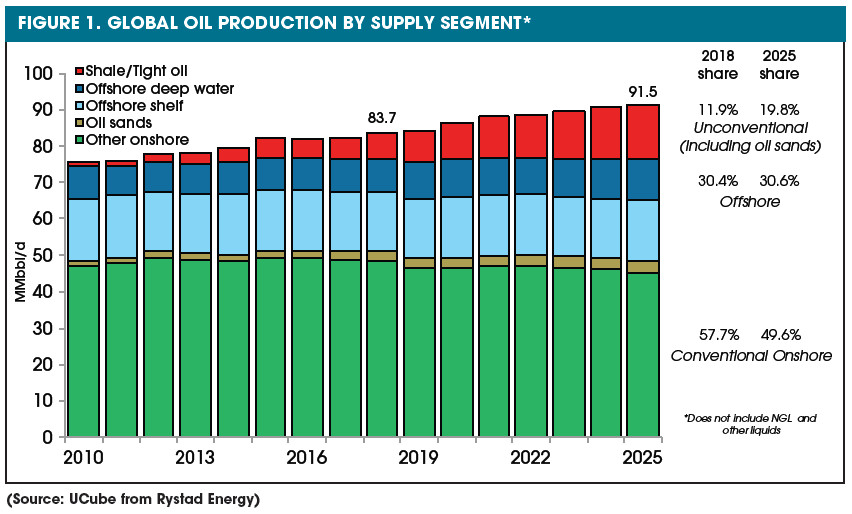

Since the beginning of this decade, the industry has seen an accelerated increase in the global oil supply as production has expanded at twice the rate on average in comparison to the previous decade. Oil output has grown more than 8 MMbbl/d in the last eight years from about 75.3 MMbbl/d in 2010 to 83.7 MMbbl/d in 2018 (Figure 1). Global oil production is set to grow further to about 91.4 MMbbl/d by 2025, as the ever-expanding shale production not only replaces the diminishing conventional oil produced onshore but also expands, catering to the growing global demand. In this high-growth environment, it is noteworthy how the share of the offshore volumes in the overall oil supply has diminished from more than 35% in the 2000s to just over 30% in the 2010s. However, these levels are no longer expected to contract and are projected to remain relatively constant over the next few years. In absolute terms, Rystad Energy forecasts offshore oil production to expand from the current 25.4 MMbbl/d to about 28 MMbbl/d by 2025.

Global offshore sanctioning—new cycle expected

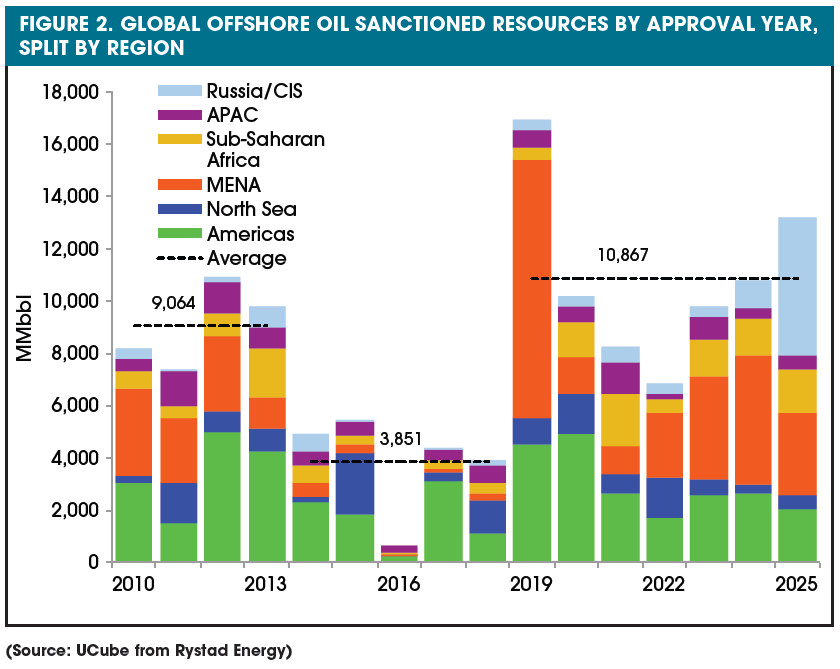

In the period 2010 to 2013, on average 9 Bbbl of offshore oil resources were sanctioned globally. After a trough of low sanctioning activity following the oil price collapse, a new surge in sanctioned resources is expected to be seen this year, with the Middle East and South America showing the most growth (Figure 2). Although somewhat lower sanctioning activity is anticipated next year, an average of 10.9 Bbbl/year in offshore oil resources is expected to be sanctioned over the next six years.

