“The capital markets really have a huge effect on A&D,” says Craig Lande, managing director of RBC Richardson Barr. (Source: Shutterstock.com)

[Editor's note: A version of this story appears in the March 2019 edition of Oil and Gas Investor. Subscribe to the magazine here.]

For the past two years, the oil and gas universe has been collapsing in on itself.

This is what life is like in the resulting public-market black hole: in January 2017, the public value E&Ps totaled $562 billion. Two years later, values have been crushed down to $434 million, said Craig Lande, managing director of RBC Richardson Barr.

The strength of the A&D market was also partly a mirage, more akin to the down year of 2015 than it seemed. As RBC counts deals—at least $20 million qualifies—from 2010 to 2017 transactions averaged about $50- to $60 billion. RBC’s tally of deals for 2018 market was $44 billion.

Addressing an IPAA audience on Jan. 24 in Houston, Lande said: “I think a lot of you will say, ‘Well, it seems like the A&D market has been fairly soft, not a lot of things happened last year, so it’s odd to say $44 billion.’ I agree.”

Partly, the 2018 deal total was inflated by the “anomaly” of BP Plc’s deal to buy most of BHP Billiton’s U.S. shale assets for $10.5 billion, he said.

“Not a lot of people got to play those” outsized transactions, Lande said. “You take that away and you’re really talking more of a $33- to $34 billion market” for the year. That compares more to 2015, when the A&D market was really in bad shape and only $23 billion in deals were transacted.

There’s quite a bit of silver in all of the gray. Chief among the good news is all of this has happened before, Lande said. It was a theme he repeatedly returned to that, he said, has either been forgotten or not yet learned: oil and gas is a cyclical business.

“Consolidation is going to happen, one way or the other, and I think everyone would agree it should in this kind of environment,” Lande said.

Yet, since at least 2010, the oil and gas industry has been fixated but frozen on mergers. In 2018, M&A finally had its breakthrough.

But as deals were made and market values shrank, so did the middle class of E&Ps with market caps between $3 billion and $10 billion. That does not bode well for the majority of companies in our industry with a mix of disparate assets, poor acreage, high leverage or inadequate cash flow.

“You’re going to see consolidation two ways,” Lande said. “You’re going to see the bigger guys pick off that sort of ‘meaty middle,’ the $3- to $10 billion companies and, unfortunately, you’ll most likely see some of the smaller guys ultimately head toward bankruptcy” if market conditions don’t change.

In January 2017, the number of companies in the $3- to $10 billion middle ground totaled 26. Now there are just 11 in that market cap range.

“Those companies didn’t get bigger,” Lande said. “They got smaller or went away.”

The middle ground E&Ps, it turns out, are important, he said. The middle is where companies have been giving way to the push and pull of the markets and, ultimately, consolidation. It’s from there that the mergers of Concho Resources with RSP Permian and Diamondback Energy Inc. with Energen Corp. emerged.

“Now scale is everything,” Lande said. “Bigger is better. You saw Concho buy RSP for about $9 billion and Diamondback Energy [buy Energen] for [about] $9 billion. Those [deals] moved the needle for those companies. There’s only a few of those that remain right now that move the needle for the bigger companies.”

The small number of companies still in the E&P middle ground will have targets on their backs or sights on each other as consolidation continues. Companies such as WPX Energy Inc. and Parsley Energy Inc., both with market caps of roughly $5.5 billion, are in the range of what Lande called a “meaningful” size—meaning they, too, can shift a company’s dynamics.

“This is the sector, this area of $3- to $10 billion, in my mind, where they are going to consolidate [with] each other or the guys above them,” Lande said.

Occasionally, smaller companies with appealing acreage, particularly in the Permian Basin, will “probably be picked off,” Lande said. One such deal: Cimarex Energy Co.’s proposed acquisition of Resolute Energy Corp. for $1.6 billion, including $710 million in long-term debt. Resolute, with a market cap of about $750 million, holds about 21,000 net acres in the Reeves County, Texas, in the Delaware Basin. (Deal closed March 1)

It’s no coincidence mergers follow a period in which the oil and gas industry has come to terms with a market voicing its discontent with activists, outright hostility or withdrawal.

For most of 2016, the markets opened up.

“Publics were getting rewarded for paying $40,000 [plus] per acre for Permian resources, and that was great for my business,” Lande said.

After funding the industrywide spending spree from 2010 to 2017 and financing an outspend of capital of about $200 billion during those years, the market has effectively been shouting down deals. Concho and Diamondback, among other consolidators, saw their stock prices suffer after announcing their deals.

The market effectively “stopped and said, ‘No more equity for acquisitions—actually show us the stuff that you bought works,” Lande said.

E&Ps are now expected to execute and show capital discipline. That shift in public market sentiment has driven public companies to become the dominate sellers in the market. For CEO’s, it’s a pain.

“They love buying. They don’t like executing,” he said. “It’s a thankless job and, in this environment, investors expect perfection and, as you can see, a lot of people have been penalized for not being ‘perfect’.”

