From a well offshore Turkey finding “abundant” gas to new contracts, below is a compilation of the latest headlines in the E&P space.

Activity headlines

Jubilee South East Production Jumps With 2nd Well

Shortly after beginning production, Tullow’s operated Jubilee South East project offshore Ghana has surpassed 100,000 bbl/d.

Tullow announced on July 14 the project had begun production and on July 17 said a second well had begun sending hydrocarbons to the FPSO Kwame Nkrumah MV21 in 1,100 m water depth, driving production up over 100,000 bbl/d. The operator said both wells are performing in line with expectations. Two more wells are expected to be brought online this year.

Trillion’s Alapli 2 Well Finds ‘Abundant’ Pay

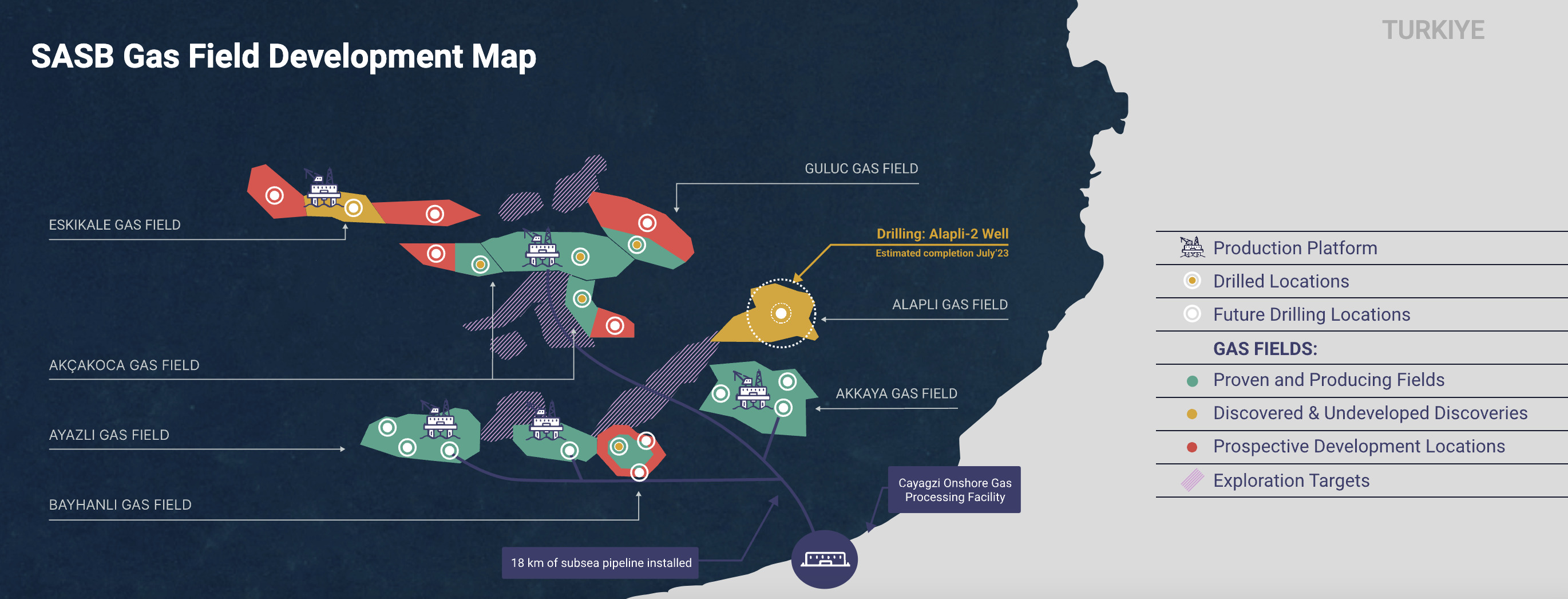

Trillion Energy International Inc. announced July 17 the sixth well on its SASB gas field in the Black Seda had discovered “abundant” gas pay.

The Alapli 2 well offshore Turkey reached 3,258 m total measured depth (TMD), and analysis of the gas measurements in the mud logging results for the Alapli 2 well suggests 40+ m of potential natural gas pay within six separate sands in the Akcakoca Member (SASB production zone).

The offset Alapli-1 well-tested 7.1 MMcf/d from a combined three zones with a measured thickness of 15 m.

Contracts and company news

Recoverable Resources at Pensacola Nearly Doubled

Recoverable resources at the Shell-operated Pensacola discovery in the U.K. North Sea are nearly double initial expectations, well partner Deltic Energy Plc. announced July 12.

Analysis suggests Pensacola in License P2252 holds gross P50 initially in place reserves of 342 MMboe, making estimated ultimate recovery around 99 MMboe, up from the 50 MMboe estimated on completing the well, the partner said.

Shell and its partners are developing an appraisal and development program for Pensacola, with spudding an appraisal well slated for late 2024.

Deltic was operator of P2252 until 2019 when Shell farmed into the license.

