(Illustration by Robert D. Avila/Hart Energy)

[Editor's note: A version of this story appears in the May 2019 edition of Oil and Gas Investor. Subscribe to the magazine here.]

Those who minded E&P finances back in 2016 will recall the fallout from some of the regulatory guidelines introduced by the Office of the Controller of the Currency. Banks in energy lending in some cases had to add reserves for “criticized” loans; a number of regional banks scaled back or exited entirely from the energy sector; and second lien business by banks dropped off dramatically.

“Even some of the larger banks have a very restrained appetite for second-lien exposure currently,” said one long-standing industry observer. “The second-lien market is really tough now.”

wants to get its

operating partner

“to reversion

as quickly as

possible, since

post-reversion

generates the

highest rate of

return and the

most upside

for our partner

to keep,” said

founder and

senior managing

director Marc

Rowland.

The resultant search for nonrecourse finance has prompted many producers to knock on the doors of Drillco providers. And suitors are by no means confined to a sub-set of small and mid-cap (SMID) companies. Those considering Drillcos, drilling joint ventures, increasingly include large-cap independent producers and, in recent years, even integrated producers.

For example, Benefit Street Partners (BSP) has been approached by a wide spectrum of operators, according to Tim Murray, managing director. In addition to SMID companies, private operators and private-equity-backed companies, BSP has been approached by large-cap independents and major oil companies requesting Drillco proposals.

Similarly, IOG Capital is seeing a pickup in inquiries for Drillcos, as well as interest in using Drillcos in broader applications, according to Marc Rowland, founder and senior managing director.

“We’re getting inbounds from very large companies; certainly, the bellwether companies are beginning to use it,” said Rowland. “I think the flight to quality today has also changed the product. It’s more of a mainstream product that has application across development pad drilling,” he observed. “I think we’ll see large deals with larger operators grabbing the headlines.”

While larger producers may be swelling the ranks of those considering Drillcos, optimum investment levels still come in an assortment of sizes. Some capital sources can provide funding of $250- to $500 million or more; however, IOG’s focus is on projects of $25- to $100 million, said Rowland. For BSP, the “sweet spot” for deals it funds is north of $100 million, according to Murray.

For Bayou City Energy (BCE), the question of investment size is one the firm doesn’t consider “in terms of a dollar amount, it’s more one of locations,” said partner Mark Stoner, speaking at Hart Energy’s Energy Capital Conference in Dallas. Typically, BCE looks to develop wells in tranches of 15 to 30 wellbores, which it can then scale up via “additional tranches over time,” he said.

A major factor driving Drillco deals is the pressure applied by investors for greater capital discipline on the part of producers, according to Drillco providers.

“The public markets are saying, ‘You have to live within cash flow,’” said Murray. “So within a fixed budget. Say you’ve got a defined area that needs to be drilled or you will lose the acreage. Maybe it’s acreage that is lower on the priority list. Rather than using money from the drilling budget reserved for higher priority development, you’ll likely seek non-recourse capital, like a Drillco, that doesn’t add to debt. You’ll do that to develop the acreage.”

