Train 1 Cameron LNG Phase 1, a three-train LNG-export project under construction in Hackberry, La., has reached its final commissioning stage and began receiving feed gas. LNG production is expected for later this quarter. (Source: Sempra Energy)

[Editor's note: A version of this story appears in the June 2019 edition of Oil and Gas Investor. Subscribe to the magazine here.]

Flexibility and innovation are the names of the games for the worldwide LNG industry. The industry requires flexibility in its business models in highly competitive LNG markets. Innovation is needed to accelerate industry growth to meet an expected shortfall of 150 million tonnes per annum (mtpa) by 2035.

“As reservations over capital spending and uncertainty over LNG pricing persist, the study reveals increasing interest in the sector finding more agile and flexible approaches to LNG production and trading,” services firm DNV GL AS reported in an April outlook, “The LNG Era Takes Shape.”

“The new era we see emerging for the LNG sector will demand new thinking from our industry to ensure that a rapid evolution in demand and supply can be met. For example, our research shows signs of the sector opening up to new players, contracting models and pricing strategies.”

A DNV GL survey revealed “the majority of LNG-focused oil and gas professionals—85%—believes several new LNG infrastructure projects will need to be initiated in 2019 to ensure supply can meet demand post-2025.”

However, more than two-thirds (69%) “believe price uncertainty is limiting investment in LNG mega-projects.”

The firm forecasts global LNG production will increase from 250 mtpa in 2016 to around 630 mtpa by 2050.

Agility will also be key to protecting LNG buyers against risk. About 72% of LNG professionals believe buyers need more flexible contracts, where LNG volumes can be reduced, tenures shortened and delivery locations changed, the firm added.

In January, Bernstein Research analysts predicted an LNG supply cliff post-2020. “At least 50 mtpa of new capacity needs to be approved over the next two years to avoid a supply shortfall. At the same time, a pick-up in new project final investment decisions (FIDs) during the next two years will benefit a select group of E&Ps, oil majors and LNG-focused service companies, the report noted.

A peak in supply growth at more than 30 mtpa in this cycle will occur in 2019, which could put downward pressure on LNG spot prices as supply outstrips demand, causing surplus capacity for spot supply, the analysts noted.

“Looking ahead, we see a significant shortfall in LNG supply in the early 2020s. Demand is expected to grow to 450 mtpa by 2025 and 560 mtpa by 2030 when the market will need over 600 mtpa of capacity. With LNG supply growth likely to ‘fall off a cliff’ post-2020, we see a looming deficit in the market,” they concluded.

Preparing For Fierce Competition

U.S. LNG producers will be at the forefront of those making FIDs this year toward beginning commercial production in the mid-2020s. But projects in East Africa, Russia, West Africa, the Mediterranean Sea, Australia, Mexico and Canada will be vying for the same markets.

next wave of

North American

LNG projects to

reach a positive

FID will be those

that can offer

their customers

superior pricing

flexibility,” said

Matt Schatzman,

president

and CEO of

NextDecade.

“In the past, international and national oil companies led the global LNG market, but it has now been diversified,” Young-Myung Yang, executive technical advisor for Korea Gas Corp. (Kogas) and its former CTO and head of R&D, said in the DNV GL report. “New players with new business models—mainly based in North America—are entering the LNG market and changing the market structure and price dynamics.”

