Presented by:

This article first appeared in the 2022 Minerals Business Report and Buyers Directory.

Mineral and royalty deals have started to pivot toward consolidation after last year’s M&A market was muted. More recent deals, in particular the $1.9 billion merger between Falcon Minerals and Desert Peak Minerals, could begin the process of defragmenting the sector.

That may or may not be a good thing, analysts say. They’re also skeptical about minerals companies putting all their eggs in one shale.

Minerals buyers, which were on the vanguard of buying proved developed producing (PDP) focused assets before E&Ps began their transition to the same concept, have struggled to return to the same pace of deals they saw prior to the pandemic.

“You don't necessarily have the same pressure for consolidation in minerals as in [working interest] since there isn't much in the way of G&A savings from deals—minerals are mostly a low-overhead business—and there isn't the same type of in-field operational synergies,” said Andrew Dittmar, a director with Enverus.

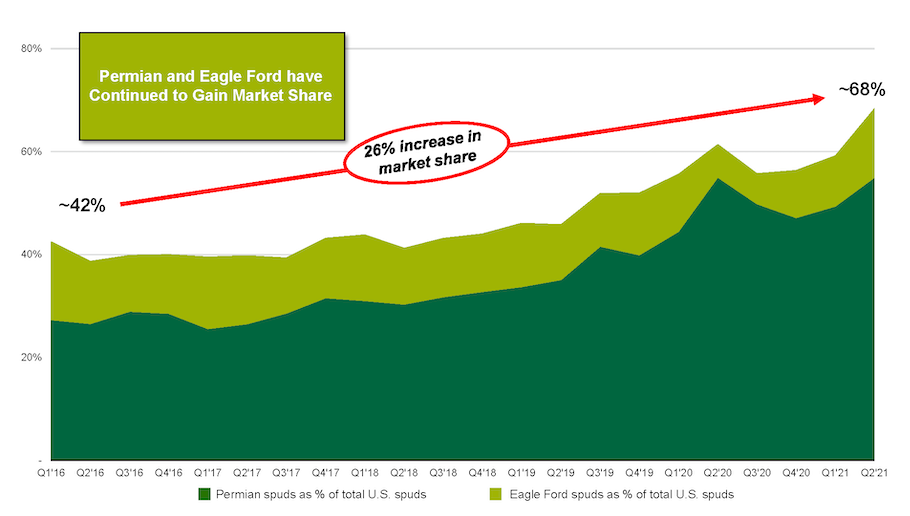

Heated competition for the hottest basins remains. Desert Peak estimated that about 68% of new well spuds are concentrated in the Eagle Ford Shale and the Permian Basin. While there are plenty of opportunities to buy—they estimate 65,000 individual mineral owners in the Permian—they also acknowledge the core of the play is where they want to be. But that only makes a strong case for the need to consolidate, Desert Peak CEO Chris Conoscenti said.

“The market clearly doesn’t need 10 companies doing the same thing in the same places,” he said. “We’re looking to be relevant to market investors at a large scale.”

