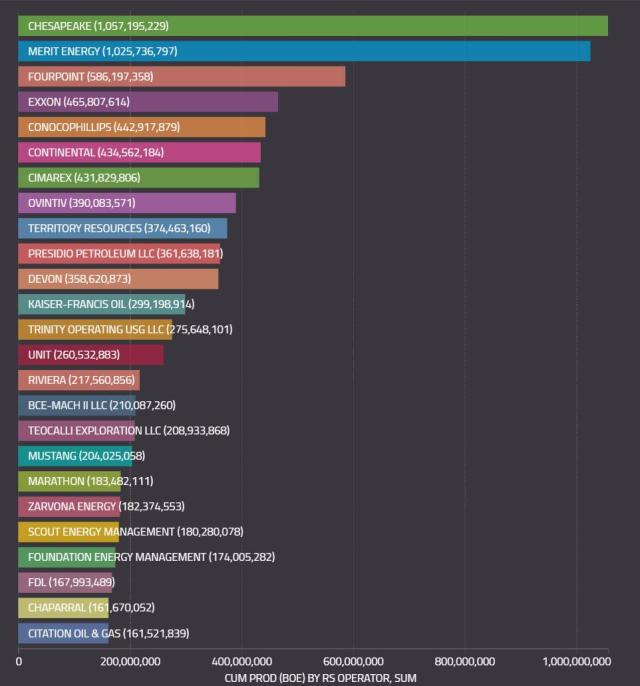

(Data courtesy of Enverus)

In this special report, Hart Energy briefly profiles the top Oklahoma operators. According to Enverus (as of July 31), the top 20 operators by total cumulative production in Oklahoma are

- Chesapeake Energy Corp.

- Merit Energy

- Fourpoint

- Exxon Mobil

- ConocoPhillips

- Continental Resources

- Cimarex

- Ovintiv

- Territory Resources

- Presidio Petroleum LLC

- Devon

- Kaiser-Francis Oil

- Trinity Operating Usg LLC

- Unit Petroleum

- Riviera Resources

- BCE-Mach II LLC

- Teocalli Exploration LLC

- Mustang Fuel Corp.

- Marathon Oil

- Zarvona Energy

In addition, Hart Energy’s DUG Midcontinent Virtual Conference, held Aug. 18-19, featured presentations by CEOs and presidents with Calyx Energy, Camino Natural Resources, Case Energy Partners, DCP Midstream, Lime Rock Resources, Mach Resources, Rimrock Resource Partners, Tapstone Energy and ULTRecovery Corp. These companies are bolded below with direct links to their conference presentations.

BCE-MACH II LLC

- 210,087,260 total cumulative Oklahoma production (as of July 31, per Enverus)

BCE-Mach LLC is a partnership between Bayou City Energy Management LLC (BCE) and Mach Resources LLC.

In early April, BCE-Mach III LLC closed the acquisitions of the upstream assets of Alta Mesa Holdings LP and its subsidiaries (AMH) as well as the midstream assets of Kingfisher Midstream LLC and its subsidiaries (KFM), which are principally located in Kingfisher County, Oklahoma.

“The acquisitions of AMH and KFM represent the first acquisitions in the newly formed BCE-Mach III LLC and the sixth and seventh acquisitions by partnerships between Bayou City Energy Management LLC and MACH Resources LLC since 2018,” according to an April 9 company press release. “With these closings, on a combined basis, the BCE-Mach partnerships will have net daily production of ~58 Mboe/d, interests in over 5,700 wells and ~500,000 net acres across the Midcontinent.”

See the Mach Resources profile below for more information on the company’s DUG Midcontinent Virtual Conference presentation.

CALYX ENERGY

Calyx Energy President and CEO Calvin Cahill presented the “Drilling through It: Arkoma Natgas” session at Hart Energy’s DUG Midcontinent Virtual Conference. This operator continues to drill and complete through 2020, targeting a natgas window in its Arkoma Basin leasehold that has windows into oil and NGL too. Watch Cahill’s presentation to learn about the economics that make continuous operations work: https://www.hartenergyconferences.com/dug-midcontinent/sessions/drilling-through-it-arkoma-natgas.