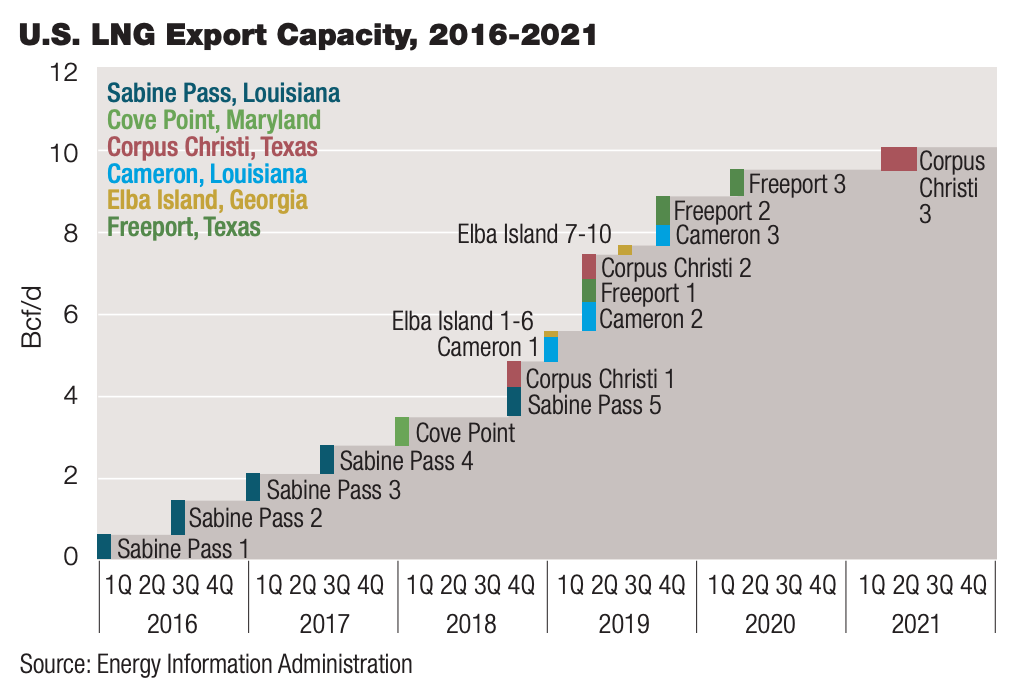

The U.S. Energy Information Administration (EIA) estimated in late 2018 that U.S. LNG export capacity will reach 8.9 billion cubic feet per day (Bcf/d) by the end of 2019, ranking it third-largest behind Australia and Qatar. At the end of 2018, the EIA expected U.S. export capacity to reach 4.9 Bcf/d as two new LNG trains became operational.

DNV GL reported, “New market actors could be key to bridging the divergent interests of LNG buyers wanting flexibility, and sellers who demand long-term cash-flow certainty to support major investments. This was once the domain of oil majors, but commodity traders are now emerging as a significant new breed.”

Innovative Indexing

Innovation in LNG price indexing was displayed at the LNG2019 conference in Shanghai in April, where two firsts in the LNG industry were announced. Tokyo Gas Ltd. and Shell Eastern Trading (Pte) Ltd. signed a heads of agreement (HOA) that included an innovative pricing formula based on coal indexation.

Another unique aspect of this HOA is that Shell can supply the LNG from its global LNG portfolio instead of from a specific LNG plant.

The second innovation involved NextDecade Corp.’s Rio Grande (Texas) LNG project and Shell NA LNG LLC. A 20-year sales and purchase agreement (SPA) was signed on April 1 for the supply of 2 mtpa to begin in 2023. The SPA is the first-ever long-term contract for U.S. LNG indexed to the Brent crude oil price. About 75% of the total will be indexed to Brent and the remainder to U.S. gas prices.

“We believe the next wave of North American LNG projects to reach a positive (FID) will be those that can offer their customers superior pricing flexibility,” Matt Schatzman, NextDecade president and CEO, said at LNG2019.

“When we at NextDecade consider how to make our business model competitive, we listen to our customers. They consistently tell us ‘flexibility,’ and that is precisely what we are offering: multiple LNG pricing options, including Brent indexation, to meet our customers’ needs in today’s dynamic and evolving global LNG market.”

In addition to indexing Brent crude and Henry Hub gas, NextDecade is offering long-term LNG supply indexed to Agua Dulce and Waha hubs and is exploring other hubs. “Indexing to Agua Dulce and Waha allows customers to leverage South Texas and West Texas gas prices, which are expected to trade below Henry Hub,” he said.

He added, “LNG projects need to offer long-term LNG indexed to oil, Henry Hub and potentially other [indices] as the LNG market evolves over the coming years. We believe successful projects will be those that offer LNG on multiple indexes, providing customers the flexibility they are seeking in today’s market.”

“We believe our ability to offer multiple pricing options maximizes our total addressable market and will ensure success for our Rio Grande LNG project, making NextDecade a leader among the next wave of LNG suppliers.

“The ability to offer Brent pricing has been a game-changer for our Rio Grande LNG project. It has accelerated our commercial marketing.”

The company’s portfolio of LNG projects includes the 27-mtpa Rio Grande LNG in Brownsville, Texas, and the 4.5-Bcf/d Rio Bravo Pipeline from the Agua Dulce area to Rio Grande LNG. NextDecade intends to develop the largest LNG export solution linking Permian Basin associated gas to the global LNG market.

NextDecade received final bid packages for the engineering, procurement and construction (EPC) contract in April from both Bechtel Corp. and Fluor Corp. The FID is expected before October.

Also in April, the Brownsville Navigation District said NextDecade agreed to privately fund the deepening of the Brownsville Ship Channel to 52 feet from the Gulf of Mexico to the company’s LNG project site. The Brazos Island Harbor Channel Improvement project is scheduled to begin in the first half of 2020 and be completed by 2023.

