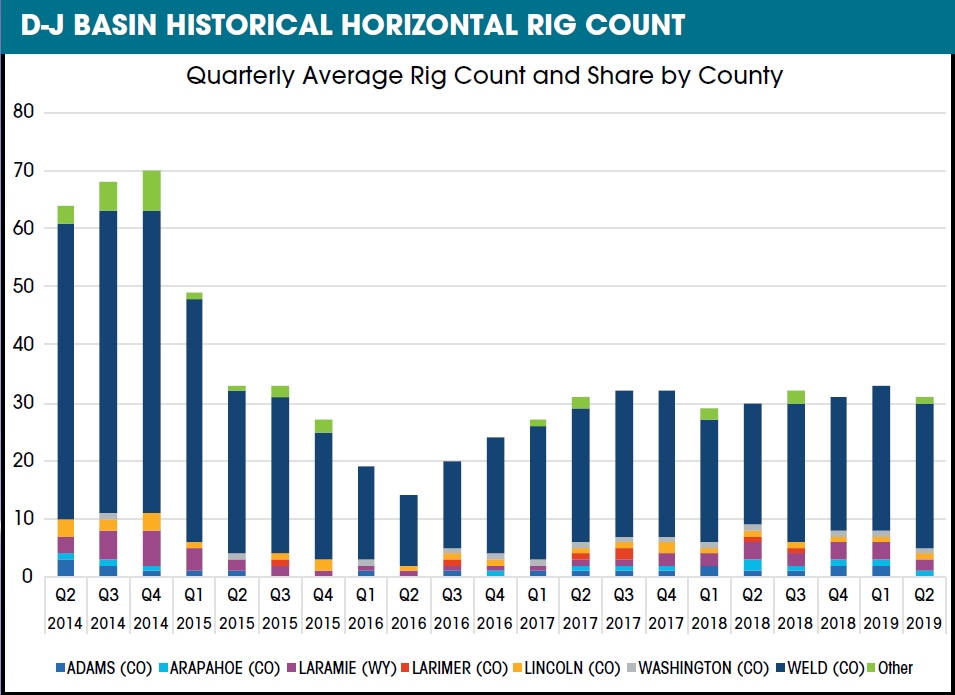

The Denver-Julesburg (D-J) Basin covers an expanse of 181,299 sq km (70,000 sq miles) comprising multiple crude oil and liquids-rich gas plays in Colorado and southeast Wyoming. With 29 active rigs (28 for oil and one for gas), according to the May 24 rig count prepared by Baker Hughes, a GE company, the basin continues to maintain high rates of production.

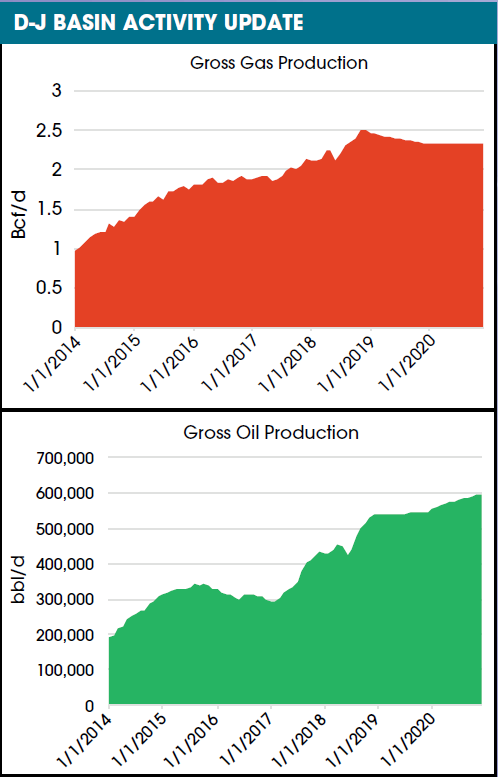

Drillinginfo forecasts gross gas production for 2019 at about 65 MMcm/d (2.3 Bcf/d) in the basin, with gross oil production at about 550,000 bbl/d, according to an exclusive report provided to E&P.

