An intensified global focus on energy security, stemming from the Russia-Ukraine war, will likely hasten the move away from fossil fuels toward greener sources, BP said Jan. 30 in its 2023 Energy Outlook.

But the report’s lead author emphasized the continued importance of oil and gas as the world’s economies transition to new energy sources.

“Even in Accelerated/Net Zero [scenarios], in which oil and gas demand fall materially … the natural rate of decline of existing production is even greater, meaning that continued investment in upstream oil and gas is required to meet future demand,” Spencer Dale, BP’s chief economist, said during the company’s webcast discussing the report.

BP employs three scenario designations in its outlook modeling:

- Accelerated, which assumes a significant tightening in climate policies;

- Net Zero — a “what if” scenario like Accelerated that also assumes a shift in societal behavior and preferences that further support gains in energy efficiency and low-carbon energy; and

- New Momentum, which models the current broad trajectory of the world energy system, including the speed and global ambitions for decarbonization.

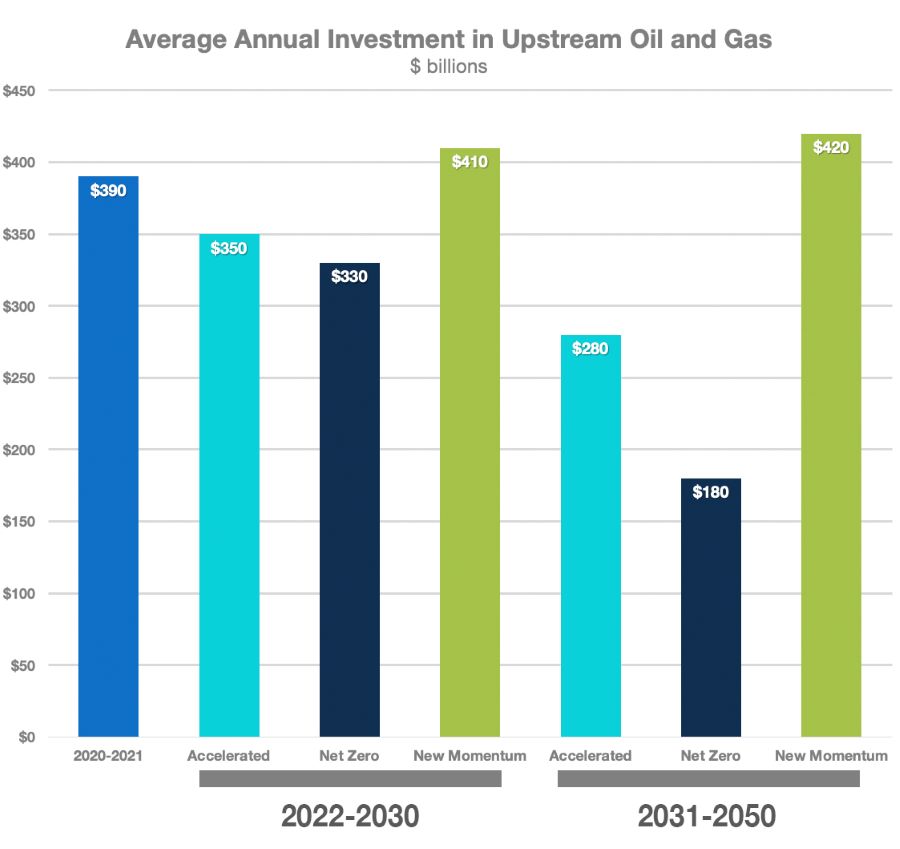

Depending on the scenario, global investment in oil and gas — about $390 billion globally from 2020 to 2021 — declines at different rates. In the Net Zero scenario, it falls by about 15% from 2022 to 2030. In the 2031 to 2050 time frame, the global average annual investment drops by more than half to $180 billion a year. The decline in the Accelerated scenario is not as dramatic but still significant. Investment increases, but only modestly, in the New Momentum scenario.

“… continued investment in upstream oil and gas is required to meet future demand.” – Spencer Dale, BP

Echoing Dale’s concerns during the webinar, Jason Bordoff, founding director of Columbia University’s Center for Global Energy Policy, noted the possible repercussions if fossil fuel investments were to decline too rapidly.

“How do you make sure that you’re synchronizing—as much as possible—declines in investment in supply with the declines in demand?” he asked in a subsequent discussion. “Because if you see declines in supply but demand doesn’t fall, the consequence is going to be higher prices and more volatility and maybe more, not less, geopolitical influence for traditional petro-states that step in to fill the gap.”

War’s lasting impact

Dale described three major energy implications of the war in Ukraine: heightened concerns for energy security, the changing composition of global energy supplies and weaker economic growth.