Three Plants, Two Countries

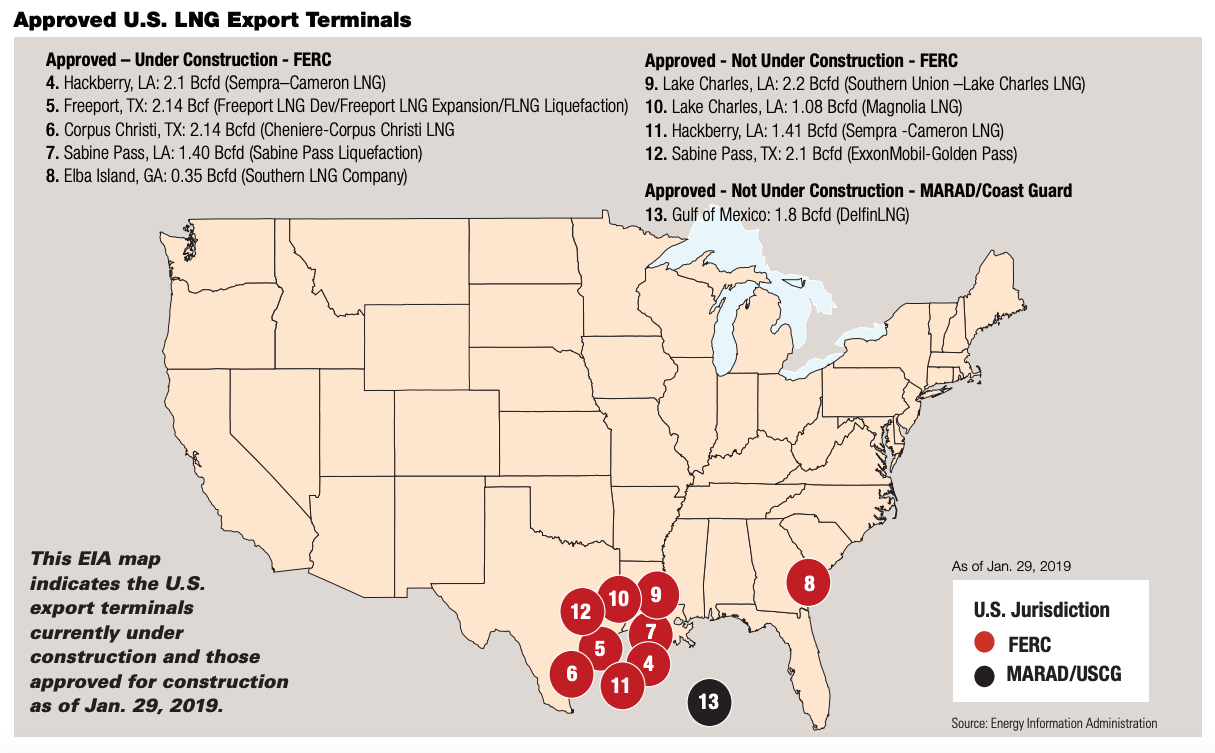

Sempra Energy is turning its two LNG import terminals—Cameron LNG in the U.S. and Energia Costa Azul (ECA) in Mexico—into export plants, while building the new Port Arthur LNG plant in Texas.

“As the economics transition to natural gas from other fuel sources, we see tremendous growth in demand [in] Europe. You see some countries—our Polish deal for example—looking for security of supply. Others want to take advantage of price certainty, different indexation or low prices in the U.S., given the shale gas revolution,” said Justin Bird, Sempra LNG president.

“Given the amazing growth of the Permian Basin, we think the U.S. will play a critical role in the supply of LNG to the world as time goes on.”

With its LNG terminals on both the East and West coasts of North America, Sempra finds itself in an enviable position. “We have what we call five world-class LNG projects. Importantly, we have the opportunity to supply portfolio players with LNG from the West Coast as well as the Gulf Coast,” Bird said.

“We think there is a large market opportunity. Our natural geographic markets will play a critical role in that.”

Sempra is more focused on its North American infrastructure. “Our CEO has an ambition to be North America’s premier energy infrastructure company. We have an ambition within our LNG business to have 45 [mtpa] of export capacity at these five projects,” he added.

Bird noted that Sempra LNG is in a privileged position to capture this opportunity. “One, we have development experience. Two, we have partnerships and strategic alliances with a lot of the key parties. Three, we have our world-class LNG projects.”

The company has five projects at three locations: Cameron LNG phases I and II; ECA phases I and II; and Port Arthur LNG.

