Despite pledges and investment, the energy transition remains sluggish as fossil fuels continue to rule, report says. (Source: Shutterstock)

This is a fossil fuels’ world, a new global energy outlook report confirms; pledges to reduce greenhouse gas emissions are just living in it.

What is new, the report’s authors say, is an energy transition from a world dominated by markets and economics to one driven by government policy.

Resources for the Future’s (RFF) Global Energy Outlook 2023, released March 28, found that global investment in clean energy technologies rose 31% in 2022 compared to 2021 to an estimated $1.1 trillion. However, fossil fuel consumption is at or near all-time highs and preliminary data show a 1% increase in CO2 emissions last year, surpassing the pre-pandemic high set in 2019.

While the seeds of the energy transition have been sown, the report’s authors acknowledge that “much more action will be required to ensure that these seeds bear fruit at the scale and speed necessary to avert the worst effects of climate change.”

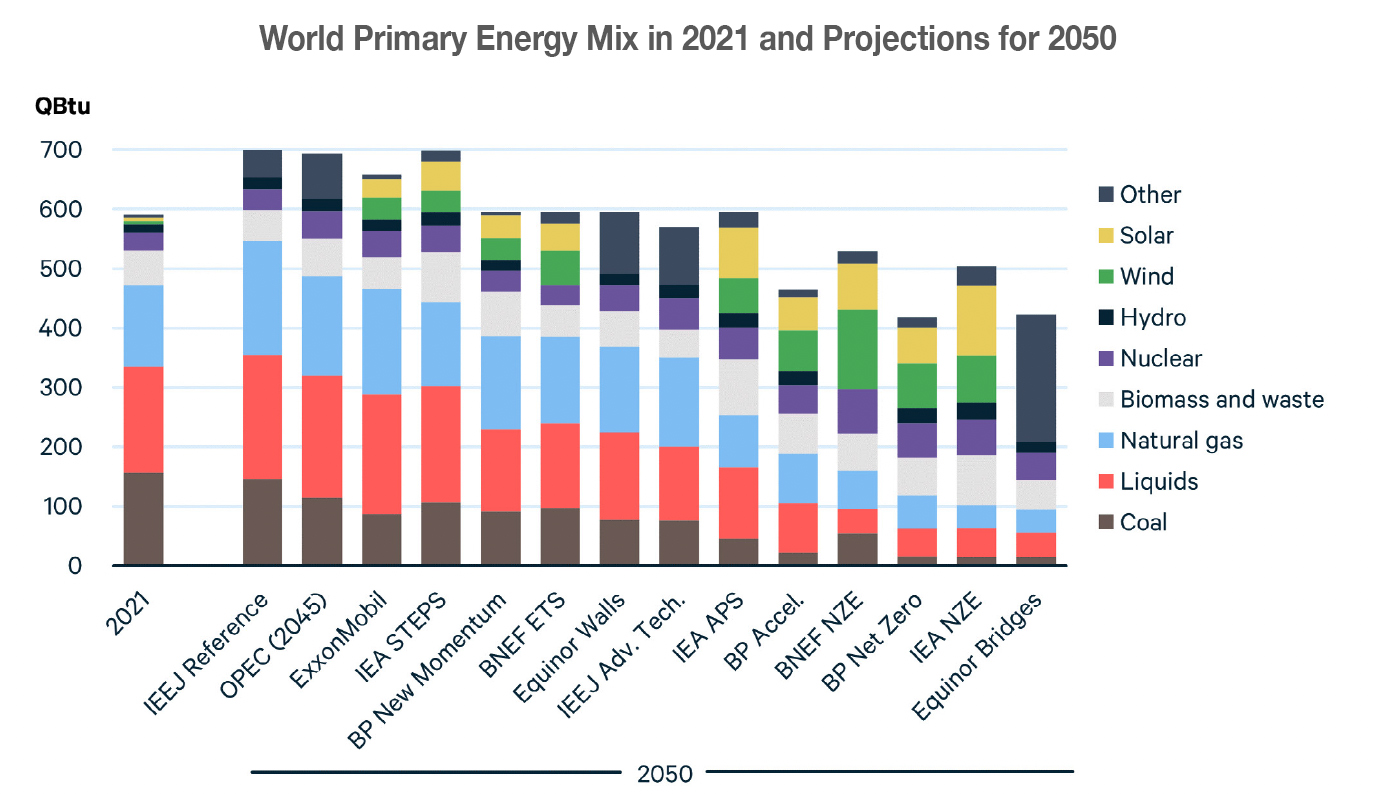

RFF does not model scenarios of its own, but rather analyzes 14 scenarios in seven energy outlooks published in 2022. Sources include Bloomberg New Energy Finance, BP (published in early 2023), Equinor, Exxon Mobil, International Energy Agency, OPEC and the Institute of Energy Economics, Japan (IEEJ).