Drillco Structures

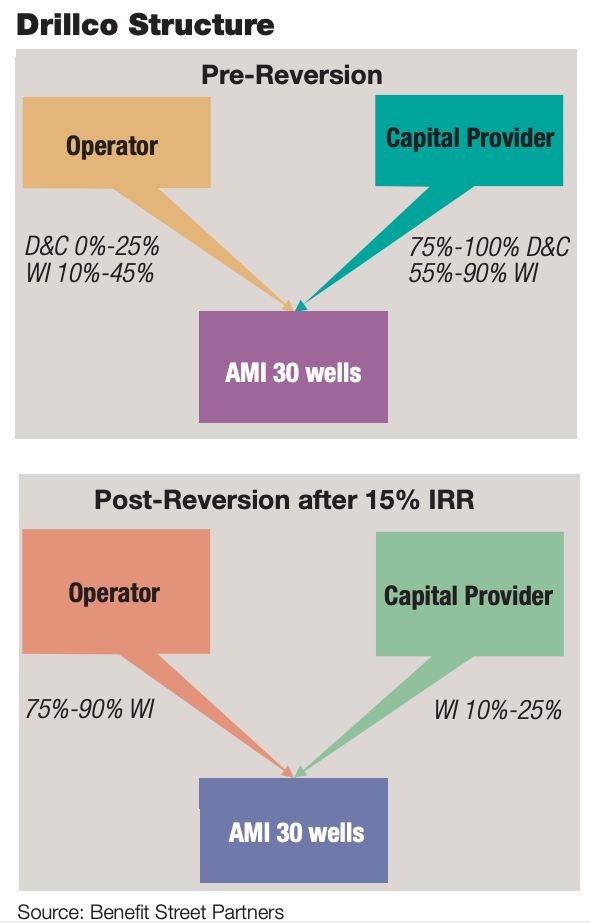

BSP has an overview to assist those getting up to speed on Drillco structures. Similar to “drill-to-earn” farmout arrangements, capital providers in Drillcos “earn interests (wellbore, drilling spacing units and/or acreage) in exchange for funding the development of wellbores/acreage,” according to the company. Structures vary by transaction but “typically include some component” of the following:

- Carried Interest: Capital provider may cover a portion of the operator’s drilling and completion costs.;

- Reversion Hurdle: Similar to an APO (after payout) back-in; generally structured as a pre-agreed return of capital (metrics = IRR, internal rate of return and/or ROI, return on investment).; and

- Tail Interest: Post-reversion working interest retained by the capital provider (majority portion of the pre-reversion interest is conveyed back to the operator).

In addition to not adding to leverage due to its non-recourse structure, Drillcos may be attractive to operators on several counts, according to BSP.

First, the structures may be potentially cheaper than raising equity. Also, the initial “carry” in favor of the operator and the subsequent reversion allow the operator to “maximize value of attractive acreage while retaining control.” Along similar lines, value may be accelerated in acreage that otherwise might not have been drilled in the near term, BSP noted.

30% IRR is the

minimum, and

it’s better if it’s

closer to 40%,”

said Tim Murray,

managing director

with Benefit

Street Partners,

as regards to the

threshold level

of economics

needed to provide

satisfactory

returns from a

drilling program.

While not always focused on Tier 1 acreage, Drillcos still need a threshold level of economics, generally cited at IRRs of 30% or higher, to provide satisfactory returns for all parties, industry observers say. In general terms, the greater the carried interest borne by the capital provider in the Drillco, the greater the IRR required in a project to meet return targets.

"I would say a 30% IRR is the minimum, and it’s better if it’s closer to 40%,” said Murray.

Previously, when more robust oil prices reflected stronger commodity confidence, deal terms for a Drillco may have included as much as a 20% carried interest, said Murray. But a 20% carry is “likely out the window now. I doubt you’re going to see 20% carry deals until we see some greater certainty in the direction of oil and gas prices,” he told Investor.

Assuming a 10% carried interest, said Murray, the capital provider is still “over-investing relative to its share of the well.” The capital provider, he pointed out, “has to get a return not only on its share of the well, but also on that share of the well that it’s paying for on behalf of the operator. So the more the carry, the more return you need to justify the program.”