Among the key discoveries to be sanctioned this year is Phase 2 of the Liza Field offshore Guyana as well as large projects in Brazil in the Tupi and Marlim areas. Mero 2 is expected to be sanctioned in May with bids to supply subsea trees for the FPSO already underway, and a tender for umbilicals, risers and flowlines is expected to be offered in April. Mero 3 and 4 are expected to be sanctioned next year. Atapu North is expected to reach a final investment decision (FID) by the end of the year, Buzios 5 in September this year and Itapu in the second half of the year (the tender process was delayed from the planned first quarter of 2019). The Marlim Revitalization project is due to be sanctioned in the second quarter of this year.

In the Middle East, expansion projects in Saudi Arabia dominate the FID landscape this year, with the expansion of the Zuluf Field to be approved by year-end, and Marjan and Berri expansions are expected to be sanctioned in the second quarter of this year.

The growth in sanctioned volumes post-2022 is expected to come both from the Americas and the Middle East, including the development of additional resources in the Safaniya Field in Saudi Arabia, Phase 2 of the Carcara Field offshore Brazil and Phase 2 of the Ayatsil-Tekel oil field offshore Mexico. Moreover, the development of Phase 2 of the Kashagan Field may add up to 5.5 Bbbl of sanctioned crude resources.

Americas poised for another wave of sanctioning

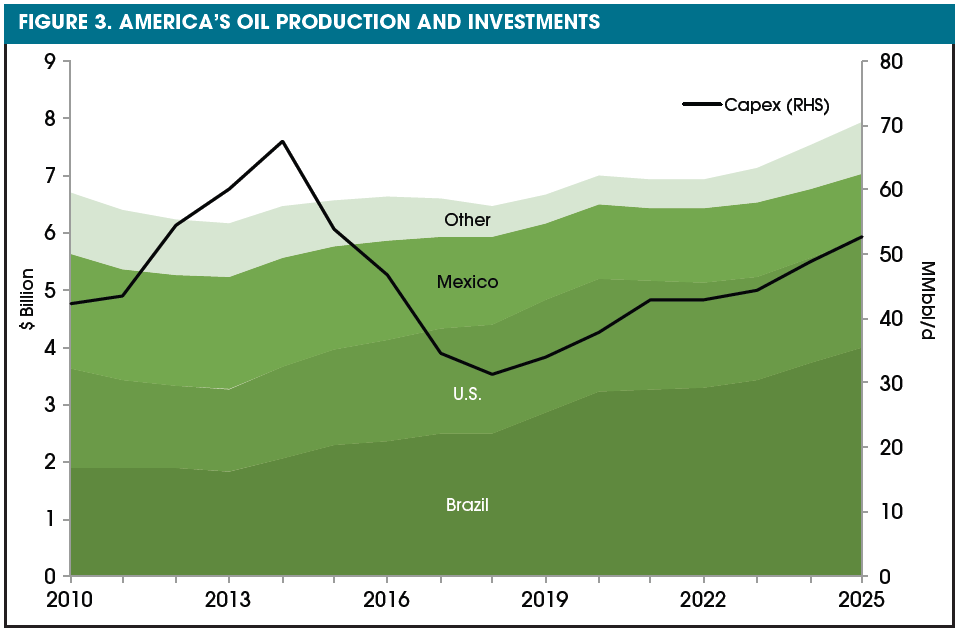

The Americas have been able to maintain a relatively stable oil supply from offshore sources over the past decade with production averaging about 6.45 MMbbl/d. The credit could largely be attributed to Brazil, as the nation has been able to compensate for the production decline from Mexico, where output has been falling steadily since 2004 (Figure 3). The gigantic presalt finds in Brazil have massively helped the Latin American nation take over as the leading offshore oil producer in the region.

