(Source: Acoustic Data)

Downhole data is essential to improving the understanding of the reservoir and in optimizing the well’s performance. Real-time pressure and temperature information provided by hardwired and wireless downhole gauge systems allow engineers to optimize output in real time without deferring production, which is not possible with sporadic data gathered by memory gauge surveys.

Wireless data acquisition systems such as Acoustic Data’s SonicGauge offer flexible monitoring which can be deployed in a wide range of applications throughout the lifecycle of the field. The technology can provide surface-read-out of data from drill stem testing (DST); to slickline retrofit in existing well stock for both routine short-term pressure surveys, or long-term reservoir surveillance; to multi-year barrier verification for plug and abandonment (P&A).

Historically, wireless telemetry systems were almost exclusively deployed in support of DST operations of exploration and appraisal wells. The technologies have provided valuable insight into reservoir behaviour during pressure build-ups, clean-up, flowback, fracture injection testing or measuring dynamic bottomhole treating pressures. In high-value deployments, duplex communication has also allowed the remote control and activation of downhole tools such as fluid samplers, electronic firing heads and shut-in valves from surface, with confirmation signals being transmitted back. These high-tech systems enable active and efficient management of the test, which in turn reduces rig time and uncertainty.

During completion activities, permanent downhole monitoring systems—cabled PDMS or PDHG—are generally installed to continuously monitor downhole pressure and temperature (P/T) and are now well-established technologies in the industry. In the early days, the systems were often restricted to “key” wells due to cost and operational constraints, meaning that many wells did not have active production management information. Additionally, many of these cabled systems failed for reasons such as cable splicing or electronic sensor failure. In most cases, the cost and risk of a workover meant that the system was not repaired or replaced, again leaving the well without essential production management information.

In wells without a functional permanent monitoring system, operators have historically run memory gauge surveys which bring well integrity risk, ongoing opex, and deferred production during installation and retrieval.

Today, the operator has a third option: the installation of a wireless telemetry system which requires a short slickline intervention to make real-time P/T data available at their desktop for years at a time.

A Downhole Dilemma?

Both real-time wireless gauge systems and memory gauge surveys require a slickline intervention to deploy and recover the tools. However, cutting edge wireless technology is able to save high-frequency data to memory while also providing live downhole data that can be used to identify and correct issues with the production of the well in real time.

Operating life is a critical parameter to be considered for gauge deployment. Onboard batteries power both memory and wireless gauges, so energy efficiency is the key to system longevity. Advances in electronics mean new-generation tools can operate in the wellbore on a micro-energy budget for years at a time before recovery, data download, battery change and redeployment.

Long deployment times free up slickline capacity for other well maintenance, important where well stocks are large, and the availability of slickline units is limited.

A Wireless World

The same advances that have reduced power consumption have also enabled portability and ease of use. A new generation of acoustic telemetry systems such as the SonicGauge fit within standard airline baggage allowances (23kg) and are both portable and safe to handle at the rig site. Lightweight surface read-out systems can be installed within a few hours, connecting to an existing data collection network or sending data independently via a 3G/4G network or satellite from remote locations. Combined, all of these advances are now opening up more economic possibilities and applications—from remote locations to high-volume onshore markets.

