There is a concern that if the forecasted start of a crude oil, NGL and natural gas price recovery doesn’t begin in the second half of 2015, the MLP market would need to be re-evaluated with a renewed focus on those centered on fee-based operations, according to Wells Fargo Securities.

The investment firm stated in a March 9 research note that MLP EBITDA guidance was reduced by an average of 3% with an 8% drop in growth capital allocation, along with an average decrease of 74 basis points for distribution growth. “The trends by subsector were as expected with gathering and processing MLP’s EBITDA and capex guidance down more than large cap pipeline MLPs.”

Based on the commodity price uncertainty, the investment firm in the note advised a defensive positioning of MLP portfolios by reducing volumetric exposure. “MLP management teams generally believe commodity prices and drilling activity will begin to recover in 2016. If commodity prices do not rebound in 2015, we expect 2016 volumes will decrease, which is mostly not reflected in current valuations, in our view,” the note said.

This isn’t to say that MLPs represent a bad investment, as the note found that the Wells Fargo Securities MLP Index improved by 2.9% in February, making up the value it lost the previous month. However, this wasn’t as strong when compared to the S&P 500’s growth of 5.5% in February.

“MLPs’ February performance was driven by a stabilization and temporary improvement in crude oil prices. WTI [West Texas Intermediate] crude prices were up 3.2%, while natural gas and NGL prices were up 2.8% and 17.5%, respectively. We expect the volatile pattern of trading for the sector to continue as MLPs essentially tread water until the medium-term trajectory of oil prices is determined,” according to the note.

The investment firm outlined a defensive investing strategy of focusing on:

- Large-cap, investment-grade pipeline companies such as Enterprise Products Partners LP, Kinder Morgan Inc. and Magellan Midstream Partners LP, due to their track record of outperforming in volatile markets;

- Natural gas pipeline companies such as Energy Transfer Partners LP, Spectra Energy Partners LP, Tallgrass Energy Partners LP and The Williams Cos. Inc. because of their steady income and the need for new construction in the Northeast;

- Dropdown sponsored MLPs that typically focus on fee-based cash flow. However, Wells Fargo Securities noted that such moves are dependent on capital market access to finance the dropdowns. The note highlighted Delek Logistics Partners LP, EnLink Midstream Partners LP/EnLink Midstream LLC, PBF Logistics LP, Tesoro Logistics LP, Valero Energy Partners LP, VTTI Energy Partners LP and Western Refining Logistics; and

- Refined product pipeline companies that stand to benefit from increased volumes due to lower gasoline prices. These include NuStar Energy LP, Crossamerica Partners LP and Sunoco LP.

—Frank Nieto, Senior Editor, Midstream Business. Contact Frank at fnieto@hartenergy.com.

Recommended Reading

US Republican Attorneys General Sue to Stop EPA's Carbon Rule

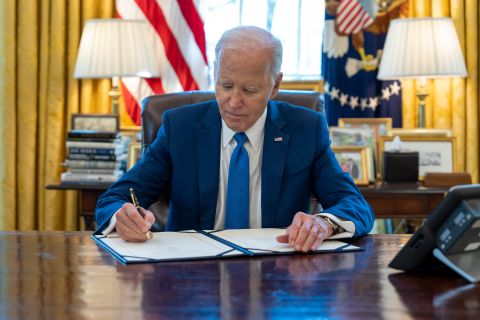

2024-05-09 - The rule, finalized by President Joe Biden's administration last month as part of an effort to combat climate change, was challenged in three lawsuits filed in the U.S. Court of Appeals for the District of Columbia Circuit.

Belcher: Brace for Onslaught of New Biden Regulations

2024-05-22 - A slew of rulemakings, executive orders and policy decisions affecting energy are headed this way.

Mexico Presidential Frontrunner Likely to Continue Reliance on US Gas

2024-05-23 - Mexico’s leading presidential candidate Claudia Sheinbaum is likely to continue with the current policies of Mexican President AMLO, likely meaning a continued reliance of U.S. imported piped-gas.

Analyst: Energy Companies Should Prepare for Tighter Methane Regulations

2024-05-24 - Regardless of election’s outcome, investors will take emission reduction plans into consideration.

Supreme Court’s Uinta Basin Rail Case Raises Stakes for LNG, Pipelines

2024-07-10 - The lawsuit, involving crude transport via railway in the Uinta Basin, is part of a larger intragovernmental fight that could have implications for how FERC decides pipeline and LNG plant permitting.