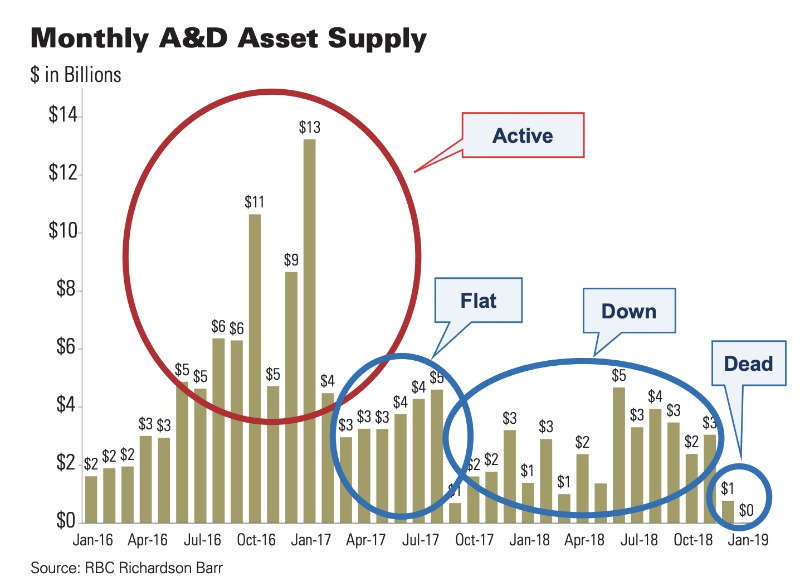

Some months, A&D deals were as much as $10 billion. As the capital markets retreated there was first a flattening and then a nose dive.

“The capital markets really have a huge effect on A&D,” he said.

By December, Lande counted four deals of more than $100 million, “and in my shoes, that's not good,” he said.

Through most of January nearly no A&D—“a giant bagel”—occurred, he said. The good news: there are more opportunities to come and more assets will likely be on the market, he said.

M&A, as Lande sees it, begets A&D. Historically, companies that make big mergers typically sell off noncore assets.

In 2016, about 34% of sellers were public companies. In 2018, nearly 70% of the asset flow came from publics. Going back to 2014, “M&A has been a wonderful thing for A&D. It promotes A&D.”

Whiting Petroleum Corp.’s $3.8 billion purchase of Kodiak Oil & Gas spawned four or five deals, Lande said. Other mergers, such as EQT Corp. and Rice Energy Inc., and Noble Energy Inc.’s purchase of Clayton Williams and Rosetta Resources also set off related, noncore sales.

Since purchasing BHP’s assets, BP plans to divest $5- to $6 billion worth of assets during the next two years. BP’s noncore assets include the Wamsutter gas field in Wyoming, the San Juan Basin in New Mexico and the Arkoma Basin in Oklahoma.

RBC is handling Diamondback’s divestiture of Central Basin Platform assets acquired with Energen, Lande said.

Encana Corp.’s pending $7.7 billion merger with Newfield Exploration Co., in theory, could produce divestitures in the Bakken, Arkoma, Uinta and perhaps the Eagle Ford. (Deal closed Feb. 13)

“You would expect some divestitures to come out of that,” Lande said.

Musing on the Encana deal, Lande noted that after an industry trend toward pure-play companies, Encana is now diversifying. “We’ll see if we can go back to diversity,” he said. “Oddly enough, our industry is cyclical, if you hadn’t realized it yet.”

Private equity will be likely buyers, which continues to look for exits but still has more money than anyone with an estimated $95 billion in dry powder, Lande said.

“There’s a lot of money. That’s not the problem. It’s obviously the tepidness right now to pull the trigger on deals,” he said.

Private equity’s targets have largely been outside of the Permian Basin. “It’s places like the Bakken that really had been left for dead by the publics,” he said. “Or the Eagle Ford, which was once considered the best rock, pound for pound. It probably still is in a lot of respects.”

The Permian simply overshadows it, Lande said.

The days of buying acreage and flipping it within a year, sometimes without having to put a rig to work, are likely over.

“If you had an asset in an attractive resource play for over 18 months and hadn’t sold it yet, then you were probably doing something wrong. That’s how frothy of a market we were in for so many years with the shale revolution. However, times have changed and now we’re back to where we used to be before the advent of resource plays—longer-term holds and cash flow and PDP.”

Patient money is now required.

Lande noted that private equity has scooped up about $16 billion in conventional assets, including $12 billion in gas.

“These are the opportunities that have presented themselves the past few years,” he said. Buyers that wait for a home run deal with excellent acreage in the core of the core are likely to have little to swing at.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Keeping it Simple: Antero Stays on Profitable Course in 1Q

2024-04-26 - Bucking trend, Antero Resources posted a slight increase in natural gas production as other companies curtailed production.

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.

Exxon Mobil, Chevron See Profits Fall in 1Q Earnings

2024-04-26 - Chevron and Exxon Mobil are feeling the pinch of weak energy prices, particularly natural gas, and fuels margins that have cooled in the last year.

Marathon Oil Declares 1Q Dividend

2024-04-26 - Marathon Oil’s first quarter 2024 dividend is payable on June 10.

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.