Oil and gas producers continue to heed shareholders’ insistence on capital discipline. And while the austerity of recent years could be as much a function of the energy transition and supply impacts on price dynamics, it has brought a degree of stability to price and routine cash returns.

U.S. producers largely pledged to keep production growth around 5%. In 2022, deal-making was uneven at best, and described as chaotic in some instances. A slow first half of the year gave way to a second half in which large public U.S. E&Ps struck six megadeals worth a combined $14.6 billion.

The discipline has paid off for the biggest players. Producers generated record profits in 2022—the haul of some $200 billion doubled the sector’s previous 12-month returns—and E&Ps returned much of that cash to investors via multibillion-dollar share repurchases and robust dividends.

It was only a matter of time before the industry would chafe at long-term restraint and finally scratch that itch to grow.

Bernstein analyst Bob Brackett said in December 2022 that during the next 12 months, M&A could “pivot from shale bolt-ons to something much grander” as supermajors pull the trigger and target independent shale companies with high-quality inventory.

Brackett named key candidates as Hess Corp., EOG Resources, ConocoPhillips, APA Corp., Devon Energy, Pioneer Natural Resources and Kosmos Energy.

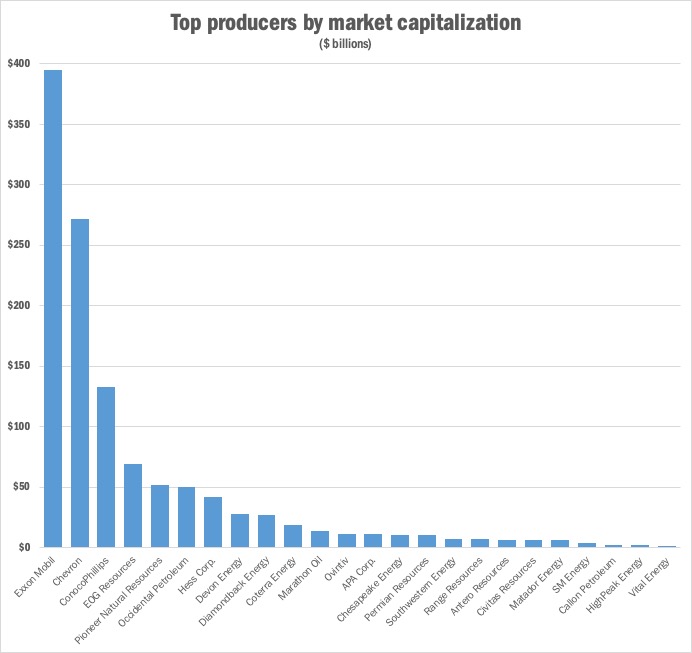

Since October, Exxon Mobil bought Pioneer and Chevron announced its acquisition of Hess, but there still exists a strong but dwindling supply of healthy indies that are ripe for the picking.

Moreover, the shale industry is maturing. The specter of dwindling inventory is very real and likely the catalyst for billions of dollars in asset-level buys in 2023.

“You’re constrained by investors. Your asset base is limited. But at the same time, nobody wants to just live status quo,” one trusted source told me. “Everybody wants to do better next year than this year, grow results and add value.”

Bigger companies tend to trade at higher multiples, and higher priced stocks command more investor attention. In the fight for market relevance, size matters.

That said, a common lament is the public market’s undervaluing of even individual E&Ps and the upstream sector as a whole. On a relative basis, that creates an inexpensive field for M&A and makes an easy case for old-fashioned competition: if you don’t buy it now, someone else might beat you to it.

Corporate M&A in 2023 didn’t just take out top public independents. Occidental Petroleum’s acquisition of CrownRock took a key private Permian Basin producer out of play—and likely boosted the odds that its rival Permian private Endeavor Energy Resources can command the $30 billion price that analysts have floated in recent months. Similarly, when Exxon won the prized Permian player with its Pioneer acquisition, Diamondback’s asking price as the biggest Permian pure play probably increased.

“Before all is said and done, my expectation is that [producers] are going to have to come out of basin. That means you are not going to be able to build a $100 billion company in the Permian,” an investor told me. “If you’re shooting for scale, you’re just going to have to be a bigger, more diversified business. And I think the market’s going to support that because, right now, they’d rather you grow your earnings with scale via consolidation than see you grow your earnings by being a 25% year-over-year grower on the volume side.”

Recommended Reading

Baytex Energy Joins Eagle Ford Shale’s Refrac Rally

2024-07-26 - Canadian operator Baytex Energy joins a growing number of E&Ps touting refrac projects in the Eagle Ford Shale.

US Rig Count Makes Biggest Monthly Jump Since November 2022

2024-07-26 - The oil and gas rig count, an early indicator of future output, rose by three to 589 in the week to July 26.

Private Equity Looks for Minerals Exit

2024-07-26 - Private equity firms have become adroit at finding the best mineral and royalties acreage; the trick is to get public markets to pay more attention.

BP and NGC Sign E&P Deal for Offshore Venezuelan Cocuina Field

2024-07-26 - BP and NGC signed a 20-year agreement to develop Venezuela’s Cocuina offshore gas field, part of the Manakin-Cocuina cross border maritime field between Venezuela and Trinidad and Tobago.

Nabors’ High-spec Rigs Help Keep Lower 48 Revenue Stable in 2Q

2024-07-25 - Nabors’ second quarter EBITDA was down 1% quarter-over-quarter but the company sees signs of increased drilling activity in international markets the second half of the year.