From a new or delayed production to contract wins, below is a compilation of the latest headlines in the E&P space.

Activity headlines

BW Energy’s 3rd Hibiscus Well Goes Onstream

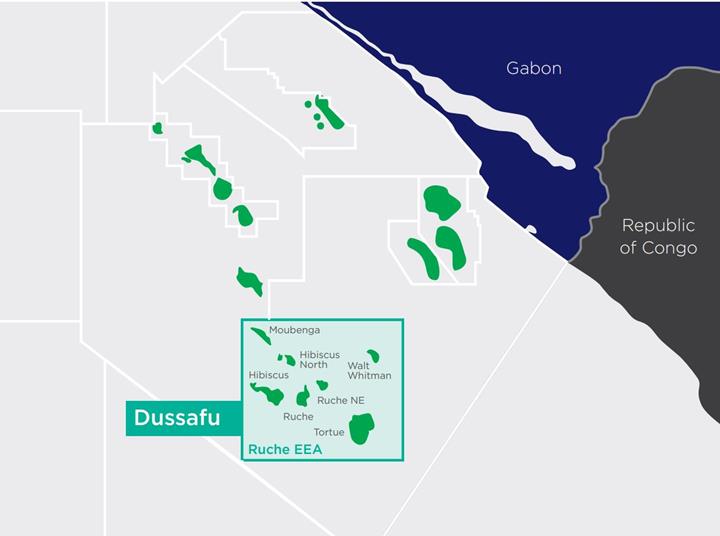

BW Energy brought online the third well of the Hibiscus/Ruche Phase 1 development in its operated Dussafu license offshore Gabon, the company announced July 20. Current well production is in line with expectations of 6,000 bbl/d.

The DHIBM-5H horizontal well was drilled from the BW MaBoMo production facility to 4,245 m total depth into Gamba sandstone reservoir at the Hibiscus Field. Following completion, the Borr Norve jackup started drilling operations on DHIBM-6H, the fourth production well.

The drilling campaign targets four Hibiscus Gamba and two Ruche Gamba wells expected to bring total oil production of up to 40,000 bbl/d when all wells are completed in early 2024. The oil produced at Hibiscus/Ruche is transported by pipeline to the BW Adolo FPSO for processing and storage before offloading to export tankers.

“We continue to see robust production rates and receive well data that confirms excellent reservoir quality,” BW Energy CEO Carl Krogh Arnet said in a press release.

Relatedly, BW started up a new gas lift compressor (GLC) on the BW Adolo FPSO in the Dussafu Marin Permit offshore Gabon, the company announced July 18. BW said the compressor is the second GLC unit installed on the FPSO to support production from the six Tortue wells. Once fully operational, it is expected to add approximately 3,000 bbl/d.

BW Energy operates the Dussafu license with 73.5% on behalf of Panoro Energy with 17.5% and Gabon Oil Co. with 9%.

Unexpected Remedial Work Delays Sangomar

Woodside Energy pushed back first oil from Sangomar Phase 1 from this year to mid-2024 due to “unexpected” remedial work that must be done on the FPSO, the operator said July 18.

The initial cost for the project offshore Senegal of $4.6 billion is climbing to $4.9 billion-$5.2 billion, an increase of 7% to 13%, Woodside said. At the end of June, the overall Sangomar project, which is in 2,560 ft water depth, was 88% complete, with subsea installation campaign at 76% complete and subsea work scope 95% complete. Twelve of 23 wells have been drilled and completed.

The Ocean BlackHawk drillship successfully completed its work scope in July, and the remaining drilling activity will be completed by the Ocean BlackRhino. Well results to date have confirmed the quality of the resource, the company said.

“We have taken the prudent decision to have the remedial work conducted while the FPSO remains at the shipyard in Singapore,” Woodside CEO Meg O'Neill said in a press release.

She said the approach minimizes the impact to the project schedule and is safer and more efficient and cost effective than undertaking the work offshore Senegal.

Carrying out the work in Singapore “ensures we can achieve production start-up in line with the adjusted schedule and ramp up operations as planned.”

Contracts and company news

Afentra Deepens Angola Commitment

Afentra Plc is increasing its share in two Sonangol-operated blocks offshore Angola, the company announced July 19.

Under a purchase and sale agreement with Azule Energy Angola Production BV, Afentra will acquire a further 12% of Block 3/05 and up to 16% of Block 3/05A for a firm consideration of $48.5 million and deferred contingent payments of up to $36 million subject to oil price, production and development conditions.

Afentra has also agreed to drop Afenta’s interest from 20% in Block 3/05 to 14%, amending the terms of an April 2022 SPA with Sonangol Pesquisa e Produção SA and reducing the firm and contingent considerations to $56 million and up to $35 million, respectively.

Afentra expects to publish the admission document early in the fourth quarter of 2023, with both the Azule acquisition and the amended Sonangol acquisition subject to shareholder approval thereafter. Combined with the previously announced acquisition from INA, the Azule acquisition and the amended Sonangol acquisition provides Afentra with 30% equity in Block 3/05 and 21.33% interest in Block 3/05A.

Halliburton Launches New Packer

Halliburton Co. introduced on July 24 its Obex EcoLock compression-set packer, which the service company said helps prevent sustained casing pressure (SCP).

The Obex EcoLock packer is a mechanical barrier to mitigate low pressure gas or fluid migration and provide isolation assurance.

The Obex EcoLock packer is built on the gas-tight, V0-rated Obex GasLock packer design. The Obex EcoLock packer provides V6-rated isolation and can support multiple-stage cementing with optional integral cementing ports and an internal closing sleeve. It is available for 7-in and 9 5/8-in casing designs with additional sizes expected in the future.

Danos Reports GoM Contracts

Danos LLC announced July 20 it had won a three-year service work agreement for BP’s five assets in the Gulf of Mexico (GoM).

Work for the contract began in April. The agreement covers project services such as fabrication, construction, scaffolding and rope access, coatings and insulation, instrumentation and electrical, and valve services.

In other news, Danos said its coatings and fabrication services recently secured several major contracts for GoM assets including an agreement with a multinational oil and gas company to perform insulation and rope access isolation; a contract for fabrication services on two facilities for an American midstream energy company operating in the GoM; and a coatings contract to perform high-pressure water blasting for corrosion and protective coatings for an American energy company.

EnerMech Wins First Contract in Asia

EnerMech won a five-year crane operation and maintenance contract in Malaysia, the company announced July 19.

It is the company’s first contract win in Asia, and EnerMech is deploying crane operators, mechanics, inspectors and technicians to the region to provide crane operations and maintenance services across several offshore assets. They will competency train qualified local personnel from the incumbent’s workforce into its employment to provide consistent project support for the client.

Recommended Reading

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.