The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

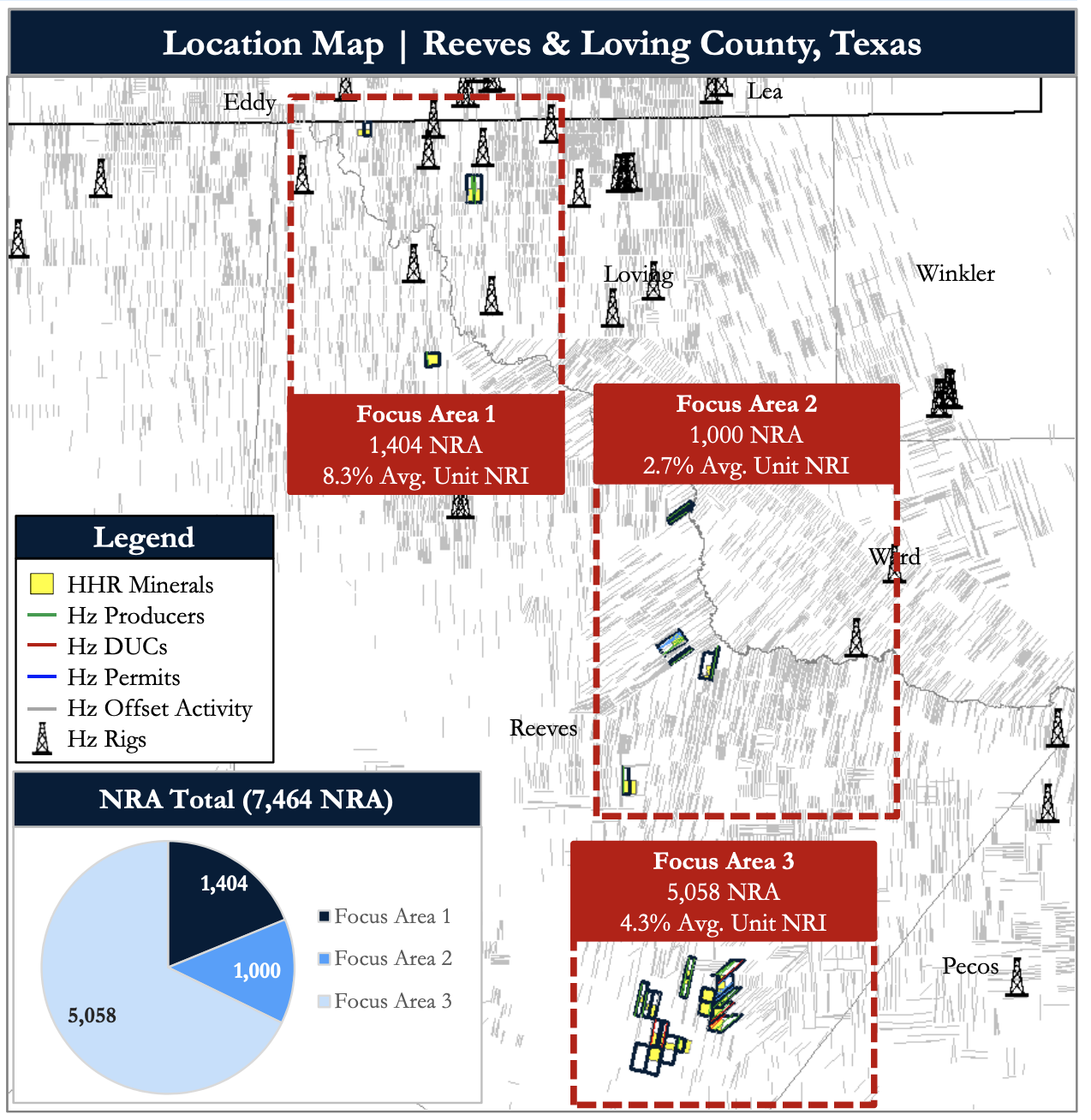

A private seller is under contract to purchase the historic Hanging H Ranch located in the Delaware Basin in Reeves and Loving counties, Texas. The seller has retained Detring Energy Advisors to market for sale the associated mineral interests.

The assets offer an opportunity to acquire approximately 7,500 net royalty acres of mineral rights under active development across several high royalty interest units (10%+).

Offers are due on Aug. 24, with anticipated sign and close occurring by Sept. 30.

Highlights:

- 7,464 net royalty acres (normalized to 1/8th)

- 90% Reeves County and 10% Loving County

- 100% Minerals

- Approximately 19,700 gross leasehold acres

- 68% HBP

- Concentrated, high-NRA units leased by top in-basin operators with avg. unit NRI of ~5%

- About $10 million next 12-month Cash Flow from PDP, DUCs and Permits

- About 500 boe/d Net Production

- 30 horizontal producing wells with average about 4.7% Net Revenue Interest

- Strong near-term cash flow driven by Four DUCs and Nine permits with about 6.2% average Net Revenue Interest

- 2020E cash flow of about $6 million with anticipated growth to a total of $12 million in 2021E driven by high Net Revenue Interest DUCs on minerals

- Total undiscounted cash flow of $591 million generated by about 21 million boe of net reserves ($143 million PV-10)

- About 500 boe/d Net Production

- Active Development by Top Delaware Basin Operators

- Whereas previous HHR ownership partially limited access, Seller will facilitate operators in developing the mineral assets

- 76 horizontal rigs continue to run in the Delaware Basin with significant near-term on-lease activity identified

- Ownership concentrated under premier Delaware Basin operators including Concho Resources Inc., Primexx Energy Partners Ltd. Occidental Petroleum Corp. (Anadarko) and PDC Energy Inc.

- Multi-decade inventory of identified 3rd Bone Spring, Wolfcamp A and Wolfcamp B targets continue to generate strong returns at current strip

Process Summary:

- Evaluation materials available via the Virtual Data Room on Aug. 10

- Proposals due on Aug. 24

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

Goodbye Manual Control: Vital Energy’s Automation Program Boosts Production

2024-07-12 - Production, ESP efficiency soared when the company automated decisions with AI at the edge.

ConocoPhillips: Permian Basin a ‘Growth Engine’ for Lower 48

2024-05-15 - ConocoPhillips views the Permian Basin as a “growth engine” within its Lower 48 portfolio, the company’s Midland Basin Vice President Nick McKenna said during Hart Energy’s SUPER DUG event in Fort Worth.

E&P Highlights: June 4, 2024

2024-06-03 - Here’s a roundup of the latest E&P headlines, with new contracts awarded and larger commitments made for oil and gas exploration in South Korea and Australia.

Utica Oil: Encino Energy’s Liquids Wells Top the Charts in Ohio

2024-06-11 - Encino Energy’s first-quarter wells took the top five spots in Ohio as the company’s liquids output accounted for more than half of the state’s 7.23 MMbbl first-quarter total.

E&P Highlights: June 17, 2024

2024-06-17 - Here’s a roundup of the latest E&P headlines, including Woodside’s Sangomar project reaching first oil and TotalEnergies divesting from Brunei.