Generalist investors demonstrated that they don’t have the stomach to endure the valuation mismatch, but the disconnect may be an opportunity. (Source: Hart Energy/Shutterstock.com)

The energy renaissance of 2018 may not have materialized, portfolio managers for Cushing Asset Management said during a recent webcast, but fundamentals remain strong for oil and gas stocks this year.

“Stocks were not following suit as quickly as fundamentals were improving and prices were moving up,” said Matthew Lemme. “And yet, energy equities outpaced the downturn for oil in the fourth quarter, so that created even more multiple compression.”

Generalist investors demonstrated that they don’t have the stomach to endure the valuation mismatch, but Lemme called the disconnect an opportunity—it’s a quality-on-sale market. And where should an oil investor start? At the top.

“Industry changes seem to have started at the top, i.e., the largest companies, and that’s reflected in the statistics,” Lemme said. “The larger companies tend to be the first to recognize some value-destructive tendencies of past cycles; they tend to be the first to cut costs; and they tend to be the first to focus on returns and focus on capital regeneration. That’s what we saw over the last three to five years.”

Lemme stressed that not all large caps are good investments and that many mid-caps offer value to investors. Still, the big dogs retain a substantial advantage.

Lemme stressed that not all large caps are good investments and that many mid-caps offer value to investors. Still, the big dogs retain a substantial advantage.

“We think valuations are disconnected from fundamentals to the stocks’ detriment,” he said. “They’re cheap on a lot of measures.”

Oil fundamentals, Cushing predicts, will improve in the first half of 2019 because of factors that include OPEC production cuts and reduced Canadian oil shipments to the U.S. The resulting tighter inventories, Lemme said, will drive up the commodity prices and bolster oil company stock prices as well.

The outlook for natural gas, however, is challenged.

“If you had told me a year ago that we’d have a cold winter starting in early November and inventories that were at multi-year lows, I would have told you that gas was probably going to be more than $4 per million BTUs,” Lemme said. “The trouble with that prediction is that production gains have been sound and that gas producers have shown that they can drill economically at $3 or even less. So while freezing cold temperatures in November drive the cost of gas higher, the forward curves have hardly budged because supply is just too easy to come by.”

So easy that the Henry Hub Nymex price at mid-afternoon Feb. 4 was down to $2.66 per million British thermal units (MMBtus) and the Chicago City Gate spot price had tumbled to an eight-month low of $2.49/MMBtu just two days after the temperature dropped to 21 degrees below zero on Jan. 30.

This was supposed to be the year, based on calculations made in early 2018, that natural gas prices turned bullish. Now it’s seen as just another round of surplus supply.

“We’ve seen bearish revisions like this several times in the last few years,” Lemme said. “Our opinion is that, while … LNG exports likely had better than market balance in 2020, a truly better structured gas market is likely more of a 2021 event.”

But Cushing maintains a positive outlook, especially for midstream stocks. In a recent report, the portfolio managers wrote that they anticipated 2018 would bring a number of positives to the midstream, including:

- Simplified structures;

- Improved governance;

- Reduced leverage;

- Minimal equity requirements; and

- A renewed focus on returns-based metrics.

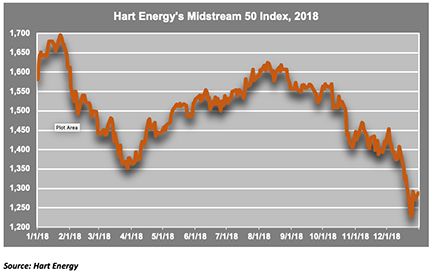

They were right, but those positives did not bring about an equity price performance as the equal-weighted Cushing 30 MLP Index ended the year with a -18.7% total return. Hart Energy’s Midstream 50 Index, in which companies are ranked by EBIDTA and weighted by market cap, showed a return of -18.5%. Still, the midstream sector outperformed other areas of the industry—the S&P Oil & Gas Exploration & Production Select Industry Index, for example, took a 28% hit in 2018.

Cushing forecasts that, with simplifications and resets coming to an end, midstream companies have a better chance of appealing to investors in 2019.

“We believe they will find a simpler, healthier asset class that is supported by compelling valuations and underlying drivers that are generally strong,” the managers wrote in the report. “We think the midstream group is simply too hard to ignore given where valuations sit today.”

Recommended Reading

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.

Weatherford M&A Efforts Focused on Integration, Not Scale

2024-04-25 - Services company Weatherford International executives are focused on making deals that, regardless of size or scale, can be integrated into the business, President and CEO Girish Saligram said.