From collaborations to new contracts, below is a compilation of the latest headlines in the E&P space within the past week.

Activity headlines

Sinopec finds shale gas at Sichuan Basin

Sinopec announced a major discovery in the Qijiang shale gas field in the Sichuan Basin, finding 145,968 MMcm of proven reserves. The discovery was by Sinopec Exploration Co. and Sinopec Southwest Oil & Gas Co.

The Qijiang shale gas field is the first shale gas field discovered in medium-deep and deep strata in a complex tectonic zone at the basin margin. Shale gas buried deeper than 3,500 m is considered to be deep shale; the burial depth of Qijiang shale formations ranges from 1,900 m to 4,500 m, with most being deep shale.

To address the question of how a shale gas reservoir was formed at the basin margin with such complex surface and underground conditions, the Sinopec team conducted more than 10,000 core laboratory analysis tests at a depth of 1,320 m. The tests revealed that deep shale can develop broad reservoirs with high porosity, including sweet spots.

The team collected 3D seismic data over an area of 3,662 sq km in the southeastern margin of the Sichuan Basin, as well as drilling data from existing wells in southern Sichuan.

Sinopec said it has devised a deep shale gas seismic prediction technology with pressure coefficient and gas content, fracture prediction and horizontal stress difference in the ground to predict the sweet spots of deep shale gas. Sinopec also said it has developed 3D fracturing technology with precision cutting, pressurization and expansion, balanced expansion and guaranteed filling for deep shale, which it claims has improved daily shale gas production wells.

Contracts and company news

FEBUS, LYTT collaborate for well monitoring

FEBUS Optics and LYTT have teamed up to offer an integrated distributed fiber optic sensing (DFOS) and analytics solution for well monitoring.

FEBUS Optics, which manufactures DFOS devices, and LYTT, a sensor fusion analytics platform provider, say the collaboration delivers real-time insights to enable operators to make quick and informed decisions.

DFOS technology can capture acoustic, temperature and strain data.

LYTT said its end-to-end platform combines, centralizes, and analyzes DFOS data and implements the latest innovations, like sensor fusion, machine learning and artificial intelligence to transform sensor data into connected business insights within seconds that can be accessed anywhere in the world.

SLB’s OneSubsea announces Cypre contract

SLB announced its OneSubsea business and Subsea Integration Alliance won a large contract from BP for its Cypre gas project offshore Trinidad and Tobago. The contract scope covers the engineering, procurement, construction and installation (EPCI) of the subsea production systems and subsea pipelines.

The Subsea Integration Alliance team delivered the initial front-end engineering and design phase for the project and will transition into the full EPCI phase. Offshore installation is scheduled to begin in 2024.

OneSubsea will deliver the subsea production systems, including seven horizontal subsea tree systems, subsea controls and connection systems, distribution and control systems and aftermarket services.

Subsea7, also part of Subsea Integration Alliance, will deliver the subsea pipelines for the project. Previously, Subsea7 announced its portion of the contract, which includes concept and design, engineering, procurement, construction and installation of a two-phase LNG tieback to the Juniper platform through dual flexible flowlines and a manifold gathering system, along with topside upgrades.

Phoenix FPU contract extended

Helix Energy Solutions Group Inc. announced that a Talos Energy Inc. affiliate has extended Helix Producer I floating production unit (FPU) contract by a year through June 1, 2024. The Helix Producer I FPU has been processing production from the Phoenix Field in the Gulf of Mexico since 2010.

Shell extends CGG operations in Brunei

CGG said Brunei Shell Petroleum Co. Sdn Bhd (BSP) had awarded CGG a multiyear extension to continue operating a dedicated seismic imaging center in Brunei.

In the past six years, CGG has delivered land, marine, transition zone, OBC and high-density OBN seismic imaging results at the BSP center. The company said its in-house team will continue to apply technologies such as Time-lag FWI, Q-FWI, least-squares migration and shallow imaging to address regional challenges posed by the presence of widely distributed shallow gas clouds, channels, gas-charged silts, and complex fault structures around discovered fields.

Ramform Hyperion wins Mediterranean work

PGS reported it had won a 3D exploration acquisition contract in the Mediterranean from an independent energy company. The Ramform Hyperion was expected to begin acquisition in late November and complete it in mid-January 2023.

“We currently have the Ramform Hyperion working in the Southeast part of the Mediterranean and this contract secures visibility for the vessel into next year,” PGS President and CEO Rune Olav Pedersen said in a release announcing the contract.

