Gordon Huddleston, Aethon partner and president, speaks at Hart Energy’s DUG Haynesville 2023 Conference. (Source: Hart Energy)

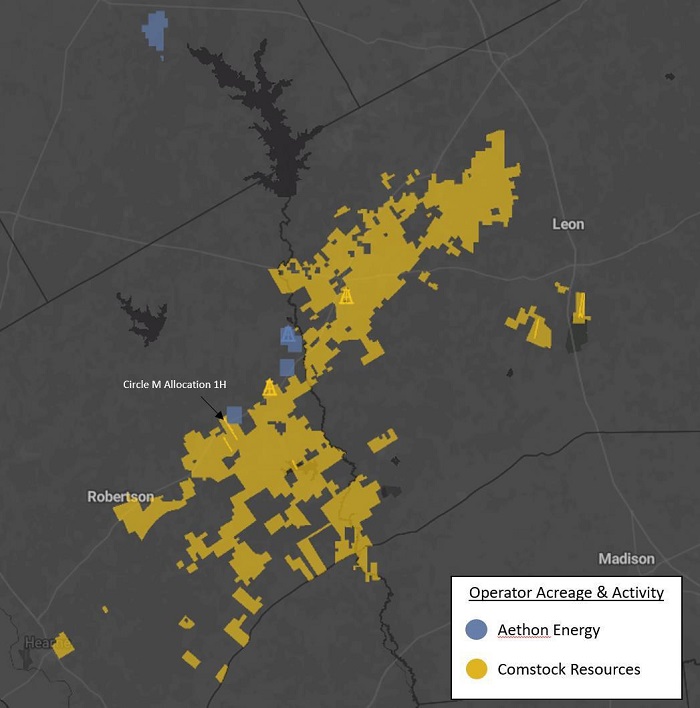

Aethon Energy has added a screamer wildcat to Comstock Resources Inc.’s horizontal Bossier prospecting north of Houston, according to Enverus.

A screamer is an extreme, super-pressurized gas well, so-called because they produce an audible shriek.

The Aethon well, Currie #2H, in eastern Robertson County, Texas, came in with 36.9 MMcf/d from a 6,561-ft lateral at an average 5.6 million cubic feet per day (MMcf/d) per 1,000 ft, according to Erin Faulkner, an Enverus analyst.

The 24-hour test was on a 20/64 choke with 12,072 pounds per square inch (psi) flowing casing pressure, she added. It was fracked with 5,941 lb of proppant per lateral foot; fluid, 134 barrels per foot (bbl/ft).

Aethon had tight-holed the well since it was completed in late September. The data rolled off Texas’ six-month well confidential status the last week of March.

Gordon Huddleston, Aethon partner and president, told Hart Energy’s DUG Haynesville 2023 conference attendees in Shreveport, Louisiana, in March, “We’re doing a lot of work over in Robertson with some other operators and have been looking at that for some time.

“[We’re] very excited about the results we’re getting there.”

Comstock calls the prospect its “Western Haynesville” play where it’s leased some 100,000 net acres—at an average of $550 a net acre—for the deep Bossier in Robertson and the adjacent Leon County, Texas.

Its first three wells in the area were landed in the Bossier, which is at the intersection of the easternmost Eagle Ford and the westernmost appearance of Haynesville and Bossier.

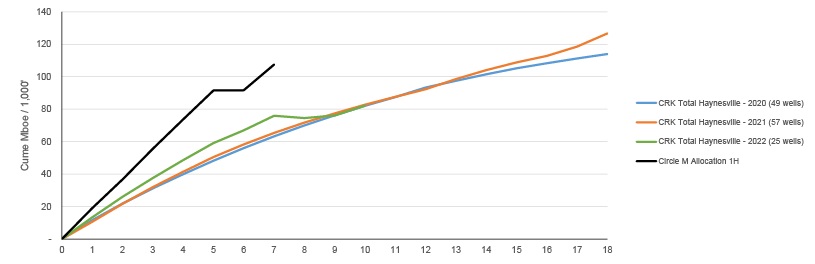

Its Cazey Black A #1H’s 42 million cubic feet equivalent per day (MMcfe/d) came from 7,900 ft of lateral in the Lower Bossier. Also in Robertson County, its first test, Circle M Allocation #1H, came in with 37 MMcf/d, also from a 7,900-ft lateral in the Lower Bossier.

Enverus’ Faulkner reported that Aethon’s Currie well is five miles northeast of Comstock’s Circle M, which was completed with 3,319 lb of proppant per foot; fluid, 89 bbl/ft.

The Circle M test was on a 28/64-inch choke at 9,488 psi flowing tubing pressure. “It went on to deliver cumulative volumes of 2.15 billion cubic feet (Bcf) over its first 90 days, equivalent to a rate of 23.9 MMcf/d,” Faulkner added.

A third Comstock well, Campbell B #2H, was being completed in late February; it has a lateral of 12,700 ft, according to Comstock. Two rigs were drilling its fourth and fifth wells—a fourth well in Robertson and a first well in Leon—at the time.

Aethon, whose prospect leasehold is entirely in eastern Robertson, was drilling another deep Bossier well at the time as well, according to Enverus data.

‘Big boy play’

Huddleston said in Shreveport that most of privately-held Aethon’s capex is focused on developing its existing, proved, core acreage in East Texas and western Louisiana.

“We’re not in the true exploration game,” he said. “We’re looking at where there are step-out areas—potentially overlooked areas—that could be interesting.”

Capex for wildcatting is less than 20% of the budget “because, you know, ultimately there’s a cost to science-ing things.”