CAMINO NATURAL RESOURCES

Camino Natural Resources CEO Ward Polzin presented the “Operator Spotlight: From Zero to 100k” session at Hart Energy’s DUG Midcontinent Virtual Conference. In just three years, Camino Natural Resources has grown a SCOOP and Merge position of more than 100,000 net acres—and it continues to grow. Watch Polzin’s presentation, in which he shares the company’s outlook and plans: https://www.hartenergyconferences.com/dug-midcontinent/sessions/operator-spotlight-zero-100k.

CASE ENERGY PARTNERS

Case Energy Partners LLC President and CEO Charlie Matter presented the “Lower 48 Minerals: Midcontinent & Beyond” session at Hart Energy’s DUG Midcontinent Virtual Conference. Relatively fragmented in comparison with big Texas ranches, Midcontinent minerals are just as highly sought. Case Energy Partners is an owner and buyer of minerals in Oklahoma and throughout the Lower 48. Watch Matter’s presentation, in which he describes his portfolios and plans: https://www.hartenergyconferences.com/dug-midcontinent/sessions/lower-48-minerals-midcontinent-beyond.

CHESAPEAKE ENERGY CORP.

- 1,057,195,229 total cumulative Oklahoma production (as of July 31, per Enverus)

Oklahoma is home to Chesapeake’s corporate headquarters. With 768,000 acres, the company boasts it is one of the largest oil and natural gas producers in Oklahoma.

In fact, according to the company’s website, it is “one of the largest leaseholders and active drillers in the state and a catalyst for economic development—not only in Oklahoma City but also a large portion of West and Northwest Oklahoma in the Mississippi Lime and Granite Wash plays.”

The company’s Midcontinent assets generated more than $20 million in free cash flow in 2019, according to the company’s “4Q 2019 Earnings” investor presentation. Chesapeake also reported about 736,000 net acres and production of 14,000 boe/d in the region during that quarter. Looking ahead, the company anticipated turning 10 to 15 wells inline, running about one rig and one frac crew, and working with a total capex of $35 million to $50 million in 2020, according to the presentation. That 2020 production mix comprised 44% gas, 36% oil and 20% NGL.

With the double whammy of oil prices and COVID-19, and like many others facing this reality, Chesapeake laid off 200 employees in Oklahoma, the state said on April 15. Half of the job cuts were at the company’s Oklahoma City headquarters and half were in the oil field, according to the Oklahoma Office of Workforce Development.

“We continue to prudently manage our business and staffing levels to adapt to unprecedented market volatility and challenging commodity prices,” said Chesapeake spokesman Gordon Pennoyer.

On June 28, Chesapeake announced that the company voluntarily filed for Chapter 11 protection in the U.S. Bankruptcy Court for the Southern District of Texas to facilitate a comprehensive balance sheet restructuring. Chesapeake intends to use the proceedings to strengthen its balance sheet and restructure its legacy contractual obligations to achieve a more sustainable capital structure, according to the press release.

“Chesapeake’s operations are focused on discovering and developing its large and geographically diverse resource base of unconventional oil and natural gas assets onshore in the U.S.,” according to an April 2019 company fact sheet. “The company also owns oil and natural gas marketing and natural gas gathering and compression businesses.”

“We continue to look for new opportunities to tap Oklahoma’s energy future through improving technology and enhanced recovery techniques,” the company stated on its website.

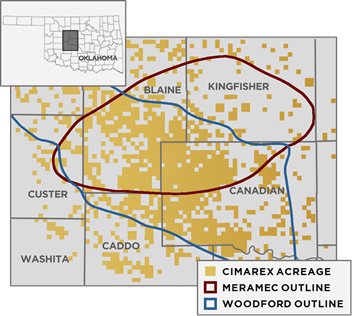

CIMAREX

- 431,829,806 total cumulative Oklahoma production (as of July 31, per Enverus)

Cimarex is an E&P company with operations in Oklahoma, Texas and New Mexico. The majority of its activity is in the Permian Basin and the Anadarko Basin in Western Oklahoma.

