From the sanction of a project offshore Libya to new discoveries, below is a compilation of the latest headlines in the E&P space.

Activity headlines

Neptune brings another Cygnus well online

The 10th well in the Cygnus gas field in the U.K. southern North Sea has begun production, field operator Neptune Energy announced Feb. 1.

Borr Drilling’s Prospector 1 jackup rig drilled the well. Neptune has begun drilling for the field’s 11th well, which is expected to begin production in the second quarter of this year.

Neptune operates Cygnus with 38.75% interest on behalf of partner Spirit Energy with 61.25%.

Eni, NOC plan gas project offshore Libya

Eni and National Oil Corp. of Libya (NOC) will develop the Structures A&E project offshore Libya, Eni announced on Jan. 28.

The $8 billion project will see the development of two gas fields – Structure A and Structure E – in contractual area D with the target of starting production in 2026 and reaching a production plateau of 750 MMcf/d.

Development plans call for two platforms to be tied into existing treatment facilities at the Mellitah Complex as well as the construction of a carbon capture and storage facility at Mellitah.

Trillion’s Guluc 2 finds gas, going onstream soon

Trillion Energy International Inc. reported on Feb. 2 discovering 73 m of potential natural gas pay in its Guluc 2 well in the SASB Field in the Black Sea.

Analysis from logging while drilling results indicate 14 separate sands, and Trillion said initial perforation intervals were being selected to bring the well into production in February. After completion of the Guluc 2 well, the rig will move to the West Akcakcoa-1 well, where 1,008 m of surface hole has already been drilled, to drill it to total depth.

“The Guluc 2 well exceeded our expectations in gas saturated potential pay with 73 meters, compared to only about 20 meters of gas pay discovered in the Guluc 1 exploration well drilled over 10 years ago,” Trillion CEO Arthur Halleran said.

On Jan. 31, Trillin announced it had begun a 3D seismic reprocessing project for the SASB block. WesternGeco shot the 3D seismic in 2004, and the data covers 223 sq km, including the SASB block. It was processed in 2004 with pre-stack time migration. The reprocessing will take advantage of improvements in seismic data processing algorithms.

The project will use advanced pre-stack depth migration and incorporate time-depth data from wells drilled since the 2004 model was created.

Equinor, BP receive C-NLOPB license

The Canada-Newfoundland and Labrador Offshore Petroleum Board (C-NLOPB) said on Feb. 3 it had issued Significant Discovery License 1059 to Equinor Canada Ltd. and BP.

The C-NLOPB updated the estimated recoverable reserves at Equinor’s Cappahayden K-67 discovery to 358 MMbbl based on the board’s interpretation of well and seismic data associated with the offshore discovery.

Contracts and company news

NPD: Norwegian shelf holds rare earth minerals

The Norwegian Petroleum Directorate (NPD) released its resource assessment of the seabed minerals on the Norwegian shelf on Jan. 27. According to the assessment, the shelf holds three types of mineral deposits. The manganese nodules, manganese crusts and sulphides all contain multiple metals and are located between 1,500 m and 6,000 m water depth.

The NPD’s resources in place assessment for sulphides estimates 38 million tons of copper, 45 million tons of zinc, 2,317 tons of gold, 85,000 tons of silver and 1 million tons of cobalt.

The prospective area for manganese crusts is estimated to cover more than 8,500 sq km of the study area, with expected total resources in place of 3.1 million tonnes of cobalt, 230,000 tonnes of lithium, 24 million tonnes of magnesium, 8.4 million tonnes of titanium, 1.9 million tonnes of vanadium, 185 million tonnes of manganese, 19,000 tonnes of gallium, 73,000 tonnes of niobium, 15,000 tonnes of hafnium and 80,000 tonnes of tungsten.