Elsewhere, a relatively stable oil price environment from 2010 to 2014 supported multiple field sanctioning on the U.S. side of the Gulf of Mexico (GoM), which led the region to follow in Brazil’s footsteps. The two countries have been adding an average of 250,000 bbl/d year on year into the market over the past five years. This upward trend is expected to flatten out but just in the U.S. GoM. Brazil embarked upon its 10-year journey of doubling its 2-MMbbl/d offshore oil supply in 2014 and has not even reached the halfway mark yet. The country is expected to add about 370,000 bbl/d in supply per year over the next two years. This would help the Americas region reach the 7-MMbbl/d mark and sustain it over the next four years until the next wave of presalt oil kicks in, further expanding the region’s output to 8 MMbbl/d.

The 2010 to 2018 production levels were made possible by the massive investments by E&P operators during the oil price boom period. Capex was at an all-time high in the Americas from 2012 to 2014, peaking at about $67 billion in 2014. As one would expect, Brazil and the U.S. GoM were the areas that attracted the highest spending. As E&P companies started contracting their spending budgets in the backdrop of the oil price collapse, since 2014, capex shrunk significantly, with investments in 2018 at less than half of what was spent five years ago. However, this trend is expected to be reversed as the industry stands at the cusp of the next potential investment wave. Over the next two to three years, the industry could see companies making FIDs on nearly 14 Bbbl of oil within the Americas. Brazil is touted to attract tremendous attention from the floater specialists as it launches a barrage of tenders covering FPSO developments.

Some of the projects expected to gain the most traction would be the three additional units on Mero, two units on the Campos Basin Marlim project, where the operator intends to extend the life of field, a unit each on Parque das Baleia and Itapu, and a fifth unit on Búzios. In the U.S. GoM, Chevron is expected to lead efforts on the Anchor and Ballymore discoveries, while LLOG is expected to move ahead with its Mormont, Shenandoah and Khaleesi finds over the next few years. Mexico also is expected to make a return to the investment commitment scene, with Pemex expected to begin developing its multiple shallow-water finds, such as Esah, Cheek, Manik, Kinbe and Mulach. Fieldwood Energy, whose plan of development for its Pokoch-Ichalkil development was approved recently, is expected to make a FID soon. Elsewhere, Exxon Mobil is expected to commit larger capital to its Guyanese finds with Phase 2 on Liza followed by the Payara-Pacora fields. Combined, these factors will propel the spending in the region upward to more than $45 billion per year on average over the next six years.