All scenarios anticipate lower coal consumption in 2050 than 2021, but liquids consumption is higher under four of the 14 scenarios. Natural gas demand rises in eight of the scenarios. All of the scenarios project dramatic increases in wind and solar use, but estimates range from 10% of global primary energy demand in Exxon Mobil’s study to about 50% in Equinor’s.

Changes in projections

Richard G. Newell, president and CEO of RFF, acknowledged the wide range in projections among the outlooks but said clear trends had emerged in the studies over time.

“If you look back five or 10 years, all of these outlooks would have been coal, oil, gas, renewables—everything going up as far as the eye can see, including overall energy consumption,” Newell said during an online discussion of the findings. “The expectation now, across these scenarios, is that energy consumption growth will moderate. It will continue to grow, but it will be less than it has been in the past.”

Demand will be increasingly met by clean energy sources like solar, wind, geothermal, nuclear power and fossil fuels with carbon capture and storage, he said.

“We actually see leveling off, peaking and decline in coal, oil and gas, which you didn’t use to see in these outlooks,” Newell said.

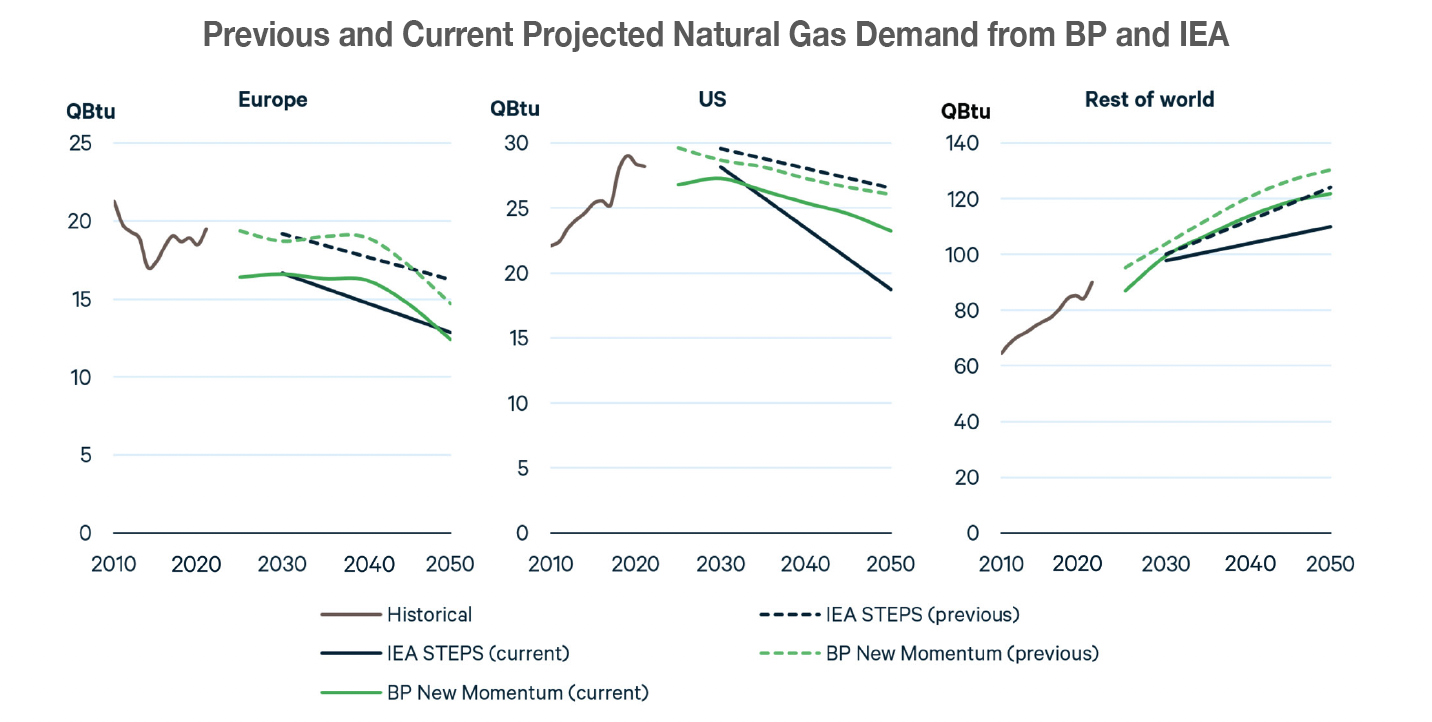

In the last year, projections for natural gas demand in the 2010-2050 time frame have declined sharply. While consumption had been projected to diminish in the U.S. and Europe, while continuing to rise elsewhere in the world, current projections in the BP Energy Outlook and from the IEA show a steeper decline.