Additionally, it contains rare earth minerals including 56,000 tonnes of scandium, 300,000 tonnes of yttrium, 370,000 tonnes of lanthanum, 1.7 million tonnes of cerium, 100,000 tonnes of praseodymium, 420,000 tonnes of neodymium, 23,000 tonnes of europium, 100,000 tonnes of gadolinium, 15,000 tonnes of terbium and 86,000 tonnes of dysprosium.

The NPD said confirming whether the mineral resources are recoverable with acceptable environmental impact will require further investigation of the seabed and technological development surrounding recovering methods.

"Of the metals found on the seabed in the study area, magnesium, niobium, cobalt and rare earth minerals are found on the European Commission’s list of critical minerals. Costly, rare minerals such as neodymium and dysprosium are extremely important for magnets in wind turbines and the engines in electric vehicles," Kjersti Dahle, NPD’s director for technology, analysis and coexistence, said.

Aker BP awards Utsira High work to TechnipFMC

TechnipFMC announced Jan. 31 Aker BP awarded it an integrated engineering, procurement, construction and installation contract valued between $500 million and $1 billion for the Utsira High development in the Norwegian sector of the North Sea.

The contract brings together three projects that will tie back to the Ivar Aasen and Edvard Grieg production platforms. TechnipFMC will engineer, procure, construct and install the subsea production systems, controls, pipelines and umblicals for the development. It follows a two-year integrated FEED study to optimize field layout.

SLB completes Gyrodata Incorporated acquisition

SLB announced on Feb. 3 it had completed the acquisition of gyroscopic wellbore positioning and survey specialists Gyrodata Incorporated.

SLB will incorporate Gyrodata’s wellbore placement and surveying technologies into its well construction business. The service company said the combination will improve wellbore quality and reduce drilling risk to unlock remote and complex reservoirs. Integrating three-axis solid state gyro measurements with the SLB technological innovations will help ensure tighter trajectory control, reduce data acquisition time and improve the decision-making process to result in greater overall drilling efficiency, according to SLB.

Baker Hughes unveils digital offerings

Baker Hughes on Jan. 30 announced new digital offerings, including Leucipa and Cordant, along with a collaboration with Corva.

Leucipa is a public and private cloud-based automated field production software designed to help oil and gas operators manage production and reduce carbon emissions. Argentinian energy company Pan American Energy Corp. is Leucipa’s launch customer, and it will be released to the global market by mid-2023.

Cordant is an integrated suite of solutions supporting industrial asset performance management and process optimization. It will combine existing digital offerings for hardware, software and services capabilities into one integrated and simplified user interface. It is available as a hardware and software bundle, software as a service, on-premises offerings or an outcome-based solution tied to specific performance indicators.

Corva offers an open solution for well construction digital offerings to enhance rig visualization and decision making in the oil and gas industry. Baker Hughes, a minority investor in Corva, said the collaboration aims to create a digital accelerator for improved efficiency in rig operations.

Transocean locks in 910-day Brazilian contract

Transocean Ltd. announced on Jan. 31 that a national oil company had awarded ultra-deepwater drillship Dhirubhai Deepwater KG2 a 910-day contract for work offshore Brazil. The estimated backlog of $392 million excludes a mobilization fee. The new contract is expected to begin in the third quarter of 2023.

CGG, 2CRSi offer HPC as a service

CGG and 2CRSi have signed a strategic agreement to jointly launch a new high-performance computing (HPC)-as-a-Service offering, CGG announced Feb. 1.

The collaboration leverages decades of experience and expertise in HPC infrastructure and

solutions and opens a new chapter in the respective histories of both companies. The partners are offering co-developed HPC solutions and services that combine CGG’s HPC expertise in operating and optimizing specialized data centers for production workflows and 2CRSi’s competency in the design and manufacture of high-performance energy-efficient computer servers.

