Privately held, longtime Ohio operators Ascent Resources Utica and Encino Energy’s EAP Ohio are reporting stunning wells in their oil-weighted footprints.

Leading the state’s new oil well results, former Chesapeake Energy executive vice president of production Jeff Fisher’s Ascent made a two-well Lavada RCH GR pad in Guernsey County that produced a combined 2,691 bbl/d during its first 166 days online through March 31.

The Lavada #2H averaged 1,448 bbl/d, while the Lavada #4H averaged 1,243 bbl/d, according to Ohio’s Department of Natural Resources data.

Solution gas averaged 4.5 MMcf/d per well during that time frame.

On another pad—the Jackalope WSG GR—Ascent made three wells, bringing in an average of 4,405 bbl/d during the wells’ first 83 days online. The #6H averaged 1,532 bbl/d; the #4H, 1,483 bbl/d; and the #2H, 1,381 bbl/d.

Solution gas from Jackalope, which is also in Guernsey County, averaged 9.8 MMcf/d or 3.27 MMcf/d per well.

Meanwhile, former Range Resources Chairman and CEO John Pinkerton’s Encino/EAP Ohio added four wells in the Utica-trapped oil play—the Point Pleasant—in its previously one-well Williams CR MON pad in Carroll County.

The new wells produced an average of 1,118 bbl/d each in their first 182 days online. Solution gas averaged 4.9 MMcf/d per well.

Pinkerton, who is Encino/EAP’s executive chairman, led Range Resources in its discovery of the Marcellus shale play in 2007. Ray Walker, Encino COO, was part of that Marcellus-discovery team. Hardy Murchison, president and CEO, managed First Reserve oil and gas investments.

Encino’s investors include the Canada Pension Plan Investment Board (CPPIB).

Ascent, which is in First Reserve’s current portfolio, is the No. 1 privately held Appalachian oil and gas producer, making 424,000 boe/d, 96% gas, at year-end 2022, according to Enverus data.

Encino is No. 2, producing 192,000 boe/d, 86% gas. Among all privately held U.S. gas producers, Ascent is No. 2; Encino, No. 8.

Ascent and Encino operate the Top 50 oil wells in first-quarter 2023 production in Ohio, according to state data, except for three wells by Infinity Natural Resources and one by EOG Resources.

All in Carroll County, the three INR wells made 60,176 bbl in 86 days averaging 700 bbl/d; 54,170 bbl in 90 days averaging 602 bbl/d; and 52,523 bbl in 75 days averaging 700 bbl/d.

The EOG well, Brookfield NBK15 #3A in Noble County, made 50,694 bbl in 90 days, averaging 563 bbl/d. The well had been brought online in the fourth quarter with 88,420 bbl during its first 77 days, averaging 1,148 bbl/d.

The Business Journal in Youngstown, Ohio, found four Encino horizontals in Columbiana County made 228,058 bbl/d in their first 90 days, and responsible for nearly all the county’s 233,390 bbl/d in that period. All four wells are from the same pad, it added.

“Traditionally, wells in Columbiana County have not produced much oil, as this portion of the shale play is instead known as a major source of natural gas and natural gas liquids,” Managing Editor Dan O’Brien wrote in June.

“During the fourth quarter of 2022, for example, the entire county produced just 5,084 barrels of oil.”

Encino holds more than 900,000 net acres in Ohio, across the phase windows: black oil, volatile oil, wet gas and dry gas. It bought Chesapeake’s Ohio Utica property in October 2018 for $2 billion. In addition to being Ohio’s largest oil producer, it is its second-largest gas producer. Nearly all its leasehold is HBP and none is on federal land, it reported.