Cameron is the 12-mpta facility with three LNG trains. “We are getting very close to starting operations on the first train. That project is 100% sold on a tolling basis to Total [SA], Mitsui [& Co. Ltd.] and Mitsubishi [Corp.]. Those same three parties are on the equity side. We call that Cameron Phase I,” he said.

Total came into the project when it bought Engie SA’s LNG business in 2017. “I think it is important that Patrick Pouyanne, Total’s chairman and CEO, said Total was basically acquiring this Cameron interest for the Phase II expansion [trains 4 and 5],” he said.

Sempra is currently doing technical studies, with the intent of completing them soon, and then look at the development of Phase II.

Since the plant is a tolling facility, the customers supply the gas. “Our customers basically deliver gas to the flange and each of them has their own sourcing. Then we deliver LNG to the other flange,” he added.

The greenfield Port Arthur LNG facility will be in Jefferson County, Texas, with a capacity of about 11 mtpa. In 2018, Sempra signed an agreement with the Polish Oil & Gas Co. for 2 mtpa beginning in 2023.

For its gas supply, the company is looking for a location that will give them the ability to source from multiple basins.

amazing growth

of the Permian

Basin, we think

the U.S. will play

a critical role in

the supply of LNG

to the world,”

said Justin Bird,

Sempra LNG

president.

“We’re continuing to work with Bechtel … toward an EPC. We are actively engaged in marketing the remaining volumes. We expect the FID by the end of 2019 or first-quarter 2020,” he said.

Pacific Coast

In “Field of Dreams,” Ray Kinsella is told, “Build it and they will come.” Bird tells his team, “When they come, we will build it. That is marketing driven.”

ECA is about 30 miles south of the U.S.-Mexico border. “We have two projects there. Phase I is our mid-scale project—3 mtpa—and Phase II is the large-scale project—12 mtpa. Like Cameron, ECA has an existing regas contract or existing facility contract,” he said.

“We are working with those regas customers to terminate those contracts early so we can advance the development of Phase II.”

For Phase I, ECA’s liquefaction plant can co-exist with the regas contracts. Sempra LNG and its Mexican subsidiary IEnova have signed HOAs with Total, Mitsui and Tokyo Gas Co. Ltd. TechnipFMC Plc and Kiewit Corp. are working on the FEED. The FID is expected at the end of 2019.

Sempra will be working with IEnova on Phase II. In March, ECA received U.S. Department of Energy authorization to export U.S.-produced gas to Mexico and to re-export LNG to countries that do not have a free-trade agreement with the U.S. from its Phase I and Phase II facilities. Gas most likely from the Rockies and the Permian Basin will be delivered by existing pipeline to Phase I.

“For Phase II, we will build our own new line, mostly in Mexico. We would have a large pipeline that would come from the Permian Basin or Waha area. IEnova owns about 40% of the natural gas pipelines in Mexico,” he said.

Bird emphasized that Sempra is “a little different from the others. I call us an LNG infrastructure business. I basically look to form strong relationships or alliances with big strategic players. I am more interested in building infrastructure that allows our customers to take advantage of U.S. natural gas and export it to the world.”

To do that, the company faces some challenges. One of the biggest is what the EPC market is going to be. What if all those projects get built? What will that mean for good builders?

“For the industry, it is ‘How do we get the right qualified people to build all these facilities?’ And how do we do it in a safe and right manner?” he said.

“If you ask me my clear goal, it is to be what we call North America’s premier LNG company, which, for us, means we will get this 45 mtpa of capacity built and see where we go from there,” he said.

He has challenged his team to see how they can expand the capacity for both Port Arthur LNG and ECA. “It is a very exciting time to be in the LNG space. We’re doing reinvestment. We’ve gone through that cycle at Cameron, and we’re doing that cycle at ECA.

“America will be at the forefront of adding to the world’s clean energy in our ability to supply gas from the Permian Basin.”

Energy Transfer, Shell

In March, Energy Transfer LP and Shell US LNG LLC signed a project framework agreement (PFA) that provides the framework to further develop a large-scale LNG export facility at the Lake Charles LNG plant in Louisiana.

Lake Charles LNG, which is one of the oldest import terminals in the U.S., is owned by Energy Transfer. BG Group Plc, which is now part of Royal Dutch Shell, was the sole customer for that regasification terminal.

“With the shale revolution, it didn’t make any sense for BG to be importing natural gas [amid] low U.S. natural gas prices. It then became economic—at least for BG—to consider investing with us or signing a long-term contract for us to build an export facility on the same site,” said Tom Mason, Lake Charles LNG president and Energy Transfer executive vice president and general counsel.

