Here’s a roundup of the latest E&P headlines including company updates from the past week in the upstream oil and gas industry.

From the Nova tieback going online in the Norwegian North Sea to Eni SpA’s Ivory Coast discovery to rig contracts, below is a compilation of the latest headlines in the E&P space within the past week.

Activity Headlines

Nova tieback boosts Gjøa

Wintershall Dea has begun production from its Nova Field, which is a subsea tieback to the Neptune Energy-operated Gjøa platform in the Norwegian North Sea.

Nova, about 17 km southwest of Gjøa, is in about 370 m of water depth. The project has two subsea templates tied back to Gjøa. One has three oil producers and the other has three water injectors.

“With the start-up of the major project Nova, Wintershall Dea is now operating three subsea production fields in Norway,” Hugo Dijkgraaf, Wintershall Dea member of the executive board and CTO, said in a press release. “We are expanding our subsea technology expertise and meanwhile three further tieback-developments, including Dvalin, are in the planning.”

The Dvalin Field and the partner-operated Njord Future-project, in which Wintershall Dea holds a 50% share are expected to begin production later this year. The company expects to submit a plan for development and operations for the recent Dvalin North discovery by the end of 2022.

Wintershall Dea operates the Nova oil field with 45% interest on behalf of partners Sval Energi with 45% and Pandion Energy Norge with 10%. When Wintershall Dea’s transfer of 6% share of the Nova field to OKEA is complete in fourth-quarter 2022, Wintershall Dea’s share will drop to 39%.

Wintershall Dea also holds 28% share in the Gjøa Field.

PTTEP, Eni find gas in deeper zone offshore Abu Dhabi

PTTEP MENA Ltd. announced a gas discovery in Abu Dhabi Offshore Block 2.

Eni Abu Dhabi operates the block with 70% interest, in which PTT Exploration and Production Public Company Ltd. (PTTEP) is a partner with 30% interest.

The new find is in a deeper zone of the first exploration well XF-002 in Abu Dhabi Offshore Block 2. The gas-bearing reservoirs were tested with excellent flow rates, and fast-track development options are currently under evaluation, according to PTTEP. After this well, the partners plan to continue drilling at nearby prospects to further evaluate potential of the block.

Eni finds oil at Baleine East 1X offshore Côte d’Ivoire

Based on the results of the Baleine East 1X discovery well, Eni SpA announced it has increased its hydrocarbons in place volume by 25%.

The Baleine East 1X well, the first exploration well in block CI-802, marks Eni’s second discovery on the Baleine structure, offshore Côte d’Ivoire. The Baleine East 1X well is about 5 km east of the Baleine 1X discovery well in the adjacent block CI-101, and Eni said it represents the first commercial discovery in the CI-802 block and confirms the extension of the Baleine Field.

Eni now estimates reserves at 2.5 billion barrels of oil and 3.3 Tcf of associated gas.

The Saipem 12000 drillship drilled the Baleine East 1X well to 3,165 m measured depth (MD) in 1,150 m water depth.

The well found a continuous oil column of about 48 m in reservoir rocks with good properties and a production test confirmed a potential of at least 12,000 bbl/d of oil and 14 Mscf/d of associated gas of production from the well Baleine East 1X.

Eni plans to drill a third well in the Baleine Field and aims to begin production from the trio of wells in first-half 2023, about a year and half from the Baleine 1X discovery well.

Eni operates the block with 90% interest on behalf of partner Petroci Holding with 10%.

Comet Ridge’s Mahalo North test well update

Comet Ridge announced its Mahalo North had surpassed gas production of 760 Mcf/d and that gas production continued to increase daily while the water rate continued to decline. Current water production is around 1,000 bbl/d, down from a peak of 1,560 bbl/d of water.

The well is about 15 km from the Mira 6+ well in the contiguous pipeline 1082 permit.

“We plan to extend this distance again, with further appraisal at our other 100% block at Mahalo East. This block is also on the high-productivity fairway and will be appraised to add even more scale to the Mahalo Gas Hub area in a very tight gas market,” Comet Ridge Managing Director Tor McCaul said.

Comet Ridge has 70% interest in the Mahalo Gas Project, and Santos QNT Pty Ltd. holds the remaining 30% interest.

TechnipFMC wins gas-to-energy project contract in Guyana

An Exxon Mobil Corp. affiliate awarded TechnipFMC a contract to handle engineering, procurement, construction and installation of subsea risers and pipelines for the gas-to-energy project in Guyana.