North Sea

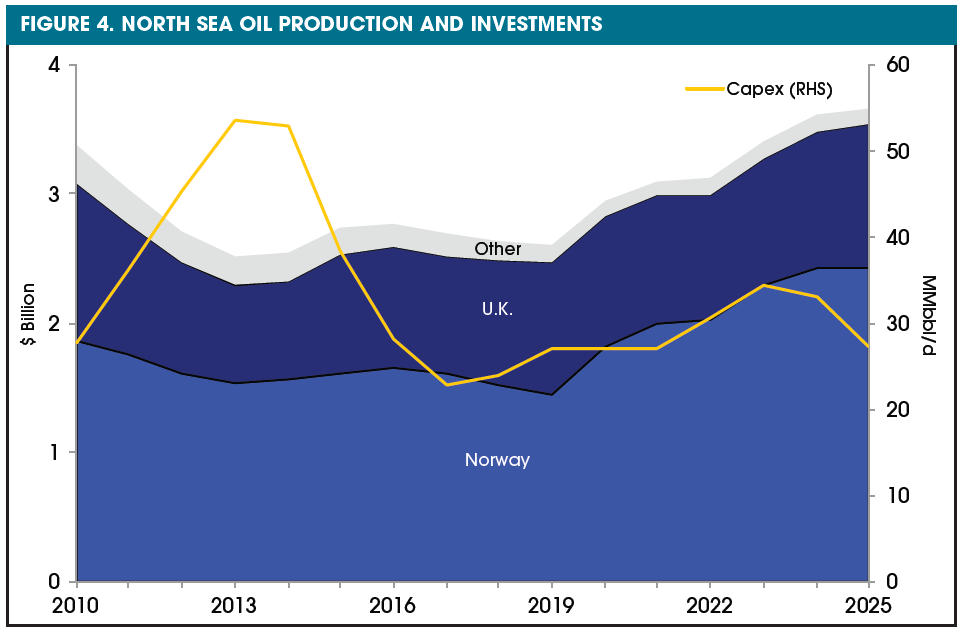

As a result of the natural decline of mature fields, oil production from the North Sea declined historically from 3.4 MMbbl/d in 2010 to 2.5 MMbbl/d in 2014 (Figure 4). After a period of growth in 2015 to 2016, the decline was resumed, with this year’s supply expected to fall to about 2.6 MMbbl/d. With Phase 1 of Norway’s Johan Sverdrup project expected to start producing by the end of 2019 and Phase 2 in 2022, renewed production growth is expected next year, leading to about 3.6 MMbbl/d produced by 2025. From 2020, Johan Sverdrup is estimated to be the field with the most significant contribution to production growth, along with Johan Castberg and the expansion of the Snorre Field.

Investments in the region have declined steeply from the peak levels in 2013 to 2014 to a low of $23 billion in 2017. The increase in spending before 2014 was primarily from mature fields in the Norwegian North Sea, such as Troll, Ekofisk, Eldfisk and Gullfaks, as well as the more recent Edvard Grieg and Jasmine discoveries. Key contributions to investments post-2017 are from the development of discovered resources, primarily Johan Sverdrup, as well as the Culzean Field, both of which are expected to start producing by the end this year, and the Johan Castberg Field is scheduled to be online by year-end 2022. Post-2020, the Rosebank/Lochnagar and Lancaster projects in the U.K. North Sea, the Ormen Lange subsea compression project and the Grosbeak discovery (Gjøa area) in Norway, and the redevelopment of the Hejre Field in the Danish North Sea are expected to see increasing investments.

Hence, overall capex in the North Sea is expected to reach about $27 billion this year, roughly half of the peak levels seen five years ago, and should grow to $30 billion to $35 billion over the next five years. Supported by the increasing investments, and largely driven by Norway, North Sea oil production is expected to enter a new growth phase next year and reach 3.6 MMbbl/d by 2025. Commercial development of the long-awaited Johan Sverdrup Field will play a key role in stable supply in the medium term. Both Norway and the U.K. hold significant discovered resources, and the timely development of these, as well as successful exploration performance in the future, will be crucial for the long-term production in the region.

