Activity headlines

CNOOC’s Kenli project starts production

CNOOC has brought online its shallow water Kenli 6-1 oilfield 5-1, 5-2, 6-1 block development project in the Bohai Sea.

Located in about 19 m water depth, the main production facilities include a central platform and six unmanned wellhead platforms. CNOOC plans 107 development wells, including 67 production wells, 36 water injection wells and 4 water source wells. The operator expects the project to reach peak production of 36,100 bbl/d in 2024.

Kenli 6-1 oil field 5-1, 5-2, 6-1 block is the main area of Kenli 6-1 oil field, which is the first large-scale shallow lithological oilfield with a reserve of 100 million tons discovered in Laibei lower uplift in the Bohai Sea. The project represents the company’s first large-scale use of standardized unmanned platforms in the Bohai Sea.

CNOOC Ltd operates the project and holds 100% interest in it.

In related news, CNOOC announced the Bozhong- Kenli oil fields onshore power project had started operations. The project will supply electricity to 39 offshore production platforms in the Kenli oilfields, Bozhong 19-6 condensate gas fields and Bozhong 28-34 oil fields. By 2025, the project is expected to support the production of about 400,000 bbl/d in the region.

Barents Sea find may tie back to Goliat

Vår Energi’s latest Barents Sea wildcat has found gas offshore Norway.

The 7122/9-1 T2 well, referred to as Lupa, is the first exploration well drilled in PL 229E. It is located about 27 km northeast of the Goliat field, which is also operated by Vår Energi. According to the Norwegian Petroleum Directorate (NPD), the licensees will consider tying the discovery back to existing infrastructure on the Goliat field at a later date.

The Transocean Enabler drilled the well in 403 m of water depth.

The objective of the well was to prove petroleum in lower Triassic reservoir rocks in the Havert Formation, as well as to investigate the reservoir quality in the Ørret Formation in the Upper Permian, according to the NPD.

The well encountered a 55-m gas column in the targeted sandstones of the Havert formation of Triassic age. Extensive data acquisition and sampling have been carried out, but the well was not formation tested, the NPD said.

Vår Energi operates the production license with a 50% stake on behalf of partner Aker BP, which holds the remaining 50% interest. Eni holds 63% share in Vår Energi.

Petrobras, 3R complete Papa Terra sale

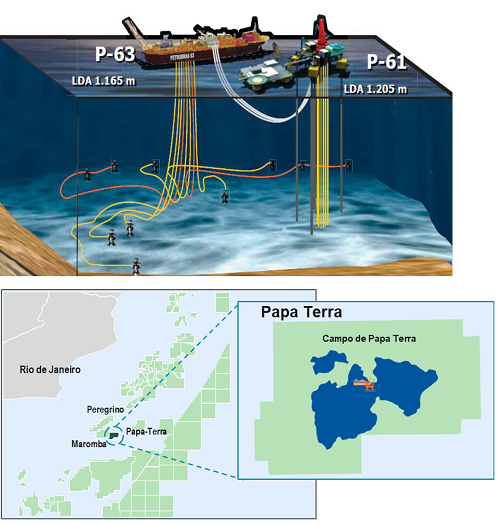

Papa Terra map: Discovered in 2003, the Papa Terra field in 1,200 m water depth is part of the BC-20 concession.

(Source: Petrobras)

Petrobras has wrapped up the sale of its stake in the Papa Terra Field offshore Brazil to 3R Petroleum Offshore.

Discovered in 2003, the Papa Terra Field in 1,200 m water depth is part of the BC-20 concession. Production at Papa Terra started in 2013. Average oil production from September to November 2022 was 16,200 bbl/d through the P-61 tension leg wellhead platform and P-63 FPSO, where all the production is processed. The P-61 and P-63 have a processing capacity of 140,000 bbl/d of oil, injection capacity of 340,000 bbl/d of water, storage capacity of 1.4 MMbbl and slots to connect up to 21 production wells and 11 injection wells.

According to ANP data, the estimated original volume of oil and gas in place is approximately 2 Bboe, with a density between 12° and 16° API and low level of contaminants. The current recovered fraction is around 2%, while the Campos Basin average is around 16%, 3R Offshore said.

Petrobras originally announced that it would sell its Papa Terra stake in July 2021, and 3R Offshore paid an initial $6 million when the contract was signed. On Dec. 22, National Agency of Petroleum, Natural Gas and Biofuels (“ANP”) approved the transfer of 62.5% stake in Papa Terra to 3R Offshore.

Now, 3R Offshore has paid Petrobras $18.2 million, and Petrobras said it expects to receive up to $80.4 million in contingent payments, depending on future Brent prices and asset development.

3R Offshore has now assumed operatorship of the field and holds 62.5% stake. Partner Nova Técnica Energy Ltda. holds the remaining 37.5%.

3R Offshore said the acquisition of Papa Terra Cluster represents an important milestone for the company's offshore portfolio, with the beginning of its operations in deep waters and the start of operations in the Campos Basin.

