(Source: Pipeline Machinery International)

[Editor's note: A version of this story appears in the January 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

Five years have passed since commodity prices cratered and the energy industry faced an onslaught of producer bankruptcies. For almost as long, producers and midstream companies have squared off over whether dedications in gathering and processing agreements are real property interests—and therefore immune from the reach of the bankruptcy court—or executory contracts that may be shed by a debtor through the restructuring process.

Until recently, the only ruling on the characterization of these dedications, Sabine, came down in favor of producers. However, a recent opinion in Badlands Energy by a Colorado bankruptcy court may have evened the playing field, providing midstream companies leverage in their negotiations with producers.

The financial implications of the characterization of dedications in gathering and processing agreements are huge. Over the past two decades, midstream companies have collectively invested billions of dollars in pipeline infrastructure in response to the domestic shale boom. Transportation and related fees charged to producers are structured to provide midstream companies with a return of and on their investment over the life of the agreement.

The dedications contained in these agreements were intended to act as security for midstream companies (and their financiers), with the understanding that such dedications are real property interests and, therefore, binding on successors to the mineral interests.

The bankruptcy courts provide a unique forum for energy companies duking it out over the characterization of midstream dedications. Bankruptcy courts are federal courts that apply the laws of the state where the property is located to determine the parties’ relative rights. Given the popularity of Delaware and New York as “debtor friendly” filing venues, bankruptcy courts from these districts are often tasked with construing complicated and archaic property laws from states with significant oil and gas reserves, like Texas and North Dakota. These circumstances tend to favor producer-debtors over their midstream counter-parties.

