The following information is provided by Detring Energy Advisors. All inquiries on the following listings should be directed to Detring Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Longreach Alternatives (LRA) has retained Detring Energy Advisors for the sale of its operated oil and gas assets in Andrews County in the northern Midland Basin. The package includes 1,200 boe/d of net production.

Opportunity Highlights:

- ~$17MM NTM PDP Cash Flow | ~1,200 Boed of Net Production | ~90% Liquids

- Oil weighted production stream generated from 6 modern horizontal and 143 vertical wells

- PDP Net Reserves: 3.3 MMBoe

- PDP PV10: $60MM

- Development program fully funded by operating cash flow

- Oil weighted production stream generated from 6 modern horizontal and 143 vertical wells

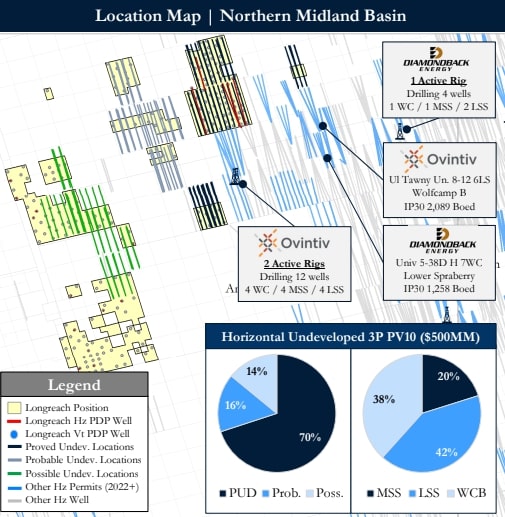

- ~16,000 Net Acre Position | Concentrated Footprint Ready for Development

- Large, contiguous operated position, 100% held-by-production

- Condensed position allows for centralized facilities and operations

- 1 active, operated SWD well handles majority of produced water

- Additional SWD candidates on acreage

- Large, contiguous operated position, 100% held-by-production

- ~180 Remaining Locations | Highly-Economic Reserves

- 84 Proven, 54 Probable, 40 Possible horizontal locations targeting multiple highly productive intervals

- Robust EURs of ~900 Mboe generate IRRs up to 100%+ (average IP30 of 850 Boed)

- 3P Net Reserves: ~80 MMBoe

- 3P PV10: ~$560MM

- De-risked prospects underpinned by recent on- and off-lease development

- Large, operated prospects with developmental control

- $850 per lateral foot of DC&F

- 84 Proven, 54 Probable, 40 Possible horizontal locations targeting multiple highly productive intervals

Bids are due Dec. 15. For complete due diligence, please visit detring.com or email Melinda Faust, managing director, at mel@detring.com .

Recommended Reading

WoodMac: Are MidEast, Asia NOCs Poised For M&A Resurgence?

2024-07-18 - International M&A spend by national oil companies (NOCs) has dwindled from nearly 50% to less than 5% today. But Wood Mackenzie researchers see NOCs playing a larger role in international M&A in the future.

CEO: Devon Eyes 3-Mile Williston Wells With $5B Grayson Mill Deal

2024-07-08 - Devon Energy is digging deeper in the Williston Basin of North Dakota through a $5 billion deal with EnCap-backed Grayson Mill Energy.

US to Close Northeast Gasoline Reserve with 1 MMbbl Sale

2024-05-21 - The Biden administration will sell nearly 1 MMbbl of gasoline in the U.S. managed stockpile in northeastern states as required by law, the Department of Energy said on May 21, effectively closing the reserve.

Exxon Mobil Selling Malaysia Oil, Gas Assets to Petronas - Sources

2024-07-19 - Exxon Mobil, which last year marked its 130th year in Malaysia, has been trying to sell its upstream assets in the country since 2020.

WildFire Energy I Buys Apache’s Eagle Ford, Austin Chalk Assets

2024-05-21 - Private producer WildFire Energy I, backed by Warburg Pincus and Kayne Anderson, scooped up Apache’s portfolio in the eastern Eagle Ford and Austin Chalk plays.