Esso Exploration and Production Guyana Ltd.’s project will connect the production from Liza Destiny and Unity back to shore, delivering associated gas from the field to a gas-fired power plant that will supply electricity to the community.

The project is subject to final sanction.

Subsea 7, Van Oord awarded offshore Guyana contract

Subsea 7 and Van Oord announced Exxon Mobil affiliate Esso Exploration and Production Guyana Ltd. (EEPGL) awarded them a pipeline contract for the Guyana Gas to Energy project.

The scope covers the project management, engineering, and installation of approximately 190 km of pipeline in up to 1,450 m water depth, with an associated shallow water portion and onshore approach making landfall to the west of the Demerara River, along the coast of Guyana.

Neptune Energy spuds Ofelia exploration well

Neptune Energy announced the Deepsea Yantai semi has begun drilling the Ofelia exploration well in the Norwegian sector of the North Sea.

The Deepsea Yantai, owned by CIMC and operated by Odfjell Drilling, is drilling the 35/6-3 S well about 13 km north of the Gjøa Field within the Neptune-operated PL929 license.

If commercial, Neptune has said the Ofelia prospect could be tied back to the Neptune-operated Gjøa platform.

In April, Neptune Energy and its partners today announced an oil and gas discovery at the Hamlet exploration wells in 358 m water depth. In-place volumes are estimated at 5-11 MMcm, or 30-70 MMboe. Hamlet is being considered as a tieback to the Neptune-operated Gjøa semisubmersible platform.

“Ofelia could potentially be developed in parallel with Hamlet 2, resulting in a low cost and carbon efficient development,” Steinar Meland, director of subsurface in Norway for Neptune Energy, said.

The reservoir target is the Lower Cretaceous Agat Formation and is expected to be reached at a depth of approximately 2,570 m. The drilling program comprises a main-bore (35/6-3 S) with an optional side-track (35/6-3 A) based on the outcome of the exploration well.

Neptune operates the prospect with 40% on behalf of partners Wintershall Dea (20%), Pandion Energy (20%), DNO (10%) and Lundin Energy Norway (10%), which is a fully owned subsidiary of Aker BP as of July 30.

Oceaneering Wins ROV Service Contract Offshore Brazil

Oceaneering International’s subsea robotics segment won a multiyear service contract supporting Petrobras projects off the coast of Brazil.

Oceaneering will provide survey and ROV services for AKOFS Offshore’s subsea equipment support vessel Aker Wayfarer.

The scope of work includes providing two Millennium Plus work class ROVs, complete specialized tooling packages for each ROV, ROV personnel for simultaneous operations, and survey equipment and personnel. The contract is for four years plus options to extend.

Transocean rigs win new work and extensions

Transocean announced new contracts and a total backlog of $6.2 billion in its latest fleet status report.

The Deepwater Skyros was awarded a 10-well contract in Angola at $310,000 per day, and the Deepwater Invictus was awarded a two-well contract extension in the U.S. Gulf of Mexico at $375,000 per day.

The Transocean Spitsbergen was awarded a nine-well firm contract at $335,000 per day, plus two one-well options at $375,000 per day for work in Norway, and a customer exercised two one-well options in Norway at $305,000 per day.

The Paul B Loyd Jr. was awarded a one-well contract, plus two one-well options and an eight plug and abandonment (P&A) well option in the U.K., each at $175,000 per day.

The Dhirubhai Deepwater KG1 was awarded an estimated 86-day contract extension plus up to four option wells (270 days) in India at $330,000 per day. The Deepwater Mykonos was awarded a 435-day contract, plus options up to an incremental 279 days in Brazil at approximately $364,000 per day.

The aggregate incremental backlog associated with these fixtures is $650 million. As of July 25, the company’s total backlog is $6.2 billion.

ONGC contracts Shelf jackup

Shelf Drilling Ltd. has won a three-year contract for the C.E. Thornton jackup rig from Oil and Natural Gas Corp. (ONGC) for operations in the Mumbai High, offshore India. Operations are planned to begin in second-quarter 2023.

Recently, Shelf purchased the Deep Driller 7 high-spec jackup drilling rig from Aban Offshore Ltd. and renamed it the Shelf Drilling Victory.

Valaris announces rig contracts, extensions

Valaris Plc reported a string of new contracts and extensions in its latest quarterly fleet status report.

