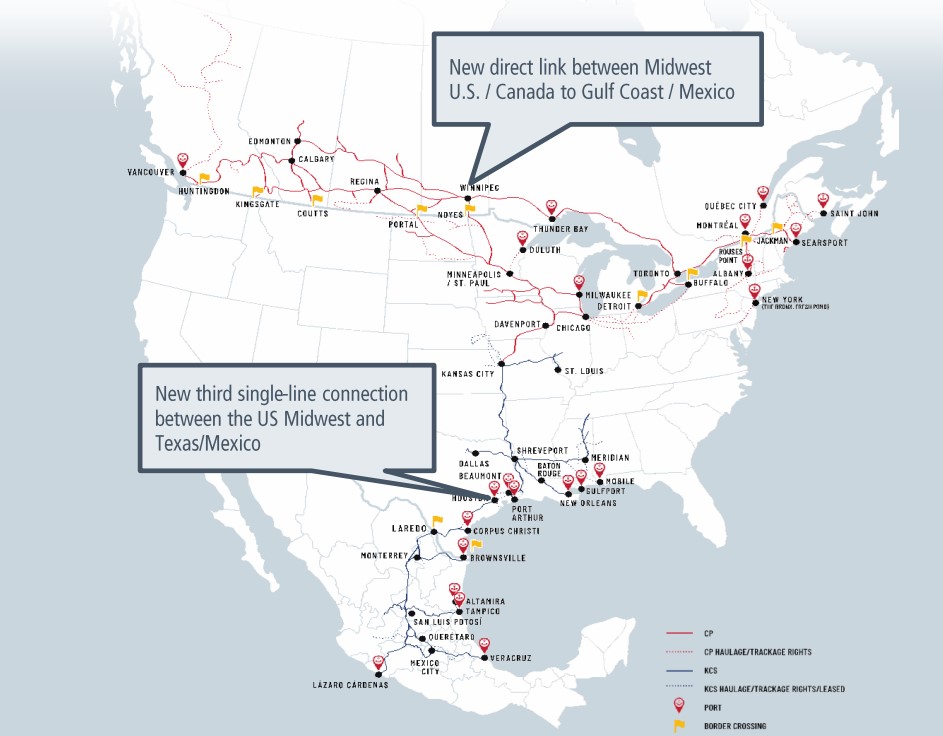

Canadian Pacific Railway and Kansas City Southern’s new CPKC rail system creates the only crude-by-rail and refined products network spanning Canada to Mexico. (Source: Shutterstock.com)

The long-pending megamerger to create the “Canadian Pacific Kansas City” (CPKC) railroad could take effect in mid-April after U.S. regulators approved on March 15 a combination that would create the only single-line railway connecting North America from Canada through Mexico.

Canadian Pacific Railway’s (CP) $27 billion acquisition of Kansas City Southern (KCS) will create a rail network that would stretch from the Canadian oil sands into Mexico, including crude-by-rail to the U.S. Gulf Coast and refined products shipments into Mexico.

“A combined CPKC will connect North America through a unique rail network able to enhance competition, provide improved reliable rail service, take trucks off public roads and improve rail safety by expanding CP's industry-leading safety practices,” Canadian Pacific CEO Keith Creel said in a news release.

The deal also comes as the rail industry is receiving extra scrutiny since the February derailment of a Norfolk Southern train carrying toxic materials in East Palestine, Ohio.

As such, the regulatory U.S. Surface Transportation Board (STB) said the merger decision includes an “unprecedented seven-year oversight period,” including conditions designed to mitigate environmental impacts, preserve competition, protect railroad workers and promote efficient passenger rail. The STB also said the merger should result in improvements in safety and reductions of carbon emissions.

Although the sale already closed in a voting trust in late 2021, the two companies could not become the integrated CPKC until they received STB approval following the lengthy review process that well exceeded the initial estimate of 12 months.

STB’s decision authorizes CP to take over KCS as early as April 14, 2023, and then formally combine to create the new CPKC. Creel said CP is reviewing the full 212-page decision in detail and will soon announce a more specific timeline.

Combination a long time coming

The largest North American railway merger of this century is expected to prove more beneficial thanks to the revised U.S.-Mexico-Canada Agreement trade deal from 2020.

With only seven major freight railroad companies left in North America, CP's regulatory argument was that only the two smallest, CP and KCS, should be allowed to merge because their networks do not overlap and they meet neatly in Kansas City, Missouri. The larger rival, Canadian National Railway, which offered more money for KCS, received more regulatory pushback because it has more routes that run parallel with the KCS network.

CP also has highlighted that KCS holds a 10-year extension to its concession exclusivity rights in Mexico until 2037, creating long-term certainty for the value of the merger.

Canadian crude-by-rail exports into the U.S. averaged 126,198 bbl/d as recently as December, which is well down from the pre-pandemic high of 411, 991 bbl/d in February 2020, according to the Canada Energy Regulator.

Rebounding crude-by-rail exports fell again are projected to rise in the fall of 2021 when Enbridge’s Line 3 replacement project came online, easing the longstanding Canadian oil bottleneck into the U.S. However, rail exports are expected to tick up more through much of 2023 until the Trans Mountain Pipeline expansion comes online, most likely in 2024.

Megamerger may ‘enhance safety’

One big impact touted by both Canadian Pacific and the STB is the amount of commercial trucks that could be taken off of the roads.

“The [STB] expects that this new single-line service will foster the growth of rail traffic, shifting approximately 64,000 truckloads annually from North America’s roads to rail, and will support investment in infrastructure, service quality, and safety,” the board said in its decision.

The board added that approval of the transaction may even enhance safety for the nation as a whole.

“Thus, any rail traffic diverted to CPKC from other railroads will likely mean traffic moving to a railroad with a better safety record,” according to the board’s decision.

Headquartered in Calgary, CPKC would remain the smallest of six U.S. Class 1 railroads by revenue, CP said. The combined company will have a much larger network though across North America, operating about 20,000 miles of rail and employing close to 20,000 people.

“This transaction is ‘end-to-end,’ meaning that there are little-to-no track redundancies or overlapping routes,” the STB added. “If consummated, it will reduce travel time for traffic moving over the single-line service; it should result in increased incentives for investment; and it will eliminate the need for the two, now-separate CP and KCS systems to interchange traffic moving from one system to the other. This will enhance efficiency, which in turn will enable the new CPKC system to better compete for traffic with the other larger Class 1 carriers.”

Recommended Reading

Supreme Court Passes on MVP Appeal Challenging FERC’s Authority

2024-05-21 - The Supreme Court declined to take up a lawsuit against the Mountain Valley Pipeline, the latest in a series of legal maneuverings over a case filed by opponents of the pipeline.