The Midcontinent accounted for 32% of Cimarex’s year-end 2019 proved reserves and 31% of total production, according to the company. Cimarex reported 2019 data of 16 net wells drilled and completed and total equivalent production of 87.3 Mboe/d in the region.

Cimarex invested $84 million during the second quarter of 2020, with 12% focused in the Midcontinent, according to the company’s second-quarter 2020 results report. Production from the Midcontinent averaged 68.7 Mboe/d for the second quarter, down 20% from second-quarter 2019 and down 6% sequentially. During the second quarter, 20 gross (1.4 net) wells were brought on production in the Midcontinent region. At the end of the quarter, 26 gross (<1 net) wells were waiting on completion. Cimarex is not currently operating drilling rigs or completion crews in the Midcontinent (as of Aug. 5).

CONOCOPHILLIPS

- 442,917,879 total cumulative Oklahoma production (as of July 31, per Enverus)

ConocoPhillip’s Anadarko Basin asset comprises approximately 283,000 net acres, located in the Texas Panhandle and western Oklahoma areas, according to a March 2020 company fact sheet. Production is primarily from stacked liquids-rich and tight-gas Cleveland, Redfork, Granite Wash, Atoka and Morrow formations. The company’s 2019 net production was 14 Mboe/d, according to the fact sheet.

ConocoPhillips said it would revive production in the Lower 48 region during July, according to a June 30 Reuters report. “ConocoPhillips, the world’s largest independent oil and gas producer, had announced the biggest cuts by any North American producer in April, reducing its output by 460,000 bbl/d by June,” the report stated. “Accounting for curtailments and planned turnaround activity, it now expects to report second-quarter production volumes of 960,000 to 980,000 boe/d.”

Click the image above to watch an exclusive video interview between Hart Energy and ConocoPhillips CTO Greg Leveille, as explains why now is the best time for oil and gas companies to ramp up new technology efforts.

CONTINENTAL RESOURCES

- 434,562,184 total cumulative Oklahoma production (as of July 31, per Enverus)

Based in Oklahoma City, Continental Resources has significant positions in the state, including its SCOOP Woodford and SCOOP Springer discoveries and the STACK plays.

On June 18, the company reported its intentions to curtail production.

“The company previously announced it would curtail 70% of operated oil production in May, with continued curtailments into June. In July, the company expects to partially begin resuming production but still expects to curtail approximately 50% of its operated oil production,” the company stated in a news release. “June 2020 total production is expected to average 150,000 to 160,000 boe/d. Second-quarter 2020 total production is expected to average 200,000 to 205,000 boe/d. July 2020 total production is expected to average 225,000 to 250,000 boe/d.”

Click the image above to watch an exclusive video interview between Hart Energy and Harold Hamm, founder and executive chairman of Continental Resources, as he explains how American GulfCoast Select—a new crude benchmark—will help producers in the oil industry.

DCP MIDSTREAM

DCP Midstream’s Corey Walker, president of operations, presented the “In the Pipe: Shipper Spotlight” session at Hart Energy’s DUG Midcontinent Virtual Conference. With operations in the SCOOP/STACK, as well as the Permian and Denver-Julesburg Basin, this pipeline operator has a distinct perspective on flows to natgas and NGL demand centers. Watch Walker’s presentation, in which he describes the marketplace today: https://www.hartenergyconferences.com/dug-midcontinent/sessions/pipe-shipper-spotlight.

DEVON

- 358,620,873 total cumulative Oklahoma production (as of July 31, per Enverus)

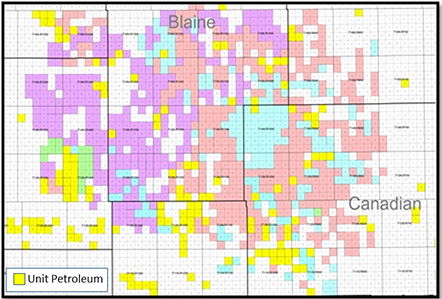

Devon’s Anadarko Basin activity is located primarily in Oklahoma’s Canadian, Kingfisher and Blaine counties.

