PDC Energy Inc. completed its acquisition of SRC Energy Inc. on Jan. 14 in an all-stock merger worth about $1.7 billion, including the assumption of debt.

The two Denver-based independent E&Ps had announced the merger agreement last August. PDC and SRC shareholders both approved the merger at special meetings held Jan. 13.

In a statement on Jan. 14, Bart Brookman, president and CEO of PDC, said: “Today is a pivotal day for PDC as we have completed the merger of these two companies, both of which are grounded in strong core values and a shared commitment to responsible and safe operations.”

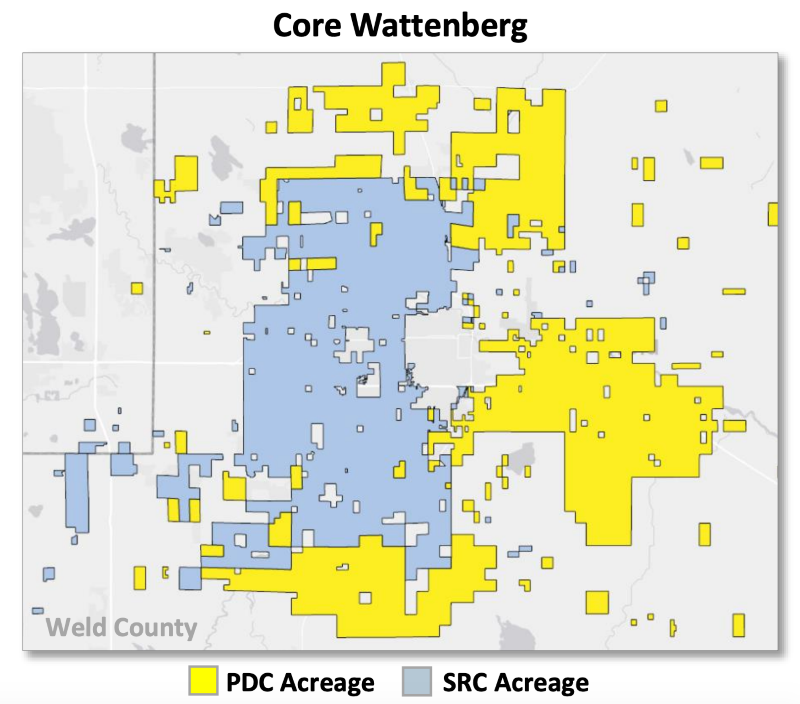

Upon closing, PDC now adds SRC’s core area of operations in the Greater Wattenberg Field of the Denver-Julesburg (D-J) Basin to its portfolio, which includes positions in the D-J Basin as well as in the Permian’s Delaware sub-basin. Combined, the company is set to become the second-largest oil and gas producer in the D-J Basin.

PDC, SRC Energy All-Stock Combination D-J Basin Asset Map (Source: PDC Energy Inc. August 26, 2019 Investor Presentation)

Brookman added that the merger creates a combined company able to “delivering sustainable free cash flow” that would make significant shareholder returns possible—something that had been publicly campaigned for by Kimmeridge Energy Management Co., a private-equity firm which owns a stake in PDC.

In August, PDC said it expected the combination to generate about $800 million of free cash flow between the second half of 2019 and year-end 2021, half of which is planned to be returned to shareholders through an increased share repurchase program.

Under the merger agreement, SRC shareholders received a fixed exchange ratio of 0.158 PDC shares for each share of SRC common stock, representing an implied value of $3.99 per share based on the PDC closing price as of Aug. 23.

PDC also agreed to assume SRC’s net debt of about $685 million as of June 30.

J.P. Morgan was exclusive financial adviser to PDC for the transaction, and Wachtell, Lipton, Rosen & Katz served as its legal counsel. Citi and Goldman Sachs & Co. were financial advisers to SRC and Akin Gump Strauss Hauer & Feld LLP provided the company with legal counsel.

Recommended Reading

Utica’s Encino Boasts Four Pillars to Claim Top Appalachian Oil Producer

2024-11-08 - Encino’s aggressive expansion in the Utica shale has not only reshaped its business, but also set new benchmarks for operational excellence in the sector.

Houston Natural Resources to Rebrand to Cunningham Natural Resources

2024-11-08 - Now rebranded as Cunningham Natural Resources Corp., the company will continue its focus on traditional oil and gas opportunities and energy transition materials.

US Oil, Gas Rig Count Holds Steady for Record Third Week

2024-11-08 - The oil and gas rig count was steady at 585 in the week to Nov. 8, Baker Hughes said on Nov. 8. Baker Hughes said that puts the total rig count down 31 rigs, or 5% below this time last year.

SM, Crescent Testing New Benches in Oily, Stacked Uinta Basin

2024-11-05 - The operators are landing laterals in zones in the estimated 17 stacked benches in addition to the traditional Uteland Butte.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.