Focusing on consolidation and scale

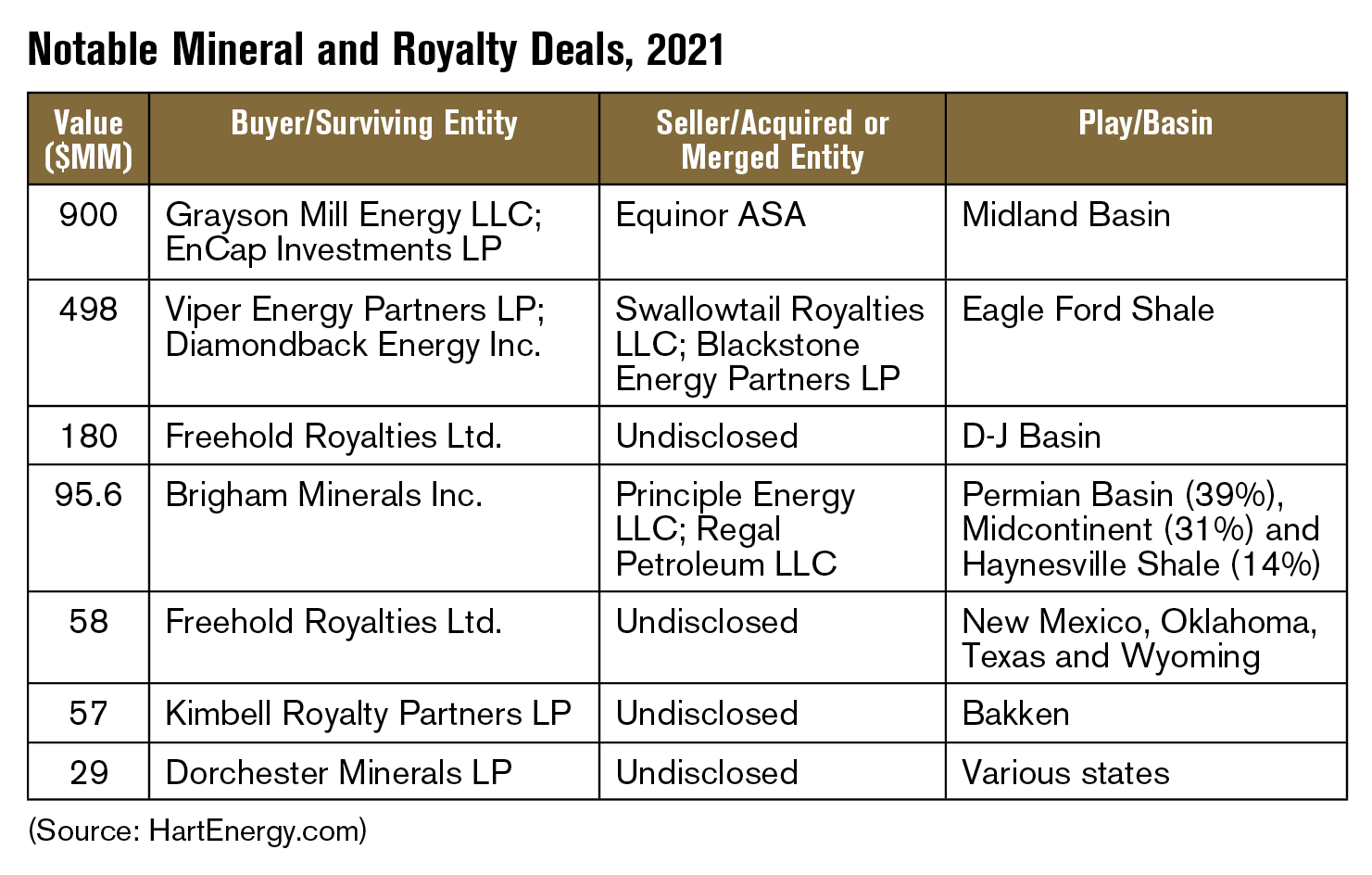

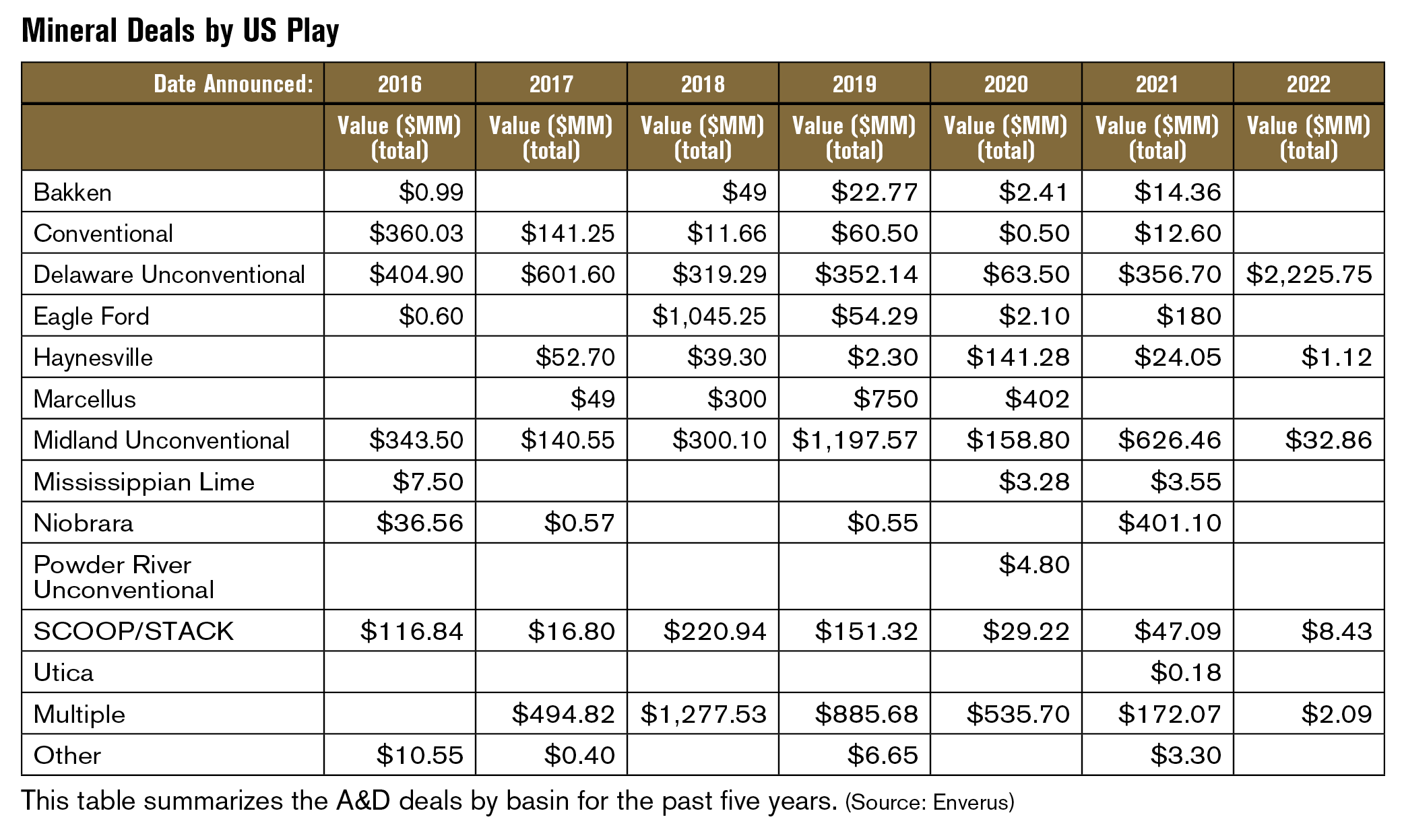

Royalty deals for 2021 totaled about $1.8 billion— roughly the same as the pandemic-hammered previous year and about half of 2019, when minerals transactions totaled $3.6 billion, according to data by Enverus.

Overall, E&P deals were up 25% to $66 billion in 2021, according to Enverus—a trend driven by larger corporate acquisitions. Mineral and royalty deals made up almost 3% of that value.

This is what makes recent deals by Desert Peak and Brigham Minerals all the more interesting.

Both companies are now borrowing from the E&P playbook by focusing on consolidation and scale, with the added hardship of plotting acquisition targets in areas that are most likely to be drilled. Brigham is actively divesting areas that aren’t being drilled.

Following the January announcement of a merger between Falcon and Desert Peak, Conoscenti threw down the royalty gauntlet by saying the company is “100% focused on becoming the logical consolidator of Permian minerals.”

But he said the company’s aim is to have great value through scale, not to be the biggest. That scale has helped the company reduce its costs while keeping its staffing relatively stable the past few years.

Scale is important “not only to be relevant to the equity investor community, but also to capitalize on the efficiencies that come with scale in a business as simple as this one,” he said on a January conference call announcing the merger. “Our combined [Falcon and Desert Peak] asset base provides us the scale needed to serve as a platform to continue the consolidation of this highly fragmented sector.”

