(Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

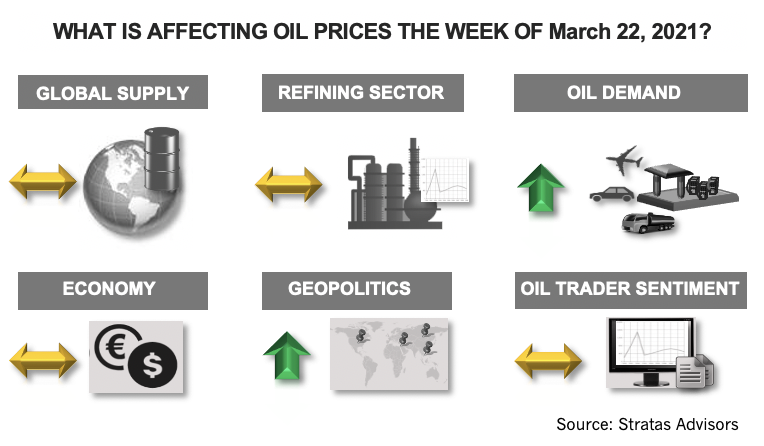

The price of Brent crude oil closed last week at $64.53 after closing the previous week at $69.22. The price of WTI closed the week at $61.42 after closing the previous week at $65.61. Last week’s price movement is the first significant decline in oil prices since the beginning of March, when the market was waiting for the outcome of the OPEC+ meeting held on March 4. In the aftermath of the positive news coming out of the OPEC+ meeting, oil prices spiked by more than 10%. Further support for prices came from the passing of the $1.9 trillion recovery/stimulus package. With the decline in prices last week, prices are now only around 3% more than before the referenced good news.

Last week, the oil market was reacting to concerns about Europe and the ongoing issues with the region’s response to COVID-19, including the disappointing rollout of the vaccines. Europe is currently going through another round of lockdowns, which, obviously, will have a negative impact on oil demand. The increase in the U.S. inventories of crude oil, gasoline and diesel fuel, as indicated in the latest Energy Information Administration report also influenced the oil markets. Additionally, there were concerns about rising interest rates with the U.S. 10-year treasury reaching 1.712%, the highest level since January 2020. (Note: Oil prices did rebound some on March 19, in part, because of another drone attack on Saudi Arabia by Yemen’s Houthis fighters)

Each of the developments that led to the decline in oil prices were highlighted in last week’s note:

- Any signs that the supply/demand fundamentals are deteriorating will result in a price correction. This includes a slowdown in demand recovery stemming from a rebound in COVID-19. From a supply-side perspective, the breakdown of the OPEC+ arrangement would have the most impact.

- Rising interest rates could lead to a major sell-off in the equity markets is likely to pull down other asset classes—including oil.

- A correction in the oil price could occur just because oil traders decide to sell off to capture the gains of the last several months.

As such, given the developments of last week, we are not surprised that there was a notable downward slide in oil prices. However, looking forward, we still are expecting that supply/demand fundamentals will be improving with demand picking up and outstripping supply during the upcoming months. While we see interest rates rising, we do not expect that interest rates will rise to a level that will cause a major sell-off in equity markets and other asset classes, in part, because rising rates will attract additional buying of U.S. bonds, which will keep interest rates from rising too fast and too high. Lastly, while oil traders have been increasing their bullish positions since November 2020, the level is still well below that of 2018, the last time oil prices were in the midst of a major upward trend (and reaching the $85 range). Based on these expectations, we are still holding that there will not be major price correction (i.e. Brent price declining below $55), unless there is another significant disruption associated with COVID-19 that affects the U.S. and/or Asia.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

TXOGA Supports Ruling to Pause Biden’s Pause

2024-07-02 - The Texas Oil & Gas Association (TXOGA), the oldest and largest oil and gas trade association in Texas, sided with a Louisiana judge’s ruling to pause U.S. President Joe Biden’s pause of LNG permits.

Bipartisan Bill Aims to Speed Up Permitting Bureaucracy

2024-07-23 - If passed, the new rules would tackle litigation delays for energy projects across all sectors, an analyst says.

Saudi Aramco Holding LNG Talks with US Firms Tellurian, NextDecade, Sources Say

2024-06-04 - Oil giant Aramco is in talks with Tellurian to buy a stake in the Driftwood LNG plant near Lake Charles, Louisiana.

Belcher: Brace for Onslaught of New Biden Regulations

2024-05-22 - A slew of rulemakings, executive orders and policy decisions affecting energy are headed this way.

DOE Approves Order Needed for Startup of Venture Global’s Plaquemines

2024-07-19 - Venture Global’s project is one step closer to production with the Department of Energy’s permission to export.