From discoveries in the Bohai and Barents Seas to new contracts, below is a compilation of the latest headlines in the E&P space.

Activity headlines

CNOOC hits light crude in Bohai Sea

CNOOC Ltd. reported on March 1 its Bozhong 26-6 discovery in the Bohai Sea holds 100 million tons (MMton) of reserves.

Located in 22 m water depth, the discovery well encountered 321 m of oil pay. During the well test, the Bozhong 26-2-2 discovery well produced an average of 2,040 bbl/d of light crude and 11.45 MMcf/d of natural gas.

"Bozhong 26-6 oilfield is the third oilfield discovery with hundred million tons of reserves in southern Bohai Sea after Kenli 6-1 and Kenli 10-2. It is identified as the largest metamorphic buried hill oilfield in China,” Xu Changgui, deputy chief exploration engineer at CNOOC, said in a press release.

Vår Energi’s Barents Sea wildcat

Vår Energi ASA’s 7122/8-1 S wildcat well near the Goliat Field in the Barents Sea encountered about 240 m of gas and oil columns, the Norwegian Petroleum Directorate reported on March 2.

The Transocean Enabler drilled the Countach well in 399 m water depth in Vår-operated PL229. The well, which has been permanently plugged and abandoned, was not formation-tested, but extensive data acquisition and sampling were carried out.

Vår said preliminary estimates of recoverable reserves are between 3 MMboe and 13 MMboe but that the potential of the Countach prospects is estimated at up to 23 MMboe of recoverable oil.

“We will consider potential commercial development options and tie-in of the discovery to Goliat FPSO,” Rune Oldervoll, Vår Energi’s executive vice president for exploration and production, said in a press release. “Due to late arrival of the drilling rig on the field this winter, we have not been able to carry out the planned sidetrack before the environmental drilling restrictions commence on 1 March. We look forward to continuing to explore the area around Goliat at a later point in time.”

Vår Energi operates the license with 65% interest on behalf of partner Equinor with 35%.

Papa Terra production halted

3R Petroleum Oil and Gas reported on Feb. 28 that production had halted at the Papa Terra Cluster offshore Brazil as of Feb. 25, due to limitations in the energy generation and supply system of the tension leg wellhead platform at Papa Terra.

The company said repairs were expected to be complete within a week and that production would then gradually resume. Before the stoppage, four wells were producing an average of close to 17,000 bbl/d.