The company also sees plenty of room to further consolidate, with its own estimates suggesting the Delaware Basin has about 4.8 million acres of acquirable net royalty acres and 5.7 million acres in the Midland Basin.

Conoscenti also noted that for most of 2020, as the company evaluated 195,000 acres for acquisition, it held off on purchasing any interests because of a wide bid-ask spread.

“We held firm,” he said, adding that the “good news is that many of the opportunities we evaluated did not transact, so they are still available.”

Crowded space

The problem remains that E&P minerals remains a crowded space, said Joseph McKay, senior equity analyst with Wells Fargo Securities LLC.

He noted that companies, such as Black Stone Minerals (BSM), with a diversified footprint help reduce the risk of too much concentration in certain areas.

“The visibility into growth in 2022 is comparatively clearer for BSM via development agreements in the Haynesville and less reliant on a disjointed M&A market,” he said.

McKay sees a mineral M&A market that will largely stay the same in 2022.

“While the combination of FLMN [Falcon] and Desert Peak Minerals headlines a strong start to 1Q22 capital market activity, we think expectations for continued activity should remain subdued,” he said. “Activity has continued to decline after reaching a relative peak in 2Q21, as divergence between the spot (front month) commodity prices and the 12-month strip usually drive a wider bid-ask spread in the market.”

