Comstock Resources Inc.’s third Bossier wildcat north of Houston came in with 36 MMcf/d—and it hasn’t backed down. (Source: Shutterstock)

Comstock Resources Inc.’s third Bossier wildcat north of Houston came in with 36 MMcf/d—and it hasn’t backed down.

The well—Campbell #2H in Robertson County, Texas—was made with a 12,763-ft lateral, landed in the Bossier 15,700 ft below the surface. It was brought online on March 19.

“We're trying to be real conservative on managing the drawdown. We certainly could have IP’ed this well a lot higher,” Dan Harrison, Comstock COO, said in a call with analysts Wednesday morning.

“We just chose not to. We IP’ed it on a smaller choke. It has [a] really low drawdown.”

Comstock didn’t reveal the choke size. Except for what Comstock chooses to reveal, the well’s details remain in confidential status in Texas Railroad Commission files for six months post-completion.

Jay Allison, CEO, said May 3 that the decision to small-choke the Campbell #2H is unusual. “You know, over the 36 years I've been in this business, most people IP [a well] at three times what they produce it at. So, it's a little different norm what we're doing here.”

Comstock’s first two wildcats in the play—Cazey Black A #1H and Circle M Allocation #1H—came in with 42 million cubic feet equivalent per day (MMcfe/d) and 37 MMcfe/d, respectively.

Both in Robertson County, each has a 7,900-ft lateral in the Lower Bossier.

Circle M, which was completed with 3,319 lbs of proppant per ft and 89 bbl/ft of fluid, was tested on a 28/64-inch choke at 9,488 pounds per square inch (psi) flowing tubing pressure. Its first 90 days of production averaged 23.9 MMcfe/d, according to Enverus.

The Circle M’s average, though, may have been affected by that Comstock shut it in for 35 days during a nearby well completion. It’s currently producing 30 MMcfe/d, Harrison said. “[We’re] just getting it back up to pace.”

The Cazey Black is flowing between 25 MMcfe/d and 30 MMcfe/d “and then we're going to flow this Campbell well at 36 [MMcfe/d] and just manage the drawdown,” he said.

The new well, Campbell #2H, has a lower IP at 36 MMcfe/d than the Cazey Black and the Circle M, while it has 4,900 ft more lateral. But it “looks really good,” Harrison said.

All three wells “are obviously capable of flowing at higher rates,” he added. “They have great pressures.”

The drawdowns are “much better than the drawdowns we see in our core [wells in] East Texas and North Louisiana. We’re managing the wells for longevity for maximum value.”

Allison suggested analysts “put asterisks on” the wells, though.

“You don't know how many more Campbell wells are out there,” he said. “You don't know the footprint. And it's going to take a long time to de-risk this. That's why we've taken the long road to do this, the slow road.”

