The following information is provided by Meagher Energy Advisors. All inquiries on the following listings should be directed to Meagher. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

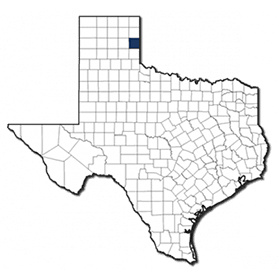

Tapstone Energy LLC retained Meagher Energy Advisors for the sale of Granite Wash upstream and midstream assets in Wheeler County, Texas.

Highlights:

- Shallow decline, horizontal Granite Wash producing properties and wholly-owned midstream assets supplement operating margins and cash flows.

- April estimated EBITDA of $2.65 million with a profit margin of 82% including midstream, and a 12-Month forecast total PDP net cashflow of $30.4 million.

- 32,000 boe in 1P reserves representing a 15.8-year R/P ratio, shallow annual decline rate of 13% for the oil phase and 10% for the gas phase. Limited near-term P&A.

- Trailing Six-Month average net production of 5,532 boe/d consisting of 50% liquids and 50% gas from 194 operated PDP wells.

- Wholly-owned Wheeler Midstream compression and gathering systems contribute over $700,000 in stable fee-based cashflows per month.

- ~9,000 contiguous, de-risked HBP net acres in the core of the Granite Wash. 100% HBP with high working interest and limited royalty burden.

- Ample de-risked development opportunities and high rate-of-return non-producing, behind-pipe opportunities with reserves totaling 19,400 boe.

Bids are due April 19. The transaction is expected to have an April 1 effective date. A virtual data room is available.

For information visit meagheradvisors.com or contact Nick Asher, vice president of business development, at nasher@meagheradvisors.com.

Recommended Reading

Solaris Stock Jumps 40% On $200MM Acquisition of Distributed Power Provider

2024-07-11 - With the acquisition of distributed power provider Mobile Energy Rentals, oilfield services player Solaris sees opportunity to grow in industries outside of the oil patch—data centers, in particular.

Quantum’s Wil VanLoh on Turning ESG into E$G

2024-05-21 - Wil VanLoh, founder and CEO of Quantum Energy Partners said private companies need to change their mindset on ESG because they’re building a product to sell to public companies — and may be missing out on cost savings.

Halliburton Sees NAM Activity Rebound in ‘25 After M&A Dust Settles

2024-07-19 - Halliburton said a softer North American market was affected by E&Ps integrating assets from recent M&A as the company continues to see international markets boosting the company’s bottom line.

Offshore, Middle East Buoys SLB’s 2Q as US Land Revenue Falls

2024-07-19 - Driven by a strong offshore market and bolstered by strategic acquisitions and digital innovation, SLB saw a robust second quarter offset by lower drilling revenue in the U.S.

Liberty Energy Warns of ‘Softer’ E&P Activity to Finish 2024

2024-07-18 - Service company Liberty Energy Inc. upped its EBITDA 12% quarter over quarter but sees signs of slowing drilling activity and completions in the second half of the year.