The VALARIS DS-17 will be reactivated for a 540-day contract with Equinor ASA offshore Brazil. The contract, expected to begin in mid-2023, is valued at approximately $327 million, including an upfront payment totaling approximately $86 million for mobilization costs, capital upgrades and a contribution towards reactivation costs. The remaining contract value relates to the operating day rate and additional services, including managed pressure drilling (MPD), ROV, casing running, slop treatment and cuttings handling.

The VALARIS DS-15 won a contract extension to continue drilling for TotalEnergies EP Brasil offshore Brazil.

Shell Nigeria Exploration and Production Co. (SNEPCo) exercised a six-month option for the VALARIS DS-10 to continue drilling offshore Nigeria.

Woodside Energy extended the VALARIS DPS-1 for work offshore Australia. The two-well extension has an estimated duration of 38 days and will be in direct continuation of the existing firm program for Woodside’s Enfield P&A campaign. Woodside also extended the same semi for one well for about 60 days, to be executed within Woodside’s Scarborough development campaign sequence.

Brunei Shell Petroleum signed a four-year contract for heavy-duty modern jackup VALARIS 115 for work offshore. The contract is expected to start in April 2023 and has a total contract value of approximately $159 million.

Three-year bareboat charter agreement with ARO Drilling for standard duty modern jackup VALARIS 141. The agreement is expected to commence in August.

BP Plc signed a four-well contract extension for heavy-duty modern jackup VALARIS 106 for work offshore Indonesia. The four-well contract extension has an estimated duration of 360 days and will follow the existing firm program.

Shell signed a one-well contract extension for heavy-duty harsh environment jackup VALARIS 122 for operations in the U.K. North Sea. The one-well contract extension has an estimated duration of 150 days and will follow the existing firm program.

The standard duty modern jackup VALARIS 144 won a four-well contract for an undisclosed operator in the U.S. Gulf of Mexico. The contracted work is expected to take place during the third quarter 2022 with an estimated duration of 60 days and an estimated contract value of approximately $5 million.

Talos Energy Inc. signed a one-well contract with Talos in the U.S. Gulf of Mexico for standard duty modern jackup VALARIS 144. The contract is expected to start in fourth-quarter 2022 for a minimum of 30 days at $85,000 per day.

Cantium LLC signed a 90-day contract for standard duty modern jackup VALARIS 144 for operations in the U.S. Gulf of Mexico. The contract is expected to start in fourth-quarter 2022. The operating rate is $80,000 per day.

The heavy-duty modern jackup VALARIS 107 won a one-well option exercised by an undisclosed operator offshore Australia. The one-well option has an estimated duration of 31 days at $112,000/day and will follow the existing firm program.

GB Energy offshore Australia signed a one-well contract for heavy-duty modern jackup VALARIS 107. The contract is expected to begin either late in the fourth-quarter 2022 or early in first-quarter 2023 with an estimated duration of 20 days. The operating rate is $118,000 per day.

The previously disclosed contract awarded to VALARIS DS-11 was terminated with effect at the end of June.

Valaris sold the VALARIS 36 to another drilling contractor with restricted use provisions for $9 million.

Wintershall well near Brage field comes up dry

The Norwegian Petroleum Directorate announced that Wintershall Dea Norge AS had a dry well in production license 055 about 7 km south of the Brage Field.

Drilled from the Brage platform in 137 m water depth, wildcat well 31/4-A-13 C aimed to prove petroleum in Middle Jurassic reservoir rocks in the Brent group as well as the Upper Triassic to Middle Jurassic reservoir rocks in the Statfjord Group and the Cook Formation.

While the well encountered good to very good reservoir quality sandstone rocks as well as some that were poor reservoir quality, there was no trace of petroleum.

The well will now be permanently plugged and abandoned.