Devon’s position is “one of the largest in the industry, providing substantial long-term inventory optionality,” according to the company.

Devon’s contiguous acreage footprint is primarily located in the overpressured oil window, and its operations are focused in the oil-prone Meramec and the liquids-rich Cana-Woodford Shale.

The company reported 2019 net production of 119 Mboe/d (56% liquids), which was 36% of the company.

The company’s second-quarter 2020 net production averaged 90,000 boe/d in the Anadarko Basin, according to Devon’s second-quarter 2020 earnings release. “The company’s operational focus during the quarter was concentrated on optimizing base production and reducing controllable downtime across the field,” the report stated.

Devon does not currently operate drilling rigs or completion crews in the basin (as if Aug. 4).

EXXON MOBIL

- 465,807,614 total cumulative Oklahoma production (as of July 31, per Enverus)

According to a March 4 Hart Energy report, Exxon Mobil’s budget in 2019 was 93% of its 10-year average of $26.1 billion. After dropping sharply in 2014, Exxon Mobil’s spending has been rising, in fact, with $24.4 billion invested last year. According to the report, the company plans to expand capex this year to more than $30 billion, in what has been described as a counter-cyclical strategy.

“Two years into an ambitious growth plan to revive earnings at the largest U.S. oil company, Exxon Mobil Corp. said on March 5 it would stick to its plans to ‘lean in’ to spending even as its rivals trim costs,” Reuters reported. “Exxon sees a chance to grow while its peers underinvest in new projects. It plans to spend between $30 billion and $35 billion a year through 2025. Spending will rise from $31 billion last year to about $33 billion this year.”

The company is “mindful of the current market environment” but will stay with its strategy of “leaning into this market when others have pulled back,” Exxon’s CEO Darren Woods said at the company’s annual investor day meeting.

Exxon’s growth plans include “a big bet on U.S. shale, where output has surged,” Reuters reported.

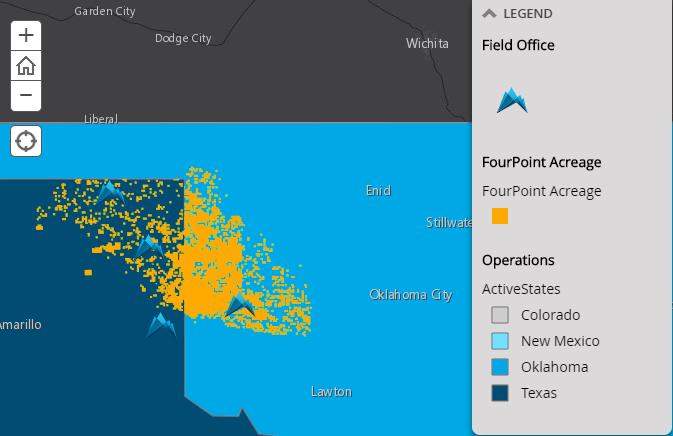

FOURPOINT

- 586,197,358 total cumulative production (as of July 31, per Enverus)

FourPoint’s area of focus is in the Western Anadarko Basin, where 23 different correlative zones have been successfully targeted since 2005. The company’s acreage position in the Anadarko Basin comprises two states, 13 counties and more than 2 million gross acres. FourPoint has 5,474 producing wells, two operated rigs and 430 MMcfe/d of gross operated production (47% gas, 30% NGL and 23% oil) in the basin.

KAISER-FRANCIS OIL CO.

- 299,198,914 total cumulative production (as of July 31, per Enverus)

Kaiser-Francis Oil Co. is a Tulsa-based oil and gas E&P company.

According to a January 2020 Hart Energy report, Unit Petroleum and Kaiser-Francis have been actively developing secondary Hoxbar targets horizontally with promising results over the last roughly five years. Multi-pay possibilities include Hogshooter, a historical vertical production. Kaiser-Francis demonstrated successful horizontal development with the McPherson 20-9-11-1H well.