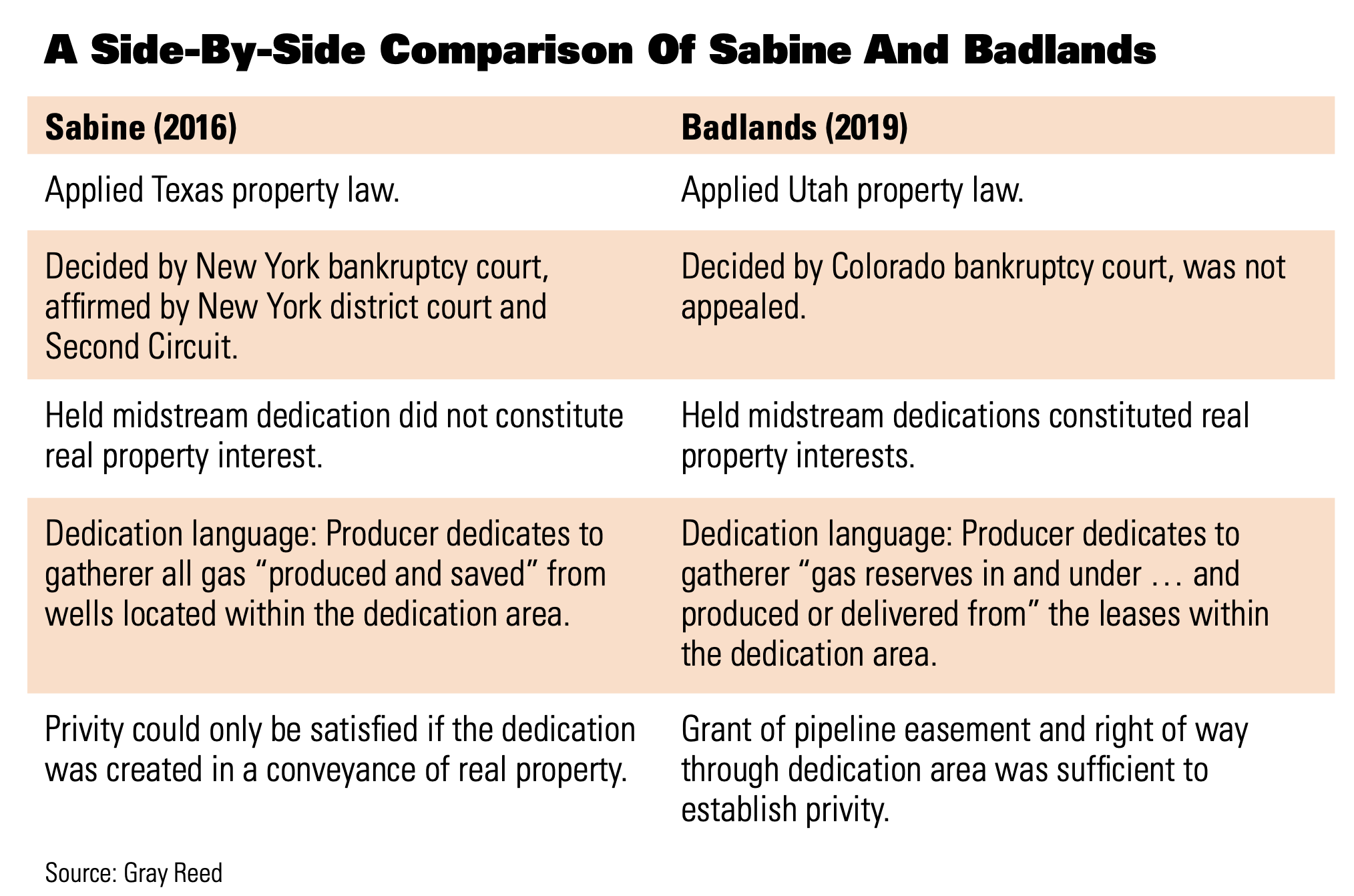

The Sabine case, decided in 2016, is the prime example of how things can go wrong for a midstream company litigating the characterization of its dedications in bankruptcy court. Sabine sought to reject its gathering and processing contracts with Nordheim Eagle Ford Gathering and HPIP Gonzales Holdings in an attempt to make its assets more marketable and thus, enhance its prospects for a successful restructuring. Nordheim and HPIP asserted the dedications in their agreements were covenants running with the land (a type of real property interest) under Texas law, were binding on any successor, and could not be rejected in bankruptcy. Because the dedication language referenced produced gas, a personal property interest, the Sabine court found the agreements were not real property interests. Rather, the Sabine court determined the agreements were nothing more than service contracts, and therefore, Sabine was able to jettison its gathering and processing agreements, saving as much as $115 million in future gathering fees and expenses.

The Badlands case arms midstream companies with additional arguments in the event their gathering and processing agreements face the prospect of rejection in bankruptcy.

Sabine has dominated the midstream characterization debate since it was decided three-plus years ago. At the time, the dedication language in the Nordheim and HPIP agreements was in large part standard across the industry. In subsequent producer bankruptcies, producers relied heavily on the Sabine decision to support their attempts to reject alleged “out of market” gathering and processing agreements. As a result, many midstream companies opted to enter into new gathering and processing agreements with lower rates rather than the roll the dice in bankruptcy court.

In September 2019, a Colorado bankruptcy court in the Badlands Energy case found that a gas gathering agreement and a saltwater disposal agreement were both covenants running with the land under Utah law and therefore could not be rejected or otherwise stripped from the underlying assets by a bankruptcy sale. The Badlands opinion evens the score (so to speak) and provides midstream companies with compelling authority that agreements containing appropriate dedications of oil and gas reserves, and that otherwise meet the relevant legal requirements, should ride through bankruptcy unaffected.

Utah and Texas law on covenants running with the land are similar for the most part. The driver of the different result is the dedication language. In Badlands, the dedications in the agreements burdened the producer’s interest in gas reserves “in and under” the subject acreage. The bankruptcy court found the dedication language sufficient to qualify the agreements as real property interests under Utah law.

From a midstream perspective, the Badlands decision supports drafting gathering and processing agreements to include a dedication of a producer’s interests in oil and gas reserves, leases and related lands, rather than just the produced hydrocarbons.

Another significant distinction between Badlands and Sabine centered on grants of pipeline easements and rights of way. The Sabine court found that a grant of a pipeline easement or right of way in connection with entry into a gas gathering and processing agreement (a common occurrence in the industry) was insufficient to satisfy the requirements for a covenant to run with the land under Texas law. However, in Badlands, the bankruptcy court found that such a related conveyance was enough for a covenant to run with the land in Utah.

Because there is still such uncertainty surrounding the characterization of gathering and processing agreements, and the law can vary from state to state, midstream companies should obtain a pipeline easement or right of way from their producer when they enter into a new agreement.

The Badlands case arms midstream companies with additional arguments in the event their gathering and processing agreements face the prospect of rejection, or an attempted free and clear sale, in bankruptcy.

Given current commodity prices, and the recent spike of producer bankruptcies since May 2019, the characterization of midstream dedications will continue to play out in bankruptcy courts across the country for years to come. In fact, the issue is currently before a Texas bankruptcy court—for the first time—in the Alta Mesa bankruptcy. Given the level of oil and gas production in Texas, market participants should keep an eye on how a Texas court handles the characterization fight.

The moral of the story is that the language used in any gathering and processing agreement matters and will be the focal point of any dispute. It is critical that midstream companies revisit their existing dedications and ensure that future dedications are drafted to clearly implicate mineral interests in place and thus, insulate the agreement in question to the greatest extent possible from a subsequent attack in bankruptcy.

Jonathan Hyman is a partner in Gray Reed’s Houston office. He has obtained successful verdicts, arbitration awards and settlements in a wide range of complex business litigation matters across Texas, the U.S. and abroad. In the midstream sector, Hyman handles every detail and phase of disputes involving midstream agreements. Lydia Webb is an associate in Gray Reed’s Dallas office. She focuses on representing and advising debtors, creditors, committees and post-confirmation trustees in bankruptcy cases and other insolvency or restructuring scenarios.

Recommended Reading

E&P BW Energy Undergoes ‘Technical’ Ownership Restructuring

2024-05-08 - The restructuring will not involve any change to the ultimate control of BW Energy as the shares currently held by BW Group will be sold to BW Energy Holdings.

Wood Mackenzie Appoints Jason Liu as CEO

2024-05-07 - Liu replaces former CEO Mark Brinin, who is departing to pursue other opportunities, Wood Mackenzie said.

Hess Midstream Subsidiary Plans Private Offering of Senior Notes

2024-05-08 - The proposed issuance is not expected to have a meaningful impact on Hess Midstream’s leverage and credit profile, according to Fitch Ratings.

Exxon Appoints Maria Jelescu Dreyfus to Board

2024-05-08 - Dreyfus is CEO and founder of Ardinall Investment Management, a sustainable investment firm, and currently serves on the board of Cadiz Inc. and Canada-based pension fund CDPQ.

OFS Sector Loses Jobs, but Trade Org Says Growth Potential Remains

2024-05-08 - According to analysis by the Energy Workforce & Technology Council, the OFS job market may still have potential for growth despite a slight decrease in the sector in April.