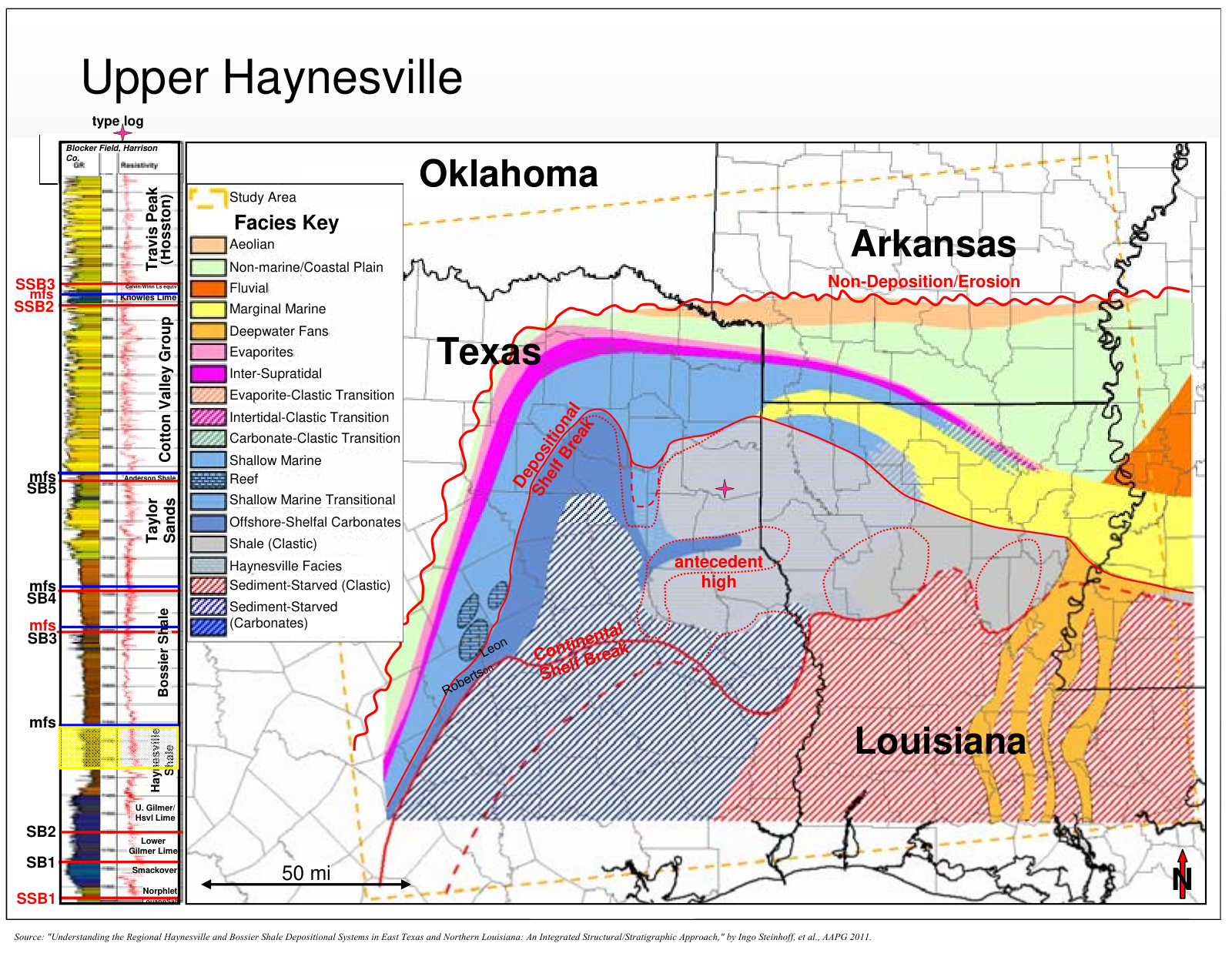

Testing the Western Haynesville

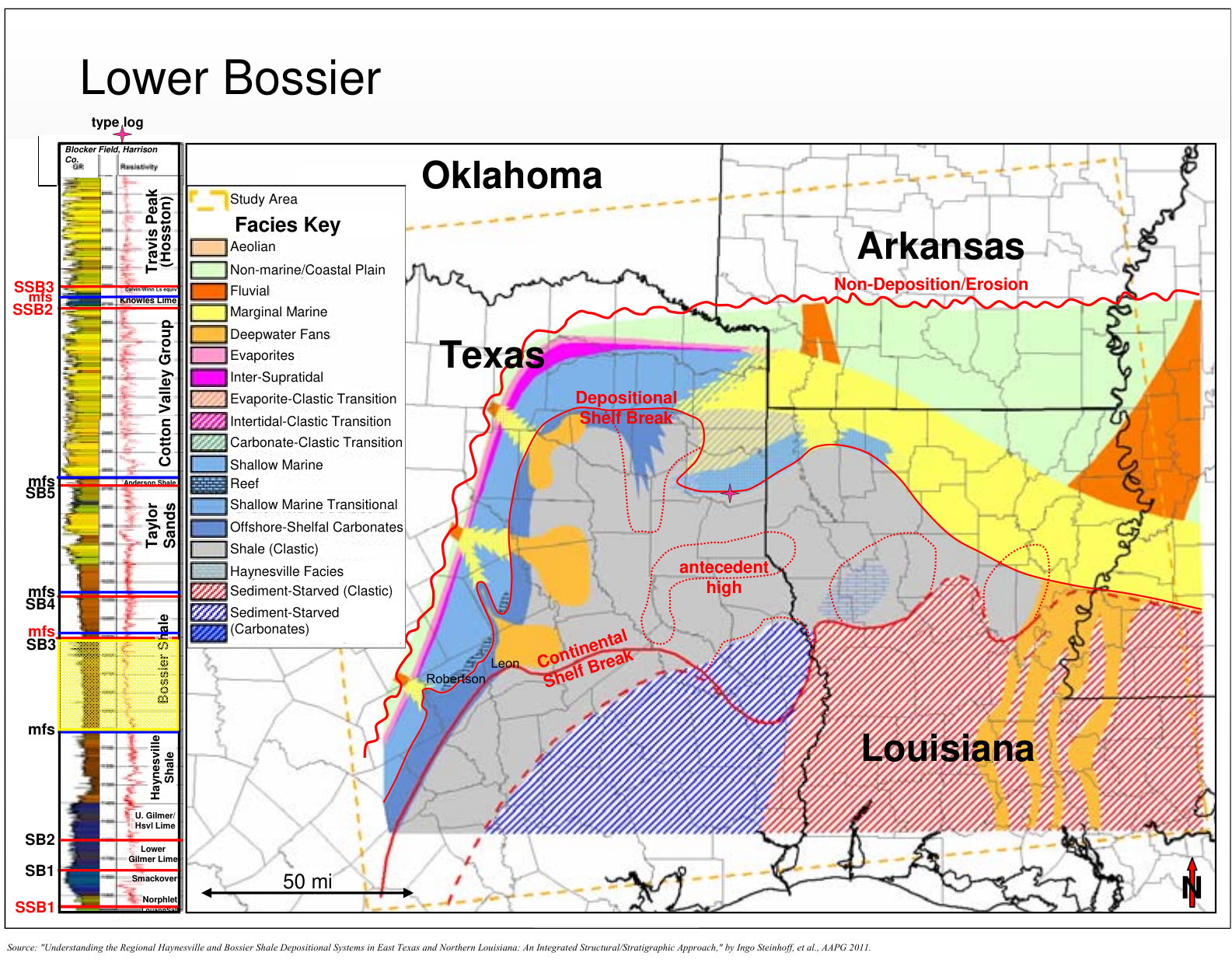

Comstock revealed the new play earlier this year as its “Western Haynesville” extension. While the wells online to date were all landed in the Bossier, which sits above the Haynesville, an upcoming test will be landed in the Haynesville, the company reported May 3.

“We do have one that’s [being completed] right now that’s also another Bossier,” Harrison said. “But the [fifth] well—that is waiting on completion—was drilled as a Haynesville.”

That well is expected to be online in early July. “The reason we drilled the first wells as Bossiers is, simply, we were trying to give ourselves the best chance of success,” Harrison said.

At 15,000 ft, the Bossier is super-high-pressure and super-high-temperature. The Haynesville is deeper still. But, Harrison said, “We’ve been pretty pleased with the progress we've made in a short period of time drilling just a [first] few wells.”

Whether each future well will be a Bossier or a Haynesville, he added, “We look at what we think the temperatures are going to be, and then just decide which one of the targets we need to pursue.”

The Campbell #2H is in the southwestern quadrant of Comstock’s play leasehold that stretches across eastern Robertson County and western Leon County. “For geological reasons, we only want to drill Bossiers there,” he added.

But for the balance of its leasehold, the Haynesville is Comstock’s “primary target. The Haynesville is the better rock based on all the work that's been done in the play. And we do expect superior results from our [upcoming] Haynesville completion.”

Comstock is currently drilling a sixth and seventh well in the prospect. It has some 100,000 net acres leased in the past three years on either side of the Navasota River, which forms a natural board between the two counties.

The company’s two-rig program is expected to result in 14 wildcats in the prospect by year-end.

“Our primary objective this year is to prove up our new play,” Allison said.

Well costs a mystery

Comstock hasn’t revealed yet the wells’ cost. But Leo Mariani, an analyst with Roth Capital Partners, said on the call that his understanding is they’re twice the price of a well in the traditional Haynesville play in East Texas and northwestern Louisiana.

Since Comstock reported that the wildcats’ returns are competitive with its core wells’ returns, Mariani asked what makes them competitive. “Are you seeing maybe twice the EURs or something on these wells?”

Burns responded: “Yeah, that's a good way to frame it because we said, basically, that in order to make them competitive with the [traditional play] wells, you'll want twice the EUR.”