Middle East and North Africa

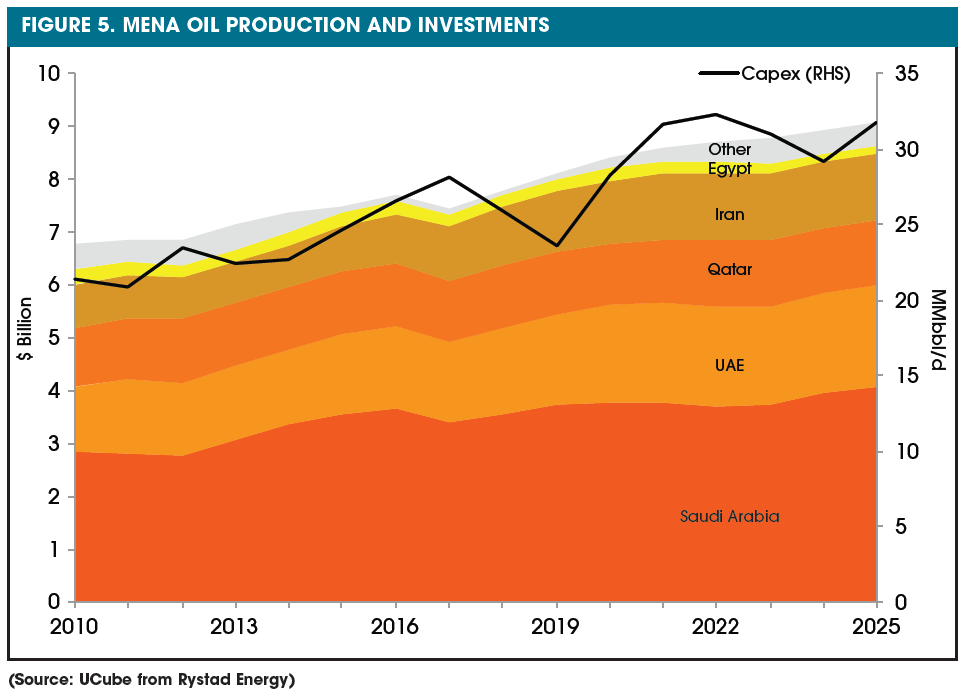

Offshore oil production in the Middle East and North Africa (MENA) region has increased from 6.8 MMbbl/d in 2010 to 7.8 MMbbl/d in 2018 (Figure 5). This year output is expected to increase by about 330,000 bbl/d to 8.1 MMbbl/d.

Saudi Arabia, the largest producer in the Arabian Gulf, is expected to keep oil supply rather flat year on year, in line with the OPEC+ cut agreement reinstated in December 2018. Rystad Energy estimates offshore oil production in the region to grow by about 180,000 bbl/d per year from 2019 to 2025, with the biggest contributions coming from the United Arab Emirates (UAE) and Iran. It is anticipated that Saudi Arabia will keep supply stable even after the OPEC agreement has expired to avoid an oversupplied market.

Offshore oil production in the MENA region is set to stand at about 9 MMbbl/d by 2025. Short-term growth is projected to come primarily from the development of the Satah Al Razboot and Umm Lulu (Phase 2) fields in the UAE, which were put on production in September 2018, as well as Phase 2 of the Nasr Field. In Iran, South Pars phases 13, 14 and 22-24 will be key for production growth going forward.

Spending levels have been increasing until 2017, reaching peak levels of about $28 billion. Last year the capex was about $26 billion, while 2019 spending is projected to stand at about $24 billion. The region’s offshore spending is expected to grow next year, averaging $28 billion to $32 billion over the next three years. During this time period, Saudi Arabia is expected to increase capital investments the most. Among unsanctioned fields, expansions of Marjan, Berri and Zuluf fields will see the largest capital contribution in the years to come, with all three projects expected to be sanctioned this year.

The UAE also is among the countries that are leading in terms of the capital investment increase in the medium term. A large part of the growth comes from new projects, including the Hail and Ghasha sour gas fields, and Phase 2 of the Upper Zakum expansion. In Qatar, the North Field expansion project (trains 8-11) is scheduled to be approved in 2019 to 2020 and will contribute to short-term growth in investments.

Hence, the MENA region’s offshore oil production is expected to grow over the next five years, with the highest short-term to medium-term growth projected in the UAE and Iran, while longer term growth is seen from the large projects in Saudi Arabia on track to be sanctioned later this year.