VALARIS DS-12 wins BP work

Valaris Ltd. announced it had received a four-well contract from BP for drillship VALARIS DS-12 for operations offshore Egypt. The contract is expected to begin late in the third quarter or early in the fourth quarter 2023 and has an estimated duration of 320 days. The estimated total contract value, including mobilization fee, is $136.4 million.

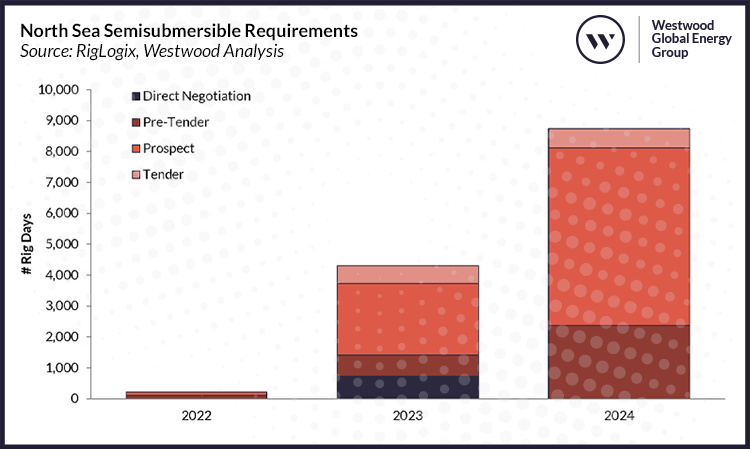

Westwood: North Sea semi utilization for 2023 ‘uninspiring’

After peaking in July, semi utilization in the North Sea has dropped to 78%. Even so, award activity this year was up although Westwood called the 2023 demand outlook “uninspiring.”

Overall, North Sea semi fundamentals are improving, but more rigs could still leave the region, according to Westwood.

According to Westwood’s RigLogix, North Sea semi supply shrank by 36%, or by 17 units, between January 2015 and November 2022, following a prolonged lack of demand for these units, especially in the more mature U.K. sector. The semi market remains seasonal, with higher utilization in the spring and summer months and lower utilization during harsher weather.

In July of 2022 however, the rig segment hit committed utilization of 90%, which is the region’s highest figure recorded since June 2015. Moving toward winter, demand has subsequently declined and utilization has dropped to 78%, with nine units currently idle, including two cold stacked units, the firm said.

Because many other regions in the world are now recording consistent committed rig utilization highs around 90%, while Northwest Europe lags, more units are leaving Europe or being bid outside the region for new contracts with longer terms and higher day rate potential, Westwood said. The same can be said for the North Sea jackup segment as well, according to the firm.

During the third quarter of 2022, the North Sea semi market fixed 3,899 days of contract backlog, which is the highest number of days fixed during a single quarter since 2012. The average contact duration is also on the rise and is currently sitting at 264 days year to date, which is also the longest it has been since 2012.

However, 37% of backlog awarded so far this year will not begin until at least 2024 and the current visible outstanding demand for North Sea semis in 2023 doesn’t look quite so promising, the firm noted.

RigLogix currently records just under 2,000 days of demand outstanding for work likely to be awarded in 2023, consisting of pre-tenders, tenders, and direct negotiations. Additionally, there is prospective demand for approximately 2,300 further days of work yet to be tendered.

This outstanding demand equates to a total of just over 4,260 days of potential work, which is almost 64% less than the visible demand outlook for 2024. Additionally, average contract duration of this outstanding demand is just 171 days, around 43% lower than this year’s current figure.

During 2024, Westwood expects to see several new Norwegian developments move ahead because of the tax incentives that were implemented by the government during 2020. Meanwhile, there are a variety of longer-term U.K. campaigns likely to start-up, consisting of plugging and abandonment (P&A) work as well as development projects.

The market fundamentals within this segment are showing potential for a tighter market, but likely not until 2024 unless further demand for 2023 emerges. This will of course depend on other factors, such as the response to the additional hike in windfall tax on U.K. oil and gas profits, as well as the Norwegian government’s plans to phase out its tax relief package that was introduced as part of its response to the COVID-19 crisis in 2020.

Until the market constricts, Westwood believes drilling contractors will continue to assess opportunities for their harsh-environment assets in other regions.