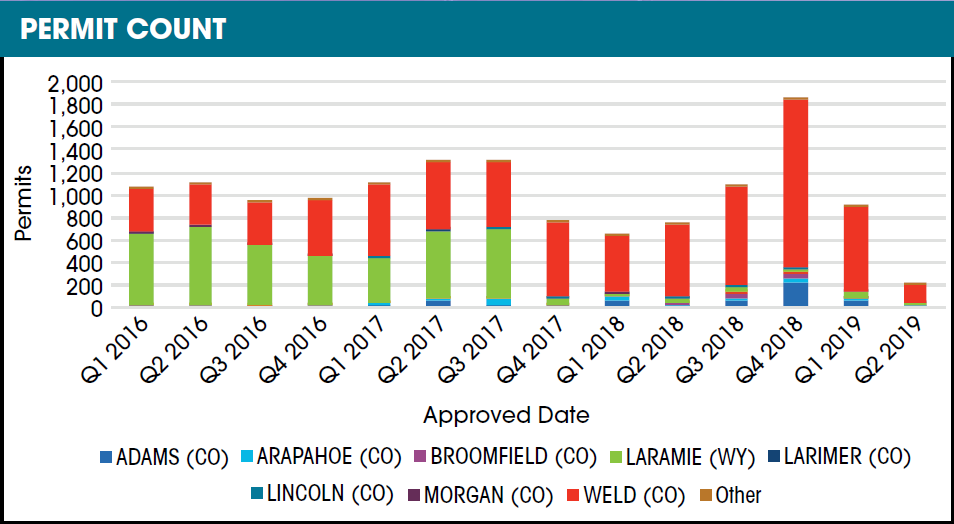

Permitting activity in the basin experienced a spike in the fourth quarter of 2018, up 72% quarter over quarter due to fears of future regulations in Colorado following the failure of Proposition 112, reported Drillinginfo, adding that almost 90% of the permits filed were in Weld and Laramie counties.

However, where one bill failed, another found success. The signing of Senate Bill (SB) 181 by the Colorado Governor Jared Polis in April gives land usage authority for oil and gas E&P to local authorities. As regulators determine the particulars of the law, permitting activity dropped by about half, from more than 1,800 permits filed in the fourth quarter of 2018 to about 900 in the first quarter of this year, according to the report.

Speaking at the recent DUG Rockies exhibition and conference, Colorado Senator John Cooke noted that Adams County, where 3.6 MMbbl were produced last year, has already halted new licenses for six months. Commissioners for Weld County, the state’s most productive county for drilling with more than 157 MMbbl produced in 2018, said the county will not adopt stricter rules.

Eric Jacobsen, senior vice president at Extraction Oil and Gas, told attendees that the company is tagged by many as one of the companies in the region most likely to be affected by SB 181 due to its acreage in Boulder. However, he said the company already operates within the spirit of SB 181 in several aspects, and he believes the company has a competitive edge in working with the new regulations.

______________________________________________________________________________________________________

Recommended Reading

Hirs: AI and Energy—Is There Enough to Go Around?

2024-11-07 - AI data centers need a constant supply of electricity, and the nation’s grids are unprepared.

As Permian Gas Pipelines Quickly Fill, More Buildout Likely—EDA

2024-10-28 - Natural gas volatility remains—typically with prices down, and then down further—but demand is developing rapidly for an expanded energy market, East Daley Analytics says.

Range Confirms: Data Center Talk Underway for Marcellus Gas-fired Power

2024-10-24 - Deals will take a while, however, as these multi-gigawatt agreements are also multi-decade investments, said Range Resources CFO Mark Scucci.

Companies Hop on Digital Twins, AI Trends to Transform Day-to-day Processes

2024-10-23 - A big trend for oil and gas companies is applying AI and digital twin technology into everyday processes, said Kongsberg Digital's Yorinde Lokin-Knegtering at Gastech 2024.

Morgan Stanley Backs Data Center Builder as AI Fervor Grows

2024-10-21 - Morgan Stanley Infrastructure Partners (MSIP) is backing data center developer Flexential as demand for AI and high-performance computing grows.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.