Sub-Saharan Africa

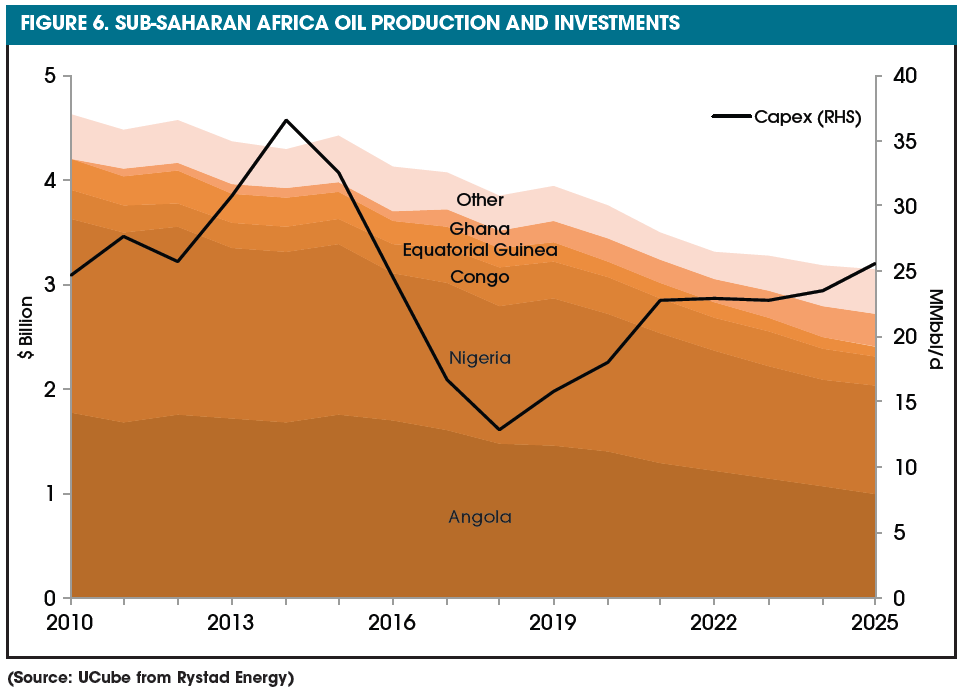

With more than half the production coming from maturing fields, Sub-Saharan offshore supply has been declining steadily since 2010. The region has seen its output decline to about 3.8 MMbbl/d in 2018 from the 4.5 MMbbl/d peak achieved in 2010 (Figure 6). Nigerian offshore output, averaging at 1.3 MMbbl/d in 2018, has declined the most, with production falling by about 525,000 bbl/d since 2010. Angola, currently the largest producer in the region, has seen its output fall by about 290,000 bbl/d during the same period, averaging 1.48 MMbbl/d in 2018. One should not expect a complete turnaround in this relatively mature region. Rystad Energy forecasts the production to continue falling by a further 800,000 bbl/d to a shade lower than 3 MMbbl/d by 2025. Investments in new projects are key for the region going forward, as more than 35% of the 2025 investments are expected to be in the currently nonproducing fields.

Offshore oil investments, which have been falling in the region since 2014, bottomed in 2018 at about $13 billion. These numbers were rallying much above the $25 billion mark, until an oversupplied market led to significant downsizing and capital discipline since 2014. However, Rystad Energy expects a reversal in the trend in the region, as the spending levels are expected to increase gradually over the short term, with slightly steeper growth expected over the medium term.

Nigerian projects, either delayed due to the uncertainly revolving around the Petroleum Industry Governance Bill (e.g., Bonga Southwest-Aparo and Owowo West) or delayed by legal action (e.g., Etan-Zabazaba) would act as key contributors to the higher spending levels and helping the country to keep the overall decline levels in check. In Angola the BP-led PAJ fields and Eni-led developments in Block 15/06 are some of the projects expected to be sanctioned over the next few years. Elsewhere, the Pecan development in Ghana and the recent finds of SNE in Senegal remain the drivers for raising the overall investment levels in the region. The projects mentioned above, along with a few others, would help raise investment levels to more than $20 billion in the short term and close to $25 billion in the medium term across the region.

