Justin Carlson is co-founder and chief commercial officer for East Daley Analytics.

Are oil and gas producers able to turn the page on natural gas flaring practices?

Operators in the Permian Basin face hard decisions over the next 12 months due to a mismatch between production capacity and midstream infrastructure, according to a new study by East Daley Analytics and Validere.

East Daley collaborated with Validere, a measurement, reporting and verification SaaS company, to quantify the environmental consequences of a shortfall in gas pipeline takeaway from the Permian. For over a year, our “Permian Supply and Demand Forecast” has pointed to bottlenecks starting in early 2023 as a result of rapid supply growth. Low and sometimes negative Permian gas prices since fourth-quarter 2022 confirm egress pipelines are not adequate for current production levels.

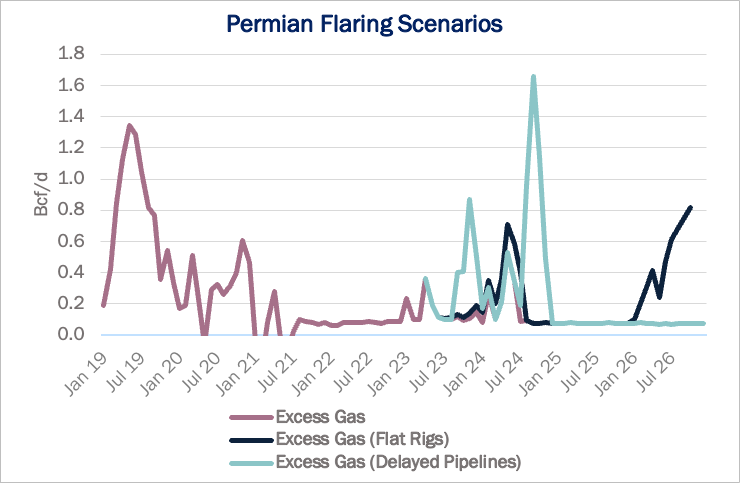

The study, “Emissions Critical: Flaring, Methane and the Cost of Looming Permian Gas Takeaway Constraints,” considers several market outcomes for the Permian. In our base case, excess gas production averages 200 MMcf/d over 17 months and peaks at about 500 MMcf/d in May 2024. We also looked at a scenario with flat Permian rigs (rigs decline in our base case given the backwardated WTI price curve) and a third scenario assuming delays in new pipeline projects.

According to Validere, each 100 MMcf/d of flaring adds 2.2 million tons per year (mtpy) of CO2 emissions and methane emissions contribute an additional 1 mtpy of CO2e emissions, based on a 20-year greenhouse gas impact at 98% combustion efficiency. In the base case, we estimate excess gas averages 146 MMcf/d in 2023; if all this gas were flared, the Permian midstream bottleneck would generate about 4.7 million tons of CO2e.

The excess gas problem grows worse if Permian rig counts are higher than we assume or if new pipeline projects are delayed. Under any scenario, the start of the 2.5 Bcf/d Matterhorn Express Pipeline in mid-2024 will be critical to realigning the gas supply chain. Compressor expansions planned on Permian Highway and Whistler pipelines in the back half of fourth-quarter 2023 will add 1 Bcf/d to help alleviate the bottleneck.

In the “Delayed Pipeline” scenario, we assume the two compressor expansions are delayed by three months, while the more complex Matterhorn is delayed by six months. The scenario is salient, given the industry is already seeing some slippage in construction timelines. On its first-quarter 2023 earnings call, Kinder Morgan guided to a one-month delay for the Permian Highway expansion to December 2023, citing supply chain issues in procuring equipment and materials. Assuming producers do not further reduce drilling in response, excess gas production in the “Delayed Pipeline” scenario would spike to over 800 MMcf/d at year-end 2023 and 1.6 Bcf/d at year-end 2024, or double the base case.

Of course, flaring isn’t the only option for producers; they could opt to slow drilling, defer completions or shut in wells. The industry saw a similar scenario play out in 2019, the last time infrastructure failed to keep pace with Permian supply growth. The associated surge in Permian flaring rates brought increased environmental scrutiny and new commitments by industry to curtail or end flaring as part of ESG frameworks.

Given the recent history, it is unclear whether producers can lean on flaring once again to manage through the pipeline bottleneck and keep oil flowing. In mid-2024, when East Daley estimates the excess gas problem to be at its worst, producers would need to take the equivalent of 200,000 bbl/d of oil production offline to avoid flaring. If they need to flare, producers should focus on managing their operation to ensure they keep the flare lit and combustion efficiency high, because vented methane is a far worse outcome.

The study, “Emissions Critical: Flaring, Methane and the Cost of Looming Permian Gas Takeaway Constraints,” is available here.

Recommended Reading

Aethon to Acquire Tellurian Haynesville Shale Assets for $260MM

2024-05-29 - Aethon Energy is acquiring Tellurian Inc.'s Haynesville Shale assets in a $260 million deal, allowing Aethon to continue growing as the basin's top private producer and for financially struggling Tellurian to prioritize its flagship Driftwood LNG project.

Diversified to Buy East Texas NatGas Assets from Crescent Pass

2024-07-10 - Diversified Energy’s $106 million deal with Crescent Pass Energy comes during a prolonged dip in natural gas prices that some analysts expect to rebound as demand ramps up for LNG exports and power demand.

Woodside Energy to Buy LNG Developer Tellurian for $900 Million

2024-07-21 - Australia's Woodside Energy will pay $1 per share for Tellurian, which earlier this year sold its upstream Haynesville Shale assets to convert into a pure play LNG company, in a deal with an estimated enterprise value of $1.2 billion, including debt.

Woodside to Emerge as Global LNG Powerhouse After Tellurian Deal

2024-07-24 - Woodside Energy's acquisition of Tellurian Inc., which struggled to push forward Driftwood LNG, could propel the company into a global liquefaction powerhouse and the sixth biggest public player in the world.

ADNOC Buys 11.7% Stake in NextDecade’s Rio Grande LNG Project

2024-05-20 - The United Arab Emirates’ ADNOC will acquire a 11.7% equity stake in Phase 1 of NextDecade Corp.’s Rio Grande LNG (RGLNG) project from Global Infrastructure Partners (GIP), while also entering an offtake agreement for 1.9 mtpa from the Texas export facility.