A multitude of variables makes it tricky to calculate the price of building a pipeline. But what about the price of not building a pipeline?

From an environmental perspective, the price can be high, Validere discovered when its market fundamentals team examined the impact of canceling the Atlantic Coast Pipeline (ACP), as well as a future without the Mountain Valley Pipeline (MVP), plagued by seemingly endless permitting delays.

“We estimate that MVP and ACP would reduce CO2-equivalent emissions by approximately 8 [million] and 14 [million tonnes] annually, respectively, the equivalent of taking approximately 1.7 million and 3 million cars off the road,” Amber McCullagh, senior advisor at Validere and one of the authors of the report, said in a press release.

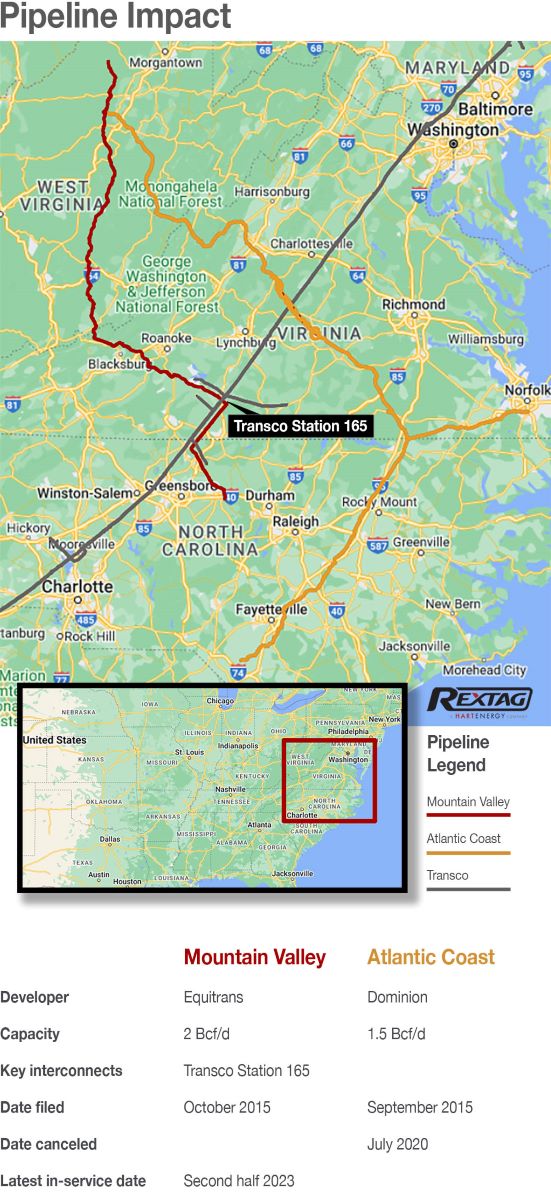

The emissions reduction estimate stems from how much coal use would be displaced by operating the two Appalachian natural gas pipelines. The Atlantic Coast Pipeline, canceled by Dominion Energy in July 2020, would have reduced CO2-e emissions by 275 million tonnes per annum (mtpa) over 20 years. The Mountain Valley Pipeline, which Equitrans has scheduled for completion in the second half of 2023, will reduce emissions by 150 mtpa over that time.

RELATED

US Gas Exports Primed to Soar, but Constrained Appalachia Can’t Meet the Moment

Not So Fast: Manchin’s Deal to Speed Permitting is Not a Done Deal

Divergence

Despite their geographic proximity, the two pipelines diverge in their potential near-term impacts. About half of Appalachia’s natural gas production is consumed in the region, unlike gas produced in the Permian Basin—almost all of which is exported from the sparsely populated area in West Texas and Southeast New Mexico.

“[Atlantic Coast] adds capacity all the way to end-users in North Carolina, so it would lead to immediate year-round coal displacement and near-term Appalachian gas production growth,” Validere said in its report.

Mountain Valley, however, terminates at Transco’s Station 165, which is limited to transmission of 1.8 Bcf/d. That means that, because Mountain Valley’s gas must compete with Transco’s southbound flows, the pipeline’s coal displacement in winter months is limited to north of that station. It also restricts the pipeline’s ability to trigger additional production of Appalachian natural gas. Completing Transco’s downstream projects, along with Equitrans’ MVP Southgate project, will rectify those problems, Validere said.

‘Fuel picture’

Resistance to natural gas pipeline permitting has stymied a number of projects, despite the advantage of lower carbon emissions that gas enjoys over both coal and oil. Environmental opponents, citing high methane emissions across the gas value chain, have succeeded in tripping up these projects. As a result, upstream development has been curtailed as well.

Sen. Joe Manchin (D-W.Va.) tried to speed the process with permitting reform legislation, but the Senate rejected its inclusion in the National Defense Authorization Act on a 47-47 vote on Dec. 15. The measure would have accelerated the permitting process for both fossil fuel and renewable projects and had the support of most Democratic senators and President Joe Biden.

Manchin criticized Senate Minority Leader Mitch McConnell for not supporting the measure that would have likely have sped Mountain Valley toward completion but vowed to push for a deal next year.

Ironically, fossil fuel opponents fight projects in the name of emission reduction in a region in which emissions are already comparatively low.

The national value chain methane emissions rate is 2.3%, which would translate as 22.5 mtpa of CO2-e from the Atlantic Coast and Mountain Valley pipelines. However, Validere estimates the Appalachian rate at 1.4%, which would bring down the combined emissions to 13.5 mtpa. If mitigation efforts succeed in lowering the rate to around 1%, total emissions could drop to 10 mtpa.

Methane emissions would, of course, increase when downstream projects are completed and put into service. But those projects would also displace more coal, leading to much lower CO2 emissions.

“When accounting for the climate impacts of natural gas pipelines, you need to look at the full picture,” McCullagh said. “Natural gas pipeline development induces changes across the value chain, including in natural gas production, gas pipeline flows, gas- and coal-fired power generation and even flows of LNG and refined products.”

Recommended Reading

Powder in the Hole: Devon May Fire up its PRB in Coming Years

2024-08-23 - Devon Energy is perfecting its spacing and completion recipe in Wyoming’s Powder River Basin play to possibly unleash full-field development later this decade.

Kimmeridge’s Dell: Every US Basin Contains Both High-quality Inventory, Risk

2024-10-05 - Inventory management is a problem for the E&P space, no matter the basin, said Kimmeridge Energy Management's Ben Dell at Hart Energy's Energy Capital Conference in Dallas.

Matador May Tap Its Haynesville ‘Gas Bank’ if Prices Stabilize

2024-10-24 - The operator holds 8,900 net Haynesville Shale acres and 14,800 net Cotton Valley acres in northwestern Louisiana, all HBP, that it would drill if gas prices stabilize—or divest for the right price.

With Montney Production Set to Grow, US E&Ps Seize Opportunities

2024-10-02 - Canada’s Montney Shale play has already attracted U.S. companies Ovintiv, Murphy and ConocoPhillips while others, including private equity firms, continue to weigh their options.

Northern’s O’Grady: Most of ‘Best’ Acres ‘Already Been Bought’

2024-10-24 - Adding new-well inventory going forward will require “exploration or other creative measures,” said Nick O’Grady, whose Northern Oil and Gas holds interests in 10,000 Lower 48 wells.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.