Contracts and company news

Suriname bid round webinar next week

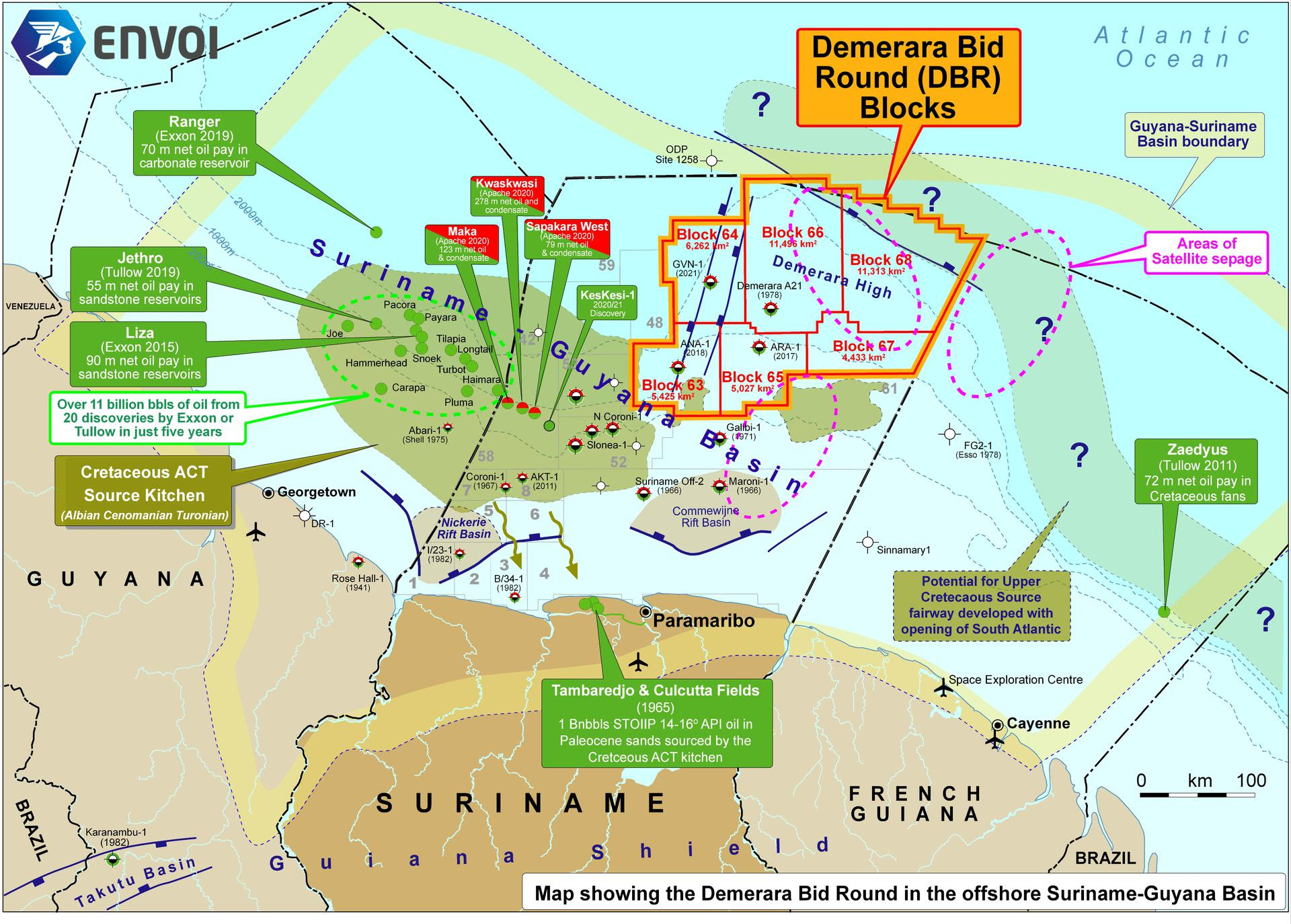

Bids are due in Suriname’s Demerara Bid Round (DBR) on May 31, bid round advisor Envoi said on March 1.

The bid round opened on Nov. 8, and a webinar on the prospectivity of the acreage is set for March 8 at 13:00 GMT (London).

The acreage on offer comprises six blocks covering an area of 43,956 sq km over the sparsely explored Demerara High. Staatsolie and specialist independent consultancies carried out studies over the acreate in 2022 that demonstrate significant undrilled prospectivity throughout the Upper and Lower Cretaceous and the Jurassic. These intervals thicken under the Demerara area and are clearly analogous to the proven conjugate margin plays in West Africa. More information about the bid round and webinar are available here. New participants must register to bid by April 28.

Eni closes on BP’s Algeria business

Eni announced on Feb. 28 it had closed on the acquisition of BP’s business in Algeria, including the In Amenas and In Salah gas concessions that are jointly operated with Sonatrach and Equinor.

Equinor buys interest in NCS finds from Wellesley

Equinor will acquire equity interest in five discoveries in the Troll, Fram and Kvitebjørn area in the North Sea on the Norwegian continental shelf (NCS) from Wellesley Petroleum AS, the company announced on March 1.

Although a mature part of the Norwegian Continental Shelf, Equinor said the Troll and Fram area has emerged as an exploration hotspot over the last years, and Equinor has made a number of discoveries in this area, including Swisher, Toppand and Røver Nord and Sør.

The deal brings Equinor’s share in Atlantis in PL878/878B/878C from 40% to 80%, in Grosbeak in PL248I from 40% to 55%, in Grosbeak in PL925 from 40% to 85%, in Røver Nord/Sør in PL923/PL923B from 40% to 60%, and in Toppand in PL630/PL630CS from 50% to 95%.

TotalEnergies buying CEPSA’s UAE assets

TotalEnergies has agreed to acquire CEPSA’s upstream assets in the United Arab Emirates, effective Jan. 1, 2023, the company said on March 1.

The assets include a 20% interest in the Satah Al Razboot (SARB), Umm Lulu, Bin Nasher and Al Bateel offshore concessions and a 12.88% indirect interest in the Mubarraz concession through the purchase of 20% of Cosmo Abu Dhabi Energy Exploration & Production Co. Ltd (CEPAD), a company holding a 64.4% interest in ADOC.

The SARB and Umm Lulu concession, operated by ADNOC Offshore with 60% interest, includes two major offshore fields. OMV holds the other 20% interest in the concession.

The Mubarraz concession has four producing offshore fields. The SARB and Umm Lulu transaction and the Mubarraz transaction are subject to customary approvals.

Saipem wins Ivory Coast work

Saipem announced on March 1 that the Joint Venture Eni Côte d'Ivoire Ltd. and Petroci had awarded it a $400 million drilling contract for the seventh-generation drillship Deep Value Driller to work offshore the Ivory Coast.