LIME ROCK RESOURCES

Lime Rock Resources President and COO Tim Miller presented the “Growing in South-Central Oklahoma” session at Hart Energy’s DUG Midcontinent Virtual Conference. Bolting on bp property in Cleveland and McClain counties in 2019, Lime Rock Resources has expanded its horizontal D&C easterly from preexisting operations in Grady County. Watch Miller’s presentation to learn about the company’s achievements and plans: https://www.hartenergyconferences.com/dug-midcontinent/sessions/growing-south-central-oklahoma.

MACH RESOURCES

Mach Resources LLC Founder and CEO Tom Ward presented the “Opening Keynote: Anadarko Rock” session at Hart Energy’s DUG Midcontinent Virtual Conference. Having picked up both the Alta Mesa and Kingfisher portfolios, Mach Resources, in partnership with Bayou City Energy, has grown to 58,000 boe/d with interests in more than 5,700 wells and some 500,000 net Midcontinent acres. Watch Ward’s presentation for the details: https://www.hartenergyconferences.com/dug-midcontinent/sessions/opening-keynote-anadarko-rock.

MARATHON OIL

- 183,482,111 total cumulative production (as of July 31, per Enverus)

In Oklahoma Marathon Oil holds net acreage with rights to the Woodford, Springer, Meramec, Osage, Oswego, Granite Wash and other Pennsylvanian and Mississippian plays, with a majority of this in the SCOOP and STACK.

The Oklahoma asset successfully transitioned to positive free cash flow generation during fourth-quarter 2019. In the SCOOP/STACK, the company reported fourth-quarter 2019 performance of 82,000 net boe/d average production, 40% improved drilling feet per day versus the 2018 average, and a 15% decrease in completed well costs per lateral foot in 2019 versus 2018 average.

“In 2020, we expect to bring 30-40 gross operated wells to sales in Oklahoma. Activity is expected to be more weighted to SCOOP,” the company states on its website.

Marathon Oil's Oklahoma production averaged 60,000 net boe/d in second-quarter 2020, including oil production of 15,000 net bbl/d of oil, according to the company’s second-quarter 2020 results report. The company did not bring any gross company-operated wells to sales during second quarter in Oklahoma.

MERIT ENERGY CO.

- 1,025,736,797 total cumulative production (as of July 31, per Enverus)

Merit Energy is a private oil and gas company that was founded in 1989.

According to a May 2020 EnergyNet report, “Merit Management Partners IV LP retained EnergyNet for the sale of a 190-well package across Oklahoma’s Dewey, Ellis, Roger Mills and Woodward counties through an auction closing June 10. The offering includes operations, nonoperated working interest and overriding royalty interest plus development potential on HBP leasehold acreage and minerals.”

MUSTANG FUEL CORP.

- 204,025,058 total cumulative production (as of July 31, per Enverus)

Mustang Fuel Corp. is a privately held company headquartered in Oklahoma City, Okla., along with its subsidiaries Mustang Gas Products LLC and Mustang Fuel Marketing Co. Mustang’s operations include oil and gas E&P, natural gas gathering and processing, and natural gas marketing.

Mustang is the operator of more than 550 properties. It also owns nonoperated interests in more than 1,100 other properties and controls more than 100,000 acres of undeveloped leasehold in Kansas, Oklahoma, Texas and Utah.

The company’s most recent and ongoing activity involves participation as a nonoperator in wells across its acreage position in the STACK and SCOOP plays of central Oklahoma, according to updates on the company’s website. Mustang also has successfully pursued strategic PDP acquisitions, with follow-on production enhancements, in the Arkoma Basin of Eastern Oklahoma.

OVINTIV

- 390,083,571 total cumulative production (as of July 31, per Enverus)

Ovintiv has about 360,000 net acres HBP, primarily in the black oil window of the SCOOP and STACK.

In the Anadarko Basin, production averaged 144 Mboe/d (61% liquids) in the second quarter, and the company averaged three rigs, down from six in the first quarter of 2020, according to Ovintiv’s second-quarter 2020 financial and operating results. During the second quarter, 13 net wells were drilled and 17 net wells were turned inline. Ovintiv is currently running two rigs in the play (as of July 28).