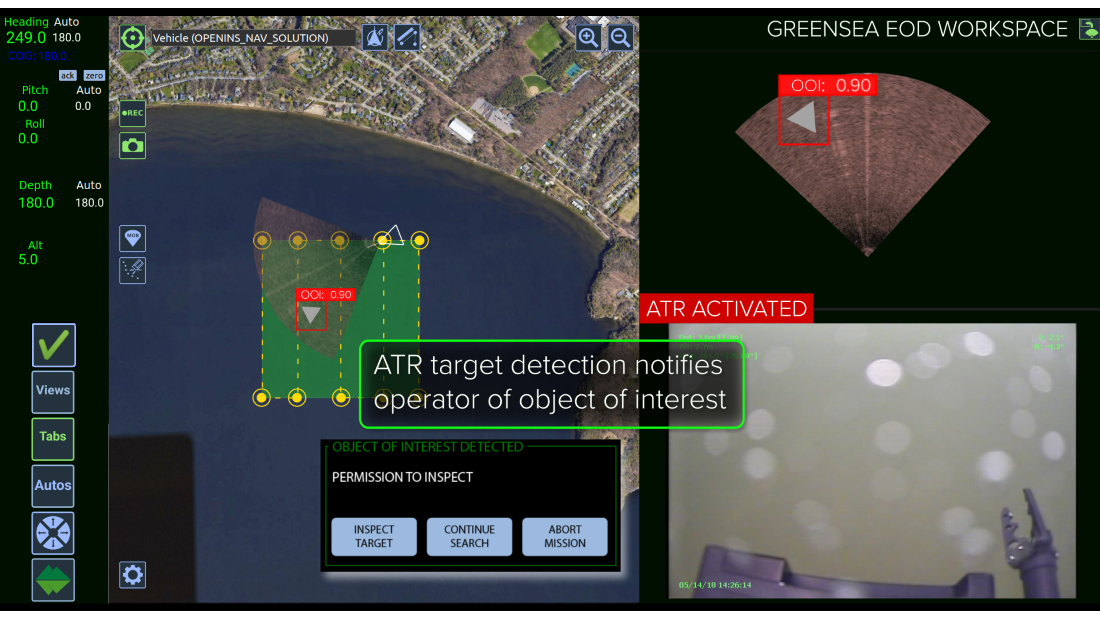

Greensea launches OPENSEA Edge

Greensea Systems Inc. announced Jan. 31 it had launched OPENSEA Edge, a modular edge computing module with perception support for autonomous underwater robots based on Greensea’s OPENSEA open architecture software platform.

While OPENSEA provides the software capabilities of navigation, control, autonomy, perception and long-range communications, OPENSEA Edge provides a modular, hardware-agnostic processing platform that converts a traditional ROV into one with autonomy, artificial intelligence, vehicle perception and tetherless, over-the-horizon, communication and control. Greensea called it a convenient add-on package to deliver integrated edge processing and perception system integration to a traditional ROV.

Recommended Reading

U.S. Shale-catters to IPO Australian Shale Explorer on NYSE

2024-05-04 - Tamboran Resources Corp. is majority owned by Permian wildcatter Bryan Sheffield and chaired by Haynesville and Eagle Ford discovery co-leader Dick Stoneburner.

Permian Surface-owner LandBridge to Raise up to $367MM in IPO

2024-06-17 - Houston-based LandBridge holds some 220,000 surface acres in the Delaware Basin.

Scott Sheffield Among Investors in Australian Shale Gas IPO

2024-06-27 - The operator who sold Pioneer Natural Resources Co. to Exxon Mobil in May for $59.5 billion joins his son Bryan Sheffield in shale gas investment Down Under.

Permian’s LandBridge Prices IPO Below Range at $17/Share, Raising $247MM

2024-06-30 - Houston-based LandBridge, which manages some 220,000 surface acres in the Permian Basin, kicked off trading at $19 per share, more than 10% above its listing price.

LandBridge Chair: In-basin Data Centers Coming for Permian NatGas

2024-06-28 - Newly public Delaware Basin surface-owner LandBridge Co. has a 100-year lease agreement with one developer that could result in ground-breaking in two years and 1 GW in demand.