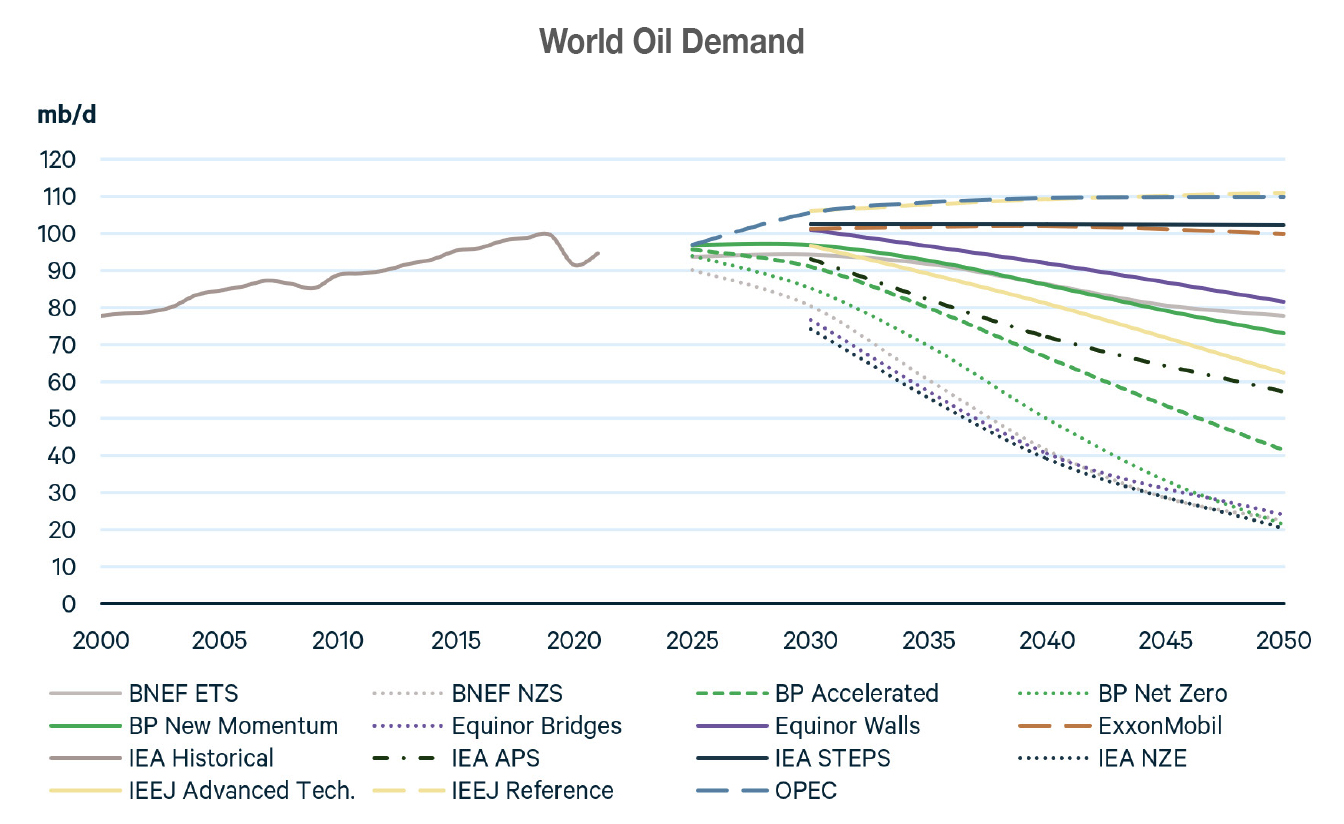

Most scenarios forecast considerably lower global demand for oil by 2050. The exceptions are reference scenarios from IIEJ, Exxon Mobil and OPEC.

Those three scenarios show oil consumption plateauing in the 2030s and remaining at or above 100 MMbbl/d through 2050. Those levels would allow international climate targets to be met.

“The real divergence is what one assumes about nations’ willingness to put in place the changes that are necessary to move global emissions and national emissions down rapidly,” Newell said. “The current path is not even close to that.”

Economics and markets will no longer drive energy consumption, as they have in the past, he said. In the era of the energy transition, policy will take a leading role.

“And the question is: how ambitious is going to be that policy? How fast? How deep does it take hold?” Newell asked. “Not just in countries like the U.S. and Europe, but also across the world.”

Recommended Reading

EY: How AI Can Transform Subsurface Operations

2024-10-10 - The inherent complexity of subsurface data and the need to make swift decisions demands a tailored approach.

E&P Highlights: Nov. 4, 2024

2024-11-05 - Here’s a roundup of the latest E&P headlines, including a major development in Brazil coming online and a large contract in Saudi Arabia.

E&P Highlights: Aug. 19, 2024

2024-08-19 - Here’s a roundup of the latest E&P headlines including new seismic solutions being deployed and space exploration intersecting with oil and gas.

E&P Highlights: Aug. 26, 2024

2024-08-26 - Here’s a roundup of the latest E&P headlines, with Ovintiv considering selling its Uinta assets and drilling operations beginning at the Anchois project offshore Morocco.

Now, the Uinta: Drillers are Taking Utah’s Oily Stacked Pay Horizontal, at Last

2024-10-04 - Recently unconstrained by new rail capacity, operators are now putting laterals into the oily, western side of this long-producing basin that comes with little associated gas and little water, making it compete with the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.