From an umbilicals contract to corporate acquisitions, below is a compilation of the latest headlines in the E&P space.

Activity headlines

Trillion finds more gas in Black Sea well

Trillion Energy International Inc. reported on March 14 that its West Akcakoca 1 well found “an abundance of gas pay” in the SASB gas field in the Black Sea offshore Turkey.

The well reached 3,839 m total measured and 1,677 m total vertical depth and located 55 m of potential natural gas pay in six sands.

After completion of the West Akcakoca 1 well, the rig will be skidded back to the Guluc-2 well for completion. The Guluc-2 well is scheduled to begin production by the end of March.

“We eagerly await the gas flow rates and plan to put the wells into production, end of this month. As South Akcakoca 2, Guluc 2 and West Akcakoca 1 wells targeted resource prospects, not reserves, Trillion has significantly increased the proved reserves through the drilling program to date,” Trillion CEO Arthur Halleran said in a press release.

Contracts and company news

Rystad: D&C slow down coming

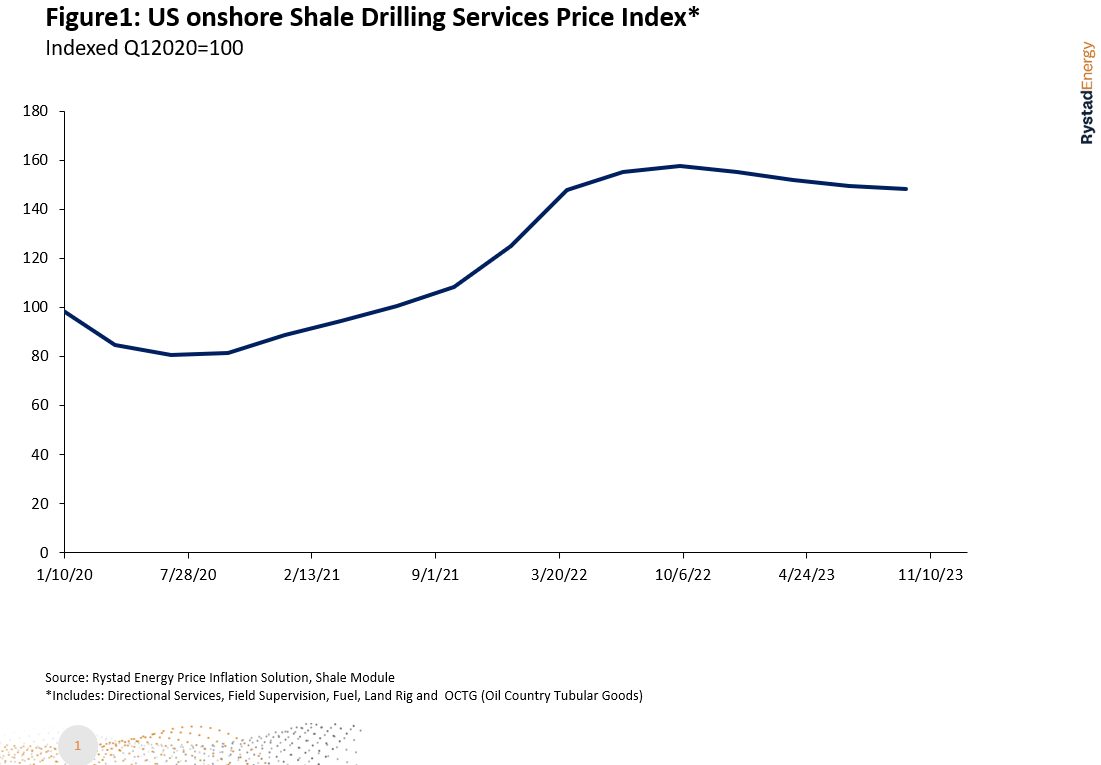

Rystad Energy analysis suggests a slowdown in drilling and completions (D&C) activity in U.S. onshore natural gas basins. The firm said on March 20 that a drop of 50% in natural gas prices since December — combined with elevated well costs — means economics will not be attractive for operators to allocate capital, even for top quartile basins.

In 2022, E&Ps saw a 40% surge of U.S. shale well-related capex, fueled by soaring inflation, supply chain constraints and a rebound in activities. Drilling contractors are experiencing an unprecedented level of utilization, leading to an over 80% increase in rig rates and shortages of oil country tubular goods, which has been a major challenge for many buyers.

According to Rystad, drilling services prices likely peaked in December, with prospects of further softness in 2023. Rystad forecasts capex to increase by 11% in 2023, even as activity levels and inflation slow.

