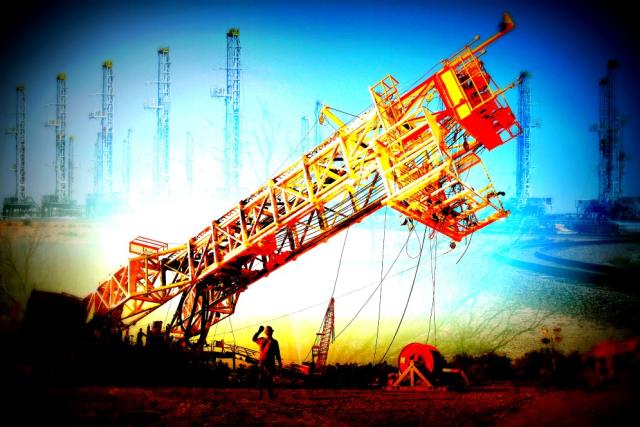

Everything about the Permian shouts big and 2018 looks poised to be the biggest year yet for this prolific basin. (Image: Hart Energy)

A version of this story appears in the April 2018 edition of Oil and Gas Investor. Subscribe to the magazine here.

Everything about the Permian shouts big: big areal extent, big production, big rig counts and big potential. Notably, 2018 looks poised to be the biggest year yet for this prolific basin.

In 2017, oil production averaged more than 2.5 million barrels per day (MMbbl/d) in 2017, an increase of 26% from 2016. Additionally, wellhead gas volumes grew by a little above 7% to almost 30 billion cubic feet per day. The growth was largely driven by surging rig counts. Compared with 2016, rig activity essentially doubled with year-end counts at 400 in the Permian. Of those rigs, Stratas Advisors estimated that almost 90% were drilling for the Wolfcamp and Bone Spring plays.

Stratas predicts record production growth in the Permian in 2018 and will likely reach about 3.9 MMbbl/d at year-end, up from roughly 2.9 MMbbl/d in December 2017. The lion’s share of the growth is coming from the Delaware Basin Wolfcamp, where production is projected to surpass 1.5 MMbbl/d at year-end. Adding to this is the Midland Basin Wolfcamp with more than 1 MMbbl/d and the Bone Spring with almost 500,000 bbl/d. The Spraberry trend and a mix of other Permian formations round out the rest of basin production.

Record Permian growth is based on robust drilling activity coupled with longer lateral wells and new completion designs. During the first quarter, the basin sustained an average rig count of 425, an increase of 35% vs. last year. While additional growth in the number of rigs drilling is feasible, incremental growth is more likely as operators shift their attention to optimizing the latest well designs. Hence, Stratas’ forecast assumes relatively flat rig counts through year-end. The firm estimates a year-end Permian rig count of about 440 units.

Longer laterals are a big deal! They are anything but new, even in the Permian. However, wide-scale applications of long laterals and stage-spacing optimization are a big thing for the basin this year. Long laterals are a key factor leading to the Permian’s record-setting production growth. Stratas estimates lateral lengths will increase by roughly 25% in 2018 compared to recent standards averaging just under 6,000 ft. Using a new 7,500-ft figure, Stratas estimates drillers will create between 40- and 50 million ft of new lateral footage in the Permian this year. The firm estimates less than 30 million ft of lateral were drilled in 2017.

When it comes time for stimulating all this newly created wellbore, operators will increasingly opt for tighter stage and cluster spacing, which also leads to higher proppant loading. Higher proppant loading is the second key factor behind the Permian’s astonishing production growth. A comment worth noting—higher proppant loading will not transform poor rock into great rock. Rock quality matters.

An exercise in napkin math. Let’s assume that 2017 finished with 30 million ft of wellbore being fracked using an average of 1,200 pounds of proppant per ft. Some simple math leads to a total of 36 billion pounds of proppant. Stratas’ 2018 numbers assume 45 million ft of lateral (midpoint) and 1,500 pounds of proppant per ft yields about 68 billion pounds of proppant. That’s a lot of proppant, and a whopping 88% increase in demand. To be sure, the actual amount of proppant per ft could be much higher if history provides any indication.

Long laterals and higher-cost completions boost Permian spending to more than $40 billion in 2018. Given the attractive economics found in the Delaware sub-basin, the region is a magnet for capital. In aggregate, the sub-basin is expected to capture more than 60% of total Permian spending, followed by the Midland Wolfcamp at almost a third. Drilling down (pun intended) into per well costs, Stratas estimates completions now comprise about 65% of total D&C cost and drilling 35%. Other costs add about 10% of total D&C costs to the overall well cost.

Completion costs contain the greatest risk, as demand for these services remains high. Stratas assumes utilization rates will remain elevated through the year, leading to greater than 20% hikes in completion costs in the Permian this year. Several operators have announced measures to control completion costs, such as sourcing proppant from local sand sources.

Drilling costs in the basin could also encounter cost pressures, albeit substantially more modest than increases expected for completions. While longer laterals are adding modest increases to drilling times, Stratas believes the increases should be easily managed in the current market. On average, the firm estimates spud-to-spud times will average 22 to 26 days in the Wolfcamp and 18 to 20 days for the Bone Spring, up from prior low 20-day and 17-day estimates, respectively.

Everything is bigger in the Permian this year. Larger production fueled by bigger completions and laterals will lead to big spending. Assuming prices remain at or near recent levels, Stratas anticipates the Permian will generate adequate cash flow to cover projected spending.

Recommended Reading

CEO: Baker Hughes Lands $3.5B in New Contracts in ‘Age of Gas’

2024-07-26 - Baker Hughes revised down its global upstream spending outlook for the year due to “North American softness” with oil activity recovery in second half unlikely to materialize, President and CEO Lorenzo Simonelli said.

Pemex Hits Debt Target, Struggles to Reverse Production Declines

2024-07-26 - Pemex achieved its long-term debt target, which aimed to gets its financial obligations below the $100 billion, while struggling to halt production declines.

Dividends Declared in the Week of July 22

2024-07-25 - Second quarter earnings are underway, and companies are declaring dividends.

NextDecade Appoints Former Exxon Mobil Executive Tarik Skeik as COO

2024-07-25 - Tarik Skeik will take up NextDecade's COO reins roughly two months after the company disclosed it had doubts about remaining a “going concern.”

Freeport LNG Parent Receives Junk-level Credit Score From Fitch

2024-07-25 - Credit-rating firm Fitch Ratings cited the 2 Bcf/d Texas plant’s frequent downtimes among the factors leading to lowering Freeport LNG Investments LLLP’s credit grade on July 25.