Petrobras Picks Weatherford for Intervention Services

Petrobras awarded Weatherford International Plc a five-year contract to provide intervention services in Brazil, the service company announced July 12.

Weatherford said it will provide its digitalization solution, the Centro well construction optimization platform.

Qatargas Taps McDermott for North Field Work

McDermott won an engineering, procurement, construction and installation (EPCI) from Qatargas Operating Company Ltd. for the North Field Production Sustainability (NFPS) Offshore Fuel Gas Pipeline and Subsea Cables Project (COMP1), McDermott announced on July 12.

The COMP1 project is part of the NFPS Offshore Compression Project involving the installation of new assets in Qatar's North Field, including compression complexes at seven locations to sustain gas supply to the existing LNG production trains into the future.

McDermott is currently executing the North Field Expansion Project (NFXP) contract the company won in 2022.

The scope of the contract, valued between $750 million and $1.5 billion, includes installing 118 miles of 32-inch diameter subsea pipelines, 11 miles of subsea composite cables, 116 miles of fiber optic cables and six miles of onshore pipelines. The project will be managed and engineered entirely from the McDermott Doha office with fabrication taking place at QFAB.

"As we continue to progress the NFXP offshore contract awarded to us last year, we are helping the State of Qatar expand LNG production from 77 [million tonnes per annum (mtpa)] to 126 mtpa via the new LNG trains under construction," Mike Sutherland, McDermott senior vice president for offshore Middle East, said in a news release.

Yinson Acquiring FPSO Atlanta

Yinson Bouvardia Holdings Pte. Ltd. will acquire FPSO Atlanta by purchasing all the shares of AFPS B.V., which owns the vessel that will be used to produce the Atlanta Field offshore Brazil, Enauta Participações S.A. announced on July 14.

The deal values the FPSO at $465 million and initiates 15-years charter, operation and maintenance agreements, with a possible five-year extension. Total value of the contract is about $2 billion for 20-years counted from the platform’s production start.

Enauta expects phase 1 production from Atlanta to start in mid 2024 with six production wells in 1,500 m water depth sending hydrocarbons to the FPSO, which can process 50,000 bbl/d and 140,000 bbl/d. It can store 1.6 MMbbl of oil.

Enauta operates the Atlanta Field in Block BS-4 in the Santos Basin, with 100% interest.

Odfjell, Equinor Agree on Strategic Collaboration

Odfjell Drilling and Equinor have entered into a strategic collaboration agreement to focus on “matters of mutual strategic importance,” Odfjell announced on July 17. With a focus on safety, drilling efficiency and lower emissions, the agreement will provide the framework for a joint effort and longer-term collaboration on these key matters, Odfjell said.

Equinor also finalized two letters of intent for Odfjell’s Deepsea Atlantic.

Equinor has signed the contracts for the rig to work in the North Sea. Odfjell previously announced the contracts would have a combined firm duration of 23 months and a value of approximately $290 million, excluding integrated services, upgrades and modifications or mobilization fees. The contracts also include provisions for performance bonuses and fuel incentives. The work will begin immediately following completion of the special periodic survey for the Deepsea Atlantic, which is currently planned during the first half of 2024.

Petrofac for Espoir Ivoirien FPSO Services

Petrofac announced July 17 it had won an integrated services contract from CNR International for the Espoir Ivoirien FPSO offshore the Ivory Coast.

The initial three-year, multi-million pound contract will see Petrofac’s asset solutions business providing integrated services for the Espoir Ivoirien FPSO. Around 110 personnel currently supporting the FPSO, including those onshore and on the vessel, will transition to Petrofac from BW Offshore following the recent sale of the vessel to CNRI. The transition of people and operatorship is expected to complete before the end of July.

Shearwater Picks Up Survey Work for OMV

Shearwater announced a new project with OMV for a towed streamer survey with ocean bottom nodes (OBNs) over the Berling gas and condensate discovery in the North Sea, the company reported July 14. Spanning 1,040 sq km, the hybrid survey will begin in July 2023 and last for three months. Shearwater's SW Tasman and Oceanic Vega vessels will lead the operations. SW Tasman will operate as an ROV node deployment vessel for the first time following its conversion and will deploy the nodes before Oceanic Vega acquires the multi-azimuth towed streamer survey.

Shearwater CEO Irene Waage Basili said in a press release the conversion of SW Tasman gives Shearwater more in-house control of operational factors “as we meet the increased demand in the seabed market.”

Recommended Reading

NOV Announces $1B Repurchase Program, Ups Dividend

2024-04-26 - NOV expects to increase its quarterly cash dividend on its common stock by 50% to $0.075 per share from $0.05 per share.

Repsol to Drop Marcellus Rig in June

2024-04-26 - Spain’s Repsol plans to drop its Marcellus Shale rig in June and reduce capex in the play due to the current U.S. gas price environment, CEO Josu Jon Imaz told analysts during a quarterly webcast.

US Drillers Cut Most Oil Rigs in a Week Since November

2024-04-26 - The number of oil rigs fell by five to 506 this week, while gas rigs fell by one to 105, their lowest since December 2021.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.