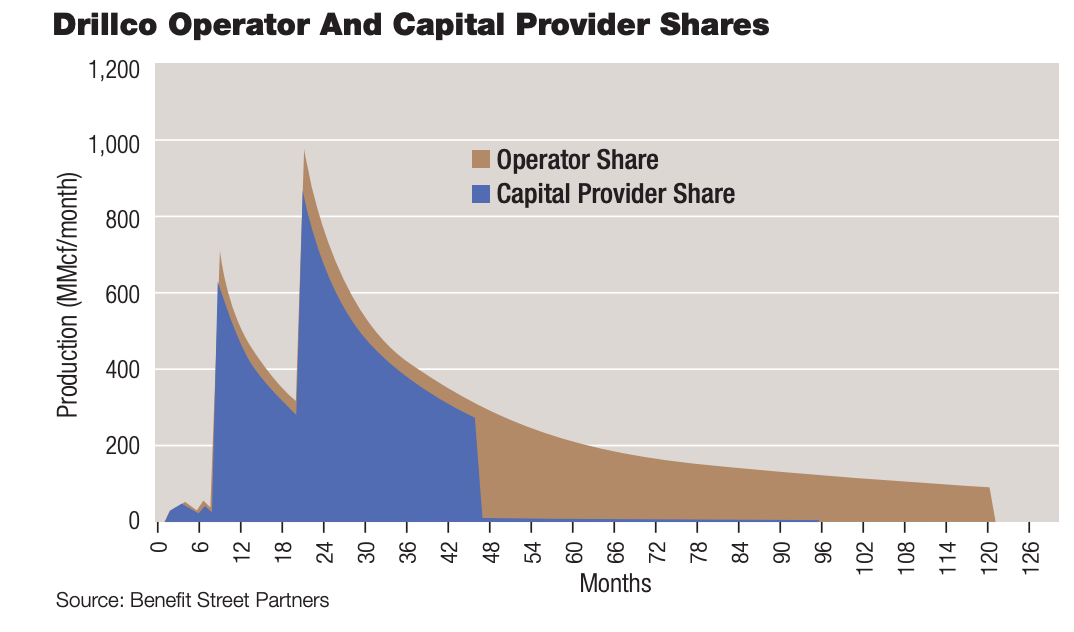

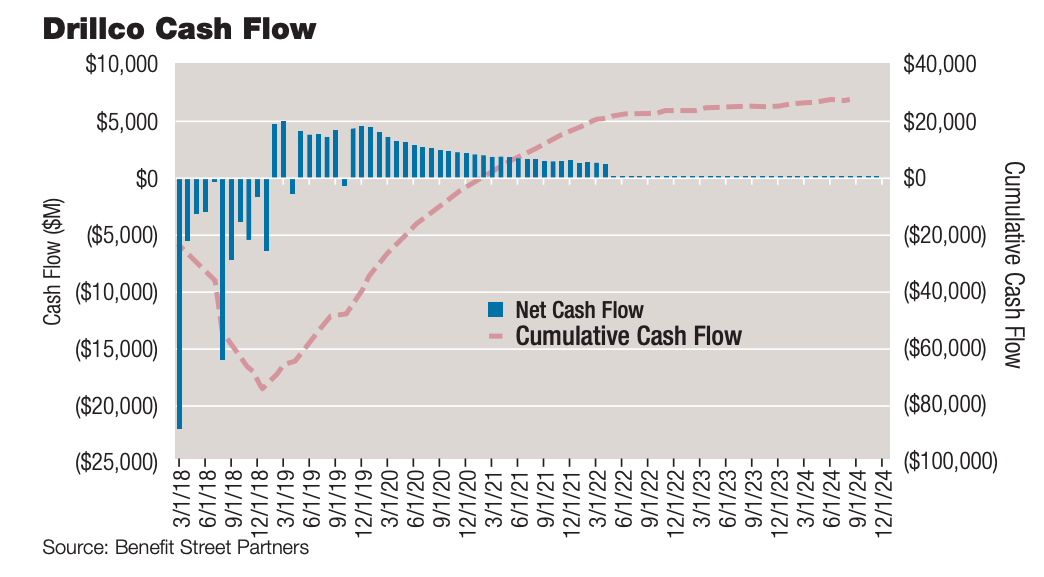

The reversion point, or hurdle, reflects the point at which the well has paid out and earned a pre-set return, usually in the mid-teens. Assuming 15%, “it then reverts, or flips, and you end up with the tail,” said Murray. “For unconventional wells, where the tail production level is usually lower than a conventional well may be, the capital provider is likely to get a bigger slice of the working interest to offset the carry.”

If the tail adds a 5% to 7% return to the reversion point, for example, the economics of a program of wells offering no more than 30% IRRs may begin to look a little tight, according to Murray. “If you have a 30% IRR well, with a reversion point of 15% and a tail adding 5% to 7%, the capital provider is earning up to a 20% to 22% return,” he said; this leaves less attractive economics to incentivize the operator and less cushion if something goes wrong.

Residual Value Plus Cushion

“There are two things to consider,” he said. “First, there needs to be enough residual value in the Drillco so that the operator remains interested. And, second, you want to have a little cushion in case the wells don’t turn out exactly right, commodity prices fall at the wrong time or costs go up.”

In the “fairly robust economics” in the core of the Permian Basin, BSP has structured mainly “wellbore only” Drillcos with both Midland Basin and Delaware Basin operators. The carried interests built into the Drillco deals have ranged from 15% to 20% and the reversions from 12.5% to 15%, according to Murray. The tails “can range from 10% to 20%,” he said.

In the Scoop/Stack play, by contrast, Drillcos have been structured with carried interests of 10% to 15%, reversions of about 15% and tails in a range of 20% to 25%. The difference in terms vs. the Permian was largely because “target formations in the Permian are better defined and more proven,” said Murray.

“You have a lot of offset wells in the Permian to formulate your type curves, so people feel pretty confident about what they’re going to get,” he elaborated. “The frack recipes are coalescing around some standard treatments, so, again, that eliminates one of those uncertainties. And, of course, it’s mostly an oil province, with the economics driven primarily by oil.”

