Investor Returns Keep Aethon IPO-ready

Haynesville producer Aethon Energy is focused on investor returns, additional bolt-on acquisitions and mainly staying “IPO ready,” the company’s Senior Vice President of Finance said Oct. 3 at Hart Energy’s Energy Capital Conference (ECC) in Dallas.

Newest Giant North Houston Bossier Wildcat Won’t Sputter Out

Driller Comstock Resources Inc. says it plans to keep it strong-choked to remain at its first-24-hour rate of 36 MMcf/d.

Aethon’s Screamer Well Joins Comstock’s Deep-Bossier Wildcatting

Aethon Energy’s 36.9 MMcf/d Currie #2H north of Houston makes for a third well revealed in the Bossier prospect north of Houston that one longtime Texas wildcatter calls a “big boy play.”

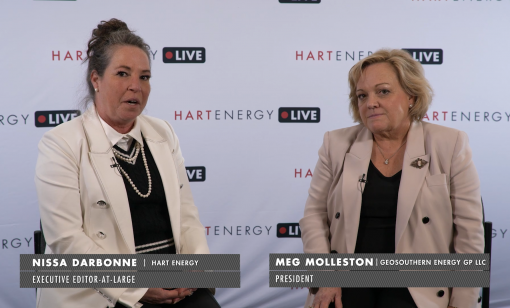

Molleston: GeoSouthern's Gamble in the Mid-Bossier Pays Off [WATCH]

Hart Energy's Nissa Darbonne sat down with Geosouthern Energy's President and CEO Meg Molleston to talk about Geosouthern's move from the Eagle Ford to the Haynesville and the obstacles the company faces moving forward with its Block 2 property.

By Hook, Crook and Bolt-on, E&Ps Scramble to Add Inventory

Operators are adding inventory, largely through M&A, as some E&Ps see well productivity plateauing.

Inside Comstock’s North Houston ‘Western Haynesville’

Comstock Resources is putting modern horizontals and frac jobs into the deep Bossier, long known to be a super-stocked natgas tank. It’s looking like the new recipe works.

Natgas-Bagging: Chesapeake’s Choking Back Haynesville Growth for Now

Chesapeake Energy is teeing up for more natural gas takeaway and LNG demand in late 2023 and into 2024. Plans have been canceled for adding an eighth rig in the Haynesville.

Energy A&D Transactions from the Week of Aug. 24, 2022

Here’s a snapshot of recent energy deals including Phillips 66 offer to buy DCP Midstream in $3.1 billion cash deal plus Brigham Minerals’ largest acquisition to date.

Energy A&D Transactions from the Week of Aug. 17, 2022

Here’s a snapshot of recent energy deals including the sale of Laredo Petroleum’s Howard County properties in the Permian Basin to Northern Oil and Gas for $110 million.

Energy A&D Transactions from the Week of Jan. 19, 2022

Here’s a snapshot of recent energy deals including the $1.9 billion merger of Falcon Minerals with privately held Desert Peak plus Clearfork bags its first deal after a $400 million equity commitment.