the National Environmental Policy Act, or NEPA, by the Biden administration.

Canadian Railway Companies Brace for Strike

2024-04-25 - A service disruption caused by a strike in May could delay freight deliveries of petrochemicals.