Middle Forks, a privately-held E&P backed by Quantum Energy Partners, agreed to buy QEP’s Uinta Basin assets located in eastern Utah. (Source: Hart Energy and Shutterstock.com)

QEP Resources Inc. (NYSE: QEP) said July 10 it’s making headway on the company’s Permian pure-play target with an agreement to sell Uinta Basin assets for $155 million.

Middle Fork Energy Partners LLC, a privately-held E&P backed by Quantum Energy Partners, agreed to buy QEP’s Uinta assets located in eastern Utah in Duchesne and Uintah counties.

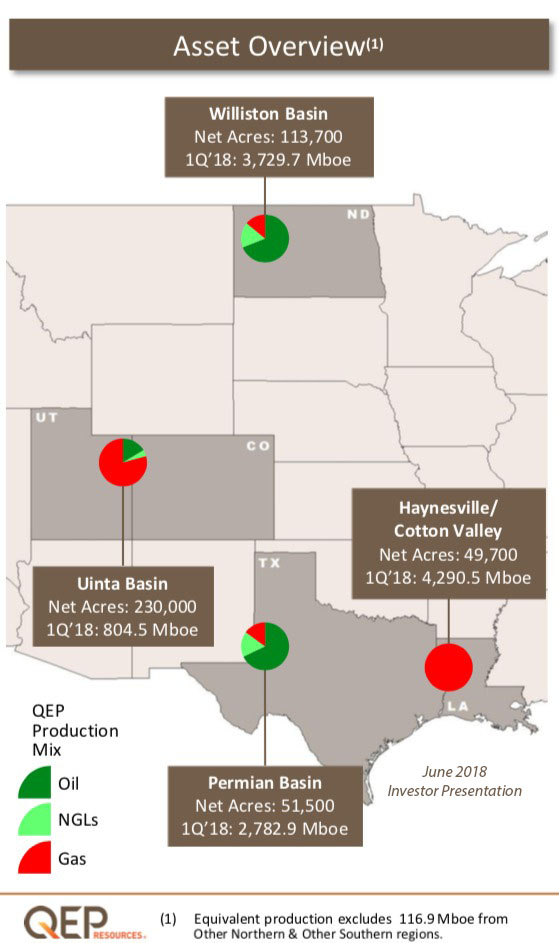

The transaction includes natural gas and oil producing properties, undeveloped acreage and related assets with net production in the first quarter of 54 MMcfe/d, of which about 23% was liquids. The assets, which cover about 230,000 net acres, also have an estimated 605 Bcfe of proved reserves.

QEP’s divestiture is part of its plans announced in late February to jettison roughly 85% of its holdings in order to regroup as a Permian pure player.

Analysts have speculated that the sales across four states in the Williston, Uinta and Haynesville/Cotton Valley plays could generate between $2 billion and $3 billion in proceeds. The proceeds will be used to pay down debt and cover cash flow outspend for first-half 2019. QEP will also consider share repurchases with any remaining funds.

Analysts with Capital One Securities Inc. said proceeds from QEP’s Uinta exit “narrowly” exceeded its modeled value of $139 million.

“The sale comes as no surprise given QEP’s strategy to become a pure-play Midland Basin operator first announced in February,” Capital One analysts said in a July 10 note. “The Uinta is the smallest of what QEP has put on the auction block, but next up in the sequence of planned divestitures is the much larger Williston asset.”

Charles B. Stanley, chairman, president and CEO of QEP, said the company had made “significant early progress” in regard to the asset sales during its first-quarter earnings call on April 26.

“We are seeing strong interest in both the Uinta and Williston basin packages... We anticipate closing the sales of these assets in the second half of the year,” Stanley said.

He added that work was underway for the sale of the company’s Haynesville/Cotton Valley assets, which QEP intends to market in the second half of the year.

QEP also currently has packages of mineral assets in the Uinta Basin still for sale through EnergyNet.

Capital One analysts estimate the value of QEP’s Williston assets at about $2.4 billion and roughly $750 million for the company’s Haynesville assets.

Middle Fork, the buyer of QEP’s Uinta assets, was formed in 2017 with an initial capital commitment from Quantum of more than $200 million earmarked for assets in the Rocky Mountain region.

Porter Hedges LLP provided legal counsel to Middle Fork for the acquisition. Citigroup Global Markets Inc. was financial adviser and Latham & Watkins LLP provided legal counsel to QEP.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Trio Chairman Robin Ross Named CEO Less Than a Month After Return

2024-07-15 - Robin Ross, who last month returned to Trio Petroleum as board chair, has been named CEO while predecessor Michael Peterson will remain as a consultant.

Riley Permian Increases Stake in West Texas Power JV with Conduit

2024-05-22 - Riley Exploration Permian increased its ownership in RPC Power, a JV with Conduit Power, to 50% from 35% and has agreed to sell up to 10 MMcf/d of natural gas as feedstock supply for the generation facilities as RPC plans to sell to ERCOT.

Earthstone’s Anderson Relaunches, Seeks Conventional

2024-05-24 - The new E&P PetroPeak Energy will also take a look at unconventional property in the Eagle Ford and Austin Chalk.

Permian Resources Completes Liquidation of Canada’s Lynden Energy

2024-05-28 - Permian Resources said the liquidation of Lynden Energy, a subsidiary of Earthstone Energy, will simplify its corporate structure and reduce go-forward tax obligations at the time of the Earthstone acquisition.

Hess Shareholders Approve Chevron Merger

2024-05-28 - Hess Corp. stockholders voted in favor of the company’s merger with Chevron Corp. during Hess’ May 28 special meeting.