A global economic slowdown may further impact prices and activity, as evidenced by the recent rapid decline in Nymex WTI futures. This may impact D&C activity and investments in some liquid-rich basins as well, Rystad said.

Equinor farms down in Statfjord Field

Equinor is selling a 28% working interest in its Statfjord area production license in the North Sea to OKEA, the operator announced on March 20.

The deal, which has an effective date of Jan. 1, 2023, is for total consideration of $220 million plus a contingent payment element based on oil and gas prices over a three-year period. The 28% working interest in PL037 gives OKEA 23.9% in Statfjord Unit, 28% in Statfjord Nord, 14% in Statfjord Øst Unit and 15.4% in Sygna Unit.

Since Statfjord started production in 1979, it has produced over 5.1 Bboe.

Camilla Salthe, Equinor’s senior vice president for field life extension, said the transaction brings a “player with late-life expertise into the Statfjord partnership.” She added, “We still have high expectations for Statfjord, and by developing new ways of working, we aim to extend the lifetime of the field towards 2040 and reduce emissions with 50% by 2030.”

Closing of the transaction is subject to customary government approval and is expected in fourth-quarter 2023. Following the transaction, Equinor will remain operator of PL037 with 54.7% interest, OKEA with 28% and Vår Energi with 21.4% interest.

JX Nippon buying Japan Drilling

JX Nippon Oil & Gas Exploration Corp. announced on March 15 it is acquiring Japan Drilling Co. Ltd., with the deal expected to be complete around the end of April. When the deal closes, JDC will become a consolidated subsidiary of JX.

ABL acquiring AGR

Energy and marine consultancy firm ABL Group is buying AGR, a software provider, the companies said on March 20.

The acquisition expands ABL’s offerings within well and reservoir consultancy and its ability to support digitalization and decarburization plans.

PXGEO wins Brazilian OBN survey

PXGEO said on March 20 that it had secured a contract with the Sépia Consortium for a 3D ocean bottom node survey in the Santos Basin, Brazil. The survey, to last four months, is to be acquired in water depths to 2,300 m.

Aker Solutions awards umbilicals contract

TUBACEX said on March 14 that it will supply 1,000 km of umbilical tubes for a trio of Aker Solutions projects in the North Sea under a $75 million contract.

TUBACEX will manufacture these offshore umbilical tubes at its production facilities located in Spain and Austria, with deliveries scheduled in 2023 and 2024.

Halliburton launches RockJet charges

Halliburton Co. on March 20 introduced the RockJet family of reservoir-optimized shaped charges.

Developed at the Advanced Perforating Flow Laboratory at the Halliburton Jet Research Center, the RockJet charges are certified using the American Petroleum Institute’s (API) new perforation witnessed test protocol.

Halliburton said its RockJet shaped charges help increase production and improve well productivity and injectivity by improving reservoir contact through deep and clean tunnels that extend beyond the damage zone. When tested at downhole conditions, they delivered 22% higher penetration and an 83% increase in area open to flow.

“In the perforating business, optimizing penetration depth and flow area is the key,” said Chris Tevis, Halliburton’s vice president of wireline and perforating services. “A lot of companies may have charges that are tested on the surface, but how they perform in downhole conditions is difficult to prove. By following the API’s new test protocol, we can provide our customers with confidence that the RockJet charges, custom engineered at JRC’s Advanced Perforating Flow Lab, will perform downhole.”

Recommended Reading

Wars Complicate Energy Transition Despite US LNG Security Blanket

2024-06-10 - Analysts with Norway’s Equinor argue that increased levels of geopolitical conflict and outright wars “have made the energy transition more fragmented,” despite U.S. LNG creating an energy security blanket for Europe and elsewhere.

Former Exxon Exec.’s Company to Develop Guyana Gas Project

2024-06-30 - Fulcrum LNG, recently formed by a former Exxon Mobil Guyana executive, has been selected by the government of Guyana to move forward a project to develop that country’s offshore gas. Baker Hughes and McDermott are also part of the development.

Howard: Power Generation Growth Dependent on NatGas Demand

2024-06-13 - Electricity demand needs reliable natural gas to function as coal capacity is retired and less reliable renewables take a greater share of the power supply stack.

TotalEnergies Joins Ruwais LNG Project in UAE

2024-07-11 - French energy giant TotalEneriges joined the two-train 9.6 million tonnes per annum Ruwais LNG project in the United Arab Emirates with a 10% interest. The LNG project is expected to start sending out cargos in the second half of 2028.

Hirs: Peak Oil Demand—Where Upstream Diverges from Downstream

2024-08-13 - The impact of peak oil demand is the same regardless of the sliding timelines published by the experts.