IOG Capital, led by founder Marc Rowland, was a pioneer in developing Drillcos and has closed roughly 30 transactions to date. The company has a diverse deal flow encompassing transactions in a variety of basins: the Permian, Scoop/Stack, Eagle Ford, Merge, Bakken and Marcellus/Utica. IOG has made investments of more than $800 million, including 14 follow-on investments.

IOG Capital, led by founder Marc Rowland, was a pioneer in developing Drillcos and has closed roughly 30 transactions to date. The company has a diverse deal flow encompassing transactions in a variety of basins: the Permian, Scoop/Stack, Eagle Ford, Merge, Bakken and Marcellus/Utica. IOG has made investments of more than $800 million, including 14 follow-on investments.

Reversion As fast As possible

“The first thing I say when meeting an operator we haven’t dealt with previously is, ‘We want this project to be the best project you’ve ever done,’” said Rowland. “We want to get them to reversion as quickly as possible, since post-reversion generates the highest rate of return and the most upside for our partner to keep. That’s how we’re going to measure ourselves as being successful in helping them.”

While IOG structures larger Drillco deals, it will also work with operators whose initial capital needs are in the $25- to $50-million range with running room for follow-on drilling.

“Often we’ll size it with five to 10 wells to begin, and then we’ll see if we’re able to grow,” commented Rowland. “That’s ideal, because we now know the specific operator, we trust him, and we hope to have a long-term relationship rather than just a ‘one-and-done’ type of relationship.” A recent monetization involved an operator with whom IOG went on to do a “repeat deal.”

Largest Drillco

IOG’s largest Drillco deal was struck with Seneca Resources Co., the E&P division of National Fuel Gas Co., headquartered in Houston. Seneca is active in the gas-oriented Marcellus and Utica plays. IOG has invested more than $300 million in 75 wells it has drilled with Seneca.

Like others, Rowland generally uses a threshold level of roughly 30% IRR at the field level (excluding acreage, midstream, and general and administrative costs) as a target for projects. “Basically, that is to protect us and the operator partner against things that go bump in the night: cost overruns, production that comes in less than expected, drops in commodity prices before you can get hedged, etc.”

Advantages of a Drillco structure are that operators have the optionality of starting at more modest levels and then scaling up their operations. In addition, operators have an opportunity to “do more with less” by deploying Drillco dollars on Tier 2 acreage, without burdening balance sheets, according to Bayou City Energy partner Mark Stoner.

Based in Houston, Bayou City has structured Drillcos during the past four years. Assuming a carried interest of 10% to 20%, projects typically “need about 30%-plus IRRs in order to ultimately get reversion,” said Stoner. “That’s typically a nice line in the sand.” The reversion hurdle is calculated on a tranche basis, rather than well by well, and is typically set in a range of 10% to 20%.

Based in Houston, Bayou City has structured Drillcos during the past four years. Assuming a carried interest of 10% to 20%, projects typically “need about 30%-plus IRRs in order to ultimately get reversion,” said Stoner. “That’s typically a nice line in the sand.” The reversion hurdle is calculated on a tranche basis, rather than well by well, and is typically set in a range of 10% to 20%.

“We can partner up with an operator after they’ve assembled a land position, after they’ve drilled a handful of delineation wells, after they’ve figured out their saltwater disposal needs and after they’ve got gathering and processing contracts in place,” stated Stoner. “We can then come in at the wellhead and start to deploy development capital there.”

“We can partner up with an operator after they’ve assembled a land position, after they’ve drilled a handful of delineation wells, after they’ve figured out their saltwater disposal needs and after they’ve got gathering and processing contracts in place,” stated Stoner. “We can then come in at the wellhead and start to deploy development capital there.”

Optionality

However, for those preferring the optionality of starting small and scaling up, Bayou City and an operator “can start at 10 or 15, or 20 wells and grow it over time. You don’t have to overcommit on day one,” said Stoner. And for its part, Bayou City doesn’t “put in any ‘unilateral off-ramps,’” he added. “We’re not going to drill one or two wells and then walk away if those don’t look like the type curve.”

to overcommit

on day one,” said

Mark Stoner,

partner with

Bayou City Energy.

Operators “can

start at 10 or 15 or

20 wells and grow

it over time.”