“We went down the path with BG for several years, including going through the whole permitting process with the Federal Energy Regulatory Commission and [U.S.] Department of Energy, which took a lot of time and money. We reached the stage where we were ready to pull the trigger with BG. And then Shell acquired BG,” he explained.

do this project

with or without

Shell. But Shell’s

the most logical

partner based

on their position

as the largest

LNG marketer

in the world,”

said Tom Mason,

president, Lake

Charles LNG, and

executive vice

president and

general counsel

for Energy

Transfer.

The development agreement with BG expired at the end of 2016. “Shell was trying to understand what to do with BG. In late spring of 2017, Shell came back to us and said, ‘We like Lake Charles, and we want to continue discussions,’” he said.

That accelerated the project in 2018 and culminated in the PFA in March. “The PFA sets forth all the commercial terms to move forward on the development of the export facility. It was a different arrangement this time with Shell being a 50:50 equity partner in the project. Also each of us will have 50% of the LNG offtake.”

There was a long-term regas services contract with BG that was inherited by Shell. “The commercial arrangements are that Shell will continue to make those payments through the expiration of the regas contract in early 2030,” he added.

This is the first foray into the LNG business for Energy Transfer. The export facility will be a brownfield project with existing assets such as LNG storage tanks, jetties, piping and a lot of other infrastructure. The facility will have a capacity of 16.45 mtpa.

Natural gas will be supplied through Energy Transfer’s pipeline system.

The location will allow Energy Transfer to source gas from multiple basins. “There are some pipeline modifications that Energy Transfer needs to do to reverse the flow of gas through the existing pipeline connected to the Lake Charles facility. The modifications will include additional pumps, meters and so forth along with additional pipeline interconnects,” he said.

The target for the FID, which is subject to several requirements, is the second half of 2020. Goals are “based on the locking up of long-term LNG offtake contracts that will provide us with steady cash flow streams with an attractive rate of return. This is an ideal project for a pipeline company like us.

“We wanted to do this project with or without Shell. But Shell’s the most logical partner based on their position as the largest LNG marketer in the world. We’re very pleased to have Shell as our partner.

“We’re pursuing the project on a very cooperative basis. They’ve got incredible talent in LNG engineering and project development. They’re dedicating a lot of resources to the project.”

Mason sees the success of the project being dependent upon receiving a cost-competitive EPC bid. The company has been engaged in discussions with the potential EPC contractors. On May 3, Lake Charles LNG issued an invitation to tender to U.S. and international consortia to bid for the EPC contract.

There are always questions about labor availability on the Gulf Coast. “We think Lake Charles is an ideal location based on the abundance of skilled workers in the area that can be brought to bear on projects of this size and scale.

“Louisiana is a business-oriented state that appreciates the value of infrastructure projects. We are very happy to be in a location with enthusiastic state and local governments,” he said.

Another big challenge is marketing its 50% of the LNG offtake. China, other Asian countries and Europe are big markets. “China LNG demand is growing incredibly. In the last three years its demand for LNG has grown 35% to 40% year-over-year.

“It is a big market, but the challenge is to get through the trade disputes with China and the U.S. We are encouraged that these trade disputes will get resolved, and we will have a very open Chinese market at that time,” Mason said.

Energy Transfer is working with customers on innovative LNG pricing. “Every customer is unique and has their own outlook on U.S. natural gas prices and also other index prices.

“We are actively pursuing alternate LNG offtake pricing with some customers and, concurrently, are in discussions with U.S. natural gas producers to obtain longer term natural gas supply arrangements tied to similar innovative natural gas price indexing.”

Recommended Reading

Swift Solar, with Backing from Italy’s Eni, Raises Tech Financing

2024-06-12 - Swift Solar, with backing from Italy’s Eni and others, has raised a total of $44 million for work transforming the solar energy landscape with perovskite tandem solar projects.

Berntsen Joins Xcel as Executive VP, Chief Legal and Compliance Officer

2024-05-22 - Rob Berntsen is assuming the role from Amanda Rome, who had been in the position on an interim basis.

Pemex Hits Debt Target, Struggles to Reverse Production Declines

2024-07-26 - Pemex achieved its long-term debt target, which aimed to gets its financial obligations below the $100 billion, while struggling to halt production declines.

Utility, Clean Energy Company Allete to Go Private in $6.2B Deal

2024-05-06 - The Minnesota-based utility said on May 6 it agreed to be acquired by a partnership led by Canada Pension Plan Investment Board and Global Infrastructure Partners.

Top Exxon Directors Cruise to Re-election Despite Activist Opposition

2024-05-29 - The campaign amounted to a test of whether top fund firms would rally to defend the small shareholders whose resolutions have put topics like the environment and workforce diversity at the center of many corporate annual meetings.