Subsea tree technology is a key element in today’s multiwell subsea developments. Most production facilities have subsea trees clustered at drill centers producing through gathering manifolds with flowlines tied back to the host.

The downturn in oil prices since 2014 has led to a period of normalization and reset across the subsea business. The challenge in today’s economic climate is the pursuit of drastic cost reductions needed for subsea developments to go forward in current market conditions.

Currently, subsea systems are too expensive, and deliveries are too long. Subsea trees are a large part of capex and therefore must be part of project cost adjustments. In addition, tree deliveries drive the drilling schedule, which is a huge part of project capex. The focus has to be on identifying how to reduce costs and delivery schedules that have resulted from too many unique one-off and highly customized end-user specific solutions. Standardization is a tool that can drive lower costs and shorter deliveries for combined project capex benefits. The International Association of Oil and Gas Producers (IOGP) has recognized the need for standardization with Joint Industry Project (JIP) 33, supported by the World Economic Forum Capital Project Complexity Initiative. The intent of the initiative is to cut costs in offshore projects.

“In our industry, we have been eroding value by developing bespoke components in each of our projects,” according to IOGP. “Our vision is to achieve industry-level standardization to enable efficient cost-effective procurement and support improved delivery of safe, reliable and competitive projects and operations across the globe.”

Cultural shift required

Subsea tree standardization requires a cultural shift in the industry’s approach to the specification and procurement of subsea trees. Collaboration between end users and suppliers to adopt common fit-for-purpose solutions is one of the most important challenges the industry faces.

Although challenges with this cultural shift are unlike the focus on technology development, true diligence associated with standardization is where significant cost reductions will be achieved.

Hard choices and coming to agreement

In subsea, no single tree design will ever provide the 100% solution to all project cases. However, by standardizing on the majority cases, the industry can align along functional and technical requirements such that it can realize the cost and schedule efficiencies of scale for a large percentage of new subsea projects. No new technology developments are needed for this next step.

Mature technology

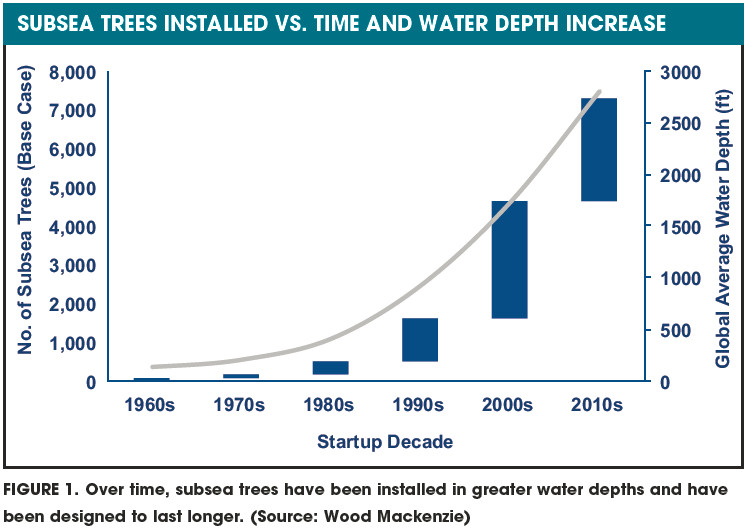

Subsea tree systems technology is already mature from lessons learned and continuous improvement over 50 years of development as new discoveries across the globe were made. The increasing number of subsea trees installed over the past 50 years with the progression into deeper waters confirms this conclusion (Figure 1).

Figure 2 shows global subsea tree startups by region beginning with 2010 and extending with an estimated forecast through 2022. This provides more specific confirmation of subsea tree use in the future. With this many trees installed worldwide operators have had significant successful experience with subsea trees for field developments under a wide variety of operating circumstances. Consequently, subsea tree technology has evolved from the very basics into complex systems, having grown in both size and complexity.

A comparison of an early technology basic tree vs. an example of today’s highly customized project-specific configuration follows the brief descriptions of each below.

Early subsea trees

Early subsea trees were only a conduit for bringing production to the surface for processing and an annulus for monitoring. They still are, essentially. By definition, all subsea trees include a simple tree-to-wellhead connector interfacing with the production tubing string below and a series of typically fail closed and/or manual (ROV) valves in both the production stream and the annulus access pathway.

This was the extent of the tree equipment in the beginning, which at the time was satisfactory for floating production systems that were considered a temporary means of achieving early production, often intended only as a transitionary extended well-test phase followed by expanded fixed platform development. At that time long-term life-of-field requirements were not considered in the tree design.

Step change

As more subsea trees were installed in early production system projects, their viability for longer term use gained acceptance. However, additional capabilities were needed to address all key considerations for any field development, including the reservoir characteristics/fluid properties and flow assurance over the projected life of the field. The requirement to design the subsea tree for a field life of 20-plus years is considered the step change responsible for the technology evolution that followed.

Today’s fully capable subsea trees can be equipped for downhole chemical injection, downhole gas lift, intelligent well completions, and downhole electrical and fiber-optic connectivity, among other functional options. All of these are associated with optimizing production over the field life.

Subsea tree standardization is key

As a consequence of abnormally high oil prices from 2009 to 2014, tree cost and delivery have been disregarded. Additionally, subsea tree technology, although mature enough to cover the majority of subsea technology needs, has resulted in increased cost and delivery when pushed beyond the 10,000-psi standard tree design.

Customization and the continuous pursuit of optionality has been eroding value by escalating cost and adding to the delivery time. Subsea trees should be as simple as possible functionally such that:

- They can be delivered in the shortest lead time possible;

- Operators can reduce schedule risk exposure to the drilling rig completion schedule; and

- The unit cost capex can be minimized. Alignment on the following is key:

- Core functional requirements;

- Material, welding and inspection specifications;

- Tree configurations that limit optionality; and

- The provision to the manufacturing community of the confidence to support the industry with stocking programs of long-lead schedule-critical components.

To see more details of progress at IOGP, visit iogp. org/JIP33.

Recommended Reading

EIA: E&P Dealmaking Activity Soars to $234 Billion in ‘23

2024-03-19 - Oil and gas E&Ps spent a collective $234 billion on corporate M&A and asset acquisitions in 2023, the most in more than a decade, the U.S. Energy Information Administration reported.

Ohio Oil, Appalachia Gas Plays Ripe for Consolidation

2024-04-09 - With buyers “starved” for top-tier natural gas assets, Appalachia could become a dealmaking hotspot in the coming years. Operators, analysts and investors are also closely watching what comes out of the ground in the Ohio Utica oil fairway.

ConocoPhillips CEO Ryan Lance: Upstream M&A Wave ‘Not Done’ Yet

2024-03-19 - Dealmaking in the upstream oil and gas industry totaled $234 billion in 2023. The trend shows no signs of slowing, ConocoPhillips CEO Ryan Lance said at the CERAWeek by S&P Global conference.

Report: Devon Energy Targeting Bakken E&P Enerplus for Acquisition

2024-02-08 - The acquisition of Enerplus by Devon would more than double the company’s third-quarter 2023 Williston Basin production.

UAE's ADNOC Recently Eyed BP as Takeover Target, Sources say

2024-04-11 - The Emirati giant, Abu Dhabi National Oil Co., considered all options when looking at BP, including buying a big stake.