Asia-Pacific

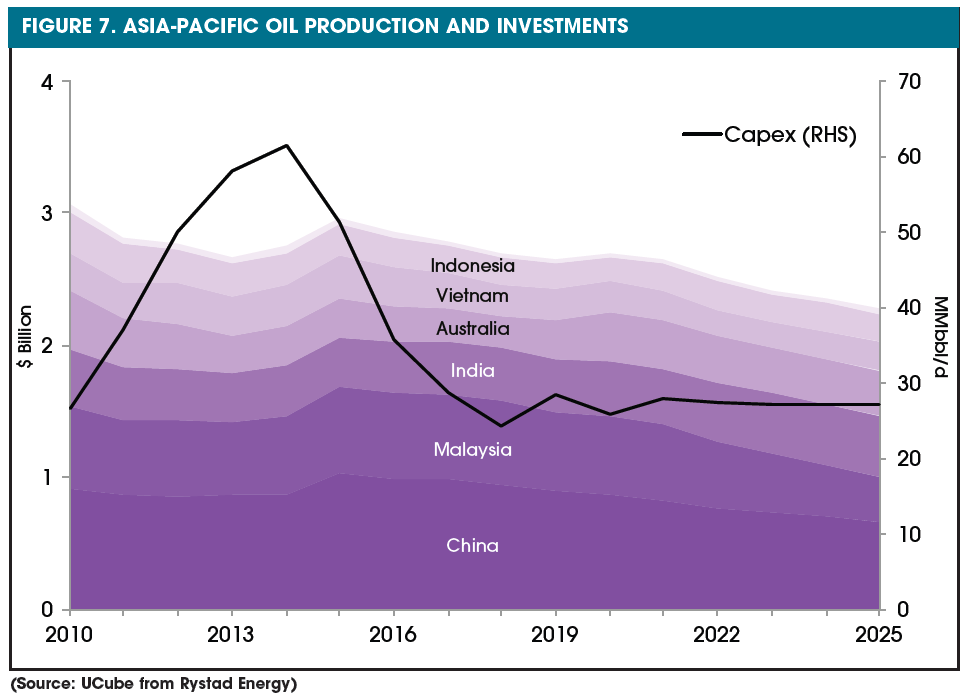

Another region where a significant amount of offshore oil supply comes from maturing fields is the Asia-Pacific, where Rystad Energy has seen the production decline from more than 3.5 MMbbl/d in 2010 to under 3 MMbbl/d in 2018. While the majority of the nations that make up the region have been able to sustain production, certain countries (namely Indonesia, Australia, Brunei and New Zealand) have seen their output fall dramatically.

One of the major factors for the offshore output falling is the lack of discovered volumes in the region. Over the past 10 years, total new volumes found in the region’s waters represent a meager 8% of the total discovered offshore oil resources globally. Additionally, only about a third of these discovered volumes have been able to get off the ground. This decline in production is expected to continue into the future, with production falling another 500,000 bbl/d over the next six to seven years, reaching about 2.5 MMbbl/d in 2025. However, this phase of decline is seen to be primarily dominated by China, Malaysia and Indonesia, whereas India and Australia are expected to revamp their supply.

One major reason nations like India and Australia are expecting to raise their production would be the high level of project sanctioning over the past few years. The 2018 sanctioning by ONGC on the R-Series and KG-DWN-98/2 (Northern Cluster) in India and the Ichthys and Prelude projects in Australia are helping to support production growth in these countries.

Offshore investments in the Asia-Pacific region have declined massively over the past five years, contracting by about 60% from the 2014 peak of $60 billion (Figure 7). The 2018 investment levels are expected to be sustained over the short and medium term as E&P operators battle to find projects worth investing in within this mature region. Overall, about $1.6 billion worth of oil resources are expected to be sanctioned over the next four years, driven by the CNOOC-operated Lufeng and Weizhou fields. Further contribution is expected from the shallow-water fields in India, led by a plethora of Indian E&P operators like ONGC, Vedanta and Hardy Oil & Gas. However, a lack of sizable investment options dictates an inevitable decline scenario in the region.

