The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Henry Resources retained TenOaks Energy Advisors as its exclusive adviser in connection with the sale of certain nonoperated working interest properties in the Midland Basin.

Transaction Overview:

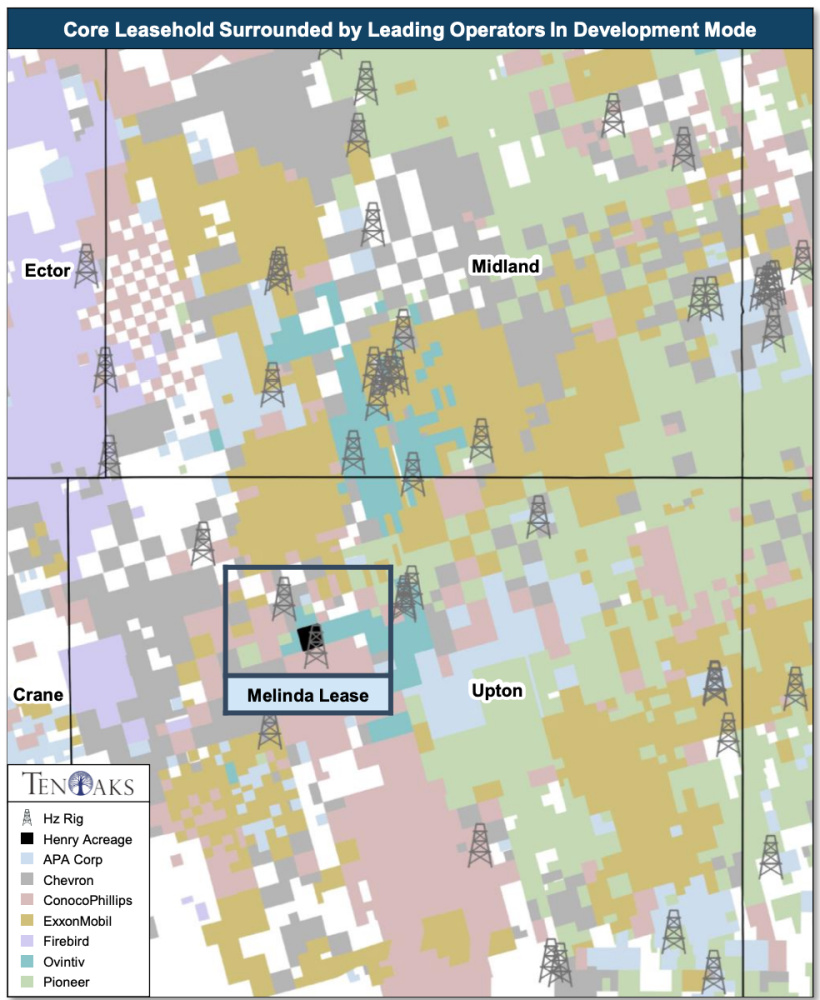

- Henry operates the Melinda Lease (100% working interest) in northern Upton County

- Henry is looking to sell a 45% nonoperated working interest in the Melinda Lease, which includes 13 horizontal PDPs and five horizontal PUDs

- Henry is willing to consider various structures that ensure development of the PUDs

Key Considerations:

- Unique opportunity to partner with a leading Permian Basin operator with an impeccable 50+ year track record developing and operating Permian assets

- PDP PV-10: $30 million | Next 12-month PDP cash flow: $8 million

- Five horizontal PUDs targeting marquee zones with attractive economics (Jo Mill, Lower Spraberry, Wolfcamp A & B)

- EURs from 80-120 boe per ft.

- Development timing subject to a negotiated pace

- Six horizontal rigs currently running within a 5-mile radius

Bids are due at noon CST on Nov. 10. The transaction has an effective date of Oct. 1 and is targeted to close before year-end.

A virtual data room is available. For information visit tenoaksenergyadvisors.com or contact B.J. Brandenberger at TenOaks Energy Advisors at 214-663-6999 or BJ.Brandenberger@tenoaksadvisors.com.

Recommended Reading

Marketed: Anschutz Three-well Opportunity in Powder River Basin

2024-06-25 - Anschutz Exploration Corp. has retained EnergyNet for the sale of three wells in the Powder River Basin.

Marketed: Anschutz Exploration Niobrara Shale Opportunity

2024-05-29 - Anschutz Exploration Corp. has retained EnergyNet for the sale of a Niobrara Shale opportunity in Campbell County, Wyoming.

Marketed: Gulfport Appalachia Utica Oil Opportunity

2024-05-22 - Gulfport Appalachia LLC has retained EnergyNet for the sale of three EOG operated Utica wells in Noble County, Ohio.

Marketed: Anschutz Exploration Powder River Basin Opportunity

2024-06-20 - Anschutz Exploration Corp. has retained EnergyNet for the sale of a Powder River Basin in the Castle 3568-1324-1TH of Converse County, Wyoming.

Marketed: Legacy Income Five Well Package in New Mexico, Texas Counties

2024-05-21 - Legacy Income Fund I has retained EnergyNet for the sale of a five well package in Lea County, New Mexico and Loving County, Texas.