(Source: Kryuchka Yaroslav/Shutterstock.com)

Presented by:

Editor's note: This column appears in the new E&P newsletter. Subscribe to the E&P newsletter here.

Oil and gas operators are constantly striving to improve performance. Generally, this means seeking improvements in the well delivery process, which is their core business. But what does this really mean, and what does it require?

“Improving performance” usually means two things:

- Working toward the smooth delivery of many tens or hundreds of wells to production every year, according to a published schedule and budget; and

- Continually seeking ways to improve timing and costs of those well delivery operations to increase return on capital employed.

Many factors influence positive well delivery performance, but seven stand out.

No. 1

The most important factor is an open attitude toward changes in business process and workflow needed to increase agility and positioning for success. People must embrace the changes that will occur as the performance improvement initiative unfolds and look to the future (and their performance objectives). I’ve sometimes heard “I don’t think that’s my job” and “That’s not the way that we do things here,” and I always get a sinking feeling about the likelihood of success when I do. It’s the people that will build success or break the initiative!

No. 2

There must be a sustained leadership commitment for change, both organizational and technical. Management must display this commitment, provide regular oversight and insight, and be ready to enforce adoption of new processes and technologies. Otherwise, with lack of direction and input, people return to their old ways of doing things and often continue to exhibit territorial behavior and poor information sharing.

No. 3

The team should determine appropriate key performance indicators (KPIs) to measure performance, because what gets measured gets improved. These establish improvement criteria, align the team around clear objectives and ensure that everybody knows when things are going in the right direction.

No. 4

All disciplines (subsurface to execution and management) in the well delivery value chain must be committed and able to collaborate effectively through an integrated business operations model. This is sometimes tricky and may need reconfiguration periodically, but it eliminates territorial behavior, pushes decisions out to the appropriate people and mitigates erosion of value that sometimes appears through well delivery program stages.

No. 5

Barriers to rapid and accurate access to any required data, from any discipline, must be eliminated or minimized. People must be able to obtain data that they need when they need it, and it must be accurate. Extensive data cleanup may be needed, but in the end it’s worth it. It reinforces the required feedback loops between disciplines (see below), decreases the time required to make informed decisions and ensures that information is synchronized across disciplines.