The price now is an “early” cost, Burns added. “I think the future cost of development will be significantly better,” he said.

The wildcats are singles while its core Haynesville wells are doubles, triples and more—multiple wells on a single pad that offer efficiencies of scale.

“If we [were to] drill single wells in our traditional Haynesville, they will be our most costly wells,” Burns said. The savings of multiple wells per section “is so significant.”

But, in the process of delineating its prospect with wildcats, Comstock is just “out of the gate.”

“We’re not starting out in a bad position.”

Bonus economics

Allison added that there’s a bonus to the economics of the new play: Comstock owns a gas-treating plant and a 145-mile, high-pressure, 500-MMcf/d gas pipeline in the area. It bought the assets in 2022 for $16.8 million.

“We could drill these wells close to that Pinnacle [Gas Treating] line. If they need to be drilled there, then we're going to save a lot of money on gathering costs,” Allison said. “So we're going to have a competitive advantage there, which you don't put in the cost structure until you do it.”

He added that even if Comstock “called it quits” on the play, “it would still be a very good play for us as far as dollars in/dollars out and reserves added.”

Burns said the wildcats “actually can compete, believe it or not, with our top, low-cost wells, especially when we get them on our gathering system and we save that transportation cost.”

Another bonus: should the prospect continue to produce giant—and long-lived—gas wells, there is potential for assured gas production and signing long-term LNG-supply contracts.

Liquefaction-terminal operators and LNG buyers are “looking for commitments—not for 2027, but for 2047,” Allison said.

They’re looking for “who has the inventory that they can do business with that's predictable, that's got the balance sheet and the management capability to deliver what they need…over decades.

“That is our longer-term view of what we're doing with the company.”

Comstock currently produces some 1.4 Bcfe/d. It is majority owned by Jerry Jones, owner of the Dallas Cowboys franchise.

RELATED

Bossier history

One of the prior owners of Pinnacle Gas Treating was Anadarko Petroleum Corp., which bought the treating and pipe infrastructure in 2001 from Western Gas Resources Inc. for $38 million.

Anadarko used the facilities as part of its vertical prospecting in the deep Bossier in the area, where it had 33 rigs drilling at the time. The pipe travels through Freestone, Anderson, Leon and Robertson Counties, Texas.

Campbell #2H joins an Aethon Energy wildcat, Currie #2H, that came online with 36.9 MMcf/d in October from a 6,561-ft lateral for 5.6 MMcf/d per 1,000 ft, according to Erin Faulkner, an Enverus analyst.

The 24-hour test was on a 20/64 choke with 12,072 psi flowing casing pressure, she added. It was fracked with 5,941 lbs of proppant per lateral foot; fluid, 134 bbl/ft.

Gordon Huddleston, Aethon partner and president, told Hart Energy’s DUG Haynesville 2023 attendees in Shreveport in March, “We’re doing a lot of work over in Robertson with some other operators and have been looking at that for some time.

“[We’re] very excited about the results we’re getting there.”

Enverus’ Faulkner reported that Aethon’s Currie well is five miles northeast of Comstock’s Circle M.

Recommended Reading

NextDecade Targets Second Half of 2024 for Phase 2 FID at Rio Grande LNG

2024-03-13 - NextDecade updated its progress on Phase 1 of the Rio Grande LNG facility and said it is targeting a final investment decision on two additional trains in the second half of 2024.

Darbonne: Brownsville, We Have LNG Liftoff

2024-04-02 - The world’s attention is on the far south Texas Gulf Coast, watching Starship liftoffs while waiting for new and secure LNG supply.

Biden Administration Hits the Brake on New LNG Export Projects

2024-01-26 - As climate activists declare a win, the Department of Energy secretary says the pause is needed to update current policy.

Gunvor Group Inks Purchase Agreement with Texas LNG Brownsville

2024-03-19 - The agreement with Texas LNG Brownsville calls for a 20-year free on-board sale and purchase agreement of 0.5 million tonnes per annum of LNG for a Gunvor Group subsidiary.

Venture Global, Grain LNG Ink Deal to Provide LNG to UK

2024-02-05 - Under the agreement, Venture Global will have the ability to access 3 million tonnes per annum of LNG storage and regasification capacity at the Isle of Grain LNG terminal.