Company Briefs

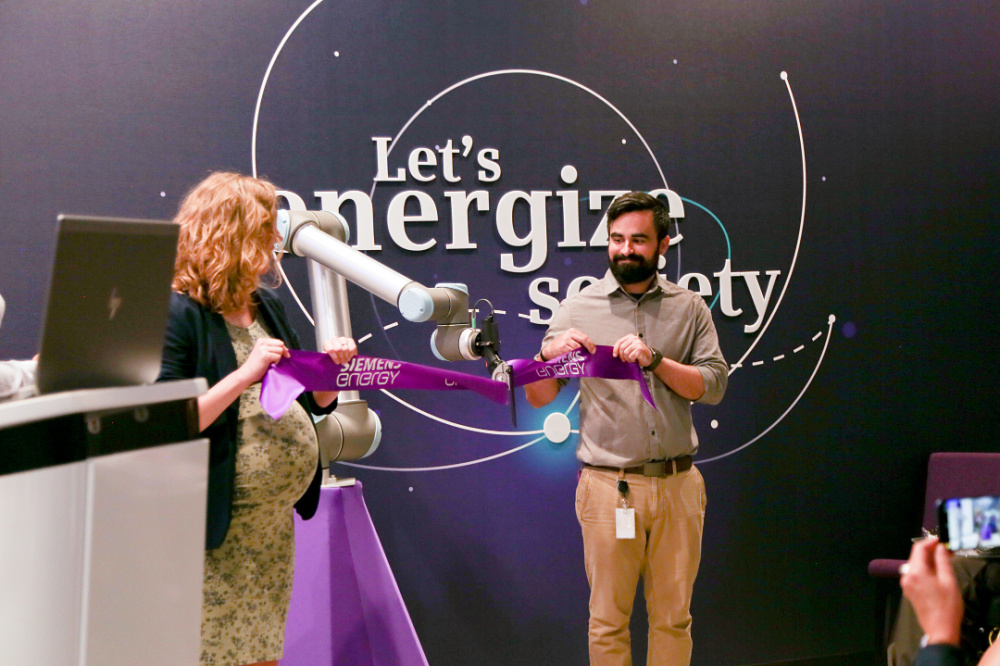

Siemens Energy expands Innovation Center - Orlando

Siemens Energy announced it had expanded its Innovation Center in Orlando, Florida, so it could better serve as a hub for accelerating the development of products and solutions to drive the energy transition through collaboration, rapid prototyping, and testing.

It is the company’s first global hub targeted at energy transition solutions, and the company said that the early-stage R&D facility operates with a start-up mentality, so ideas that used to take six months to test can now be tested in six weeks.

Siemens originally opened the facility in October 2019, and it has invested more than $30 million in the past four years in building up the Florida R&D operations.

The expansion represents a new $2 million investment in additional space for the Orlando facility and $5 million in CAPX for equipment to enhance the facility’s machine shop and technical application area, including its additive manufacturing capabilities and use of robotics to inspect and repair components for equipment. The space now includes a TED Talk theater. The expansion increases the space from 17,000 sq ft to 30,000 sq ft.

Siemens Energy plans to open Innovation Centers in Berlin, Abu Dhabi and Shenzhen.

CGG, BP sign data transformation, curation agreement

CGG SA announced a major multiyear global data transformation and curation agreement with BP Plc that will play a key role in supporting BP’s subsurface digital strategy.

Ariel Flores, senior vice president of subsurface at BP, said in a press release that leveraging the capability of both companies will help bring the hidden value of unstructured data directly into the hands of BP’s subsurface practitioners.

CGG CEO Sophie Zurquiyah added that the company’s data hub group will help BP unlock “the true value of huge volumes of disparate unstructured data” so asset teams can focus on generating new insights to better understand uncertainty and risk, improve decision-making, and deliver business value.

Local Buyout of Baker Hughes Oilfield Services in Russia

Baker Hughes Co. is selling its oilfield services (OFS) business in Russia to its local management team. The agreement follows on the company’s previously announced suspension of new investments for its Russia operations and commitment to comply with appliable laws and sanctions.

The new business will operate independently of Baker Hughes—including an independent brand—and it will assume all current OFS Russia assets, liabilities and commercial obligations.

The transaction is expected to close in the second half of 2022, subject to the approval of local authorities.

Recommended Reading

Noble’s $1.59B Diamond Offshore Acquisition Clears Antitrust Hurdle

2024-07-26 - Noble Corp.’s acquisition of Diamond Offshore Drilling still requires approval by Diamond shareholders as well as regulatory authorization in Australia.

Safeguarding the Trend of Accelerating CCUS Adoption

2024-07-24 - Policy pushes meet industry pull, positioning CCUS for takeoff.

Bipartisan Bill Aims to Speed Up Permitting Bureaucracy

2024-07-23 - If passed, the new rules would tackle litigation delays for energy projects across all sectors, an analyst says.

Pitts: Oh, What a Tangled Web the Supermajors Weave

2024-07-23 - Exxon and Chevron and Guyana and Venezuela—‘Let’s Make A Deal’ meets ‘Love, South American Style.’