No. 6

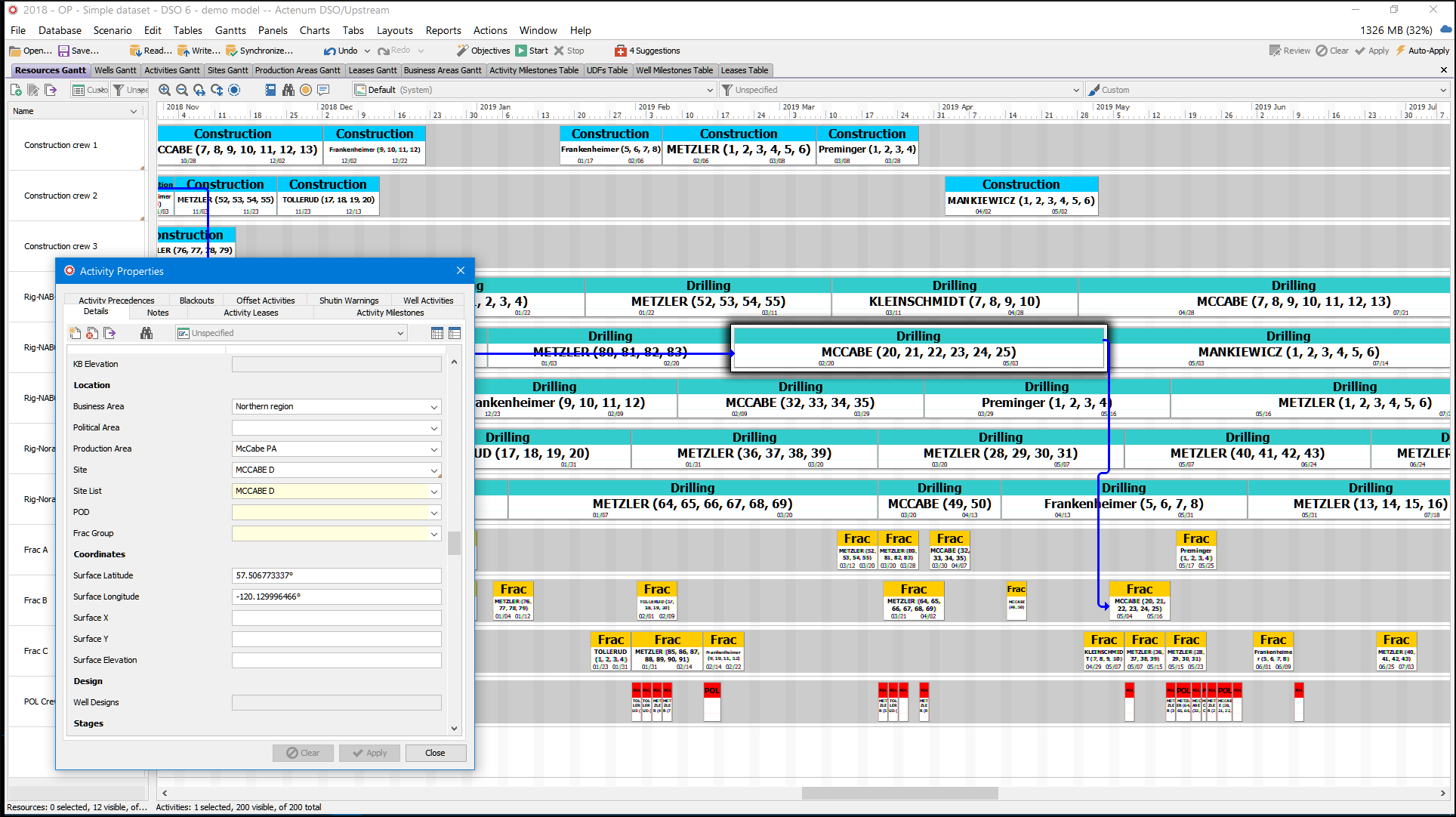

A flexible and sophisticated planning and scheduling platform, incorporating optimization, needs to be put in place to provide a model of operations and a focus for all disciplines. There must also be a capability for rapid creation and evaluation of multiple development plans and operational scenarios. If this is missing, then there won’t be an operations model available, and it won’t be clear what reworking the execution schedule will yield in terms of KPI improvements.

No. 7

Rapid and effective feedback loops between all disciplines—from subsurface to reservoir to drilling and completions—must be put in place to enable effective decision-making and reconfiguration of operations in response to changes that may be required.

Conclusion

Operators may gain value by focusing on each of these factors separately, because adopting a well delivery process that encompasses all of them may be a daunting task. But major performance improvements are driven from a wholistic approach: decreased cycle times, improved forecasting of costs and production, more efficient use of capital, the ability to rapidly reconfigure operations in response to recommendations from subsurface and/or planning, alignment of all aspects of operations, and enhanced ability to meet organizational targets.

Recommended Reading

CAPP Forecasts $40.6B in Canadian Upstream Capex in 2024

2024-02-27 - The number is slightly over the estimated 2023 capex spend; CAPP cites uncertain emissions policy as a factor in investment decisions.

Air Liquide to Add CO2 Recycling at Plant in Germany

2024-02-08 - In a supply agreement, Air Liquide and Dow plan to add a new CO2 recycling solution to two air separation units and one partial oxidation plant.

1 Fatality in Equinor Helicopter Training Accident Offshore Norway

2024-02-29 - Equinor employee died following the helicopter accident, the cause of which has not been reported.

Equinor Resumes Helicopter Flights on NCS Following Fatal Accident

2024-03-01 - Operator also announced it is expanding its helicopter fleet by 15 through contracts with Bell and Leonardo, with the first two helicopters slated for delivery in about a year.

Coalition Launches Decarbonization Program in Major US Cities, Counties

2024-04-11 - A national coalition will start decarbonization efforts in nine U.S. cities and counties following a federal award of $20 billion “green bank” grants.