The spread for both oil and gas began to contract toward the end of 2021 but has since widened again, particularly for oily assets, he said.

Natural gas has not been subjected to the same market forces, at least for now.

This looks to be a headwind for companies such as Brigham and Falcon, which plan to continue M&A as a way of aggregating interests.

“Conversely, we think this is an advantage for diversified peers with depth such as KRP [Kimbell Royalty Partners] and BSM—coincidentally operators with a focus on natural gas production,” he said.

Conoscenti disagreed with this notion when asked about rising oil prices, arguing the target size of an acquisition remains a deciding factor.

“The smaller acquisitions I would describe as overheated and uneconomic,” he said, noting that broadly auctioned assets below $25 million to $50 million are seeing “heavy interest from people who have either different cost of capital or much different underwriting assumptions than what we have.”

His conversations with larger mineral owners tend “to be rational about relative value so the run-up in oil prices hasn’t negatively impacted those conversations when you talk about it on a relative value basis.”

Brigham Minerals, also with its eyes on consolidation, in November 2021 announced its largest transaction since its IPO in 2019—a $95.6 million deal in the Denver-Julesburg (D-J) Basin.

In February of this year, Brigham also agreed to a cash-and-stock mineral acquisition in the Midland Basin, buying acreage largely operated by Pioneer Natural Resources and Endeavor Energy Resources.

Like the Falcon-Desert Peak deal, the transaction focused on building scale. Tudor, Pickering, Holt & Co. analysts valued the deal at about $32.5 million.

“We remain extremely focused on capturing and creating value through consolidation and are pleased that our disciplined underwriting has been rewarded with acquisitions of over $120 million in the past three months,” Brigham CEO Robert M. (Rob) Roosa said in a news release.

In an earnings presentation, Roose said he’s optimistic that Brigham’s team will be able to consolidate “in this positive macro backdrop and generate substantial shareholder returns.”

He said the D-J Basin deal was substantially accretive, with a “high teens yield on 2022 cash flow” that should enable the company to further enhance its dividend policy. He noted that Brigham underwrote the acquisition almost exclusively using PDP and DUCs, “thereby reducing reliance on unpermitted locations and minimizing Colorado political risk.”

‘Goldilocks-like period’

Bud Brigham, founder of Brigham Minerals, sees a constructive environment for deals right now. But in the back of his mind he has some concerns.

“This is a unique time,” Brigham said during the earnings call. “I think the math is easier now than it typically is. I mean the underinvestment in oil and natural gas over recent years and … while demand is increasing as the economies kind of come back online post pandemic, I think it's, as I stated, it's a very bullish setup.”

Higher prices are inevitable, he said. For now, the industry is in a “Goldilocks-like period, in my view, for oil and natural gas with a lower cost structure coming out of the downcycle while prices have validated, and we're not getting the supply response,” he said.

But he worries that as the runway for value beckons E&Ps and minerals companies, the price may get too far out of bounds.

“I am concerned personally that they could get too high,” he added. “Clearly, it's going to be beneficial for the consumer and for the overall economy. It's certainly inflationary.”

Recommended Reading

The OGInterview: BPX E-fracs Push ‘Values Up, Emissions Down,’ CEO Says

2024-07-02 - BPX Energy CEO Kyle Koontz discusses the company’s role as the “nimble entrepreneurial” arm of supermajor BP in the Permian Basin and Haynesville and Eagle Ford shales.

Industry Consolidation Reshapes List of Top 100 Private Producers in the Lower 48

2024-06-24 - Public-private M&A brings new players to top slots in private operators list.

Baytex Energy Joins Eagle Ford Shale’s Refrac Rally

2024-07-26 - Canadian operator Baytex Energy joins a growing number of E&Ps touting refrac projects in the Eagle Ford Shale.

US Drillers Add Oil, Gas Rigs for First Time in Four Weeks: Baker Hughes

2024-05-17 - The oil and gas rig count rose by one to 604 in the week to May 17.

URTeC: E&Ps Tap Refrac Playbook for Eagle Ford, Bakken Inventory

2024-06-17 - Refracs and other redevelopment projects might not be needle-moving growth drivers—but they’re becoming more common for E&Ps levered in maturing plays like the Eagle Ford and Bakken, experts discussed at URTeC 2024.