The asset's reserve certification, issued by DeGolyer and MacNaughton with a base date of Dec. 31, 2021, indicates a volume of proved plus probable (2P) reserves of 172.0 MMboe for 100 % of the asset. The company has a net interest of 53.13%[1] of the asset, which represents 91.4 million boe in 2P reserves.

The Cluster recorded an average daily production of 15,100 boe in 2021, with peak daily production reaching 19,900 boe in August of the same year. The average production for 2021 was impacted by the maintenance shutdown carried out by the operator since December 2021 for repairs and improvements in some FPSO systems. In August 2022, operations in the Papa Terra field were resumed with average daily production of around 16,000 bbl of oil, supported by three producing wells (PPT-50, PPT-51 and PPT-16). The asset has also two more closed production wells (PPT-17 and PPT-37), which should be reopened after adjustments to the processing and storage systems, which will be carried out in the first months of operation by 3R. It should be noted that all of Papa Terra's production systems have the capacity to support the implementation of the development plan projected for the asset, together with revitalization and redevelopment activities, which are 3R's core business.

Sinopec updates on Fuling output

Sinopec announced that China's Fuling shale gas field, the first commercially developed shale gas field in the country, has produced 53.2 Bcm of shale gas over the past decade.

The output is a production record for shale gas fields in China, according to Sinopec.

The company’s Jiaoye 1 HF well, located in Fuling, southwest China's Chongqing Province, started production at the end of 2012, and the field holds nearly 900 Bcm of proven reserves, Sinopec said.

The operator said it has been accelerating its exploration and development of shale gas in the Sichuan Basin in southwest China based on its Fuling experience. Sinopec’s four shale gas fields—Fuling, Weirong, Yongchuan and Qijiang—hold proven shale gas reserves of 1.19 Tcm, according to the company.

Sinopec sets Sichuan Basin depth record

Sinopec said it had drilled its Yuanshen-1 exploration well in the Sichuan Basin to a basin record vertical depth of 8,866 m.

According to Sinopec, the well shows the potential of deep ancient carbonate rocks in the region. The ultra-deep carbonate rock in the Dengying Formation showed positive hydrocarbon evidence in the porous reservoir, the operator said.

The well was part of Sinopec’s "Project Deep Earth – Natural Gas Base in Sichuan and Chongqing" effort, which it is carrying out in collaboration with Sinopec Exploration Co., Sinopec Southwest Oil & Gas Co., Sinopec Zhongyuan Oilfield Co., Sinopec Jianghan Oilfield Co. and Sinopec East China Oil & Gas Co.

The company said it has developed a handful of technologies to support ultra-deep drilling.

Contracts and company news

OKEA enters Brasse license

OKEA ASA signed an agreement with Brasse license operator DNO Norge AS to enter the license. Following the transaction, effective Jan. 1 if approved by the Ministry of Petroleum and Energy, both companies will hold 50% interest in the field, DNO remaining operator.

The partners will carry out a fast-track, low-cost review to assess development concept possibilities for Brasse’s estimated 30 MMboe recoverable reserves in PL 740. Brasse is 13 km south of the OKEA-operated Brage field.

Brasse, discovered in 2016 and appraised by four wells from 2017 to 2019, is in 120 m water depth.

Petrobras seeking Atapu, Sépia FPSO bids

Petrobras has started the contracting process for two FPSOs for the shared reservoirs of Atapu and Sépia.

The Brazilian operator expects to receive bids in July 2023 and for production from the P-84 serving Atapu and the P-85 serving Sépia to start in 2028.

The P-84 and P-85 will have production capacity of 225,000 bbl/d of oil and processing capacity of 10 MMcm/d of gas. The platforms will have an emphasis on an all-electric concept, which aims to optimize the processing plant for increased energy efficiency and incorporate technologies around zero routine venting, deep sea water harvesting, use of variable speed drives on pumps and compressors, cogeneration, zero routine flaring, valves with requirements for low fugitive emissions and the capture, use, and geological storage of CO2 from the produced gas.

Petrobras operates the shared Atapu reservoir with 65.7% interest on behalf of partners Shell with 16.7%, TotalEnergies with 15%, Petrogal with 1.7% and the Brazilian government, represented by Pré-Sal Petróleo S.A. - PPSA, with 0.9%.

Petrobras operates the Sépia shared reservoir with 55.3% interest on behalf of partners TotalEnergies with 16.9%, Petronas Petróleo Brasil Ltda. with 12.7%, QatarEnergy with 12.7% and Petrogal with 2.4%. In both reservoirs, PPSA acts as manager of the sharing contract.

Weatherford, DataRobot team up for AI effort

Weatherford International said it signed a multi-year agreement with artificial intelligence (AI) company DataRobot regarding AI solutions for the service company’s digital platforms.

According to Weatherford, the relationship with DataRobot will accelerate the development of machine learning (ML) and AI-enabled offerings within its Digital Solutions portfolio, which includes the ForeSite production optimization and Centro well construction platforms.