In the STACK, 14 wells have been drilled and completed in 2020 for less than $5 million. The pacesetter drilling and completion well costs are now $4.4 million, representing a 30% reduction from 2019 average results, according to the second-quarter 2020 results report.

PRESIDIO PETROLEUM LLC

- 361,638,181 total cumulative production (as of July 31, per Enverus)

Presidio acquired MidStates’ Western Anadarko Basin assets in May 2018 and Apache’s assets in July 2019. The company boasts its assets are “performing beyond expectations under Presidio management,” and “workovers and recompletions have flattened production with very attractive payouts.”

Presidio has an ongoing basin study project that has unlocked significant numbers of drilling locations and high-graded previously identified locations in the Cleveland, Marmaton, Tonkawa, Cottage Grove and other formations, according to statements on the company’s website.

RIMROCK RESOURCE PARTNERS

Rimrock Resource Partners CEO and President Burt Williams presented “The Golden SCOOP: Operator Spotlight” session at Hart Energy’s DUG Midcontinent Virtual Conference. The Golden Trend that produced more than 84 MMbbl and a 1 Tcf of gas from Pennsylvanian in the past century is the target for deeper, horizontal Woodford, Springer and Sycamore, including by Rimrock Resource Operating, which made a 2016 bolt-on in south-central Oklahoma. Watch Williams’ presentation to learn more: https://www.hartenergyconferences.com/dug-midcontinent/sessions/golden-scoop-operator-spotlight.

RIVIERA RESOURCES

- 217,560,856 total cumulative production (as of July 31, per Enverus)

Heavily concentrated in Blaine, Major and Garfield counties, Riviera has a core position in the northwest STACK play targeting the Meramec and Osage formations.

Recently there has been significant horizontal development within Riviera’s NW STACK position, the company stated on its website. Additionally, Riviera has production from legacy vertical wells across Western Oklahoma producing oil, natural gas and NGL from various formations throughout the basin.

On Aug. 6, the company announced it signed a definitive agreement to sell its interest in certain properties located in the Anadarko Basin in Oklahoma. The transaction is expected to close in the fourth quarter of 2020 for a contract price of $15.8 million, according to the press release. The properties are located in 14 counties throughout central and northwest Oklahoma and consist of about 2,100 wells with average second-quarter net production of approximately 28 MMcfe/d.

TAPSTONE ENERGY

Tapstone Energy LLC Chairman and CEO Steve Dixon presented the “Operator Spotlight: Stacking Up on the STACK” session at Hart Energy’s DUG Midcontinent Virtual Conference. Great rock begets great returns. This operator—with experience in more than 10,000 horizontals across every major U.S. play—is stacking up on STACK. Watch Dixon’s presentation to hear the company’s plans: https://www.hartenergyconferences.com/dug-midcontinent/sessions/operator-spotlight-stacking-stack.

TEOCALLI EXPLORATION LLC

- 208,933,868 total cumulative production (as of July 31, per Enverus)

Private E&P company Teocalli Exploration LLC operates in Oklahoma and is one of the top 20 producers in the state, according to Enverus.

MineralAnswers.com reported that Teocalli’s total production was 420,698 boe during May 2020 and that the company has an estimated daily production of 127 bbl of oil and 127 Mcf of gas, coming from 163 actively producing wells in the state.

TERRITORY RESOURCES

- 374,463,160 total cumulative production (as of July 31, per Enverus)

Territory Resources LLC is a privately held energy company headquartered in Stillwater, Okla. Territory’s focus is “the acquisition and exploitation of existing properties coupled with opportunity-driven resource plays where advancements in drilling and completion technologies open commercial opportunities,” according to the company.