Noble rigs win work

Noble Corp. reported new drilling and plugging & abandonment (P&A) contracts in its February fleet status report.

The Noble Innovator won a one-year contract from BP for P&A services plus drilling. The contract, valued at $50 million, is expected to begin in May 2023.

The Noble Gerry de Souza won a six-well contract in Nigeria with an undisclosed operator with a minimum duration of 290 days and with unpriced options extending into the third quarter of 2024.

The Noble Stanley Lafosse won a $148 million six-well contract from an undisclosed operator for a program in the U.S. Gulf of Mexico (GoM), expected to begin around June and to keep the rig busy for at least 340 days. The contract includes five one-well operations options.

The Noble Faye Kozack won a one-well contract from Kosmos for operations in the U.S. GoM at a dayrate of $450,000. This contract is scheduled to begin in mid-2023 in direct continuation of the rig’s upcoming one-well contract with LLOG. Additionally, QuarterNorth Energy has exercised its third, and final, option well.

The Noble Globetrotter I won a 70-day contract from Shell for P&A work in the GoM. Work is expected to begin in the third quarter at $375,000/day.

Ramform Titan to survey off Namibia

PGS announced on March 3 that it had signed a 3D exploration acquisition contract for work offshore Namibia. The Ramform Titan will acquire the survey, which is expected to be complete in late May.

TGS, SLB for Engagement III OBN survey

TGS announced on Feb. 28 a collaboration with SLB for the Engagement III ultra-long offset ocean-bottom node (OBN) acquisition in the Green Canyon section of the U.S. GoM.

The 111 block survey is underway, with acquisition expected to be complete in April 2023. Imaging uplifts will be delivered through the application of full-waveform inversion (FWI) velocity model building using the ultra-long offsets. Imaging will be carried out by SLB with final results expected in mid-2024. Engagement III is the fifth multi-client ultra-long offset OBN acquisition in the GoM and extends the data coverage south from prior phases.

The project is supported by industry funding.

Petrobras picks Bluware for seismic interpretation

Bluware Corp. announced on Feb. 28 that Petrobras had signed a five-year, multi-million-dollar agreement for a large-scale deployment of Bluware VDS data compression technology, FAST data streaming, and InteractivAI deep learning solutions for seismic interpretation.

According to Bluware, the technology will facilitate Petrobras’ journey to the cloud, accelerate workflows and extract more information from their subsurface data in a shorter amount of time.

Welltec buys Autentik

Welltec A/S has purchased Autentik AS, which specializes in electric wireline fishing and interventions, for an undisclosed amount, the firm said on Feb. 28. The acquisition expands Welltec’s downhole intervention capabilities.

To date, more than 50 runs have been successfully conducted with the Wellgrab ERFT (electric release fishing tool) across North America, Europe, Africa and the Middle East. Autentik will operate as a wholly owned subsidiary of Welltec, and its employees will join the Welltec team.

TGS, NRGX expand partnership

TGS announced on March 3 it was expanding its partnership with NRGX to enable access to TGS well log data simultaneously with client proprietary data through the NRGX well log data workflow optimization system.

By joining forces, the NRGX LAS WORX application offers single-point access, allowing easy queries of available well and curve coverage.

Recommended Reading

CEO: Coterra Drops Last Marcellus Rig, May Halt Completions

2024-09-12 - Coterra halted Marcellus Shale drilling activity and may stop completions as Appalachia waits for stronger natural gas prices, CEO Tom Jorden said at an industry conference.

Vitol CEO: US Shale Gas Growing Source of Shipping, Trucking Fuel

2024-09-18 - International commodities trading house Vitol sees growing demand for U.S. shale gas to spur LNG exports to China, India and emerging economies in Asia.

Midcon Momentum: SCOOP/STACK Plays, New Zones Draw Interest

2024-09-03 - The past decade has been difficult for the Midcontinent, where E&Ps went bankrupt and pulled back drilling activity. But bountiful oil, gas and NGL resources remain untapped across the Anadarko, the SCOOP/STACK plays and emerging zones around the region.

Non-op Rising: NOG’s O’Grady, Dirlam See Momentum in Co-purchase M&A

2024-09-05 - Non-operated specialist Northern Oil & Gas is going after larger acquisitions by teaming up with adept operating partners like SM Energy and Vital Energy. It’s helping bridge a capital gap in the upstream sector, say NOG executives Nick O’Grady and Adam Dirlam.

Dallas Fed: Low Natgas Prices Force Permian E&Ps to Curtail Output

2024-09-25 - Falling oil prices, recession fears and the U.S. election cycle are weighing on an increasingly pessimistic energy industry, according to a new survey of oil and gas executives by the Federal Reserve Bank of Dallas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.