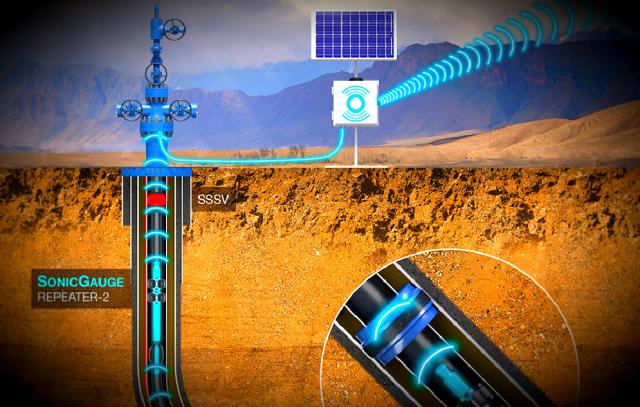

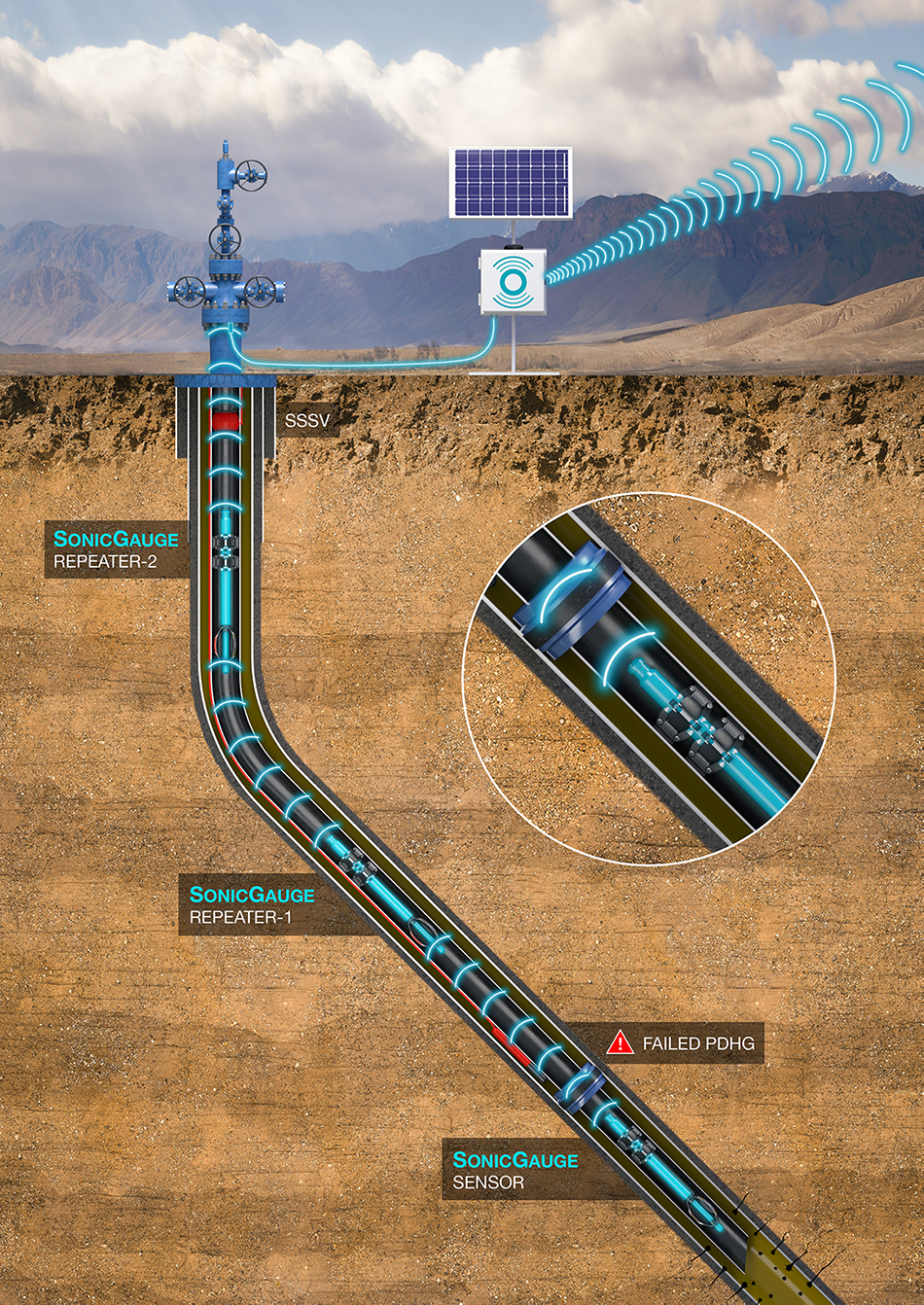

While the underlying measurement of pressure and temperature is broadly similar to conventional cabled systems, the method by which the SonicGauge sends data to surface is different. Data is measured, encoded and transmitted to surface as a vibration. At the wellhead, a small magnetically mounted accelerometer picks up the vibration which is decoded and displayed on the surface data logger.

Typically, wireless repeater stations are used to boost acoustic data packets to surface due to signal strength decaying with distance, essentially removing any depth limitation in regard to the installation of the lowest gauge in the well. Deployment of the downhole SonicGauge System on the Barracuda HEX-Hanger technology allows both placement of the measurement sensor at the required location in the wellbore and spacing of the repeater stations at optimal positions. An added bonus of Acoustic Data’s repeater network is that each station can be equipped with its own unique P/T sensor, meaning the system could monitor multiple zones and produce real-time pressure gradients, if required.

Field-Scale Systems

As with every investment decision, the cost has to be weighed against improved productivity, efficiency and output. By considering wireless downhole gauge systems as multi-year data acquisition systems, the economic analysis clearly shows reduced opex, less production downtime and increased availability of slickline equipment and crews.

Acoustic telemetry systems such as the SonicGauge are a valuable tool for the modern oil and gas industry which is facing more complex and challenging applications, and operating conditions. It’s a key addition to well testing activities, well integrity management, production optimization and reservoir management.

Recommended Reading

Crescent Point Divests Non-core Saskatchewan Assets to Saturn Oil & Gas

2024-05-07 - Crescent Point Energy is divesting non-core assets to boost its portfolio for long-term sustainability and repay debt.

Permian Resources Adds More Delaware Basin Acreage

2024-05-07 - Permian Resources also reported its integration of Earthstone Energy’s assets is ahead of schedule and raised expected annual synergies from the deal.

Evolution Petroleum Sees Production Uplift from SCOOP/STACK Deals

2024-05-07 - Evolution Petroleum said the company added 300 gross undeveloped locations and more than a dozen DUCs.

Riley Exploration Permian Closes Delaware Basin Bolt-on

2024-05-08 - Riley Exploration Permian said it added 13,900 acres and up to 25 net locations in Eddy County, New Mexico.

CGG, Baker Hughes Sign MOU for CCS Projects

2024-05-08 - The memorandum of understanding between CGG and Baker Hughes will bring the companies’ complimentary skillsets together to explore carbon capture and sequestration solutions.