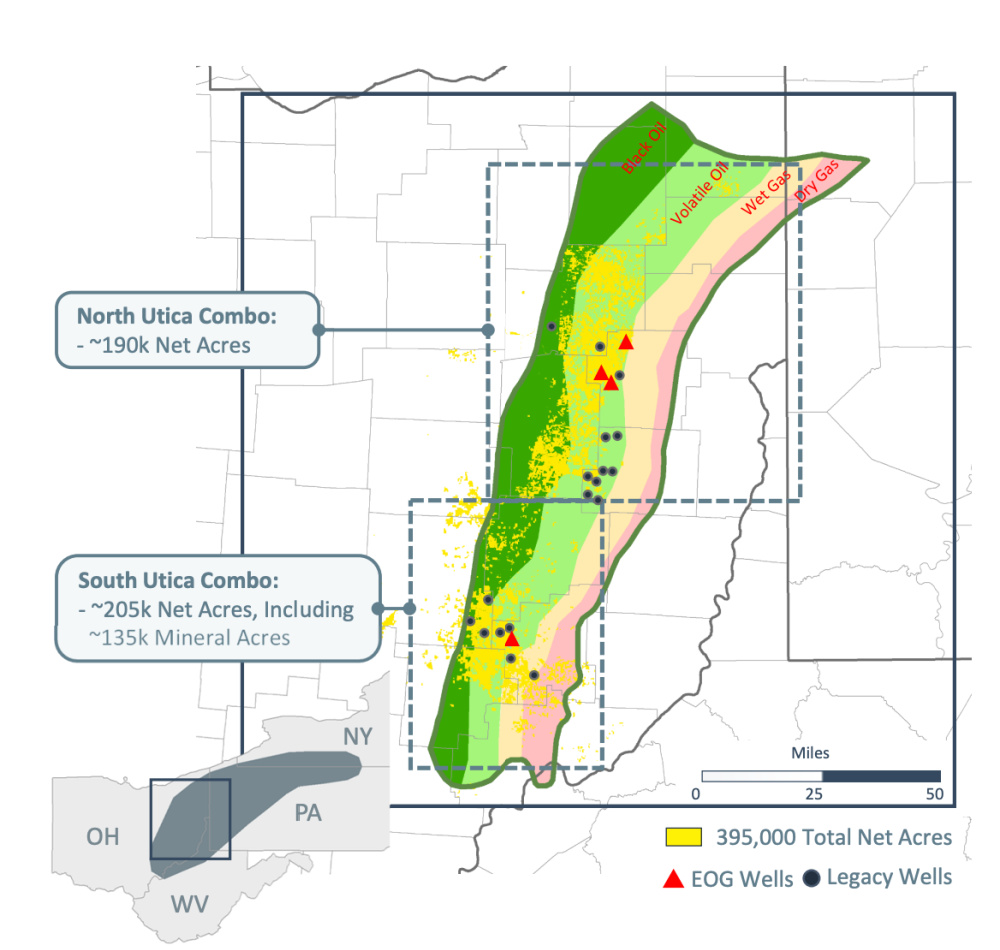

Meanwhile, EOG is working on making a new play for itself in Ohio’s oil fairway. Bob Brackett, analyst for Bernstein Research, told EOG chairman and CEO Ezra Yacob this summer, “The thesis on the Utica was ‘Here was a play early in the shale oil revolution that came and went quickly. We haven’t drilled a decent well there, or a modern-technology well, in a dozen years.’”

His question: “Why would the Utica not work?”

Yacob said, “It’s funny, right? When you take the blinders off and you come with a different perspective from different basins, it’s amazing the things that you can uncover….

“I’ll be honest: It’s not the first time that we’ve looked at the Utica. We’ve been in and out of looking at the Utica and the liquids-rich window for a number of years.

“But … as you’re learning things [in other plays] that are less pressured, you start to apply these understandings to different basins and that’s when you start to unlock newfound value.”

Recommended Reading

Patterson-UTI Updates Drilling Rig Status

2024-09-10 - Patterson-UTI’s monthly announcements represent the company’s average number of revenue-earning drilling rigs in the U.S.

Kolibri Global Drills First Three SCOOP Wells in Tishomingo Field

2024-09-18 - Kolibri Global Energy reported drilling the three wells in an average 14 days, beating its estimated 20-day drilling schedule.

E&P Highlights: Sept. 23, 2024

2024-09-23 - Here's a roundup of the latest E&P headlines, including Turkey receiving its first floating LNG platform and a partnership between SLB and Aramco.

US Drillers Add Oil, Gas Rigs for First Time in Four Weeks

2024-10-11 - The oil and gas rig count rose by one to 586 in the week to Oct. 11. Baker Hughes said the total count was still down 36 rigs or 6% from this time last year.

Seadrill to Adopt Oil States’ Offshore MPD Technology

2024-09-17 - As part of their collaboration, Seadrill will be adopting Oil States International’s managed pressure drilling integrated riser joints in its offshore drilling operations.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.