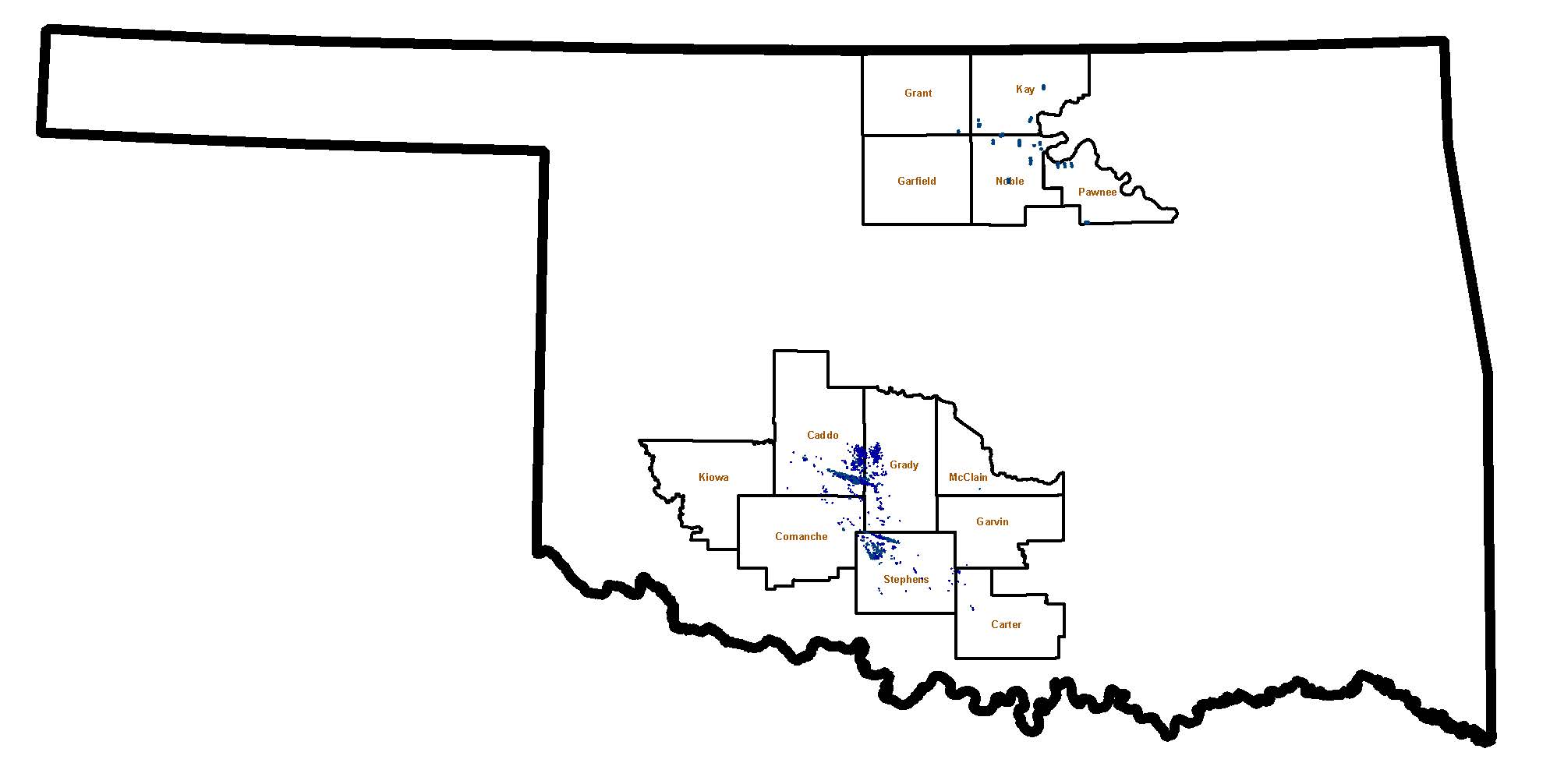

Territory operates more than 500 wells in Oklahoma that are primarily located in north-central and southwestern Oklahoma.

TRINITY OPERATING USG LLC

- 275,648,101 total cumulative production (as of July 31, per Enverus)

Trinity Operating is an independent oil and natural gas company headquartered in Houston with operations in Oklahoma and Texas. The company has total oil production of 5.6 MMbbl, total gas production of 205.5 MMcf and 958 producing wells, according to shalexp.com.