Conclusion

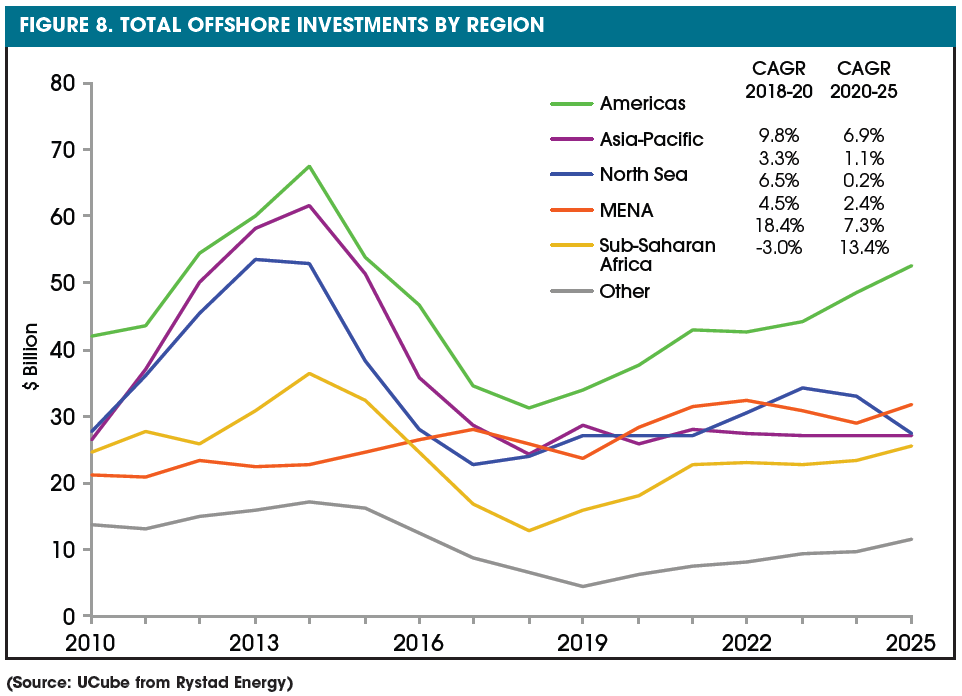

The honeymoon years of high offshore investment activity were followed by a period of more cautious activity and lower spending, culminating in 2018 when the offshore spending levels are estimated to have dropped to a low of about $125 billion, a level not seen since 2007. However, a gradual recovery is expected already next year with capex estimated to reach almost $180 billion in 2025.

Further analyzing the spending trends by region (Figure 8), this cyclical trend is evident for all geographies, to a greater or lesser extent, with a notable exception of the MENA region, where the spending levels have been fairly stable since 2010. The Americas are by far the largest region in terms of offshore investments, followed by Asia-Pacific, North Sea and MENA. North and South America are also the regions where we expect to see the highest growth in investments going forward, with Brazil and the U.S. GoM contributing the most.

The high growth in investments in South America and the GoM, the increasing spending in the North Sea and the consistently high spending levels in the Middle East are mirrored in the production contributions of these regions to the global offshore oil supply outlook. Hence, motivated by the significant sanctioning activity expected from these regions over the next five years, increasing volumes are expected to mitigate the decline from the regions dominated by the more mature production base, such as Sub-Saharan Africa and Asia-Pacific, keeping medium-term global offshore oil supply at about 27 MMbbl/d.

Contact E&P's Executive Editor Jennifer Presley at jpresley@hartenergy.com for comments or questions about this story.

This story first appeared in E&P magazine's "2019 Offshore Technology Yearbook" issue, which published in May. Read the other "2019 Offshore Technology Yearbook" articles:

OVERVIEWS:

Back to Deep Water

Mexico Finding Its Place in Offshore Landscape

Middle East Offshore Market Treads Recovery Path

KEY PLAYERS:

Operators Foresee Vast Potential

TECHNOLOGY:

New Generation of Offshore Drilling Tools Targets Safety, Wellbore Conditions

Platforms Enter a New Cycle

Subsea Sector Recovery Underway

Evolving ROVs

CASE STUDIES:

Advanced Flowmetering

Composites Gain Ground

PRODUCTION FORECAST:

Americas and Middle East Put Offshore Back on the Map (story above)

Recommended Reading

Oxy’s 1PointFive Lands Federal Funds for South Texas DAC Hub

2024-09-12 - DAC technologies can pull CO2 directly from the atmosphere anywhere, avoiding the need to be near the point of emissions.

8 Rivers Lands Investment from JX Nippon for DAC Technology

2024-09-17 - An investment by JX Nippon Oil Exploration will support 8 Rivers’ Calcite direct air capture technology as it moves from pilot to commercial development, the company says.

Oxy’s 1PointFive Lands US Funding for Carbon Sequestration Hubs

2024-10-03 - 1PointFive plans to use the funding to advance site characterization activities, permitting and environmental approvals for construction at each hub, Occidental said.

Pacific Northwest Hydrogen Hub Targets Hard-to-Abate Sectors

2024-08-22 - Hydrogen demand is coming from the end users in harder-to-decarbonize sectors, hub association director says.

ADNOC to Acquire Stake in Exxon’s Hydrogen, Ammonia Facility

2024-09-04 - Exxon’s Baytown facility is expected to produce up to 1 Bcf of hydrogen daily and more than 1 million tons of low-carbon ammonia per year, if it receives required regulatory permits and government policy support.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.