That said, “We don’t want to be the tutorial dollars for a team trying to get started,” he observed. “We want to see a track record of demonstrated results. We don’t want to be the R&D arm of an operator who is still trying to figure out where it should lay its lateral, what zone it’s looking to target, and how many frack stages there should be. We want to step in with a partner who’s largely figured that out.”

A “heavily negotiated deal point,” noted Stoner, is related to authorization for expenditure (AFE) caps for wells being drilled that may suffer cost overruns.

“Because we live and die by the wellbore, we put in AFE caps,” he explained. “It’s a way to protect us, because we have no upside within our structure other than what’s in the wellbore. We’ll work with the operator to lay out all the capital we expect to spend in the program. Essentially, we’ll target funding 100% of that; anything over that will typically accrue to the operator.”

‘Do More With Less’

Stoner offered an example of a Drillco being able to “do more with less,” showing how a Drillco could “accelerate free-cash-flow neutrality in a balance sheet accretive manner.”

The example gave two competing scenarios. In the first, a budget is divided 50%:50% between Tier 1 and Tier 2 acreage. In the second, the same budget is spent 100% on Tier 1 acreage, while funding from a Drillco is used to drill wells on the Tier 2 acreage. Wells on the Tier 1 and Tier 2 acreage are assumed to generate, respectively, 70% IRRs and 38% IRRs.

During a period of four years (2019 to 2022), production in the first scenario—with the budget split 50:50 between the higher and lower IRR acreage areas—production increases from roughly 29,800 barrels of oil equivalent per day (boe/d) to about 33,300 boe/d in 2022. In the second scenario, a Drillco with $250 million of gross capex supplements the operator’s budget. The Drillco is used to fund development of the Tier 2 acreage, allowing the operator to more optimally focus 100% of its balance sheet on the Tier 1 acreage, with production growing from a similar base to almost 37,300 boe/d.

In terms of EBITDA, a gap begins to open up between the two cases, as EBITDA grows to roughly $237 million in the first scenario, but as much as $284 million in the second scenario from the same base. In a similar vein, free cash flow (assuming non-recourse Drillco capex) approaches breakeven levels in the first scenario, while in the second, free cash flow reaches $45 million annually.

For those adhering to the mantra of spending within cash flow, and lowering debt levels, the Drillco case also proves to be deleveraging. In the first scenario, debt to 2022 EBITDA falls from 2.96 times to 2.02 times, while in the second scenario it drops from the same starting point to 1.68 times. In addition, strategic goals may have been met in terms of holding leasehold, meeting minimum volume commitments in the latter scenario.

__________________________________________________________________________________________________

SIDEBAR:

Eagle Ford Drillco

In May of 2016, IOG Capital partnered with 1836 Resources LLC, an established Eagle Ford-focused management team. The joint venture (JV) was structured at the asset level, with IOG holding a majority working interest alongside the 1836. Governance was documented by way of a simple joint development agreement and a joint operating agreement.

IOG was attracted to 1836’s demonstrated ability to execute in the oil window of the Eagle Ford Shale in Karnes County, Texas. At their respective working interest levels, the JV partners acquired several valuable leasehold positions and turned six wells online from 2016 to an exit in late 2018. IOG provided all back office support for the JV, allowing 1836 to focus on land, subsurface and operations.

IOG funded more than $30 million in drilling and completion. Reversion was triggered on the exit, based on a predetermined IRR reversion hurdle, and proceeds were split based on the respective post-reversion working interests. IOG is currently four wells into a follow-on project with 1836 on a similar Drillco structure.

“The sale accomplished the objectives of both, our partner, 1836 Resources, and ourselves,” recalled Rowland. “Our objectives were to, first, take undeveloped reserves and turn them into cash flowing reserves, and then, second, monetize the assets for the benefit of both parties. It worked exactly as it was supposed to do. We realized our returns and they realized their back-end returns.”

__________________________________________________________________________________________________

Chris Sheehan can be reached at csheehan@hartenergy.com.

Recommended Reading

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Tech Trends: SLB's Autonomous Tech Used for Drilling Operations

2024-02-06 - SLB says autonomous drilling operations increased ROP at a deepwater field offshore Brazil by 60% over the course of a five-well program.

E&P Highlights: March 15, 2024

2024-03-15 - Here’s a roundup of the latest E&P headlines, including a new discovery and offshore contract awards.

ShearFRAC, Drill2Frac, Corva Collaborating on Fracs

2024-03-05 - Collaboration aims to standardize decision-making for frac operations.

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.