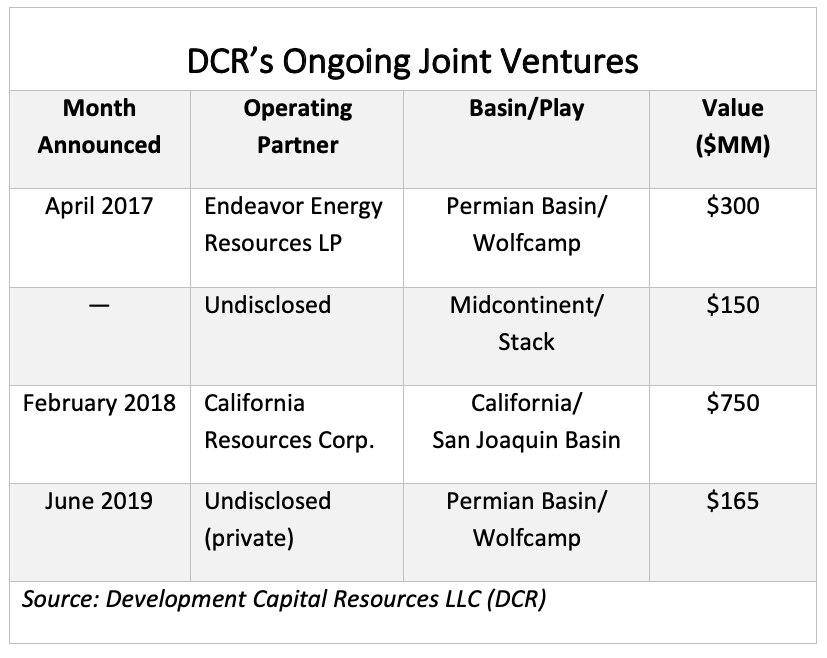

The JV is DCR’s fourth nonop partnership since forming in 2017, which includes more than $1.3 billion worth of capital deployed. (Source: Hart Energy)

Development Capital Resources LLC (DCR) formed a multibillion-dollar Permian Basin joint venture (JV) set to deploy capital in the bountiful Wolfcamp shale play.

On June 19, DCR said it had agreed to invest up to $165 million in the JV for the drilling and development of the Permian’s Wolfcamp formation. As part of the agreement with an unnamed private operator, the company will participate in the JV as a working interest owner.

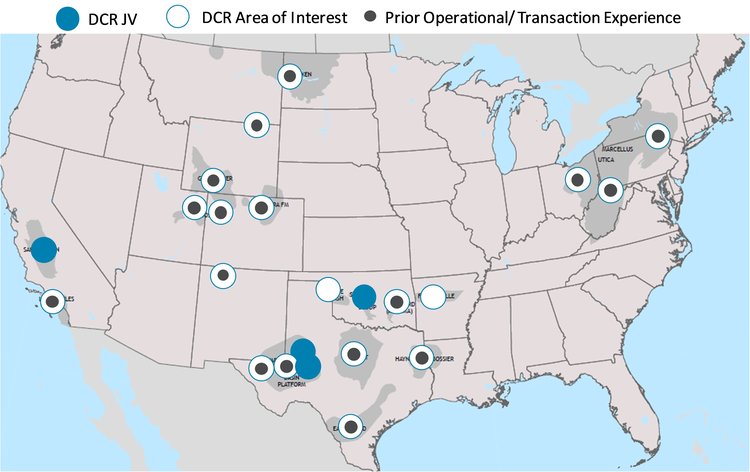

Backed by Ares Management Corp., DCR focuses on participating in nonoperated JVs throughout the North American E&P industry. At the time of its formation in 2017, President and CEO Ronnie Scott said DCR, which has offices in Houston and Midland, Texas, had a “substantial amount of capital available” for investments that included but weren’t limited to drilling JVs, nonoperated working interests and royalty participation.

Demand for drilling JVs—also known as Drillcos—has been growing thanks to the recent lack of more traditional sources of capital for publicly traded operators. Most recently, Houston-based Glendale Energy Ventures LLC landed an initial $500 million in capital commitments to fund nonop acquisitions across the U.S.

__________________________________________________________________________________________________

RELATED:

Drilling Joint Ventures: Knocking On The Drillco Door

Houston Oil Firm Lands $500 Million Backing For Nonop Deals

__________________________________________________________________________________________________

In a statement on June 19, Scott said: “As the structure of energy joint ventures continues to evolve, DCR has worked to remain flexible in finding ways to assist operators to improve and develop their assets.”

DCR’s latest transaction is its fourth nonop partnership since forming, noted the company’s COO Matt Loreman.

According to the company website, DCR is also currently managing another JV in the Permian Basin as well as partnerships in Oklahoma’s Stack Play and the San Joaquin Basin in California. Partnering operators include Endeavor Energy Resources and California Resources Corp.

“In each case, we have been able to structure a creative solution tailored to the needs of the operator,” Loreman said in a June 19 statement.

The four transactions representing more than $1.3 billion in capital, according to the company press release.

DCR claims to be commodity and basin agnostic. Additionally, the company said its team has experience with conventional and unconventional assets in almost every major producing region of North America.

Scott, who has over 30 years of experience in the oil and gas industry, previously led private-equity backed True Oil Co. as its CEO and president. He also has served as president and COO of Henry Petroleum and its successor companies. Scott began his career with Exxon Corp. holding various supervisory and managerial assignments.

As for Loreman, he previously served as managing director in Evercore’s Oil & Gas Advisory group in Houston. Prior to Evercore, he worked in the natural resources investment banking group of J.P. Morgan.

Loreman said although the energy investment space remains challenging, the company will focus on continuing to grow its portfolio of nonoperated partnerships by finding “investment solutions that work for [operators] and for DCR.”

DCR’s latest partnership covers the drilling and completion of identified drilling locations targeting the Wolfcamp formation in the Permian Basin. The company said the drilling has already begun and the program is anticipated to continue through 2020.

Late last year, the U.S. Geological Survey (USGS) revealed a new study of the Permian Basin’s Wolfcamp and overlying Bone Spring Formation that identified them as the “largest continuous oil and gas resource ever assessed.”

In total, the USGS estimates the Wolfcamp Bone Spring formations in the Delaware Basin portion of the Permian contain an estimated 46.3 billion barrels of oil plus 281 trillion cubic feet of gas and 20 billion barrels of NGL.

Latham & Watkins represented DRC in the transaction led by partner Stephen Szalkowski. Meanwhile, the private operator in DCR’s JV was advised by Kirkland & Ellis LLP. The Kirkland team was led by partner David Castro.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Oil, Gas and M&A: Banks ‘Hungry’ to Put Capital to Work

2025-01-29 - U.S. energy bankers see capital, generalist investors and even an appetite for IPOs returning to the upstream space.

Ovintiv Names Terri King as Independent Board Member

2025-01-28 - Ovintiv Inc. has named former ConocoPhillips Chief Commercial Officer Terri King as a new independent member of its board of directors effective Jan. 31.

Riverstone’s Leuschen Plans to IPO Methane-Mitigation-Focused SPAC

2025-01-21 - The SPAC will be Riverstone Holdings co-founder David Leuschen’s eighth, following the Permian Basin’s Centennial Resources, the Anadarko’s Alta Mesa Holdings and the Montney’s Hammerhead Resources.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.