Comstock hasn’t revealed well costs yet for its wildcats. In its earnings call in February, Chairman and CEO Jay Allison told an equity analyst, “Yeah, it’s a little too early to make any comments on that. Good question.”

Meg Molleston, president of Haynesville operator GeoSouthern Energy, said in Shreveport, “We looked at [the deep Bossier prospect] about a year ago. I think [the gas is] there, but we didn’t see how we could make any money at it.”

Rob Turnham, a longtime Texas and Louisiana wildcatter who sold Goodrich Petroleum Corp. in late 2021, said Goodrich had also looked at the deep Bossier “and we backed away just because of what Meg said: the cost and the risk associated with that.

“It’s a big boy play. We weren’t ready to take that on.”

Doug Krenek, president and CEO of East Texas-focused operator Sabine Oil & Gas Corp., said Sabine had looked at the prospect two or three years ago. “But we couldn’t get comfortable with the geology at the time.”

As for how many economic wells the acreage may hold, “it’s early to say,” he said, but “there’s a lot of reason to be optimistic.”

‘Don’t burn up’

The deep Bossier’s depth is up to 19,000 ft in the area. Molleston said, “I certainly think it’s challenged due to depth. And we need more work on some completion techniques [and] tools, so they don’t burn up at these temperatures.

“But I don’t think it’s insurmountable. I think it’s all going to be a function of [natural gas] price …. Naturally [these deep Bossier wells are] going to cost more.

“But that’s what you do: You get into new areas—into Tier 2, Tier 3 acreage—as price allows.”

Turnham noted that the first Comstock well, Circle M, averaged 30 MMcf/d in its first six months.

“That’s 5.4 Bcf in six months. That’s a lot of gas.”

Goodrich drilled in the Angelina River Trend—the deepest portion of the Shelby Trough—in East Texas in the aughts, he noted. “We burned up equipment constantly, [such as] drillbits, and you had to run much-stronger pipe everywhere you went.

“And then, if you had a drilling issue at 14,000 or 15,000 feet—or heaven forbid, deeper—then it just added exponentially to your expenditure for the well.

“So it does have a lot of issues. Over time, it’ll get better. And no question, it’s productive.”

But is it only a sweet spot or does it have legs?

“Now whether it’s geographically across a big fairway or whether there’s a structural component or stratigraphic component to it [remains uncertain],” Turnham said.

Dick Stoneburner, a career geologist and a co-founder of Haynesville operator Petrohawk Energy Corp., said of the prospect, “Intuitively, from a geologic perspective, I have to believe it is just a continuation of that known area in Angelina—which is kind of about as far downdip as we know today—into Robertson and Leon [counties].

“There’s probably some subsurface data down there that existed that lessened the risk [for the current wildcatters] and probably nothing in between, you know?”

Likely, he added, “Comstock and Aethon and those that are down there saw some old logs and said, ‘This looks pretty good.’

“And they drilled some wells and it’ll probably eventually tie together. I don’t know that, but that would be my guess.”

Turnham said operators looked at deep Bossier well logs in the aughts when Leor Energy, which was sold to what is now Ovintiv Inc., was delineating Amoruso Field in eastern Robertson County.

“It was very unique,” Turnham said. “We always thought of it as more of a structural or stratigraphic play.”

The back-story

“This is a deep, overpressured monster,” geologist Peggy Williams reported on Amoruso Field in Oil and Gas Investor in 2008 in “Deep, Tight Gas.” From vertical wells at the time, ultimate recovery was estimated at 13 Bcf.

The late geologist John Amoruso’s idea behind his prospect “was that pulses of sands had flowed off the Jurassic shelf edge and characteristics of the shelf edge affected where the sands had accumulated,” Williams wrote.

Amoruso said in the article, “I looked for the most likely place a concentration of these sands could be found over the Jurassic shelf edge.”

Across the Navasota River, into western Leon County is Hilltop Resort Field, also deep Bossier. Hilltop’s discovery well was drilled in 2003 by Gastar Exploration Ltd.

The Donelson #3 there contained ultimate reserves of 10.9 Bcf and came on with 24 MMcf/d. After six months, it was producing 13.7 MMcf/d from a single-zone completion.

The temperature was up to 425 degrees Fahrenheit; initial pressure, 17,000 psi. Wells were costing between $10 million and $12 million.

A collapsing natural gas price in 2010 derived from abundant new gas plays—the Marcellus and Haynesville—redirected capital elsewhere.

RELATED: Deep Bossier Cools its Heels

Comstock's take

Roland Burns, Comstock president and CFO, said in the earnings call in mid-February, “We do feel like we’ll substantially complete [leasing] the best part of this play this year. I would say that we’re more than half [way] done.”

The Late Jurassic Bossier is similar in age to Cotton Valley sandstone. According to Williams, the Bossier in the Robertson/Leon area has [a] porosity of 6% to 12% and permeability of 0.01 to 0.1 millidarcies.

Also of the Jurassic epoch, the Kimmeridgian-age Haynesville sits under the Tithonian Cotton Valley and Bossier.

In addition to the two rigs drilling for it in the deep Bossier, Comstock has seven rigs at work in its core Haynesville leasehold. Allison said in the earnings call, “If all that [deep Bossier] acreage ends up being Tier One acreage—who knows?—but if it did, then that’s where we would have our drilling rigs.”

The core Haynesville is HBP, “so we can swing [rigs] back and forth. That’s unusual too, but that’s how we looked at this,” Allison said.

Comstock currently produces more than 1.4 Bcfe/d. It is majority owned by Jerry Jones, owner of the Dallas Cowboys franchise.

RELATED: Executive Q&A: Jerry Jones

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.