Weatherford said those platforms provide solutions with the power of Industry 4.0 technologies, including big data analytics, IoT and cloud and edge computing.

“We began our Industry 4.0 journey in 2017 by introducing our first AI/ML-based modules in our software platforms,” Matt Foder, senior vice president of innovation and new energy at Weatherford, said. “This agreement with DataRobot adds a solid foundation to operationalize and scale these modules and those of our customers, providing incremental value across the energy industry space.”

ProFrac expanding footprint

ProFrac Holding Corp. has closed its acquisition of the Eagle Ford sand mining operations of Monarch Silica LLC and has entered into definitive agreements to acquire two companies that will grow its pressure pumping footprint and sand mine portfolio.

The company's subsidiary, ProFrac Holdings II LLC, has entered into a definitive agreement to acquire REV Energy Holdings LLC, a privately owned pressure pumping service provider with operations in the Rockies and Eagle Ford for $140 million, consisting of $70 million in ProFrac Class B common shares, approximately $39 million in seller-provided financing and the balance with cash on hand and debt assumption of approximately $5.5 million.

REV operates three premium frac fleets totaling 204,500 hydraulic horsepower that offer opportunity for upgrades through the additions of DGB engines and engine idle reduction systems. The acquisition will expand ProFrac's presence in both the Rockies and South Texas.

The subsidiary also entered into a definitive agreement with Performance Holdings I LLC and Performance Holdings II LLC, known collectively as Performance Proppants, to acquire the largest in-basin proppant producer serving the Haynesville, for $475 million of cash.

"By acquiring Performance Proppants, we would add approximately 10.4 million-tons-per-year of nameplate production capacity in the Haynesville, where we currently operate six active frac fleets,” Matt Wilks, ProFrac executive chairman, said.

Seadrill buying Aquadrill

Seadrill Limited is acquiring Aquadrill LLC in an all-stock transaction.

The combined company will have a backlog of $2.8 billion and will own 12 floaters (including seven 7th generation drillships), three harsh environment rigs, four jackups and three tender-assisted rigs. Additionally, seven rigs will be managed under a variety of strategic partnerships.

On completion of the transaction, Seadrill shareholders and Aquadrill unitholders will own 62% and 38%, respectively, of the outstanding common shares in the company. The transaction values Aquadrill at an implied equity value of approximately $958 million, based on Seadrill’s 30-day volume-weighted average share price on the NYSE of $31.25 as of Dec. 22.

The transaction has been approved by the boards of directors of both Seadrill and Aquadrill. The required approval of Aquadrill’s unitholders has also been obtained. The transaction does not require Seadrill shareholder approval.

Shelf’s Trident VIII wins Nigeria work

Shelf Drilling announced the Trident VIII jackup rig won a one-year contract for operations offshore Nigeria.

Before the contract begins in in second-quarter 2023, the Trident VIII will complete a short out-of-service project.

NWS GeoStreamer Phase 2 funded

PGS announced it has secured industry pre-funding for a large multi-client survey in the Norwegian Sea. A Ramform Titan-class vessel will acquire the survey over two seasons with mobilization set for the first season in the second quarter of 2023. The survey will be complete in summer 2024.

“We acquired the first phase of NWS GeoStreamer X this summer and have now secured pre-funding for a larger second phase. The survey covers approximately 12,500 sq km of new GeoStreamer data in a second azimuth over existing GeoStreamer MultiClient data in the region,” PGS President and CEO Rune Olav Pedersen said.

Newpark Resources exiting GoM

Newpark Resources announced it has completed the announced transactions that will allow it to exit the Gulf of Mexico market. The company sold its completions fluids operations in one transaction and entered a seven-year sublease of the company's Fourchon, Louisiana drilling fluids shorebase and blending facility with a global energy services provider.

Recommended Reading

Paisie: Oil Demand to Rise 1.2 MMbbl/d in Second Half

2024-07-26 - WTI’s price is expected to stay in the low $80s/bbl.

CF Indutries Enters CO2 Transport, Sequester Deal with Exxon

2024-07-26 - CF Industries Holdings will transport and sequester to Exxon Mobil CO2 from its carbon capture and sequestration project in Yazoo City, Mississippi.

Repsol to Implement New Share Buyback Program

2024-07-26 - Madrid-based Repsol plans to repurchase and redeem 20 million of its shares in the second half 2024, according to the company’s CEO Josu Jon Imaz.

Baytex Energy Joins Eagle Ford Shale’s Refrac Rally

2024-07-26 - Canadian operator Baytex Energy joins a growing number of E&Ps touting refrac projects in the Eagle Ford Shale.

CEO: Baker Hughes Lands $3.5B in New Contracts in ‘Age of Gas’

2024-07-26 - Baker Hughes revised down its global upstream spending outlook for the year due to “North American softness” with oil activity recovery in second half unlikely to materialize, President and CEO Lorenzo Simonelli said.