Trinity reported completions of two wells on a single pad producing more than 18,000 Mcf of natural gas in late April 2020, according to an okenergytoday.com article. The two Glynell wells had December 2018 spud dates but drilling wasn’t finished until July 2019. Completions on each were made in October 2019. “One well, drilled at a depth of 15,934 feet in the Woodford Formation, produced 8,334 Mcf of natural gas,” the article stated. “A second well was drilled at a depth of 15,454 feet into the Mayes-Woodford Formation and produced 9,883 Mcf of natural gas.”

ULTRECOVERY CORP.

ULTRecovery Corp. Chairman and CEO Jacob Jin presented the “There Are Apps for That: Oilfield Technology” session at Hart Energy’s DUG Midcontinent Virtual Conference. Operators have found increasing success with digital automation of various operations. Not all fixes are digital, though. Growing EURs are being reported from biochemical and other engineered solutions as well. View Jin’s presentation at: https://www.hartenergyconferences.com/dug-midcontinent/sessions/there-are-apps-oilfield-technology.

UNIT PETROLEUM

- 260,532,883 total cumulative production (as of July 31, per Enverus)

Unit Petroleum Co. is a wholly owned subsidiary of Unit Corp. As of year-end 2019, Unit owned 72 MMBoe of reserves, primarily in the Anadarko and Arkoma Basins, and operated or owned an interest in more than 6,100 wells, according to the company’s website. Unit's reserves are 100% proved developed.

In Hoxbar (Marchand Sand), the company reported EUR of about 568 Mboe, well costs of about $4.7 million, 75% liquids (63% oil), about 31,000 contiguous net acres (84% HBP) and about 40 to 50 locations with average working interest of 89%.

In the STACK, the company reported about 1,890 Mboe (64% liquids) and well costs of about $8 million. Unit has about 12,000 net acres in the STACK core and about 5,000 net acres in STACK extension (85% HBP). About 100 to 150 potential locations are with working interest of 40-60%. Unit participated in about 60 nonoperated wells in 2019.

ZARVONA ENERGY

- 182,374,553 total cumulative production (as of July 31, per Enverus)

Founded in 2010, Zarvona Energy is a privately held, independent oil and gas company headquartered in Houston.

Zarvona focuses on acquiring and enhancing existing onshore oil and gas fields within the U.S.

The company operates producing fields in Texas, Oklahoma and Louisiana.

The company invested more than $700 million in acquisitions and capital projects between 2011 and November 2019, according to a Zarvona presentation at Hart Energy’s Executive Oil Conference in November 2019. Zarvona has 400-plus operated producing wells making more than 21,000 boe/d (about 45% oil) in Texas, Oklahoma and Louisiana, according to the presentation.

Editor’s note: The majority of information within these profiles was written based on first- and second-quarter 2020 investor reports, if available. Send updates and/or corrections to Ariana Hurtado at ahurtado@hartenergy.com.

Recommended Reading

Hirs: AI and Energy—Is There Enough to Go Around?

2024-11-07 - AI data centers need a constant supply of electricity, and the nation’s grids are unprepared.

As Permian Gas Pipelines Quickly Fill, More Buildout Likely—EDA

2024-10-28 - Natural gas volatility remains—typically with prices down, and then down further—but demand is developing rapidly for an expanded energy market, East Daley Analytics says.

Range Confirms: Data Center Talk Underway for Marcellus Gas-fired Power

2024-10-24 - Deals will take a while, however, as these multi-gigawatt agreements are also multi-decade investments, said Range Resources CFO Mark Scucci.

Companies Hop on Digital Twins, AI Trends to Transform Day-to-day Processes

2024-10-23 - A big trend for oil and gas companies is applying AI and digital twin technology into everyday processes, said Kongsberg Digital's Yorinde Lokin-Knegtering at Gastech 2024.

Morgan Stanley Backs Data Center Builder as AI Fervor Grows

2024-10-21 - Morgan Stanley Infrastructure Partners (MSIP) is backing data center developer Flexential as demand for AI and high-performance computing grows.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.