Naftogaz, Halliburton boost cooperation

Naftogaz Group announced it is strengthening its cooperation with Halliburton to unlock the potential of Ukraine’s fields, following a meeting between the two.

In 2018, Halliburton started providing Naftogaz Group’s Ukrgasvydobuvannya with sidetrack services, which helped the company to achieve significant additional production, primarily at old wells and depleted fields.

Now, Ukrgasvydobuvannya is interested in horizontal drilling technology, Naftogaz said.

Regulatory updates

NSTA launches flaring investigation in UK North Sea

The North Sea Transition Authority (NSTA) announced it had launched an investigation into an oil and gas company for flaring and venting in the U.K. North Sea without consent.

Following the investigation, the company could be fined or lose the relevant production license, the NSTA said.

Flaring and venting made up 26% of emissions from oil and gas production activities in the U.K. North Sea between 2018-20—and reducing them will help to meet reduction targets agreed in the North Sea Transition Deal and lower gas waste.

The North Sea Transition Deal commits industry to reduce emissions from production operations by at least 50% by 2030, against a 2018 baseline, on the path to net-zero by 2050.

The NSTA introduced a net-zero stewardship expectation in March 2021, requiring operators to show their commitment to reducing greenhouse gasses throughout the project lifecycle.

A tougher approach to flaring and venting was subsequently set out in updated guidance, which provided details of the NSTA’s intent to use its consenting regime to drive reductions and, where possible, eliminate both processes.

“With our support, North Sea operators cut flaring by 20% and venting by 22% last year,” said Jane de Lozey, NSTA Interim Director of Regulation. “The NSTA is committed to holding industry to account on emissions to ensure progress continues and is prepared to take action where we suspect a company’s actions risk compromising efforts to meet and surpass agreed targets.”

Under the NSTA’s strategy, licensees are obligated to assist the Secretary of State to meet the net zero target while optimizing oil and gas production to bolster supply security, NSTA said, and unauthorized flaring and venting go against this obligation.

BSEE extends Pacific OCS decommissioning feedback deadline

The U.S. Bureau of Safety and Environmental Enforcement (BSEE) has extended the comment period for the drafted programmatic environmental impact statement (PEIS) for oil and gas decommissioning activities on the Pacific Outer Continental Shelf (OCS).

“Given the number of requests for additional time to review and evaluate options for the anticipated offshore oil and gas decommissioning in the Pacific Region, BSEE is extending the comment period by an additional 29 days to Jan. 10, 2023,” said Bruce Hesson, BSEE Pacific Region Director. “The comments we receive will inform our decisions on future decommissioning in the region. We must therefore give the public ample time to provide feedback, helping to ensure a robust analysis.”

The PEIS will inform decisions on decommissioning applications for offshore oil and gas platforms in federal waters off southern California. 23 California OCS oil and gas platforms installed between the late 1960s and 1990 are subject to eventual decommissioning.

Written comments can be made regarding BOEM-2021-0043 at Regulations.gov or by emailing BOEM.PAC.decomm.PEIS@boem.gov through Jan. 10, 2023. The original deadline was Nov. 28.

Recommended Reading

Woodside’s Scarborough LNG Receives $1B Loan from Japanese Bank

2024-06-02 - Woodside Energy’s Scarborough LNG project, located off Australia’s coast, is scheduled to start shipping cargo in 2026.

Woodside to Emerge as Global LNG Powerhouse After Tellurian Deal

2024-07-24 - Woodside Energy's acquisition of Tellurian Inc., which struggled to push forward Driftwood LNG, could propel the company into a global liquefaction powerhouse and the sixth biggest public player in the world.

Woodside Energy to Buy LNG Developer Tellurian for $900 Million

2024-07-21 - Australia's Woodside Energy will pay $1 per share for Tellurian, which earlier this year sold its upstream Haynesville Shale assets to convert into a pure play LNG company, in a deal with an estimated enterprise value of $1.2 billion, including debt.

Freeport LNG’s Slow Restart Stokes Concern Over Supply Risk

2024-07-23 - The 15-mtpa Freeport LNG facility remains under the spotlight of the global market as it slowly resumes operations after pausing ahead of Hurricane Beryl’s arrival along the U.S. Gulf Coast.

NatGas Purgatory: US Gas Spot Prices Hit Record Lows in 1H24—EIA

2024-07-22 - Facing record-low commodity prices, U.S. dry gas producers have curtailed production and deferred new completions in the first half of 2024.