The renewed focus on energy security is assumed to cause countries to want to reduce their dependence on imported energy and instead consume more domestically produced energy, he said. It also spurs improvements in energy efficiency.

“History has taught us that threats to energy security can have large and persistent impacts on the structure of global energy,” Dale said.

“People jump through hoops when energy security is at risk.” – Jason Bordoff, Columbia University’s Center for Global Energy Policy

For example, the 1970s Arab oil embargo led to the creation of the Strategic Petroleum Reserve in the U.S. and a massive buildout of nuclear power plants in France.

The common thread to this era is the demand to relieve dependence on imported fossil fuels with higher demand for renewables and other non-fossil fuels, which are predominantly produced domestically, he said. This will help to accelerate the energy transition.

“People jump through hoops when energy security is at risk and we have a growing—not yet sufficient, but growing—sense of urgency that we need to jump through hoops a lot faster to deal with the climate crisis,” Bordoff said. “When you layer on top of the urgency of dealing and coping with energy security risks, I think that is a powerful combination.”

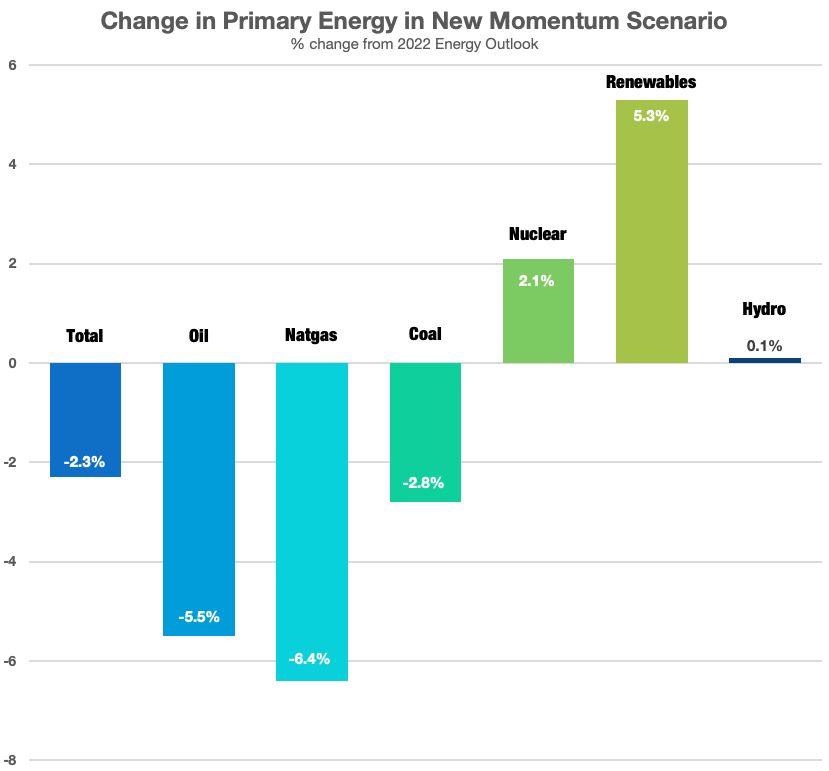

To examine the New Momentum scenario, BP compared its Energy Outlook with the 2022 report. The change in energy consumption varies, depending on the fuel, but oil and natural gas will experience a disproportionately large impact, Dale said.

Weaker economic growth is seen over the near term in high food and energy prices, which BP expects to persist for the next few years. Over the long term, fallout from the war will result in a reduction in the pace of global integration and trade as countries and regions reduce their exposure to international shocks, the outlook says. The slower pace of globalization will curb economic growth over the next 30 years.

The effect will be small on a yearly basis—only about 0.1%—but over time will reduce global GDP by around 4% in 2050. Its impact on countries will vary. Emerging Asian economies will be hit much more harshly than developed economies, such as the U.S.

Recommended Reading

Energy Transition’s Big Ticket Item? $1.5T in Natgas Infrastructure

2024-09-19 - Energy executives from companies such as Cheniere and Woodside are planning for the energy transition—and natural gas as part of it.

Exclusive: MET Eyes US LNG as European Natgas Demand Slows

2024-10-03 - Europe's MET Group has its eye on U.S. LNG as European natural gas demand is forecasted to decrease, said Benjamin Lakatos, chairman and CEO of MET Group, at Gastech 2024 in Houston.

Growing Natgas Supply Up for Grabs, but Extra NGL Headed Overseas

2024-09-25 - The additional growth of the liquids export market will be tied to an unpredictable natural gas market, experts say.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.